The latest report from the Labor Department indicates a slight uptick in overall U.S. inflation for December, driven primarily by increased energy and housing prices. The data, released on Thursday, showed a 0.3% monthly rise from November and a 3.4% increase from the previous year, slightly surpassing economists’ forecasts.

Housing costs, responsible for over half of the monthly price increase, played a significant role, along with elevated energy and food prices. Excluding volatile food and energy costs, core prices rose by 0.3% month-over-month, consistent with November’s figures. Core prices, which exclude fluctuations from month to month, showed a 3.9% increase from a year earlier, marking the mildest pace since May 2021.

While inflation has steadily cooled since reaching a four-decade high in mid-2022, it remains a concern for the Federal Reserve, which aims to achieve its 2% target. Despite the economic growth, low unemployment, and robust hiring, public dissatisfaction persists due to the lasting effects of the recent inflation surge.

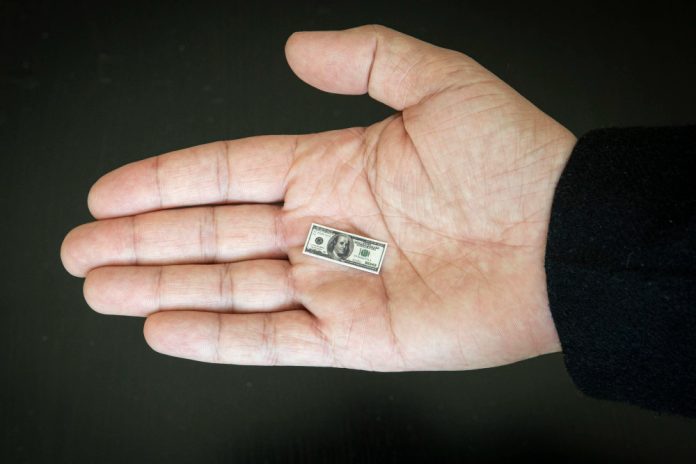

The disconnect between economic health and public perception, likely to be a focal point in the 2024 elections, is attributed to the lingering impact of the worst inflation in four decades. Although wage gains have outpaced inflation, with average after-inflation take-home pay increasing, a majority of respondents in a November poll described the economy as poor, citing rising expenses.

Housing, constituting about a third of the U.S. consumer price index, played a prominent role in Thursday’s figures. Homeownership costs alone make up roughly 25% of the index, with overall housing prices rising 0.5% from November to December. Over the past year, specific items have seen price declines, including furniture, bedding, men’s suits, coats, televisions, and sporting goods.

The Federal Reserve’s aggressive interest rate hikes since March 2022 aim to reduce year-over-year inflation to the 2% target. Despite some optimistic signs, such as a decline in consumer expectations of future inflation, challenges persist, including rising average hourly wages and a reduction in the workforce.

While inflationary pressures are gradually easing, they remain higher than anticipated, requiring more time to reach the desired target. Quincy Krosby, Chief Global Strategist for LPL Financial, noted, “Inflationary pressures, while generally inching lower, remain stubbornly higher than expectations as the so-called ‘last mile’ requires more time to reach the final goal.”

Featured Image: Freepik