The latest data from the United States reveals a continued slowdown in wholesale inflation, indicating a gradual easing of price pressures in the economy.

According to the report released by the Labor Department on Wednesday, the producer price index, which tracks inflation before reaching consumers, remained unchanged from October to November, following a 0.4% decline in the previous month. On a year-over-year basis, producer prices increased by only 0.9% from November 2022, marking the smallest rise since June.

When excluding volatile food and energy costs, known as core wholesale prices, there was no change from October, with a modest 2% increase from a year ago — the mildest year-over-year rise since January 2021. Prices for goods remained steady from October to November, primarily due to a 4.1% decline in gasoline prices, while services prices also remained flat.

The latest report supports the notion that inflationary pressures are subsiding across the broader economy, including among wholesale producers. These figures, reflecting prices charged by manufacturers, farmers, and wholesalers, serve as an early indicator of the potential trajectory of consumer inflation in the upcoming months.

Year-over-year producer price inflation has been consistently slowing since its peak at 11.7% in March 2022. This was the same month when the Federal Reserve initiated a series of interest rate hikes to curb accelerating prices. Over the subsequent period, the Fed raised the rate 11 times, transitioning from near-zero to approximately 5.4%, reaching its highest level in 22 years.

The Federal Reserve is expected to announce, following its latest policy meeting on Wednesday, that it will leave its benchmark rate unchanged for the third consecutive meeting. Most economists anticipate that the Fed has concluded its rate-hiking cycle and is likely to start reducing rates sometime next year.

In a report released on Tuesday, the Labor Department disclosed that consumer prices rose by a mere 0.1% last month from October and 3.1% from a year earlier. However, core prices, considered by the Fed as a more reliable indicator of future inflation, exhibited greater stability, rising by 0.3% from October and 4% from November 2022. Although year-over-year consumer price inflation has significantly dropped from its four-decade high of 9.1% in June 2022, it still surpasses the Fed’s 2% target.

Rubeela Farooqi, Chief U.S. Economist at High-Frequency Economics, commented, “The data confirm the downtrend in inflation, although consumer prices are moving lower more gradually. For the Fed, there is nothing in today’s figures that changes our expectation that its policymakers will hold policy steady today, and rates are at a peak.”

Despite widespread predictions that Fed rate hikes would lead to a recession, the U.S. economy and job market have remained surprisingly robust, raising hopes for the Fed to achieve a “soft landing” — increasing rates sufficiently to curb inflation without triggering an economic downturn.

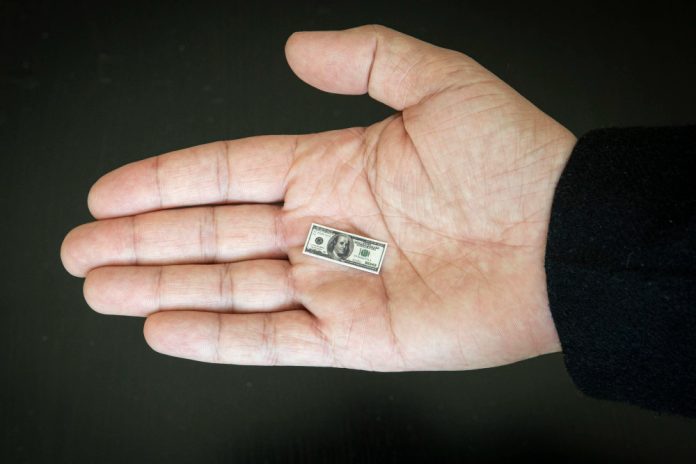

Featured Image: Freepik