With the insurance industry facing significant challenges, Info-Tech Research Group’s newly published blueprint offers critical guidance to life and annuity insurers on selecting a policy administration system (PAS) that aligns with organizational needs. By leveraging the expert insights outlined in the blueprint, organizations can make informed decisions that drive growth, enhance efficiency, and maintain a competitive edge in a rapidly evolving insurance market.

TORONTO, Oct. 18, 2024 /PRNewswire/ – The life and annuity insurance industry is undergoing rapid change, with customers increasingly expecting instant, efficient, 24/7 service and constant product innovation. As insurers strive to meet these challenges, selecting the right policy administration system (PAS) becomes crucial for IT leaders in the sector. In response, Info-Tech Research Group has published its latest blueprint, Select the Right Insurance Policy Administration System for Life and Annuity, which offers essential guidance and insights to help IT leaders choose a PAS that is adaptable, highly automated, and capable of integrating advanced AI tools. The global IT research and advisory firm explains in the new data-backed resource that by making the right PAS selection, organizations can more efficiently address industry challenges, maintain their competitive edge, and deliver exceptional service to customers.

“A policy administration system is the center of a life and annuity insurance business,” says David Tomljenovic, principal research director at Info-Tech Research Group. “But what if an existing PAS no longer meets the needs of customers or the business? The life and annuity insurance business is evolving quickly, and customers expect a better experience through whatever channel they prefer.”

Info-Tech’s latest resource highlights the significant challenges insurance companies face in evaluating and selecting an effective PAS that meets modern operational demands. The firm’s insights highlight that many organizations struggle to allocate the necessary time for a thorough evaluation of the PAS market, often missing out on opportunities for innovation and growth. Furthermore, there tends to be limited awareness among IT leaders in the industry regarding the potential benefits, risks, and critical features that a new PAS should offer. To address these issues, Info-Tech emphasizes the importance of proactively navigating the selection process.

“Meeting customer and business demands requires a PAS that is flexible, open, and highly automated,” explains Tomljenovic. “As AI continues to impact the life and annuity insurance market, a PAS must provide access to your data. The ability to use internal and external tools will become increasingly important to the future of a PAS, so IT leaders in the industry must ensure that there is an integration path for these new tools as they emerge.”

Insurers often focus too much on the immediate value of a project, overlooking its long-term impact. Given that a PAS is a significant long-term investment, Info-Tech encourages IT leaders to define their organization’s key capabilities, assess long-term goals, and evaluate potential cost and competitive advantages. By thoroughly reviewing functional criteria and selecting a vendor that aligns with long-term objectives, organizations can ensure sustained success and adaptability in the face of ongoing market changes.

Key Features of an Effective Policy Administration System (PAS)

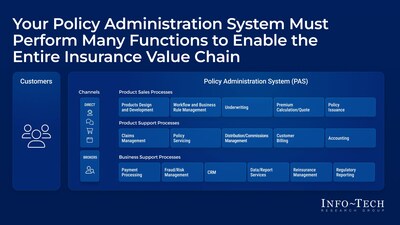

In its Select the Right Insurance Policy Administration System for Life and Annuity, Info-Tech highlights three critical functions of a modern PAS that can transform an insurance organization’s operations:

- Product Sales Process: A PAS should support the entire product lifecycle, from design and development to market launch, ensuring that new products and services are introduced efficiently and in response to market demand.

- Product Support Process: Enhancing the customer experience is essential. A robust PAS facilitates seamless product management and ensures consistent support throughout the policy lifecycle, enabling insurers to provide superior service to their clients.

- Business Support Process: As the insurance industry increasingly shifts toward ecosystem-based products, a PAS should be able to integrate additional features that indirectly impact core insurance offerings, enhancing overall agility and innovation across the business.

By leveraging this comprehensive blueprint, insurers can confidently navigate the complexities of selecting the right PAS. In the new blueprint, Info-Tech provides a detailed comparison of eight leading PAS vendors to help organizations assess their functional capabilities and make more informed decisions. The resource equips insurers with the tools needed to align their technological solutions with organizational goals, positioning them for long-term success in a highly competitive industry.

For exclusive and timely commentary from David Tomljenovic, an expert in the insurance and financial sector, and access to the complete Select the Right Insurance Policy Administration System for Life and Annuity blueprint, please contact [email protected].

About Info-Tech Research Group

Info-Tech Research Group is one of the world’s leading research and advisory firms, proudly serving over 30,000 IT and HR professionals. The company produces unbiased, highly relevant research and provides advisory services to help leaders make strategic, timely, and well-informed decisions. For nearly 30 years, Info-Tech has partnered closely with teams to provide them with everything they need, from actionable tools to analyst guidance, ensuring they deliver measurable results for their organizations.

To learn more about Info-Tech’s divisions, visit McLean & Company for HR research and advisory services and SoftwareReviews for software buying insights.

Media professionals can register for unrestricted access to research across IT, HR, and software and hundreds of industry analysts through the firm’s Media Insiders program. To gain access, contact [email protected].

For information about Info-Tech Research Group or to access the latest research, visit infotech.com and connect via LinkedIn and X.

![]() View original content to download multimedia:https://www.prnewswire.com/news-releases/insurance-providers-can-meet-business-and-customer-needs-with-ai-enabled-pas-says-info-tech-research-group-302280625.html

View original content to download multimedia:https://www.prnewswire.com/news-releases/insurance-providers-can-meet-business-and-customer-needs-with-ai-enabled-pas-says-info-tech-research-group-302280625.html

SOURCE Info-Tech Research Group

Featured Image: DepositPhotos @ Wavebreakmedia