As the world races towards AI-driven computing, Nvidia (NASDAQ:NVDA), renowned for its accelerated computing platform and cutting-edge GPUs, finds itself at the heart of this transformative journey. Just as OpenAI’s ChatGPT marked a pivotal moment for generative AI, Nvidia spearheaded accelerated computing with its GPU architecture, creating vital AI platforms. This has yielded immense benefits for the company, with its stock price surging by over 194% year-to-date.

While Nvidia’s stock has already reached impressive heights, numerous factors suggest the potential for a doubling in value from its current position. Let’s delve into the catalysts that support this bullish outlook.

Nvidia’s AI Leadership Paves the Way

Nvidia is experiencing unprecedented demand for its accelerated computing and AI platforms, driven by enterprises increasingly adopting AI strategies. The company’s second-quarter performance was nothing short of exceptional, with revenues more than doubling year-over-year and jumping by 88% sequentially.

Notably, the Data Center segment stood out with a remarkable 171% year-on-year revenue growth. This surge owes much to the escalating demand from cloud service providers and major consumer internet firms for Nvidia’s HGX platform, now integral to generative AI and large language models. The company is also witnessing strong momentum in diverse sectors such as automotive, telecom, financial services, and healthcare.

Capitalizing on this robust demand, Nvidia is continually enhancing its GPU architecture with AI-specific features, solidifying its leadership position. The company is now offering its NVIDIA DGX cloud services to enterprise customers directly and through an extensive partner network, encompassing cloud-based infrastructure, software, and services for AI model training and deployment. Moreover, Nvidia has introduced a universal data center processor for compute-intensive applications and unveiled the accelerated AI networking platform, NVIDIA Spectrum-X, while also forging partnerships with industry leaders to expand its AI initiatives.

With sustained demand for its Data Center platform, a commitment to introducing new AI products, and a focus on scaling up supply in the upcoming quarters, Nvidia is poised for substantial growth, which should propel its share price even higher.

Gaming Bounces Back

After a slowdown in the past year, end-market demand in the Gaming segment has rebounded strongly, registering a 22% year-over-year revenue increase. The driving force behind this resurgence is Nvidia’s GeForce RTX 40 Series GPUs for laptops and desktops, which bring next-generation graphics and AI capabilities to gamers. Importantly, a significant portion of the installed base has yet to upgrade to RTX, standing at only 47% by the end of Q2, with just 20% having GPUs with RTX 3060 or higher performance. This suggests ample room for growth in the gaming segment.

Nvidia’s Advancements in Autonomous Vehicles

Nvidia is poised to play a pivotal role in shaping the future of transportation as the world increasingly shifts towards electric and autonomous vehicles. The company offers a comprehensive, AI-based hardware and software solution for autonomous vehicles under the DRIVE brand, driving growth in this segment. Despite macroeconomic challenges, particularly in China, the long-term prospects for autonomous vehicles remain bright. Nvidia’s NVIDIA DRIVE design win pipeline for the next six years stands at approximately $14 billion, indicating sustained growth in the years ahead.

Conclusion

During Nvidia’s Q2 conference call, CFO Colette Kress emphasized, “Demand for our Data Center platform for AI is tremendous and broad-based across industries and customers. Our demand visibility extends into next year. Our supply over the next several quarters will continue to ramp as we lower cycle times and work with our supply partners to add capacity.” This signals ongoing momentum in Nvidia’s business, driven chiefly by the Data Center segment, with gaming also contributing significantly to its growth.

In sum, Nvidia’s ability to push technological boundaries and shape the future bodes well for its financial prospects, potentially doubling its current share price. This optimism is echoed by analysts, with 31 out of 35 covering NVDA giving it a “Strong Buy” recommendation, three suggesting a “Moderate Buy,” and one maintaining a “Hold” rating. However, it’s worth noting that the average price target for NVDA is $625.68, implying an expected upside of approximately 45% from current levels. The possibility of a 100% surge remains a compelling prospect for investors.

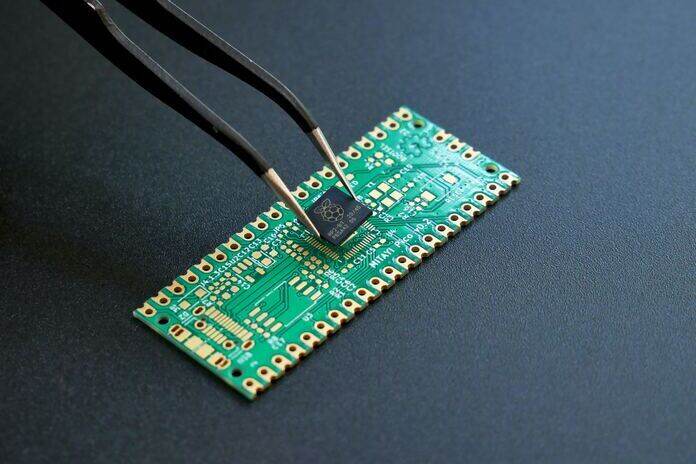

Featured Image: Unsplash @ Vishnu Mohanan