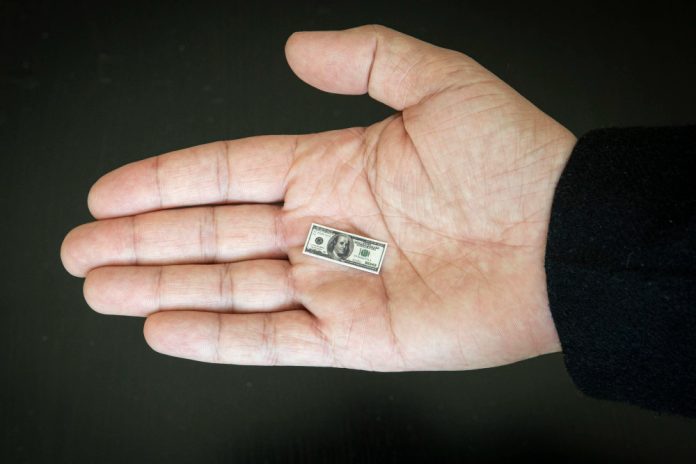

Americans are increasingly concerned about the nation’s economic health. The latest data from the University of Michigan reveals a significant drop in consumer sentiment this November, reaching the lowest point since May at 60.4 – far below the 63.7 predicted by experts. This marks the fourth consecutive month of decline in consumer sentiment.

Joanne Hsu, Director of Surveys of Consumers, noted that despite slight improvements in current and expected personal finances, there’s a noticeable 12% downturn in long-term economic prospects, partly fueled by worries over high interest rates and global conflicts in Gaza and Ukraine.

A key observation is the rise in long-term inflation expectations to levels not seen since 2011. Consumers now anticipate a 3.2% inflation rate over the next five years, up from last month’s 3%. Gas price expectations have also reached their peak this year.

This uptick in inflation expectations emerges as the Federal Reserve maintains its stance that significant efforts are still needed to achieve its 2% inflation target. The Consumer Price Index (CPI) has shown a steady annual increase of 3.7% in recent months, with October’s figures expected to indicate a 3.3% year-on-year rise.

The Fed’s preferred inflation metric, the core PCE, which excludes food and energy, recorded its largest monthly increase since May, though yearly price rises are slowing. Federal Reserve Chair Jerome Powell termed these inflation trends as “favorable,” but cautioned that it’s too early to consider the battle against inflation won. Powell emphasized the need for sustained positive data to confidently say inflation is aligning with their goals.

This week, Powell and other Fed officials indicated that further interest rate hikes might be necessary to ensure a continued decline in inflation. Speaking at an International Monetary Fund (IMF) event, Powell asserted the Fed’s readiness to tighten policy as needed, while Richmond Fed President Thomas Barkin expressed doubts about current policies being restrictive enough, highlighting persistently high shelter and service inflation. Barkin left open the possibility of further actions by the Fed, depending on whether a slowdown is sufficient to settle inflation.

Featured Image – Freepik