Applied Materials (NASDAQ:AMAT) saw its shares surge by 8% to reach an all-time high on Friday following a bullish forecast by the semiconductor equipment supplier for the second quarter. The company anticipates stronger-than-expected performance driven by robust demand from customers seeking to produce AI-enabled chips.

The optimistic outlook is further buoyed by improvements in certain electronics end-markets such as smartphones and personal computers. Analysts have pointed out Applied Materials’ diversified portfolio as a key factor setting the stage for continued growth.

J.P. Morgan analysts noted that Applied Materials is strategically positioned to capitalize on upcoming technology advancements, which are poised to drive superior performance compared to the broader wafer fab equipment (WFE) market over the coming years.

For the second quarter, Applied Materials foresees revenue of $6.5 billion, plus or minus $400 million, and adjusted earnings per share ranging from $1.79 to $2.15, exceeding market expectations. Additionally, the company surpassed first-quarter revenue expectations.

The company’s stock was trading at $203.05 during afternoon trading, reflecting a year-to-date gain of approximately 24%. Analysts at Jefferies highlighted a notable recovery in utilization across leading-edge logic and memory customers, bolstering confidence in a “V”-shaped recovery trajectory.

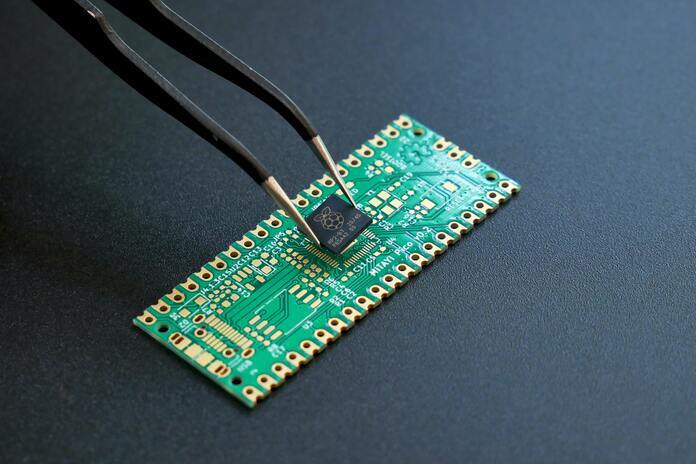

Applied Materials, a supplier to industry giants such as Intel (NASDAQ:INTC) and Samsung (005930.KS), anticipates a significant uptick in high-bandwidth memory (HBM) packaging revenues, projecting a fourfold increase compared to the previous year. HBM packaging utilizes a specialized stacking arrangement of memory chips to enhance performance, particularly suitable for high-performance computing applications.

Several analysts have upgraded their ratings on Applied Materials, with eight revising their price targets upwards, according to LSEG data. Presently, the stock is valued at 22.77 times its one-year forward earnings, compared to the industry average of 25.17, suggesting a favorable valuation relative to peers.

Featured Image: Freepik