Uranium prices (UXU23) have recently soared to their highest levels in over a decade, reminiscent of the pre-Fukushima era in 2011, with a remarkable 12% surge to $65.50 per pound in just the past month, according to data from UxC. This price surge reflects a global resurgence of interest in nuclear power, driven by utilities rushing to secure their nuclear fuel supplies.

The current landscape of the uranium market presents several opportunities for investors to capitalize on this bullish trend:

1. Invest in Uranium Producers

- Cameco (CCJ) stands as the world’s largest publicly traded uranium producer and the second-largest globally. As uranium prices continue to rise, Cameco’s CFO, Grant Isaac, has emphasized the need for new supplies. Investing in Cameco offers exposure to the uranium market through a leading player in the industry. The company’s stock has already demonstrated strong performance, with a 39% increase over the past year and more than 72% year-to-date.

2. Consider Uranium Miner ETFs

- Broad-based ETFs that focus on uranium miners provide a diversified approach to investing in the sector. The Sprott Uranium Miners ETF (URNM) is one such option, and it has shown significant gains, with a 20% increase over the past year and more than 39% year-to-date. These ETFs offer exposure to a basket of uranium mining companies, spreading risk across the sector.

3. Explore Physical Uranium Investment Funds

- For those interested in owning physical uranium, funds like the Sprott Physical Uranium Trust Fund (SRUUF) provide an avenue to invest directly in U3O8. This fund has delivered robust returns, gaining 37% over the past year and 41% year-to-date. Investing in physical uranium can offer a more direct play on uranium prices.

The reasons behind this uranium bull market are compelling. Governments worldwide are increasingly seeking energy independence by extending the lifespan of existing nuclear reactors and exploring the construction of new ones. The International Energy Agency (IEA) has emphasized the need for the nuclear industry to double in size over the next two decades to meet net-zero emissions targets.

Furthermore, innovations in nuclear technology, such as small modular reactors (SMRs), are poised to enhance the efficiency of uranium usage and boost demand. SMRs, with their smaller footprint and lower emissions, are gaining traction in both the public and private sectors, with the global SMR market expected to surge to $18.8 billion by 2030.

The World Nuclear Association (WNA) has also revised its forecasts, predicting that more than 140 reactors could operate longer than previously expected, along with the development of 35 gigawatt hours of SMRs by 2040. This substantial growth, coupled with life extensions for U.S. nuclear power plants, is expected to drive demand that surpasses supply from 2025 onwards.

It’s important to note that the uranium market has a unique characteristic of near-inelastic demand. Utility companies are compelled to purchase uranium for their reactors, regardless of the uranium price. Even if uranium prices were to surge tenfold, the impact on the cost of electricity generation from nuclear reactors would be relatively modest, making it a resilient investment option.

In summary, the uranium market is showing strong signs of a bull market, driven by increasing global demand, innovations in nuclear technology, and a dearth of new uranium mining projects. Investors can consider various strategies to profit from this emerging trend, whether through direct investments in uranium producers, uranium miner ETFs, or funds focused on physical uranium. Each approach offers its own advantages and potential for substantial gains as uranium prices continue their upward trajectory.

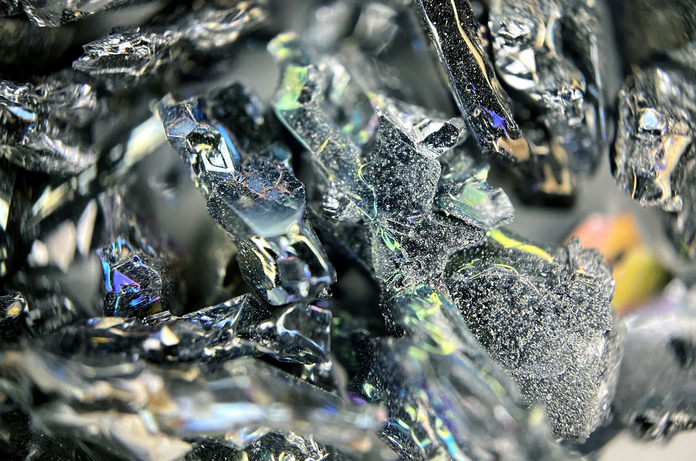

Featured Image: Freepik @ VecMes