Canada NewsWire

CALGARY, AB

,

Dec. 14, 2022

/CNW/ – Kiwetinohk Energy Corp. (TSX: KEC) today announced its 2023 budget and three-year outlook. The Company began preparing to launch a normal course issuer bid.

Kiwetinohk’s 2023 budget is focused on delivering multiple strategic initiatives:

- High rate of return oil and gas production with strong production per share growth.

- Increasing owned gas plant processing capacity to support higher production by the second half of 2023.

-

Filling majority of 120 MMcf/d of

Chicago

market Alliance Pipeline capacity with Company natural gas production. - Significant growth in adjusted funds flow (AFF1) and future free funds flow (FFF1).

- Financing its first power projects and reaching final investment decisions (FID) on 501 MW of generation capacity.

2023 budget highlights

-

Oil and gas sales

of 24.5-28.5 thousand boe/d, which is growth of ~50% year/year. Sales estimates include a provision for a 7-10-day shutdown in the third quarter of both Simonette plants for tie-in of expansion capacity. -

AFF

1

is forecasted between

$355

–

$450 million

(

~$8

–

$10

/share), ~50% increase year/year, at

US$70

–

US$80

WTI and

US$4.50

–

US$5.00

HH flat prices2. -

Total planned capital expenditures

for Upstream and Green Energy are between

$378

–

$402 million

. This plan can be funded at

US$50

WTI and

US$2.75

HH flat prices while maintaining a target net debt to AFF

1

ratio of below 1.0x, due in part to downside protection from hedges put in place during 2022. -

Drill, complete, equip and tie-in (DCET) spending

of

$270

–

$285 million

resulting in 15.5 net wells on production (10

Simonette Duvernay

and 5.5 net Placid Montney). This program includes carry over activity from 2022 and pre-investment supporting the 2024 program. It will maximize economic productivity in the Duvernay, delineate and prove the

Montney

in both Simonette and West Placid and retain land in both Simonette and Placid. -

Facility expansion capital

of

~$50 million

will be directed towards expanding owned gas processing capacity in Simonette by ~37 MMcf/d and electrification of the 5-31 Simonette gas plant. The expansions, scheduled for completion by the end of the third quarter, will support the next leg of production growth into year-end 2023 and 2024. -

Additional investments

of

$40

–

$45 million

will support maintenance of base production volumes, emissions reductions and buildout of field infrastructure to support low-cost future development. -

Green Energy investment

of

$18

–

$22 million

to further advance pre-construction development activities across Kiwetinohk’s 2,150 MW power project portfolio including

~$2 million

to pursue new Green Energy projects. -

Third party financing arrangements

are targeted for execution for Kiwetinohk’s 400 MW Homestead Solar and 101 MW Opal Firm Renewable projects in the first half of 2023 with FID anticipated by year-end. -

Asset retirement and reclamation obligation (ARO)

spending of

$5.5

–

$7.5 million

, in line with the Company’s ESG and stakeholder best practices. -

Cash taxes

are not expected to be paid by the Company in 2023 at flat

US$80

WTI and

US$5.00

HH pricing. -

Return on average capital employed (ROACE)

2,3

of 30%-34% at flat

US$70

–

US$80

WTI and

US$4.50

–

US$5.00

HH pricing.

2023 annual financial & operational guidance summary

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Natural gas sales volumes will continue to benefit from access to favourable US Dollar denominated pricing in the

Chicago

market via Kiwetinohk’s 120 MMcf/d of contracted capacity on the Alliance Pipeline. At the conclusion of the 2023 capital program, Kiwetinohk estimates it will require approximately

$160 million

of drill, complete, equip, tie-in (DCET) capital to sustain targeted 2023 average annual production rates. Given the large scale of the capital program relative to the corporate enterprise value (~55% at the time of budget Board of Director approval), Kiwetinohk will continue to actively hedge production to protect cash flows and provide a pricing floor required to fund the program.

