Moderna Inc (NASDAQ:MRNA) announced on Thursday its projection of up to $4 billion in revenue from its COVID-19 vaccine as sales transition from government contracts to the private market this year. Additionally, the company expects growing demand in 2024, equating the market size to that of flu shots.

The vaccine manufacturer anticipates generating $4 billion in sales from government contracts in 2023. Furthermore, it estimates sales ranging from $2 billion to $4 billion in the private market for the COVID vaccine, including the United States and other countries. Previously, Moderna had expected sales of $5 billion from government contracts.

Both Moderna and Pfizer (NYSE:PFE), its rival, have witnessed a substantial decline in COVID vaccine sales during the second quarter, as the government-backed market for vaccines gradually contracts.

With autumn approaching, both companies are now preparing for a vaccination campaign using updated shots aimed at targeting the XBB.1.5 Omicron subvariant of the coronavirus. These updated shots will be priced significantly higher than the previous rates charged to governments.

In light of the increasing COVID cases and hospitalizations, Moderna foresees the U.S. demand for their vaccine to reach 50 to 100 million doses during the fall season. The company draws parallels with the flu market, estimating an annual demand of 150 million flu shots in the U.S.

Chief Commercial Officer Arpa Garay stated on a conference call that over time, the demand for COVID shots could converge closer to the estimated 150 million doses, especially considering the high disease burden and potential future combinations with RSV and flu shots.

The final price for the vaccines in the private market is yet to be announced by both Moderna and Pfizer, but they expect it to be substantially higher than the previous government prices during the pandemic.

During the second quarter, Moderna’s COVID vaccine sales plummeted by 94% to $293 million. Nevertheless, this still exceeded the analysts’ average estimate of $233.6 million, according to Refinitiv data.

Moderna attributed the deferral of $1 billion in anticipated vaccine sales to governments the following year. Moreover, the company saw a significant surge of 62% in research and development costs, amounting to $1.1 billion during the quarter.

Analysts expressed concerns over the company’s continuous cash burn, especially with deferred revenue and uncertain sales in the private market. Leerink Partners analyst Mani Foroohar highlighted the commercial challenges that increase risks on the research and development front.

To offset the declining COVID vaccine sales, Moderna is focusing on other products, such as its experimental flu and RSV vaccines utilizing messenger RNA technology. Analyst Tyler Van Buren from TD Cowen emphasized that the forthcoming Phase 3 flu data later in the quarter would be a pivotal event, while the rest of the pipeline remains on track.

In preparation for the 2024 launch of its next commercial product, an RSV vaccine, Moderna disclosed that it has already commenced manufacturing the shot in anticipation of regulatory approval.

Moderna reported a net loss of $3.62 per share, which was narrower than the analysts’ average estimate of a $4.04 loss.

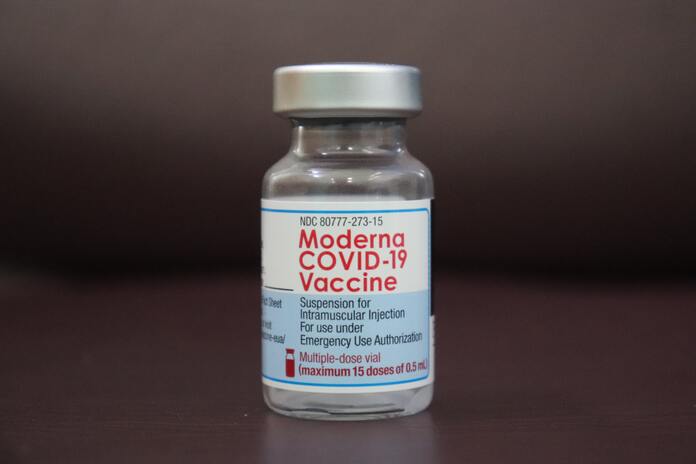

Featured Image: Unsplash @ Mufid Majnun