Rent the Runway Inc. (NASDAQ:RENT), despite its significant decline in 2023, is now attracting attention for potential speculative opportunities, particularly a bear squeeze scenario. While the stock lost nearly 97% of its value since its public debut in October 2021, recent developments suggest a potential for a rebound, prompting discussions about a bear squeeze.

Here are key factors contributing to the speculative buzz surrounding RENT stock:

Significant Decline and Potential Rebound: RENT stock witnessed a drastic decline, raising questions about its prospects. However, the recent 23% gain in market value on Monday has ignited speculation about a potential rebound, considering the stock’s low valuation at 56 cents.

Short Interest and Options Market Activity: The short interest in RENT stock is currently at 16.64% of its float, with a short interest ratio of 4.97 days to cover. In the options market, unusual volume was observed for the Jan 19 ’24 1.00 Call, suggesting heightened activity. Institutional traders appear to have engaged in both buying and selling these call options, setting the stage for a potential bull-bear showdown.

Bear Squeeze Dynamics: The concept of squeezing out bearish traders involves creating conditions where pessimistic investors are forced to cover their short positions or fulfill options contracts. This can occur in both the open market (short squeeze) and the options market. In the case of RENT stock, a potential squeeze may result from the stock moving higher, putting bearish positions at risk.

Limited Downside for Bulls: Speculative dynamics seem to favor bullish investors, as the downside risk for them is limited to their principal investment. On the other hand, bearish traders face potential obligations to return borrowed shares or fulfill the terms of call option contracts if the stock moves against them.

Bearish Pressure and Potential Dead-Cat Bounce: Given the significant drop in RENT stock’s value, bearish traders may be feeling pressure to reassess their positions. The potential for a dead-cat bounce, a temporary recovery after a prolonged decline, adds to the speculative dynamics.

While the overall sentiment is speculative, with RENT stock priced at 56 cents, the recent market activity and the potential for a bear squeeze make it an intriguing scenario for traders. The outcome remains uncertain, but the dynamics suggest a heightened level of interest and anticipation surrounding Rent the Runway’s stock performance.

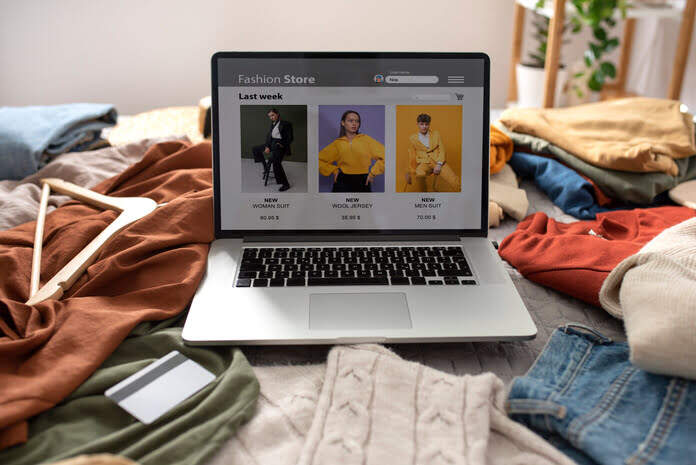

Featured Image: Freepik