Shares of Texas Instruments Inc. (NASDAQ:TXN) dipped as the chipmaker unveiled a less-than-optimistic quarterly forecast, pointing to a sluggish demand for industrial and automotive electronic components. The company anticipates first-quarter sales ranging from $3.45 billion to $3.75 billion, falling short of the average analyst estimate of $4.09 billion. Similarly, profit is projected to be between 96 cents and $1.16 a share, compared to a predicted $1.42.

The subdued outlook suggests that a recovery in orders from critical sectors is slower than anticipated, raising concerns about the broader market. As a major player with the chip industry’s most extensive customer base and diverse product range, Texas Instruments’ projections often serve as a barometer for overall economic demand.

CEO Haviv Ilan acknowledged challenges, stating, “During the quarter we experienced increasing weakness across industrial and a sequential decline in automotive.” Texas Instruments shares fell by 3.1% in early trading following the announcement, with year-to-date performance lagging behind the Philadelphia Stock Exchange Semiconductor Index.

While not all segments of the chip industry face the same challenges, Texas Instruments, known for being the largest producer of analog semiconductors, has been impacted. The company is undergoing a significant overhaul of its factories to enhance competitiveness, committing to an annual expenditure of about $5 billion through 2026.

In the fourth quarter, Texas Instruments recorded a 13% decline in revenue to $4.08 billion, below the estimated $4.13 billion, and a profit of $1.49 a share, down from $2.13 a year earlier. The company faced a 13% annual sales contraction in 2023, marking its most substantial decline in over a decade.

Despite the current challenges, the company’s executives remain cautious about giving long-term projections or estimating when customer demand might rebound. Chief Financial Officer Rafael Lizardi noted differences in the downturn this time, with various sectors experiencing declines at different rates. While industrial-related demand has been decreasing for three consecutive quarters, the automotive sector has only recently started to contract. Lizardi emphasized the company’s commitment to upgrading its factories for long-term semiconductor content growth, particularly in the auto and industrial sectors, expressing confidence in the strategy even during challenging market conditions.

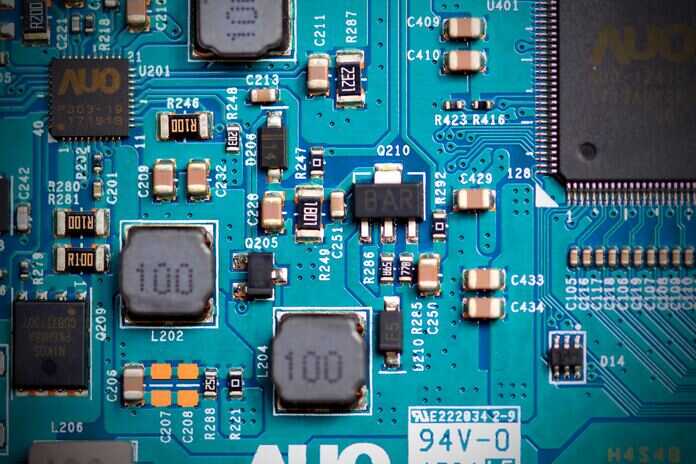

Featured Image: Freepik