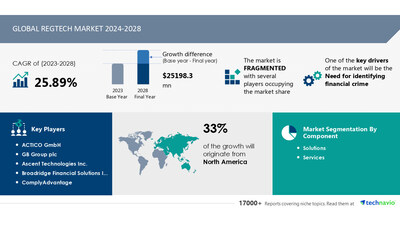

NEW YORK, Sept. 6, 2024 /PRNewswire/ — Report on how AI is driving market transformation- The global regtech market market size is estimated to grow by USD 25.19 billion from 2024-2028, according to Technavio. The market is estimated to grow at a CAGR of 25.89% during the forecast period. Need for identifying financial crime is driving market growth, with a trend towards integration of ai with regtech. However, lack of skilled workforce poses a challenge. Key market players include ACTICO GmbH, GB Group plc, Ascent Technologies Inc., Broadridge Financial Solutions Inc., ComplyAdvantage, Confluence Technologies Inc., Deloitte Touche Tohmatsu Ltd., Hummingbird RegTech Inc., Intrasoft Technologies, International Business Machines Corp., MetricStream Inc., Mitratech Holdings Inc., NICE Ltd., RIMES Technologies Corp., SAS Institute Inc., SymphonyAI Sensa LLC, Thomson Reuters Corp., Trulioo Information Services Inc., VERMEG Ltd Legal, and Wolters Kluwer NV.

Key insights into market evolution with AI-powered analysis. Explore trends, segmentation, and growth drivers- View the snapshot of this report

|

Regtech Market Market Scope |

|

|

Report Coverage |

Details |

|

Base year |

2023 |

|

Historic period |

2018 – 2022 |

|

Forecast period |

2024-2028 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 25.89% |

|

Market growth 2024-2028 |

USD 25198.3 million |

|

Market structure |

Fragmented |

|

YoY growth 2022-2023 (%) |

21.48 |

|

Regional analysis |

North America, Europe, APAC, South America, and Middle East and Africa |

|

Performing market contribution |

North America at 33% |

|

Key countries |

US, China, UK, Canada, and France |

|

Key companies profiled |

ACTICO GmbH, GB Group plc, Ascent Technologies Inc., Broadridge Financial Solutions Inc., ComplyAdvantage, Confluence Technologies Inc., Deloitte Touche Tohmatsu Ltd., Hummingbird RegTech Inc., Intrasoft Technologies, International Business Machines Corp., MetricStream Inc., Mitratech Holdings Inc., NICE Ltd., RIMES Technologies Corp., SAS Institute Inc., SymphonyAI Sensa LLC, Thomson Reuters Corp., Trulioo Information Services Inc., VERMEG Ltd Legal, and Wolters Kluwer NV |

RegTech, offered as Software-as-a-Service (SaaS), assists businesses in digitizing and swiftly complying with regulations and standards. The integration of Artificial Intelligence (AI) into RegTech enhances its capabilities. AI identifies patterns and similarities across diverse data sets, crucial for generating new insights. It processes multiple data sources, including behavior patterns and data from social media and stock markets, to uncover previously unnoticed correlations. AI-enabled RegTech benefits the Banking, Financial Services, and Insurance (BFSI) sector in three primary ways: 1) improved financial forecast models through stress testing and data-driven predictions, 2) automated monitoring and tracking of regulatory changes, and 3) enterprise email filtering using machine learning. Additionally, AI-RegTech aids in complex pattern matching and anomaly detection, leading to advanced fraud identification and prediction. Companies like ComplyAdvantage employ AI and machine learning to offer clients accurate financial crime risk assessments. The synergy of AI and RegTech is anticipated to boost the global RegTech market by providing superior RegTech solutions and driving growth during the forecast period.

The regtech market is experiencing significant growth as organizations face increasing regulatory requirements and compliance obligations in various industries. Backers like Vertex Ventures are investing in regtech solutions to help businesses navigate the complex regulatory landscape. Changes in regulations bring new compliance processes, which can be a burden with risks of non-compliance leading to severe consequences such as data breaches, mishandling of personal information, and regulatory penalties. Regulatory compliance data is crucial for maintaining trust and avoiding legal liabilities. Technology trends like artificial intelligence, big data analytics, machine learning, blockchain, natural language processing, and cloud-based solutions are driving widespread adoption of regtech. Financial regulation areas like anti-money laundering and fraud are major applications, while healthcare is also adopting regtech for data security and regulatory compliance.

