Airbnb stock (NASDAQ:ABNB) is experiencing a surge. Notably, there has been an unprecedented increase in out-of-the-money put options activity, reaching 30 times the normal volume for a particular out-of-the-money strike price, according to Barchart’s This surge in activity could be attributed to bullish ABNB stock traders engaging in shorting out-of-the-money puts as a means to generate income.

As of midday trading on Wednesday, July 26, 2023, ABNB stock is valued at $148.01 per share. The Barchart report highlights that for the Aug. 11 expiration period, over 3,000 put contracts have been traded at the $140.00 strike price today. This volume represents an increase of almost 30 times compared to the outstanding contracts prior to today’s trading session.

At $8.01 below the current spot price, or 5.40% out-of-the-money (OTM), the premium for the $140 strike price put stands at $3.88 per contract. This suggests that an institutional trader likely initiated the trade by shorting the $140 strike price and receiving $3.88 per contract for the 16-day period until expiration. This trade results in an immediate yield of 2.77% (i.e., $3.88 premium received / $140 strike price shorted), offering an attractive return for most traders. Additionally, the breakeven level of $136.12 is 8.0% below today’s price of $148.01.

If this yield is repeatable every two weeks throughout the year, the trader has the potential to achieve an annualized return of 188%, making this type of trade highly profitable.

Investors are closely awaiting the Q2 earnings results, scheduled for release on Aug. 3. The elevated put premiums may be attributed to the anticipation of potential stock fluctuations following the earnings announcement, which is a common occurrence for many tech stocks.

However, Airbnb has been consistently generating significant amounts of free cash flow (FCF). In the previous quarter, the company recorded $1.6 billion in FCF, and over the last 12 months, a remarkable $3.8 billion of FCF. Notably, its FCF margin in Q1 stood at an impressive 87%.

Investors are hopeful that the company will maintain a robust FCF level this quarter, despite its typical seasonal fluctuations. For instance, during Q2 of the previous year, the FCF margin was 38%, which was less than half of the Q1 margin due to payouts made to hosts for travel booked in Q1.

Ultimately, if investors observe that Airbnb’s FCF margin in Q2 meets or surpasses last year’s 38%, it could positively impact the stock’s performance.

As seen in recent weeks, short-sellers who engaged in short put trades with strike prices of $135 and $136 and expiring on July 28 were able to benefit from attractive yields of 1.41% and 1.55% respectively, as these puts have now decreased significantly in value.

Today’s unusual put options activity is likely to lead to profitable outcomes for the traders involved.

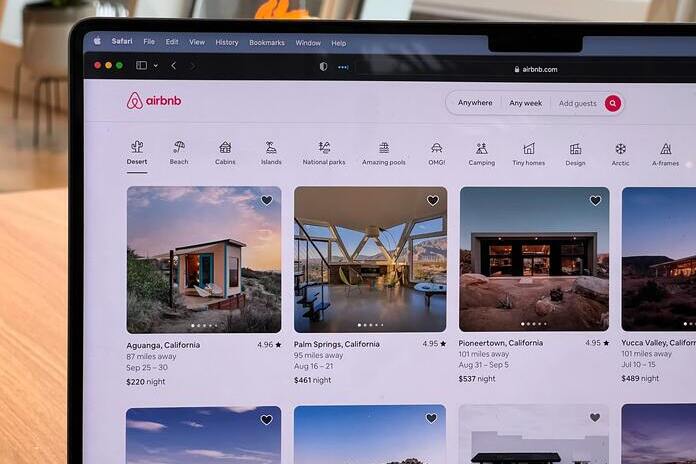

Featured Image: Unsplash