Three-year outlook

The three-year outlook is intended to provide investors with increased visibility regarding Kiwetinohk’s strategy, the value of the Company’s asset base and the Company’s projected operational and financial capabilities and prospects. Kiwetinohk intends to grow cash flow from its upstream operations while pursuing its energy transition power projects, reducing debt and increasing free funds flow generation.

Three-year outlook highlights

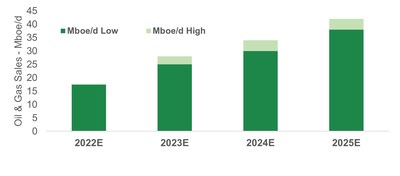

-

Annual production sales growth

expected between ~20%-50% in each of the next three years, reaching an expected average annual rate of 38-42 thousand boe/d during 2025, filling expanded processing facilities and Alliance Pipeline capacity with Company production. This represents a three-year compound annual growth rate (CAGR) of ~33% in aggregate production sales volumes and per share volumes. -

AFF and AFF/share

growth of ~100% from full year 2022 to above

$500 million

in 2025, a CAGR of ~27%. -

Free Funds Flow

of

~$180

–

$250 million

per year by 2025 (at

US$70

–

US$80

WTI flat oil prices). -

Total capital expenditures

between

$390

–

$408 million

in 2023-2024, reducing to

$318 million

by 2025. -

Green Energy division spending

of

$18

–

$22 million

in 2023,

~$13 million

in 2024 and

~$3 million

in 2025 is required to deliver the existing project portfolio to FID. In total, the Company expects to maintain spending of

$15

–

$20 million

per year in Green Energy beyond 2023 to continue advancing additional projects toward FID. -

Green Energy project financing and FID

targeted for its 2,150 MW power project portfolio. The Company continues to expand its Green Energy project portfolio with the recognition that projects face development, regulatory and execution risks, and not all projects may reach FID or have guaranteed completion success. -

Green Energy EBITDA

with commercial operations dates targeted by the end of 2025 for the 400 MW Homestead Solar, 101 MW Opal Firm Renewable and 170 MW Phoenix Solar projects. -

Debt repayment

of all outstanding corporate recourse debt balances.

Three year financial and operational outlook

|

|

|

|

||

|

|

||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Share liquidity and Normal Course Issuer Bid

Kiwetinohk is aware of, and concerned with, the lack of trading liquidity of the Company’s stock and believes that this lack of trading liquidity negatively impacts Kiwetinohk’s trading value as measured against the 2021 year-end reserve report NPV calculations and peer trading valuation metrics. To help address this issue, Kiwetinohk has made an application to the Toronto Stock Exchange (TSX) to implement a Normal Course Issuer Bid (NCIB) and Management has provided a three-year outlook to investors with additional information on the future prospects of the Company.

Kiwetinohk believes that the common shares have been trading in a price range which does not adequately reflect their value in relation to the Company’s current operations, growth prospects, energy transition projects and financial position. Kiwetinohk’s capital spending priority remains on growing the upstream production and advancing its power project development portfolio, and the measured application of an NCIB may be used to both repurchase common shares at times when management believes that the market price of the common shares does not reflect their underlying value and provide additional liquidity for shareholders. The NCIB is subject to review and acceptance by the TSX and Kiwetinohk anticipates implementing it in late 2022 or early 2023, subject to such TSX approval.

About Kiwetinohk

We, at Kiwetinohk, are passionate about addressing climate change and the future of energy. Kiwetinohk’s mission is to build a profitable energy transition business providing clean, reliable, dispatchable, affordable energy. Kiwetinohk develops and produces natural gas and related products and is in the process of developing renewable power, natural gas-fired power, carbon capture and hydrogen clean energy projects. We view climate change with a sense of urgency, and we want to make a difference.

Kiwetinohk’s common shares trade on the Toronto Stock Exchange under the symbol KEC.

Additional details are available within the year-end documents available on Kiwetinohk’s website at

www.kiwetinohk.com

and SEDAR at

www.sedar.com

.