Request Sample of our comprehensive report now to stay ahead in the AI-driven market evolution!

• The global RegTech market in the BFSI sector faces a significant challenge due to the shortage of a skilled workforce with the necessary financial and technical expertise. Integrating RegTech solutions into financial organizations requires a workforce with a solid understanding of both the financial and IT sectors. Training this workforce in advanced technology domains like blockchain and cybersecurity can be costly and time-consuming. Moreover, competition among banks and financial institutions to hire the best IT talent further complicates matters. Consequently, despite the priority given to upgrading to automated RegTech technologies, the lack of a skilled workforce is expected to impede the growth of the global RegTech market in the BFSI sector during the forecast period. Implementing and managing RegTech solutions necessitate a combination of finance experience and a sound knowledge base in technologies such as AI, machine learning, and blockchain.

• The Regtech market is transforming the banking industry by providing innovative solutions to manage risk, prevent fraudulent transactions, and combat financial crime. Money laundering and payment fraud risks are significant challenges for financial institutions, and Regtech offers software maintenance and expertise to meet these responsibilities. Monetary authorities demand digitization and data standardization for financial inclusion and regulatory compliance. Regtech deployment types include cloud computing services, offering flexible options like SaaS with fixed and variable costs. Regtech startups, such as Dot Compliance, drive product innovation through cutting-edge technologies, addressing the needs of regulated industries. Legislation and reporting formats demand data management, data quality, and security standards. Large corporations benefit from risk-reduction through Regtech’s operational methods, while investment in these startups continues to grow through extension funding rounds. Chatbots and data gathering streamline processes, ensuring a body of evidence for regulatory bodies. Regtech’s role in financial stability and innovation is crucial as it addresses the challenges of financial crime and digitization.

Discover how AI is revolutionizing market trends- Get your access now!

This regtech market market report extensively covers market segmentation by

- Component

- 1.1 Solutions

- 1.2 Services

- End-user

- 2.1 Large enterprises

- 2.2 Small and medium enterprises

- Geography

- 3.1 North America

- 3.2 Europe

- 3.3 APAC

- 3.4 South America

- 3.5 Middle East and Africa

1.1 Solutions- The RegTech market offers businesses a variety of software tools and platforms designed to address specific regulatory compliance challenges. Solutions in the market include risk and compliance management, regulatory reporting, identity verification and KYC, transaction monitoring, and data governance and privacy. Risk and compliance management solutions help businesses proactively manage and mitigate risks through features like risk assessment, policy management, and reporting. Regulatory reporting solutions automate the process of generating and submitting reports to regulatory authorities, ensuring accurate and timely submissions. Identity verification and KYC solutions verify identities and ensure compliance with AML regulations using biometrics, document verification, and data analytics. Transaction monitoring solutions employ advanced analytics and machine learning to detect suspicious activities and generate alerts for further investigation. Data governance and privacy solutions manage and protect sensitive data, providing tools for data classification, access controls, consent management, data retention, and data breach prevention. The RegTech market continues to grow as businesses seek efficient solutions to meet evolving regulatory challenges and protect against data breaches.

Download a Sample of our comprehensive report today to discover how AI-driven innovations are reshaping competitive dynamics

The Regtech market is a dynamic and innovative sector that focuses on leveraging technology to address regulatory requirements and enhance compliance operations in various industries. Artificial intelligence, big data analytics, machine learning, and blockchain are among the cutting-edge technologies driving Regtech solutions. Financial regulation, including anti-money laundering and fraud prevention, is a primary application of Regtech. The banking industry and financial institutions are major adopters, recognizing the need to mitigate payment fraud risks and ensure regulatory compliance. Regtech startups are leading product innovation, securing investment from backers, and extending funding rounds to drive growth. Digitization and software maintenance are essential responsibilities for Regtech companies to provide reliable and efficient services. Healthcare is also embracing Regtech to manage complex regulatory frameworks and improve patient care. Overall, Regtech’s role in addressing financial regulation and reducing fraudulent transactions is invaluable, making it a crucial component of the digital transformation in finance and beyond.

Regtech Market: Transforming Compliance Operations with Technology in Regulated Industries The Regtech market is revolutionizing regulatory requirements in various industries by leveraging advanced technologies such as artificial intelligence (AI), big data analytics, machine learning, natural language processing, and blockchain. These technologies enable effective risk management, fraud detection, and anti-money laundering (AML) in banking and finance, healthcare, and other regulated sectors. Regtech solutions offer on-premises and cloud-based alternatives, catering to large enterprises and startups alike. Cloud-based solutions, particularly SaaS, offer fixed costs and digital transformation benefits. Regtech startups, like Dot Compliance, are driving product innovation through investment rounds from backers such as Vertex Ventures. Regtech solutions address the regulatory landscape’s complexities and changes, reducing operational burdens and risks associated with non-compliance. They ensure data security, manage personal information responsibly, and adhere to security standards. Regtech’s role in financial inclusion, innovation, and financial stability is crucial, particularly in mitigating payment fraud risks and handling large volumes of data. Regtech solutions employ AI and machine learning to analyze data, identify patterns, and provide chatbot assistance. They also help with data gathering, standardization, and reporting formats. Regtech’s impact extends to risk-reduction, data quality, and regulatory compliance data management. In the banking industry, regtech solutions streamline AML processes, ensuring monetary authorities’ requirements are met while maintaining financial experts’ responsibilities. Regtech’s role in the regulatory technology landscape is vital for financial institutions, as it addresses the challenges of digitization, data management, and the evolving regulatory landscape. Regtech solutions offer significant benefits, including risk management, fraudulent transaction detection, and AML compliance. However, they require ongoing software maintenance and investment to stay updated with regulatory changes and technological advancements. In conclusion, the Regtech market plays a critical role in addressing the challenges of regulatory compliance, risk management, and data security in various industries. Its adoption is essential for organizations to navigate the complex regulatory landscape and maintain financial stability while ensuring regulatory compliance and reducing risks.

1 Executive Summary

2 Market Landscape

3 Market Sizing

4 Historic Market Size

5 Five Forces Analysis

6 Market Segmentation

- Component

- Solutions

- Services

- End-user

- Large Enterprises

- Small And Medium Enterprises

- Geography

- North America

- Europe

- APAC

- South America

- Middle East And Africa

7 Customer Landscape

8 Geographic Landscape

9 Drivers, Challenges, and Trends

10 Company Landscape

11 Company Analysis

12 Appendix

Technavio is a leading global technology research and advisory company. Their research and analysis focuses on emerging market trends and provides actionable insights to help businesses identify market opportunities and develop effective strategies to optimize their market positions.

With over 500 specialized analysts, Technavio’s report library consists of more than 17,000 reports and counting, covering 800 technologies, spanning across 50 countries. Their client base consists of enterprises of all sizes, including more than 100 Fortune 500 companies. This growing client base relies on Technavio’s comprehensive coverage, extensive research, and actionable market insights to identify opportunities in existing and potential markets and assess their competitive positions within changing market scenarios.

Technavio Research

Jesse Maida

Media & Marketing Executive

US: +1 844 364 1100

UK: +44 203 893 3200

Email: [email protected]

Website: www.technavio.com/

![]() View original content to download multimedia:https://www.prnewswire.com/news-releases/regtech-market-to-grow-by-usd-25-2-billion-from-2024-to-2028–driven-by-demand-for-financial-crime-detection-ai-to-shape-market-evolution—technavio-report-302240488.html

View original content to download multimedia:https://www.prnewswire.com/news-releases/regtech-market-to-grow-by-usd-25-2-billion-from-2024-to-2028–driven-by-demand-for-financial-crime-detection-ai-to-shape-market-evolution—technavio-report-302240488.html

SOURCE Technavio

Featured Image: Megapixl @ Shuttlecock