Early in August, Moderna stock (NASDAQ:MRNA) soared when the biotech company’s Covid vaccination sales unexpectedly increased in the second quarter. Sales of the Spikevax vaccine were $4.53 billion over the three months that ended on June 30, an increase of 8%. However, analysts anticipated a 9% drop in sales to $3.83 billion. Shares of Moderna (NASDAQ:MRNA) soared 16 % on August 3 in reaction and another 4 % the next day.

The efforts of Moderna (NASDAQ:MRNA), Pfizer (NSE:PFIZER), and Novavax (NASDAQ:NVAX) to improve their Covid boosters to combat the omicron version are currently in the spotlight as investors wait for new information. The B.A.1 sub-variant-targeting boosters were tested in the past by the three businesses. But B.A.1 is no longer the cause of any cases in the United States. As a result, in addition to the original strain, the enterprises are currently researching vaccines to inhibit B.A.4 and B.A.5.

According to current reports, the improved booster from Moderna (NASDAQ:MRNA) produced a strong immune reaction against the omicron strain. The promoter can target multiple strains because it is bivalent or two-valent. In October, U.S. officials plan to launch the modified bivalent boosters.

Additionally, Moderna (NASDAQ:MRNA) obtained FDA approval for its Covid vaccination in infants as young as six months old. This month, officials in Australia and Canada did the same. Additionally, booster shots from Moderna (NASDAQ:MRNA) were advised for adolescents aged 12 to 17 by consultants to the European Medicines Agency.

According to analysts’ predictions, the last year of increase for Moderna stock (NASDAQ:MRNA) is 2022. For its two-shot vaccine, Moderna (NASDAQ:MRNA) anticipates $21 billion in purchase agreements. However, analysts expect a 50% decline in sales to $10.23 billion by 2023.

Notably, Moderna (NASDAQ:MRNA) is attempting to increase the number of its non-Covid options. Moderna (NASDAQ:MRNA) administered the first dose of its Nipah virus vaccine to a trial subject in July. A respiratory condition is called Nipah.

The business also administered the first dosage of its seasonal flu vaccine to a research participant.

Is Moderna stock (NASDAQ:MRNA) a buy right now?

A Basic Analysis of Moderna Stock (NASDAQ:MRNA)

By all accounts, Moderna (NASDAQ:MRNA) improved in the second quarter. The company’s earnings fell by 19% to $5.24 per share. Analysts, however, predicted a further drop to $4.58 per share. Total revenues increased by 9% to $4.75 billion. That exceeded expectations of a 6% fall.

In addition to the $4.53 billion from Spikevax, Moderna (NASDAQ:MRNA) also disclosed a lower sum from grants and collaborative funding. However, Moderna’s second-quarter sales and profitability didn’t match the recommendations of CAN SLIM. Investors are urged to look for businesses with recent earnings growth of between 20 and 25 %. How long the Moderna (NASDAQ:MRNA) stock can continue to increase is still an open topic. Analysts currently predict that as Covid enters the endemic stage in 2023, revenues will drastically decline.

The Composite Rating for Moderna stock (NASDAQ:MRNA) is 77 out of a maximum of 99. The Composite Rating measures the essential fundamental and technical indicators for a store. Thus, Moderna stock comes in the top 25% of all equities using that criterion.

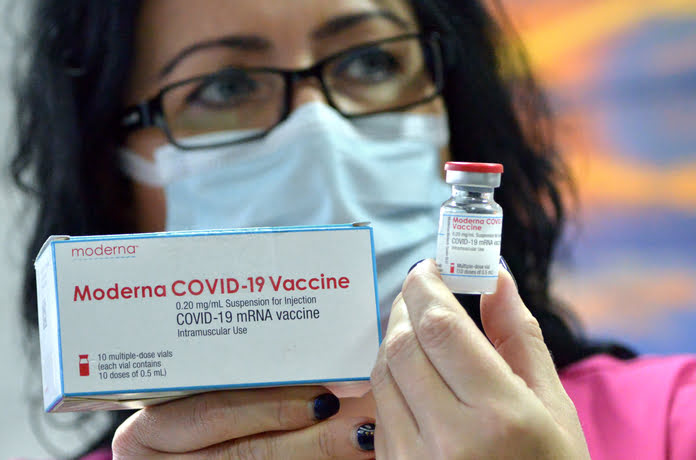

Featured Image: Megapixl @Julialazarova