Applied Materials (NASDAQ:AMAT), a prominent producer of semiconductor tools, has unveiled its projections for the fourth-quarter and third-quarter earnings, both of which have exceeded expectations. The company’s stock saw a notable 1.9% increase during after-hours trading in response.

Global governments have infused substantial subsidies over the past year into domestic semiconductor manufacturing, providing a boon to Applied Materials as well as competitors like Lam Research (NASDAQ:LRCX) and KLA (NASDAQ:KLAC), whose equipment plays a pivotal role in chip fabrication.

Anticipating the fourth quarter, Applied Materials expects to rake in revenue totaling $6.51 billion, with a possible fluctuation of $400 million, a considerable rise from the average analyst estimate of $5.86 billion. Additionally, the company forecasts an adjusted profit per share ranging from $1.82 to $2.18, surpassing the market’s projection of $1.61.

During the third quarter, Applied Materials reported revenue of $6.43 billion, outpacing analysts’ average prediction of $6.16 billion according to Refinitiv data. On an adjusted basis, the company achieved earnings of $1.90 per share for the quarter ending July 30, surpassing the projected $1.74.

Brice Hill, Chief Financial Officer of Applied, noted that despite an overall decrease in chip equipment spending this year, the company’s services division will maintain its growth trajectory.

Regarding its semiconductor systems unit, which supplies equipment to chip manufacturers, the third-quarter revenue experienced a marginal decline of approximately 1%, settling at $4.68 billion. In contrast, Applied’s profitable services unit, responsible for generating revenue through consulting and spare parts that keep the tools operating at maximum efficiency, observed a 3% increase, amounting to $1.46 billion.

Sales in the display segment, however, encountered a 29% decline, reaching $235 million during the quarter.

Applied Materials and its fellow equipment manufacturers initially encountered setbacks due to U.S. export controls limiting the sale of advanced gear to Chinese customers. However, recent months have witnessed an uptick in purchases from Chinese customers seeking equipment capable of older manufacturing processes.

Prominent technology entities such as Samsung Electronics, Taiwan Semiconductor Manufacturing Co, and Intel Corp (NASDAQ:INTC) are among those utilizing Applied Materials’ cutting-edge chip production tools to enhance their semiconductor manufacturing processes.

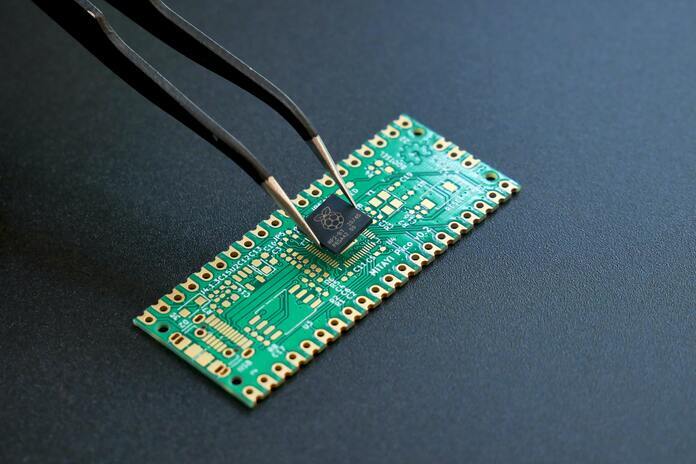

Featured Image: Megapixl @ vishnumaiea