The availability of tools such as Java, microservices, and APIs can help modernize retail banks and improve offerings against emerging competitors.

TORONTO, July 18, 2023 /PRNewswire/ – The retail banking industry faces intensified competition as new competitors gain traction with innovative products and services that use advanced hardware and software solutions to meet the evolving needs of customers. Many traditional banks struggle to adopt these same innovations due to challenges with outdated mainframe systems and software development methodologies. These challenges have led traditional retail banks to re-evaluate their mainframe investments. For IT teams working to address these challenges and deliver modernized offerings in the retail banking space, global IT research and advisory firm Info-Tech Research Group has released new research. Mainframe Modernization for Retail Banking is a comprehensive blueprint designed to help banks navigate legacy system complexities and embrace agility and innovation.

“The financial services market is undergoing a significant transformation fueled by technological innovation. Traditional banks are embracing modernization efforts, while a new wave of fintech companies is rapidly evolving, making the banking industry increasingly competitive,” says David Tomljenovic, principal research director at Info-Tech Research Group. “Many banks are grappling with the challenges posed by the rapid pace of innovation. The current systems in traditional financial institutions were designed for batch processing, accumulating, and processing data at the end of the day, which conflicts with today’s customers, who desire instant banking services.”

As outlined in the new industry resource, banks are facing mounting difficulties and rising costs in maintaining mainframe hardware and software. Specifically, the support for legacy mainframe hardware has become increasingly expensive. The banking industry is also grappling with the accelerated pace of transactions, such as instant payments and the real-time systems that have replaced traditional end-of-day settlements. To navigate this transition, banks require a complete overhaul of their software stack and a corresponding shift in software tools and methodologies.

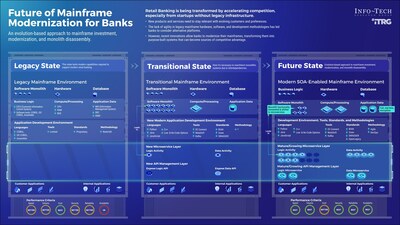

The firm’s research suggests that banks should consider modernizing their mainframe systems to enhance their hardware and software solutions. Mainframes offer unparalleled capabilities in transaction processing, large-scale data handling, and security, which are crucial for building a modernized banking infrastructure. Info-Tech’s blueprint highlights the following three organizational states commonly observed in banking institutions and offers an evolution-based approach to mainframe investment, modernization, and monolith disassembly:

- Legacy State: This state refers to the existing mainframe environment that lacks modern capabilities required to support contemporary retail banking. It comprises software monolith, hardware, and database components.

- Transitional State: This state is essential for rearchitecting monolithic systems, considering the interdependencies involved. The mainframe environment in this state includes software monolith, hardware, and database elements.

- Future State: This state represents an evolution-based approach to mainframe investment, focusing on modernization and the disassembly of monolithic systems.

Info-Tech’s research further explains the advantages of modern mainframes in facilitating faster and easier development processes. These modern mainframes support widely used development languages such as Java, which can generate executable code for these systems. The firm advises that the availability of such development tools, along with microservice and API enablement, can significantly simplify mainframe operations that would otherwise be complex and time-consuming.

To learn more about how the banking industry can leverage modernization to maintain a competitive edge, download the complete Mainframe Modernization for Retail Banking blueprint.

For media inquiries on the topic or to get exclusive, timely commentary from David Tomljenovic, a financial sector subject matter expert, please contact [email protected]

Info-Tech Research Group is one of the world’s leading information technology research and advisory firms, proudly serving over 30,000 IT professionals. The company produces unbiased and highly relevant research to help CIOs and IT leaders make strategic, timely, and well-informed decisions. For 25 years, Info-Tech has partnered closely with IT teams to provide them with everything they need, from actionable tools to analyst guidance, ensuring they deliver measurable results for their organizations.

Media professionals can register for unrestricted access to research across IT, HR, and software and over 200 IT and industry analysts through the firm’s Media Insiders program. To gain access, contact [email protected].

![]() View original content to download multimedia:https://www.prnewswire.com/news-releases/retail-banks-with-legacy-infrastructure-must-modernize-to-remain-competitive-among-startups-says-info-tech-research-group-301880201.html

View original content to download multimedia:https://www.prnewswire.com/news-releases/retail-banks-with-legacy-infrastructure-must-modernize-to-remain-competitive-among-startups-says-info-tech-research-group-301880201.html

SOURCE Info-Tech Research Group

Featured image: Megapixl © Wrightstudio