The S&P 500 experienced fluctuations following a mixed performance in the stock market, particularly among AI-related stocks. The sector witnessed notable declines after Marvell Technology Group Ltd. (NASDAQ:MRVL) provided an outlook that fell short of analysts’ expectations. This development raised concerns about the growth prospects of AI stocks, which have been a significant driver of market optimism in recent months.

Marvell Technology’s recent announcement highlighted a softer-than-expected demand for its AI products, leading to a recalibration of investor expectations. The company, known for its semiconductor solutions, emphasized challenges in the supply chain and the competitive landscape, factors that could impact its future earnings. Investors responded cautiously to this update, resulting in a drop in Marvell’s stock price.

The broader market sentiment was also affected as investors reassessed the potential of AI stocks. While the promise of artificial intelligence remains substantial, the sector’s volatility was underscored by Marvell’s announcement. Other companies within the AI domain also saw their share prices fluctuate as the market digested the implications of Marvell’s outlook.

Despite these challenges, some market analysts remain optimistic about the long-term prospects of AI technology. They argue that while short-term hurdles are inevitable, the transformative potential of AI across various industries could drive substantial growth in the future. This perspective suggests that the current market volatility may present buying opportunities for investors with a long-term view.

In contrast, skeptics caution against over-reliance on AI stocks, emphasizing the need for a diversified investment strategy. They point out that the rapidly evolving technological landscape requires companies to continuously innovate to maintain competitive advantages. This dynamic can lead to significant risks for investors who heavily concentrate their portfolios in AI-related stocks.

As the market continues to navigate these complexities, the performance of the S&P 500 remains a focal point for investors. The index’s movements are closely watched as an indicator of broader economic health and investor sentiment. Analysts suggest that ongoing developments in the AI sector, coupled with macroeconomic factors, will play a critical role in shaping market trends in the coming months.

In conclusion, while Marvell Technology’s recent outlook posed challenges for AI stocks, the sector’s potential for growth remains intact. Investors are encouraged to maintain a balanced approach, considering both the risks and opportunities within the AI landscape. The evolution of AI technology continues to be a key theme in the financial markets, with its impact expected to unfold over the long term.

Footnotes:

- Marvell Technology Group Ltd. (NASDAQ:MRVL) shared a less optimistic outlook, impacting AI stocks negatively. Source.

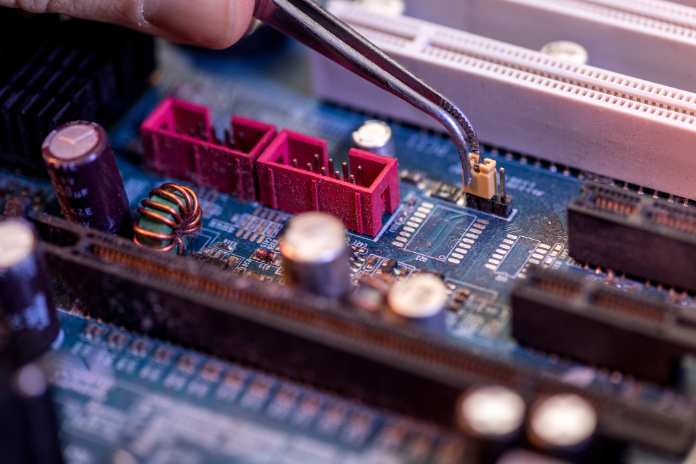

Featured Image: DepositPhotos @ AllaSerebrina