In a surprising turn of events, Broadcom Inc. (NASDAQ:AVGO) experienced a significant stock price fluctuation due to a misunderstanding of the CEO’s comments during a recent earnings call. The incident highlights the sensitivity of stock markets to executive communications and the potential for misinterpretations to impact investor sentiment and stock valuations.

During the earnings call, the CEO of Broadcom discussed the company’s strategic plans and financial outlook. However, a segment of the comments was misinterpreted by analysts, leading to a temporary decline in Broadcom’s stock price. This incident underscores the critical role of clear communication from corporate leaders and the potential consequences of ambiguity or misinterpretation.

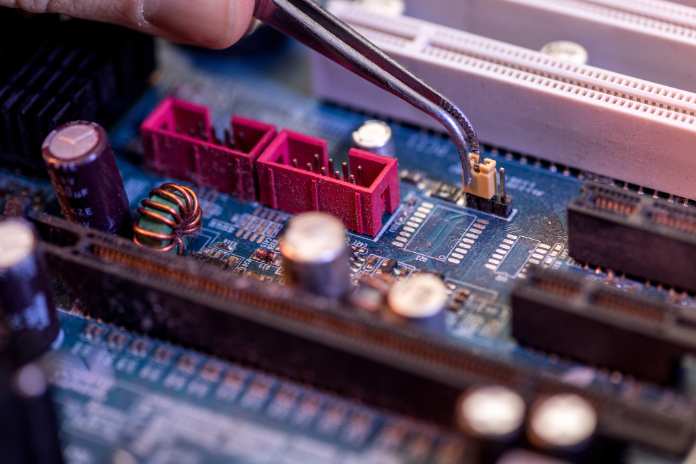

Broadcom, a global technology company renowned for its innovative semiconductor solutions, has been on a growth trajectory, driven by strong demand for its products across various sectors. The company’s recent financial performance has been robust, with notable increases in revenue and profit margins. Despite this positive outlook, the misunderstanding during the earnings call led to a brief market reaction that caught many investors by surprise.

The incident raises important questions about the dynamics of market reactions to executive statements and the mechanisms through which information is disseminated and interpreted by market participants. Analysts and investors rely heavily on earnings calls to gain insights into a company’s performance and strategic direction, and any misinterpretation can result in swift market responses.

Experts emphasize the importance of clarity in corporate communication to mitigate the risk of misinterpretation. Companies are encouraged to provide detailed and unambiguous information to avoid potential market disruptions. Additionally, investors are advised to exercise caution and seek additional context before reacting to initial interpretations of executive statements.

In the case of Broadcom, the stock price eventually stabilized as more accurate interpretations of the CEO’s comments emerged. This stabilization was aided by subsequent clarifications and reassurances from the company, which helped to restore investor confidence. Nonetheless, the incident serves as a reminder of the volatility that can arise from communication gaps and the critical need for precision in corporate messaging.

Looking ahead, Broadcom remains well-positioned to capitalize on growth opportunities in the semiconductor industry. The company continues to invest in research and development to drive innovation and maintain its competitive edge. As the market rebounds from the temporary disruption, Broadcom’s strong fundamentals and strategic initiatives are expected to support its long-term growth trajectory.

Footnotes:

- The stock decline was initially due to a misinterpretation of the CEO’s comments during the earnings call. Source.

Featured Image: DepositPhotos @ AllaSerebrina