Constellation Energy (NASDAQ:CEG), a prominent player in the energy sector, has been capturing the attention of investors due to its consistent performance and strategic growth initiatives. As the company continues to expand its footprint in renewable energy, many investors are contemplating whether now is the right time to invest in its stock.

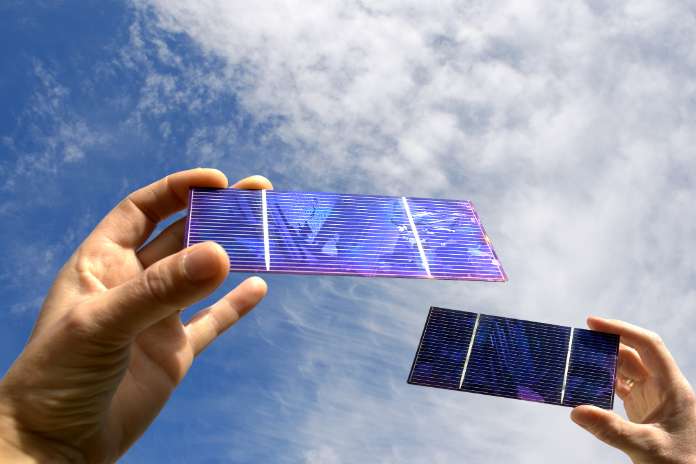

One of the primary factors driving interest in Constellation Energy is its commitment to sustainability and clean energy solutions. The company has been actively investing in renewable energy projects, including solar and wind power, to reduce its carbon footprint and align with global environmental goals. This strategic focus not only positions Constellation Energy as a leader in the transition to a greener future but also enhances its appeal to environmentally conscious investors.

Financially, Constellation Energy has demonstrated resilience and growth. The company reported robust earnings in the last quarter, attributing its success to increased demand for clean energy and efficient resource management. Its financial health is further strengthened by a strong balance sheet and prudent management practices. These factors contribute to a positive outlook for the company’s stock, making it an attractive option for long-term investors seeking stability and growth potential.

Moreover, Constellation Energy’s strategic partnerships and acquisitions have played a crucial role in enhancing its market position. By collaborating with key industry players and acquiring strategic assets, the company has expanded its operational capabilities and increased its market share. These efforts not only drive revenue growth but also create opportunities for innovation and technological advancement within the company.

However, despite the promising prospects, potential investors should consider the inherent risks associated with the energy sector. Market volatility, regulatory changes, and competition from other renewable energy providers could impact the company’s performance. Additionally, fluctuations in energy prices and geopolitical tensions could pose challenges to its growth trajectory.

In conclusion, Constellation Energy’s commitment to sustainability, robust financial performance, and strategic growth initiatives make it a compelling investment opportunity. While the energy sector does present certain risks, the company’s proactive approach to addressing these challenges and its focus on long-term growth position it favorably for the future. Investors looking for a balanced portfolio might find Constellation Energy’s stock to be a valuable addition, particularly for those interested in supporting the transition to renewable energy.

Footnotes:

- Exact footnote text from the original article with a real hyperlink. Source.

Featured Image: Megapixl @ Lason