Oil and Gas Advisories

For the purpose of calculating unit costs, natural gas is converted to a barrel of oil equivalent using six thousand cubic feet of natural gas equal to one barrel of oil unless otherwise stated. The term barrel of oil equivalent (boe) may be misleading, particularly if used in isolation. A boe conversion ratio for gas of 6 Mcf:1 boe is based on an energy equivalency conversion method primarily applicable at the burner tip and does not represent a value equivalency at the wellhead.

Forward looking information

Certain information set forth in this news release contains forward-looking information and statements including, without limitation, management’s business strategy, management’s assessment of future plans and operations. Such forward-looking statements or information are provided for the purpose of providing information about management’s current expectations and plans relating to the future. Forward-looking statements or information typically contain statements with words such as “anticipate”, “believe”, “expect”, “plan”, “intend”, “estimate”, “project”, “potential”, “may” or similar words suggesting future outcomes or statements regarding future performance and outlook. Readers are cautioned that assumptions used in the preparation of such information may prove to be incorrect. Events or circumstances may cause actual results to differ materially from those predicted as a result of numerous known and unknown risks, uncertainties and other factors, many of which are beyond the control of the Company.

In particular, this news release contains forward-looking statements pertaining to the following:

- anticipated North American commodity prices;

- the Company’s 2023 capital expenditures budget and allocations thereof;

- the Company’s 2023 and Q1 2023 financial and operational guidance, including ROACE;

- the Company’s expectations regarding cash taxes and when they are expected to be paid by the Company;

- the anticipated Simonette plant capacity additions and the timing and costs thereof and the effects of such additions on the Company’s production;

- drilling and completion activities on certain wells and pads, including cost efficiencies going forward;

- the anticipated production of certain wells and the timing thereof;

- the anticipated use of additional hedges to protect cashflows;

- the Company’s three-year financial and operational outlook;

- the anticipated CAGR, repayment of corporate debt, and timing of free funds flow during the three 3-year outlook;

- the anticipated financing, FID, and on production timing of Power projects;

- the anticipated implementation of the NCIB and the timing thereof; and

- the Company’s operational and financial strategies and plans.

In addition to other factors and assumptions that may be identified in this news release, assumptions have been made regarding, among other things:

- the timing and costs of the Company’s capital projects, including drilling and completion of certain wells;

- the impact of increasing competition;

- the general stability of the economic and political environment in which the Company operates;

- general business, economic and market conditions;

- the ability of the Company to obtain qualified staff, equipment and services in a timely and cost efficient manner;

- future commodity prices and hedging results;

- costs associated with the Company’s operations;

- currency, exchange and interest rates;

- the regulatory framework regarding royalties, taxes, and environmental matters in the jurisdictions in which the Company operates;

- the ability of the Company to obtain the required capital to finance its exploration, development and other operations and meet its commitments and financial obligations;

- the ability of the Company to secure adequate product processing, transportation, fractionation and storage capacity on acceptable terms and the capacity and reliability of owned and third party facilities;

- the timely receipt of required governmental and regulatory approvals;

- the impact of war, hostilities, civil insurrection, pandemics (including Covid-19), instability and political and economic conditions (including the ongoing Russian-Ukrainian conflict) on the Company;

- power project debt will be at the project level;

- power projects will be funded by third parties, as currently anticipated;

- the ability of the Company to successfully market its products; and

- the Company’s operational success and results being consistent with current expectations.

Readers are cautioned that the foregoing list is not exhaustive of all factors and assumptions that have been used. Although the Company believes that the expectations reflected in such forward-looking statements or information are reasonable, undue reliance should not be placed on forward-looking statements as the Company can give no assurance that such expectations will prove to be correct.

