Several US politicians have suggested that the restrictions on Chinese semiconductors used by the US government and its contractors be eased. This is in response to opposition from trade groups like the US Chamber of Commerce.

Using a draft of the plan from December 1 as proof, the news source said that some trade groups have tried to stop the proposals by saying that they would make costs go up.

Chuck Schumer, the majority leader in the Senate, and John Cornyn, a senator, proposed a bill in September that would have forced U.S. government contractors and agencies to stop using semiconductors made by Semiconductor Manufacturing International Corporation, Yangtze Memory Technologies, and ChangXin Memory Technologies right away.

Under the current proposal, the contractors would still not be able to “use” the businesses’ chips. This would also delay compliance by five years.

In addition to Micron Technology (NASDAQ:MU), South Korea’s SK Hynix, and Samsung Electronics, Yangtze Memory Technologies, and ChangXin Memory Technologies are rivals (OTCPK:SSNLF). Earlier this year, Senator Marco Rubio and Representative Michael McCaul, both Republicans, told Apple (AAPL) not to use chips from Yangtze Memory Technologies in its iPhones.

Development likely to shape Micron stock

Reuters said that businesses all over the world use SMIC chips, which can be hard to get rid of because they aren’t usually marked with the name of the company that made them. In a letter from the Chamber of Commerce, the business lobby said that taking chips out of things like toasters would be hard to do and wouldn’t do much to protect national security. The letter was also signed by the defense and telecom sectors.

President Joe Biden will visit Taiwan Semiconductor’s (TSM) new semiconductor plant in Arizona on Tuesday. The plant is set to open in 2024, and Biden is likely to be there with the CEO of Micron (MU), Sanjay Mehrotra, and a number of other business leaders.

How Low Can Micron Technology Stock Go?

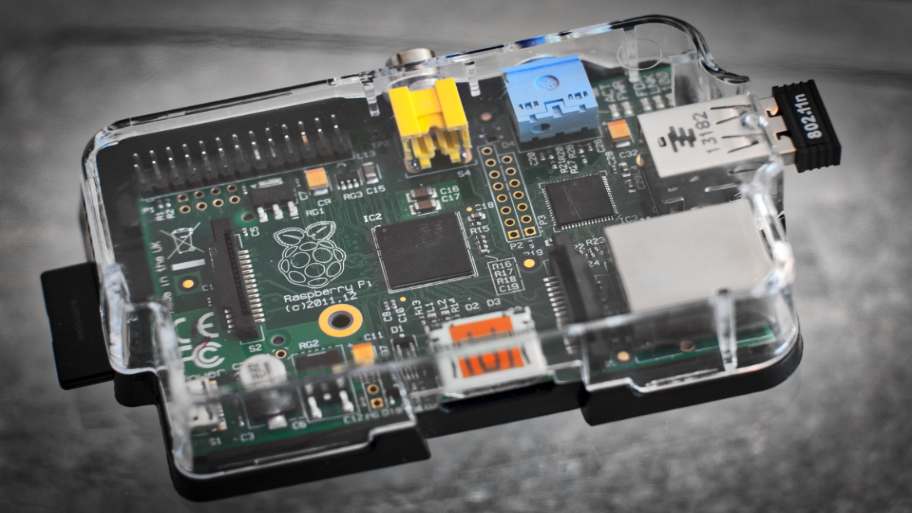

Featured Image – Pexels © Pixabay