Nvidia (NASDAQ:NVDA) recently released its earnings report, which led to a notable dip in its stock price. Investors were eager to see how the company performed given its significant role in the tech industry, particularly in AI and graphics processing units (GPUs). Despite posting strong revenue figures, the company’s stock experienced a decline, highlighting the market’s high expectations and scrutiny.

The earnings report revealed that Nvidia’s revenue exceeded analysts’ forecasts, driven by its robust data center segment. However, concerns arose over the company’s margins which fell slightly short of projections. This margin pressure is attributed to increased costs associated with expanding its AI capabilities and enhancing its product offerings.

The tech giant’s investment in AI has been substantial, and while it is expected to pay off in the long term, the immediate impact on profitability is a point of concern for some investors. Nvidia is navigating through a competitive landscape where maintaining technological leadership requires significant R&D investments.

Another factor contributing to the stock’s slip is the broader market conditions. Tech stocks, in general, have been under pressure due to macroeconomic factors, including interest rate hikes and inflationary pressures. These elements can affect investor sentiment and lead to fluctuations in stock prices, even for companies with solid financial performance like Nvidia.

Nvidia’s management remains optimistic about the company’s future prospects. The CEO emphasized the importance of innovation and strategic partnerships in driving future growth. The company’s expansion into new markets, such as autonomous vehicles and AI-driven cloud services, is seen as a pivotal move to diversify its revenue streams and mitigate risks associated with its core GPU business.

Looking ahead, analysts are divided on Nvidia’s stock trajectory. Some believe the current dip presents a buying opportunity, given the company’s strong fundamentals and growth potential. Others caution that the stock may face further volatility as the market adjusts to ongoing economic challenges.

For investors, it’s crucial to keep an eye on Nvidia’s developments in the AI sector and how these investments translate into financial performance. The company’s ability to maintain its competitive edge while managing costs will be key to sustaining its market position and delivering shareholder value.

Footnotes:

- Nvidia’s earnings report showed strong revenue but highlighted concerns over profit margins. Source.

- The company’s investment in AI is expected to impact long-term profitability. Source.

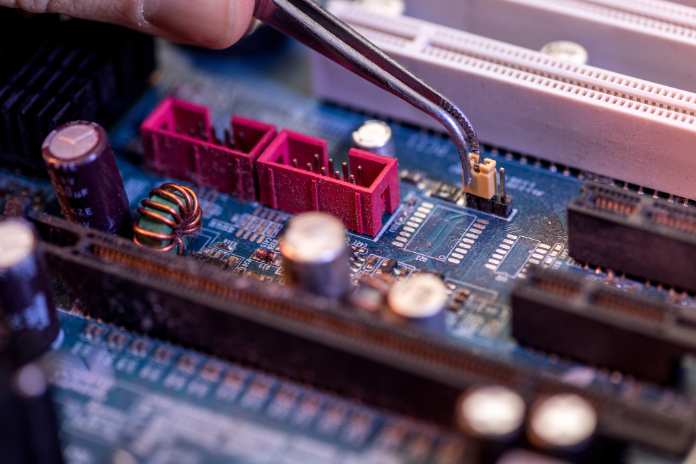

Featured Image: DepositPhotos @ AllaSerebrina