US wholesale inflation accelerated in January, indicating ongoing inflation pressures in the economy. The Labor Department’s producer price index, which tracks inflation before it reaches consumers, rose 0.3% from December to January, following a -0.1% decline from November to December. Year over year, producer prices increased by 0.9% in January.

Excluding volatile food and energy costs, core wholesale prices rose 0.5%, the highest increase since last July. Compared to a year ago, core prices climbed 2%, up from 1.7% in the previous month.

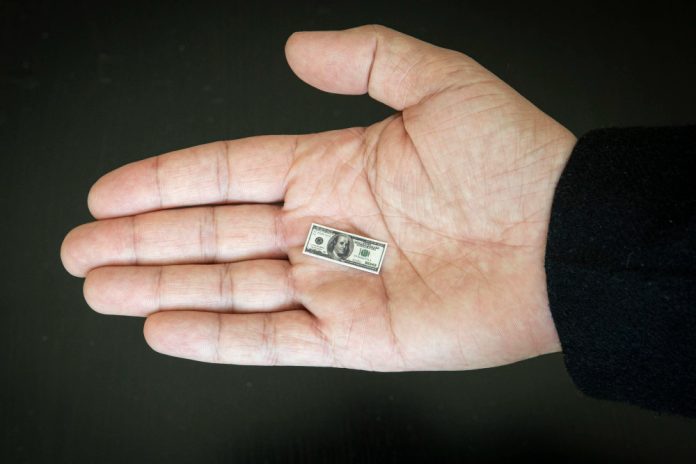

President Joe Biden’s re-election campaign faces public frustration over inflation, with average prices still about 19% higher than when he took office. The Fed is likely to remain cautious about cutting its benchmark interest rate, waiting for more data to ensure a downward trend in inflation.

The wholesale price increase in January was partly driven by measurement quirks, including a 5.5% increase in the cost of financial management services. Additionally, many companies typically raise prices early in the year, boosting overall inflation measures in January.

However, costs for hospital care, doctor visits, and hotel stays also rose, indicating that inflation in travel, healthcare, and other service industries remains elevated.

The Fed’s preferred price measure, which will be reported later this month, has been running below the consumer price index. Economists expect that core prices in the Fed’s preferred gauge will have jumped by as much as 0.4% or 0.5%, a pace faster than the Fed’s inflation target.

While some Fed officials remain cautious, others are optimistic that inflation is declining. The Fed’s rate hikes in 2023, intended to combat high inflation, have made borrowing more expensive. If inflation returns to the 2% target, the Fed would be expected to cut rates, making consumer and business loans more affordable.

Most economists now anticipate a rate cut in May or June, as the Fed gains greater confidence in the sustained return of inflation to its target.

Featured Image: Freepik