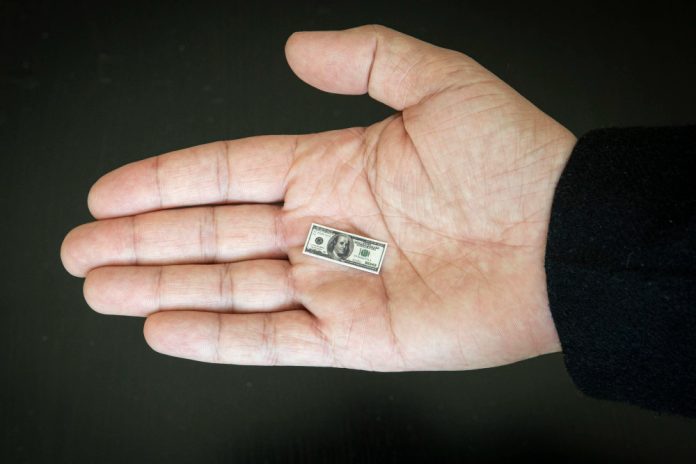

The global economy is anticipated to experience a slowdown in the coming year, as outlined by the Organization for Economic Cooperation and Development (OECD). Despite showing resilience this year, the world economy is expected to face challenges due to factors such as ongoing wars, persistent inflation, and sustained high-interest rates.

The OECD, based in Paris, projected a decrease in international growth from an anticipated 2.9% this year to 2.7% in 2024. If realized, this would represent the slowest calendar-year growth since 2020, the year marked by the onset of the COVID-19 pandemic.

While the organization expressed a somewhat pessimistic outlook, it also indicated the belief that recessions would be avoided in most regions. However, concerns were raised about the possibility of persistent high inflation and the potential impact of geopolitical conflicts, such as the Israel-Hamas conflict and Russia’s war in Ukraine, on commodity prices like oil and grain.

A significant contributor to the anticipated slowdown is the expected deceleration of the world’s two largest economies, the United States and China, in the coming year. The U.S. economy is forecasted to expand by only 1.5% in 2024, down from 2.4% in 2023, influenced by the Federal Reserve’s series of interest rate increases. The OECD predicts a decline in U.S. inflation from 3.9% in the current year to 2.8% in 2024 and 2.2% in 2025.

China, grappling with challenges such as a real estate crisis, rising unemployment, and slowing exports, is expected to see its economy expand by 4.7% in 2024, down from 5.2% this year. The OECD attributes this slowdown to factors like increased precautionary savings, pessimistic employment prospects, and heightened uncertainty.

The European Union, particularly the eurozone countries, is also likely to contribute to the global economic slowdown. These countries have been affected by elevated interest rates and a surge in energy prices following Russia’s invasion of Ukraine. The OECD projects the collective growth of the eurozone to be 0.9% in 2024, a slight improvement from the predicted 0.6% growth in 2023.

OECD Chief Economist Clare Lombardelli emphasized the contrasting outlook for the U.S. and Europe, with a more optimistic outlook for the former and a weaker one for the latter. She highlighted the impact of last year’s spike in energy prices on Europe, which led to a cost-of-living crisis and negatively affected manufacturing.

The global economy has faced numerous challenges since 2020, including the COVID-19 pandemic, unexpected inflation, the Ukraine conflict, and high borrowing rates. Despite these shocks, economic expansion has been more robust than initially anticipated. However, the OECD now warns that the positive trend may be waning, citing the impact of tighter financial conditions, weak trade growth, and reduced confidence.

Moreover, the organization raised concerns about new risks arising from heightened geopolitical tensions, particularly in the context of the Israel-Hamas war. There are apprehensions about potential disruptions to energy markets and major trade routes if the conflict were to escalate.

In summary, the OECD anticipates a global economic slowdown in 2024 due to various factors, with the U.S. and China expected to decelerate, and Europe facing challenges from heightened interest rates and energy prices. The organization also emphasizes the potential risks associated with geopolitical tensions.

Featured Image: Freepik