Semiconductor Industry

The current slowdown is actually the longest since the US-China trade war in 2018 and indicates that increasing interest rates and growing geopolitical risks have been weighing on the world economy for the majority of this year.

The market prediction for the year has now been lowered to a 13.9% rise from a previous 16.3% growth in a separate forecast by World Semiconductor Trade Statistics (WSTS), a nonprofit organization that analyzes shipments. Additionally, the semiconductor industry expects chip sales to grow just 4.6% in 2023, the slowest rate since 2019. Strong chip demand is predicted by the World Semiconductor Trade Statistics (WSTS), with the global semiconductor market estimated to rise 13.9% to $633B in 2022.

2021 had shown growth of 26.2%.

Growth in the categories of logic is forecast to increase by 24.1% year over year, analog by 21.9%, and sensors by 16.6%; The weakest projected category, optoelectronics, is anticipated to be nearly unchanged year over year.

All geographical areas are expected to expand in 2022, with the Asia Pacific at 10.5%, the Americas at 23.5%, Europe at 14%, and Japan at 14.2%.

By 2023, the global semiconductor industry will have expectedly increased by 4.6% with most categories experiencing mid-single digit growth.

In 2023, the logic category is anticipated to generate $200 billion, or nearly 30% of the market.

Invesco Dynamic Semiconductors ETF (PSI), ProShares Ultra Semiconductors (USD), First Trust Nasdaq Semiconductor ETF, VanEck Semiconductor ETF (SMH), iShares Semiconductor ETF (SOXX), SPDR S&P Semiconductor ETF (XSD) (FTXL).

Top manufacturers of semiconductors include Texas Instruments (TXN), Qualcomm (QCOM), NXP Semiconductors (NXPI), Microchip Technology (MCHP), Intel (INTC), Micron Technology (MU), and Applied Materials (AMAT).

Russia’s conflict with Ukraine is having an impact on Europe’s economy, which is forecast to grow by just 3.2%. Currently, the International Monetary Fund reduced its prediction for global growth last month and warned that 2023 might be more difficult than this year. The semiconductor boom may be coming to an end, according to several analysts, but others predict the upcycle will continue despite some growth deceleration.

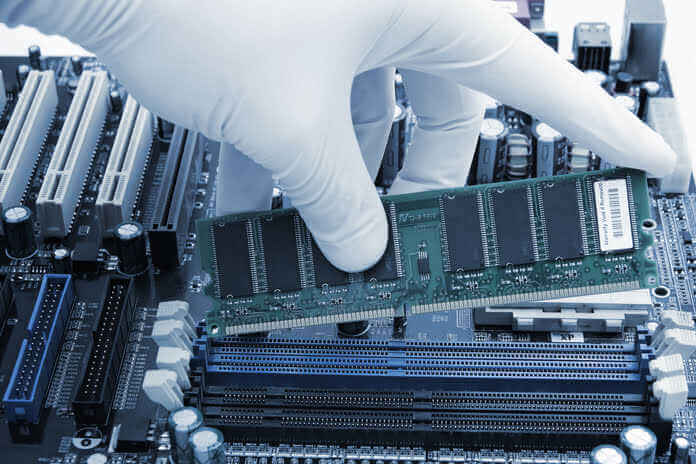

Featured Image: