Texas Instruments Incorporated (NASDAQ:TXN) is set to unveil its third-quarter 2023 financial results on October 24. The company has provided revenue guidance for this quarter, estimating a range between $4.36 billion and $4.74 billion. The Zacks Consensus Estimate stands at $4.57 billion, indicating a 12.9% decline from the previous year’s third-quarter reported figure.

In terms of earnings, TXN’s management anticipates earnings to fall within the range of $1.68 to $1.92 per share for the quarter under review. The consensus estimate hovers at $1.81 per share, reflecting a 26.1% decrease from the corresponding quarter in the prior year. It’s worth noting that the consensus estimate has experienced a slight downward adjustment of 0.5% over the past 30 days.

TXN has demonstrated its ability to outperform market expectations, as it has consistently exceeded the Zacks Consensus Estimate in each of the last four quarters, boasting an average earnings surprise of 5.85%.

Factors to Weigh

The performance of Texas Instruments in the third quarter is expected to be influenced by several key factors. The company is well-positioned to benefit from its extensive product portfolio and expanding manufacturing capabilities. Additionally, its competitive edge in manufacturing and technology is anticipated to have a positive impact.

The automotive market’s robust performance is also poised to contribute to the results for this quarter, given the strong momentum within the industry.

Texas Instruments Embedded Processing business, which has been favorably affected by the strategic refocusing of the MCU (Microcontroller) business, is likely to have a positive influence on the upcoming quarterly outcomes. The Zacks Consensus Estimate for the third-quarter 2023 revenues of the Embedded Processing segment stands at $887 million, implying an 8% year-over-year growth.

However, not all is rosy for the semiconductor giant. The company is expected to face headwinds due to the widespread weakness in the communications equipment and enterprise systems sectors. New export regulations are also projected to have a negative impact on the financial results of the forthcoming quarter.

The Analog segment is anticipated to face challenges as well, primarily due to a weakened demand environment triggered by customer inventory reductions. The consensus estimate for the third-quarter 2023 Analog segment revenues stands at $3.3 billion, reflecting a 17.3% decline compared to the corresponding period in the previous year.

As Texas Instruments readies to disclose its Q3 earnings, it faces a mix of opportunities and challenges that will shape its performance and provide insights into the state of the semiconductor industry.

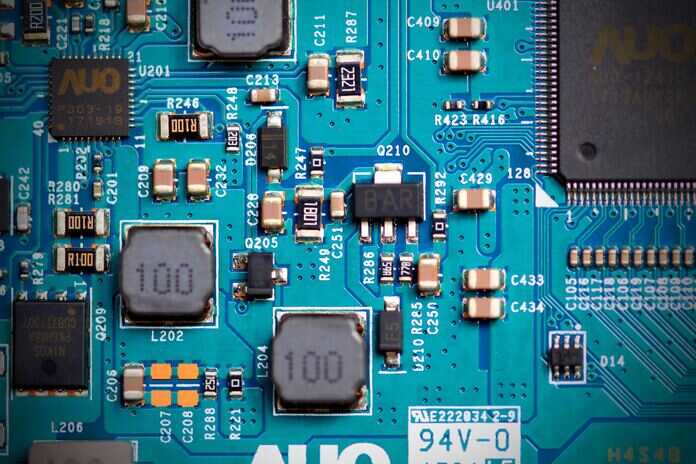

Featured Image: Unsplash @ Anne Nygård