After benefiting from a surge in travel demand post-pandemic, Airbnb (NASDAQ:ABNB) has witnessed a significant recovery in its share price, outperforming the S&P 500 Index ($SPX) by over 79% year-to-date in 2023. As the travel industry continues to show strength, investors are wondering if Airbnb’s upward trajectory can be sustained as it approaches its earnings report.

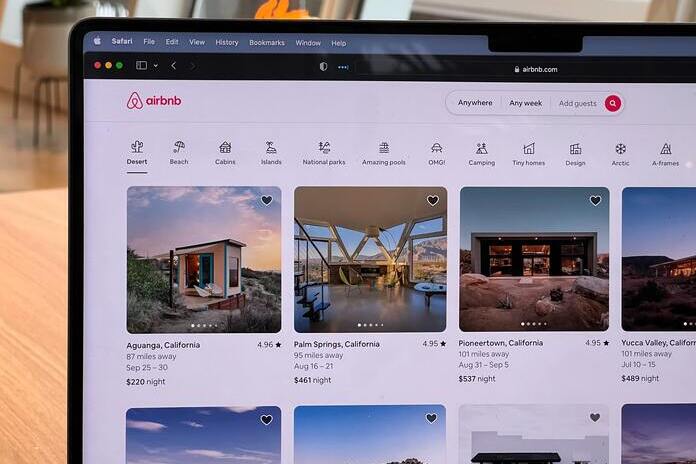

Airbnb operates as a community-based rental platform, facilitating short- and long-term stays. The company’s impressive network includes over 4 million hosts, earning revenue through service fees, net of incentives and refunds, for stays, and host fees for experiences.

Strong Performance in 2022 and Early 2023

With travel recovering, the metrics for Airbnb have shown positive growth. In 2022, Nights and Experiences booked on the platform increased by 31%, amounting to $393.8 million. Gross Booking Value (GBV) also soared by 35% year-over-year, reaching $63.2 billion. The company’s revenues for 2022 stood at approximately $8.4 billion, compared to a loss of $352 million in 2021.

The momentum continued into 2023, with Nights and Experiences booked rising by 19% to 121.1 million in the first quarter. GBV reached $20.4 billion in Q1, marking a 19% increase. Airbnb’s top-line revenue for the same period surged by 20% to $1.82 billion, accompanied by a net income of $117 million, a substantial improvement from the prior year’s loss.

Positive Factors Supporting Airbnb’s Growth

Several factors are driving Airbnb’s growth prospects. Despite macroeconomic challenges, the number of active bookers in Q1 increased, with more guests booking trips well in advance, leading to a stronger backlog. Additionally, the company’s diverse offerings and a wide range of listings position it to attract new travelers and drive bookings.

Efforts to optimize operations have led to reduced headcounts and improved operating costs, positively impacting future results. Airbnb’s strong financial position allows for investments in new growth initiatives and the return of cash to shareholders. With over 50 new features and upgrades recently launched, the company’s focus on new products and services set for introduction in 2024 and beyond contributes to its growth potential.

Furthermore, Airbnb’s emphasis on less mature markets is expected to bolster its growth rate, and its solid financial foundation enables potential acquisitions to support expansion.

Analyzing Airbnb’s Valuation and Analyst Views

Though Airbnb stands to benefit from positive travel trends and internal growth initiatives, its recent stock price surge suggests that many positives are already priced in. With a price-to-earnings ratio of 49.34 and an expected EPS growth rate of 24% and 16% in 2023 and 2024, respectively, some argue that ABNB stock may be overvalued at current levels.

However, analysts present a reasonably balanced perspective. Among 28 analysts covering Airbnb, 11 recommend a Strong Buy, two suggest a Moderate Buy, 12 maintain a Hold, and three have a Strong Sell recommendation. The average price target for ABNB is $133.56, indicating a potential downside of over 12% from its current price.

Final Considerations and Earnings Report

Despite Airbnb’s strong fundamentals and long-term growth potential, potential investors might consider waiting for a pullback due to the stock’s rich valuation. As growth rates may moderate in the future amid tougher year-over-year comparisons, the introduction of new host pricing tools could also impact average daily rates.

Investors eyeing a position in Airbnb could keep an eye on the upcoming earnings report scheduled for August 3rd. Historical patterns indicate that shares have dipped in the session immediately following earnings in three out of the last four quarters, possibly presenting a buying opportunity at more attractive prices.

Featured Image: Unsplash