Nvidia Corp. (NASDAQ:NVDA). reached an unprecedented peak on Thursday, propelled by its leading role in the expansive artificial intelligence race across industries. The company revealed a third consecutive sales forecast that outperformed Wall Street’s projections, triggering a surge in its stock price.

With a 4.8% surge, shares of Nvidia climbed to $493.70 in New York after the company announced an estimated $16 billion in sales for the upcoming three months ending in October. This figure significantly outstripped analysts’ predictions of approximately $12.5 billion, as reported by Bloomberg. Notably, Nvidia’s performance in the previous quarter also far exceeded expectations, accompanied by an additional $25 billion in stock buybacks.

This impressive outlook underscores Nvidia’s pivotal role as a major beneficiary of the ongoing AI computing surge. Driven by escalating demand for applications like chatbots and other AI tools, data center operators are actively procuring the company’s processors renowned for effectively managing the substantial workloads inherent to artificial intelligence. Consequently, Nvidia swiftly emerged from a global chip downturn and accelerated its sales growth to unprecedented levels in recent years.

Chief Executive Officer Jensen Huang remarked, “A new computing era has begun,” emphasizing the global shift towards more robust computing capable of handling advanced generative AI tasks, akin to the capabilities showcased by ChatGPT.

This robust growth builds on a remarkable threefold increase in the company’s stock value throughout the year. Prior to the release of Nvidia’s quarterly report, shares had closed at $471.16 in New York.

In the fiscal second quarter concluding on July 30, revenue doubled to $13.5 billion, while the company posted a profit of $2.70 per share, excluding specific items. These figures defied expectations, as analysts had initially projected sales of around $11 billion and a profit of $2.07.

Nvidia’s ascent to a $1 trillion market valuation in May was a historic milestone for the semiconductor industry. The company has solidified its position as a primary supplier of the essential infrastructure required to sustain the growing adoption of AI systems. While investors awaited proof that the second quarter marked the onset of a prolonged expansion rather than a momentary spike, Nvidia’s even more bullish performance on Wednesday exceeded their hopes.

Noteworthy is the fact that Nvidia’s projected revenue for this quarter exceeds Wall Street estimates by 28%, almost matching the company’s total annual sales in 2021.

Furthermore, in a significant milestone, Nvidia’s quarterly sales surpassed those of Intel Corp. for the first time. While Nvidia has held a higher valuation than Intel since 2020, this achievement highlights the widespread integration of Nvidia’s products.

Established in 1993 by CEO Huang, Nvidia evolved from a graphics chip manufacturer for video games into a dominant force in the accelerator market. These accelerators play a crucial role in training AI software by subjecting it to vast amounts of data. Nvidia’s consistent introduction of increasingly powerful processors, complemented by associated software, has solidified its lead over potential competitors. Prominent clients like Microsoft Corp. and Alphabet Inc.’s Google are eagerly securing Nvidia’s chips.

Bloomberg Intelligence analyst Kunjan Sobhani noted, “A significant 2Q beat and raise, a repeat of 1Q’s performance, suggests sustained demand strength in Nvidia’s Data Center (DC) business, while guidance 29% above consensus for 3Q implies the company may get its hands on better-than-expected supply.”

Like its peers, Nvidia relies on outsourced manufacturing from Taiwan Semiconductor Manufacturing Co. and Samsung Electronics Co., avoiding the immense costs and risks of investing in manufacturing facilities. However, this approach limits Nvidia’s agility in rapidly adjusting its supply.

While concerns about supply constraints potentially hindering Nvidia’s sales this quarter surfaced, the company’s forecast indicates smooth operations. Chief Financial Officer Colette Kress expressed contentment with the progress in securing more components, stating, “We expect supply to increase each quarter through next year.”

Nvidia’s division responsible for providing chips to data centers, once a secondary business, has now become its most lucrative sector. In the last quarter, this unit generated $10.3 billion in sales, surpassing the predicted $7.98 billion. Gaming revenue totaled $2.49 billion, exceeding the average analyst estimate of $2.38 billion. Additionally, automotive-related chips contributed $253 million.

After a period of decline, the personal computer market, which was once Nvidia’s primary revenue source, has regained momentum, driven particularly by strong demand for laptop components.

Amid the tech investment frenzy surrounding AI this year, Nvidia stands out as one of the few companies substantially profiting from this trend, which gained momentum following the debut of OpenAI’s ChatGPT in November. This tool demonstrated the broad potential of generative AI to a larger audience.

Nvidia’s stock surge of over 200% this year has outperformed all other constituents of the closely monitored Philadelphia Stock Exchange Semiconductor Index.

An intriguing aspect of Nvidia’s success lies in its inability to fully tap into the largest chip market, China. US government regulations demand Nvidia obtain licenses to supply Chinese customers with its top-performing AI-related chips.

Although this rule, introduced last year, initially impacted shipments to China and led to adjustments in Nvidia’s products, the company’s CFO Kress indicated that potential export restrictions would not likely immediately affect their financial results due to robust global demand for their products.

Furthermore, Nvidia has transformed into a vital indicator of the tech industry’s trajectory. The company’s forecasts offer insights into the strategies of some of the world’s most valuable corporations, reflecting the extent of their investments in reshaping their computer systems to accommodate AI’s exponential growth.

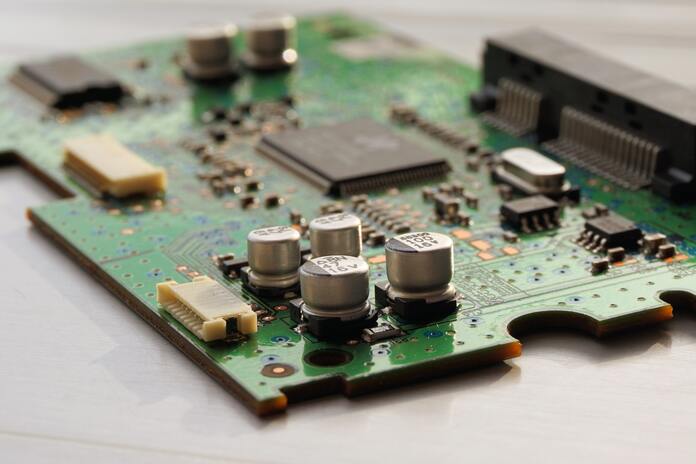

Featured Image: Unsplash