AMAT stock, one of the semiconductor stock picks, was trading at $80.58 as of 11:08 AM EDT.

On Thursday, stock prices went down because people were worried that the Federal Reserve would maintain its ultra-hawkish stance. The main U.S. stock market indices ended the day down, wiping out more of the gains made earlier in the week.

Even though the overall trend was down, the semiconductor equipment sector grew on the day. Along with companies like ASML (NASDAQ:ASML), Applied Materials (NASDAQ:AMAT), and KLA Corp., the stock of Lam Research (NASDAQ:LRCX) rose in response to a positive earnings announcement KLA Corp. (NASDAQ:KLAC)

Super Micro Computer (NASDAQ:SMCI), another notable gainer, rose when it revealed an updated forecast. On the other hand, both WD-40 (WDFC) and Union Pacific (NYSE:UNP) saw big drops in price after their separate earnings reports came out.

Sector Under Consideration

The semiconductor equipment sector saw purchases sparked by strong earnings from Lam Research (NASDAQ:LRCX). When the company gave a forecast for the current quarter that was better than expected, investors rushed into the sector. After the company’s Q1 profit was higher than expected and its revenue was 18% higher than at the same time last year, LRCX’s shares went up by about 11%. LRCX predicted that its sales for the second quarter would be between $5.1 billion and $300 million. Analysts anticipated a total of roughly $4.74 billion.

As a result of the news, ASML (NASDAQ:ASML) increased by approximately 3%, while Applied Materials (NASDAQ:AMAT) and KLA Corp. (NASDAQ:KLAC) also saw gains of around 2%.

Stock Picks: Best Gainer

The Super Micro Computer attracted investors due to an optimistic prognosis (NASDAQ:SMCI). After the company increased its revenue and earnings estimate, shares increased by 10%. SMCI said it now expects net sales for the first quarter to be between $1.78 billion and $1.82 billion. This was more than the firm’s earlier prediction of $1.52–$1.62 billion. A target amount of $1.57 billion has been set by analysts. The company attributed the increase to an increase in customer design wins.

Because people were expecting good things, SMCI went up $5.75 and ended the session at $61.34. Even with the rise, the stock stayed in a recent trading range and was still below the 52-week high of $74.93 hit in August.

Outstanding Negator

Following the release of its quarterly report, Union Pacific (NYSE:UNP) saw its stock price decline. Even if the most recent quarter’s performance topped expectations, the stock fell 7% as a result of the acknowledgment of persistent headwinds.

The railroad company’s quarterly earnings were better than expected, and operational revenue was up 18% from the year before. However, UNP also foresaw lingering efficacy problems through the year’s conclusion.

Jim Cramer Stock Picks Worth Paying Attention To

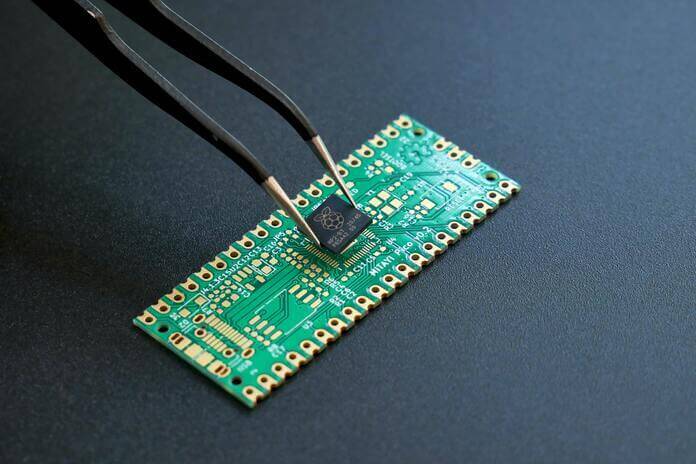

Featured Image- Unsplash @ Vishnu Mohanan