Arm (NASDAQ:ARM), a renowned British chipmaker, made a notable entry into the public market on Thursday, launching with an opening price of $56.10 during the afternoon session.

Within the initial moments of trading, the company saw its shares surge by 10%, quickly reaching a 20% increase, pushing past $61 within the first half-hour. Prior to its debut, the company’s shares had been set at $51 apiece.

Commencing its public trading with an estimated valuation of $54.5 billion, Arm’s market capitalization swiftly exceeded $60 billion. The Nasdaq hasn’t witnessed such a prominent IPO since the influx of 2021, which subsequently subsided in 2022.

Post that downturn, IPO activities had shown a gradual uptick with notable entries from beauty brand Oddity (ODD) and the Mediterranean eatery chain Cava (CAVA) during the warmer months. This subtle revival has now gained momentum with Arm’s recent debut, alongside the forthcoming IPOs of companies like Instacart (CART) and Klaviyo.

Miller Tabak strategist, Matt Maley, in a conversation with Yahoo Finance Live, highlighted the significance of this IPO. He pointed out that Arm’s success could rejuvenate a dormant market and also shed light on the existing buzz around AI. Yet, he also cautioned that just because the IPO market is active doesn’t necessarily translate into unproblematic valuations. For instance, while Arm aimed for a valuation between $60 billion and $70 billion, Instacart is reportedly revising its valuation aspirations from $39 billion in 2021 to a current $9.3 billion.

Understanding Arm’s Role

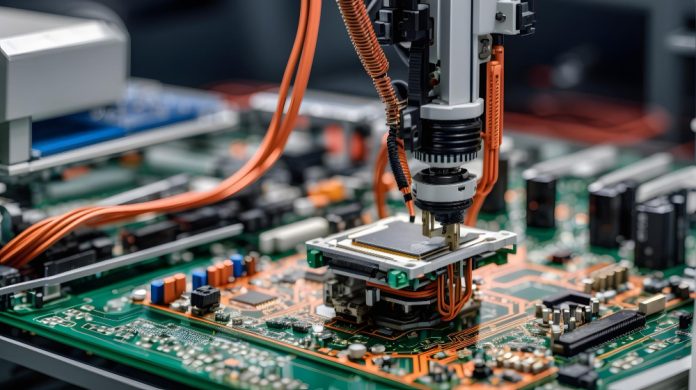

Arm’s distinction lies in its chip-designing prowess, counting tech giants like Apple (AAPL) among its clientele. As Greg Martin from Rainmaker Securities commented on Yahoo Finance Live, Arm is unparalleled in its space, especially given its near-universal presence in smartphones. While its growth plateaued the previous year, its potential in AI remains expansive.

In terms of its corporate journey, Arm was bought by SoftBank in 2016 for an estimated $30 billion. The subsequent 2021 attempt by Nvidia (NVDA) to purchase Arm was unsuccessful, facing nearly 18 months of regulatory challenges. Lately, Arm has been reevaluating its revenue strategies, introducing altered customer licensing plans and adjusting its pricing.

Discussing this shift in strategy, Maley mentioned how Arm is transitioning from primarily focusing on smartphones to more AI-centric ventures, deeming it a prudent approach.

In essence, Arm’s re-entry into the public domain stands as a crucial milestone. Maley noted that should this IPO underperform, it might spell challenges for the broader tech sector. Conversely, a commendable performance could potentially bolster a tech sector that’s been in a stagnant phase for some time.

Featured Image – Freepik