Tesla Stock (NASDAQ:TSLA)

After researching the effects of the Inflation Reduction Act on the electric car industry, Morgan Stanley concluded that investors may need to be more accurate in the beneficial catalyst the law may be for Tesla (NASDAQ:TSLA) over the next several years.

According to analyst Adam Jonas, Tesla (NASDAQ:TSLA) has achieved cost leadership and tight industry-high margins via its vertically integrated business model, technical innovation, and manufacturing experience. To assist in leveling the playing field or turning the tide for the entire electric vehicle sector, from startups to legacy OEMs striving to go electric, many investors now feel the U.S. Inflation Reduction Act may help. However, Jonas and the team believe that the IRA is so financially beneficial to Tesla compared to traditional OEMs that it acts as an insurance policy that may be undervalued. Jonas pointed out that TSLA’s size and cost advantages might translate to hundreds of basis points in operating margin. The EV manufacturer is believed to use this advantage to increase its market share at the expense of profitability.

We assume Tesla will retain 75% of the Advanced Manufacturing Production Tax Credit ($45/KWh for cells and packs as provisioned in Section 45X). Panasonic will retain 25% because Tesla’s battery production involves the proprietary manufacturing of 4680 cells at Giga Austin, the eventual ramp of 100GWh of production at Giga Nevada, and joint production with Panasonic via JV. It is assumed that GM and LGES get 50% of the tax credit and that Ford and SK ON each receive 50%.

Morgan Stanley has set a $200 price objective and an Overweight rating on Tesla stock. The Tesla PT includes the following: (1) $88/share for core Tesla Auto business on 7.9M units in 2030; (2) $9/share for Tesla Mobility on DCF with 425k vehicles at $1.7/mile by 2030; (3) $28/share for Tesla as a 3rd party supplier; (4) $33/share for Energy; (5) $8/share for Insurance; and (6) $33/share for Network Services.

On Tuesday afternoon trading, Tesla stock dipped 2.08% to $168.20, compared to their 52-week high of $314.67 and low of $101.81.

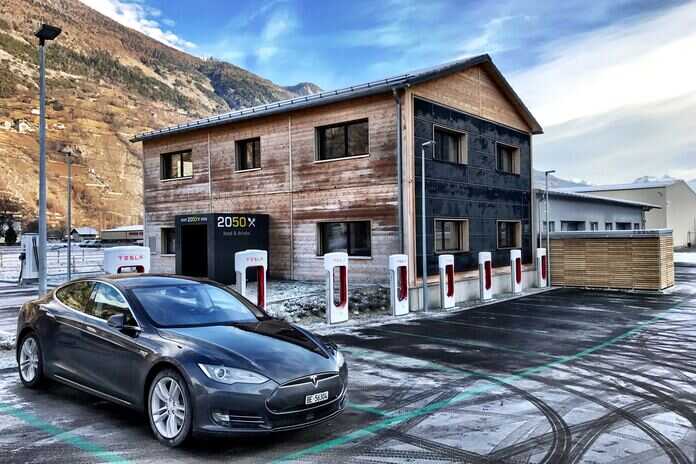

Featured Image: Unsplash @ Tesla Fans Schweiz