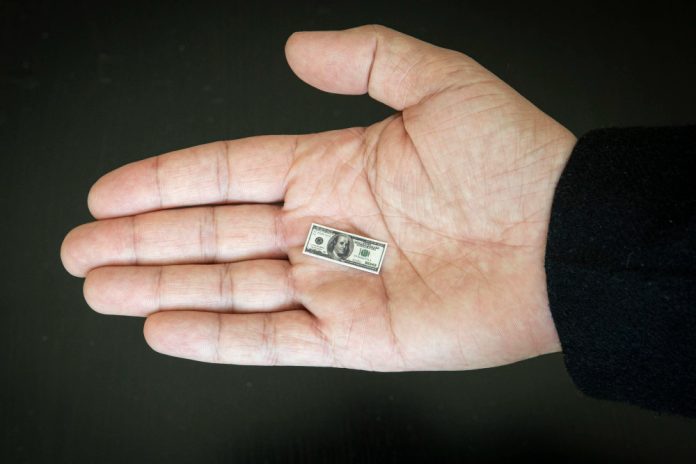

Consumer prices in the United States increased last month, indicating that inflation remains a persistent concern for the Federal Reserve and President Joe Biden’s re-election campaign, both of which are hoping for a gradual easing of price pressures this year.

According to the Labor Department’s report on Tuesday, prices rose by 0.4% from January to February, surpassing the previous month’s figure of 0.3%. Compared to a year ago, consumer prices in February rose by 3.2%, faster than the 3.1% pace recorded in January.

Excluding volatile food and energy prices, which are known as “core” prices, there was also a 0.4% increase from January to February, matching the previous month’s rise and exceeding the Fed’s 2% target. Core inflation is closely monitored as it typically provides a better indication of future inflation trends.

The rise in overall inflation was primarily driven by higher gas prices, with pump prices increasing by 3.8% just from January to February. However, grocery prices remained unchanged last month and are up only 1% from a year earlier. The cost of clothing, used cars, and rent also contributed to the increase in inflation in February.

Despite the elevated figures in February, most economists anticipate that inflation will continue to slowly decline throughout the year. However, the uptick last month may highlight the Fed’s cautious approach toward interest rate cuts.

Overall inflation has dropped significantly from its peak of 9.1% in June 2022, although the decline is now occurring at a slower pace compared to last spring and summer. Prices for certain goods, such as appliances, furniture, and used cars, are actually declining after supply chain disruptions during the pandemic caused prices to soar. On the other hand, prices for services like dental care and car repairs are still rising at a faster rate than before the pandemic.

The issue of inflation is likely to be a central theme in this year’s presidential election. Despite a strong job market and record-high stock market, many Americans blame President Joe Biden for the surge in consumer prices that began in 2021. Although inflationary pressures have eased significantly, average prices remain significantly higher than they were three years ago.

In his State of the Union speech last week, Biden highlighted measures he has taken to reduce costs, such as capping the price of insulin for Medicare patients. The president also criticized many large companies for engaging in “price gouging” and “shrinkflation,” where companies reduce the amount of product in a package instead of raising prices.

Fed Chair Jerome Powell indicated in congressional testimony last week that the central bank is nearing a decision to cut rates. After their January meeting, Fed officials stated that they needed “greater confidence” that inflation was steadily declining towards their 2% target. Since then, several Fed policymakers have expressed confidence that prices will continue to fall. One reason for this optimism is that consumers are increasingly seeking out cheaper alternatives in response to higher prices.

Most economists expect the Fed to make its first rate cut in June, although it could happen as early as May. When the Fed cuts its benchmark rate, it gradually reduces borrowing costs for mortgages, car loans, credit cards, and business loans.

One factor that could keep inflation elevated is the still-healthy economy. Despite expectations of a recession last year, hiring and growth remained strong. The economy expanded by 2.5% last year and could grow at a similar pace in the first three months of this year, according to the Federal Reserve’s Atlanta branch.

Last week, the Labor Department reported that employers added a robust 275,000 jobs in February, continuing a streak of strong hiring gains. The unemployment rate remained below 4% for the 25th consecutive month, the longest such streak since the 1960s.

However, the unemployment rate rose slightly from 3.7% to 3.9%, and wage growth slowed. Both trends could give the Fed more confidence that the economy is cooling, which could help to further reduce inflation and lead the central bank to begin cutting rates.

Featured Image: Freepik