Forward-looking statements or information involve a number of risks and uncertainties that could cause actual results to differ materially from those anticipated by the Company and described in the forward-looking statements or information. These risks and uncertainties include, among other things:

- those risks set out in the Annual Information Form (AIF) under “Risk Factors”;

- the ability of management to execute its business plan;

- general economic and business conditions;

- risks of war, hostilities, civil insurrection, pandemics (including Covid-19), instability and political and economic conditions in or affecting jurisdictions in which the Company operates;

- operational and construction risks associated with certain projects;

- the possibility that government policies or laws may change or governmental approvals may be delayed or withheld;

- risks relating to regulatory approvals and financing;

- the Company’s ability to enter into or renew leases;

- risks associated with rising capital, operating, labour, inputs and other costs;

- the timing of capital project completions;

- fluctuations in commodity prices, foreign currency exchange rates and interest rates;

- risks inherent in the Company’s marketing operations, including credit risk;

- health, safety, environmental and construction risks;

- changes in royalties, taxes, and environmental legislation and regulations in the jurisdictions in which the Company operates;

- the Covid-19 pandemic and the duration and impact thereof;

- risks associated with existing and potential future lawsuits and regulatory actions against the Company;

- uncertainties as to the availability and cost of financing;

- the ability to secure adequate processing, transportation, fractionation and storage capacity on acceptable terms;

- processing, pipeline and fractionation infrastructure outages, disruptions and constraints;

- operational issues encountered in the energy business; and

- other risks and uncertainties described elsewhere in this document and in Kiwetinohk’s other filings with Canadian securities authorities.

Readers are cautioned that the foregoing list is not exhaustive of all possible risks and uncertainties.

The forward-looking statements and information contained in this news release speak only as of the date of this news release and the Company undertakes no obligation to publicly update or revise any forward-looking statements or information, except as expressly required by applicable securities laws.

Non-GAAP Measures

This news release contains measures that do not have a standardized meaning under generally accepted accounting principles (GAAP) and therefore may not be comparable to similar measures presented by other entities. These performance measures presented in this document should not be considered in isolation or as a substitute for performance measures prepared in accordance with GAAP and should be read in conjunction with the consolidated financial statements of the Company. Readers are cautioned that these non-GAAP measures do not have any standardized meanings and should not be used to make comparisons between Kiwetinohk and other companies without also taking into account any differences in the method by which the calculations are prepared.

Please refer to the Corporation’s MD&A as at and for the nine months ended

September 30, 2022

, under the section “Non-GAAP Measures” for a description of these measures, the reason for their use and a reconciliation to their closest GAAP measure where applicable. The Corporation’s MD&A is available on Kiwetinohk’s SEDAR profile at

www.sedar.com

Future-Oriented Financial Information

Financial outlook and future-oriented financial information contained in this press release about prospective financial performance, financial position or cash flows is based on assumptions about future events, including economic conditions and proposed courses of action, based on management’s assessment of the relevant information currently available. In particular, this press release contains expected adjusted funds flow from operations, net debt to adjusted funds flow from operations and free funds flow. These projections contain forward-looking statements and are based on a number of material assumptions and factors set out above and are provided to give the reader a better understanding of the potential future performance of the Company in certain areas. Actual results may differ significantly from the projections presented herein. These projections may also be considered to contain future oriented financial information or a financial outlook. The actual results of the Company’s operations for any period will likely vary from the amounts set forth in these projections, and such variations may be material. See “Risk Factors” in the Company’s AIF published on the Company’s profile on SEDAR at

www.sedar.com

for a further discussion of the risks that could cause actual results to vary. The future oriented financial information and financial outlooks contained in this press release have been approved by management as of the date of this press release. Readers are cautioned that any such financial outlook and future-oriented financial information contained herein should not be used for purposes other than those for which it is disclosed herein.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

FOR MORE INFORMATION ON KIWETINOHK, PLEASE CONTACT:

Mark Friesen

,

Director, Investor Relations

IR phone: (587) 392-4395

IR email:

[email protected]

Address: Suite 1500, 250 – 2 Street S.W.

Calgary, Alberta

T2P 0C1

Pat Carlson

,

CEO

Jakub Brogowski

,

CFO

|

|

|

|

|

|

|

|

SOURCE Kiwetinohk Energy

![]()

View original content to download multimedia:

http://www.newswire.ca/en/releases/archive/December2022/14/c0081.html

Featured image: Depositphotos © Ssuaphoto