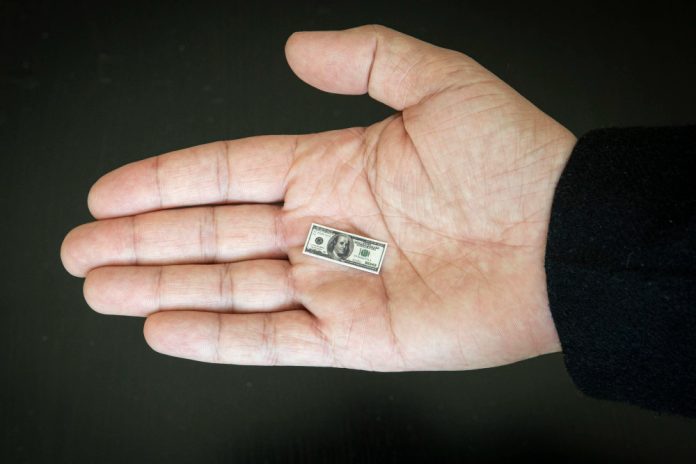

The latest data from the Labor Department indicates a moderation in annual inflation in the United States, though prices remain significantly elevated, underscoring the slow progress in taming the price surge fueled by the pandemic.

According to the report released on Tuesday, the consumer price index (CPI) increased by 0.3% from December to January, a slight uptick from the 0.2% rise observed in the previous month. On a year-over-year basis, prices have risen by 3.1%.

While this marks a decrease from December’s 3.4% figure and a substantial drop from the peak of 9.1% experienced in mid-2022, it still exceeds the Federal Reserve’s target of 2%. The persistence of high inflation has become a significant concern amid President Joe Biden’s re-election campaign, reflecting public frustration with rising prices.

Excluding the volatile food and energy categories, core prices rose by 0.4% last month, up from 0.3% in December, with a year-over-year increase of 3.9%, unchanged from December. Core inflation is closely monitored for its predictive value regarding future inflation trends.

While Biden administration officials highlight the significant decline in inflation since the peak driven by pandemic-related disruptions and government aid, there remains discontent among Americans, with average prices still approximately 19% higher than at the start of Biden’s term.

The mixed data released on Tuesday may reinforce the cautious stance of Federal Reserve officials, who acknowledge progress in curbing inflation but remain vigilant for sustained evidence of a return to the 2% target. Most economists anticipate the Fed delaying any adjustments to its benchmark rate until May or June, given the current rate’s 22-year high of around 5.4%.

Having raised its key rate 11 times between March 2022 and July of the following year to combat high inflation, the Fed aims to lower borrowing costs through rate cuts, which could stimulate economic activity. However, a robust economy poses challenges as increased demand may lead to higher wages and consumer spending, potentially exacerbating inflationary pressures.

Notably, while prices for goods like used cars, furniture, and appliances have seen declines, costs for services such as auto repairs, healthcare, and entertainment continue to rise. The Fed will closely monitor services prices for signs of inflationary easing.

While a rate cut could benefit consumers and businesses by reducing borrowing costs, it must be carefully calibrated to balance economic stimulus with inflation containment. Despite the challenges, indicators suggest ongoing economic growth, with businesses expanding hiring and manufacturing and services sectors reporting increased sales in early 2024.

Featured Image: Freepik