CHICAGO, Oct. 9, 2024 /PRNewswire/ — More property owners failed to pay their property taxes on time following record increases in south suburban residential tax bills this year, according to an analysis by the Office of Cook County Treasurer Maria Pappas.

The spike in south suburban tax delinquencies, combined with a smaller collections dropoff in other parts of the county, led to $225 million in additional taxes going uncollected. That puts more residents at risk of losing their homes and squeezes finances for schools, municipalities and other taxing districts, according to the latest edition of the Pappas Portal newsletter.

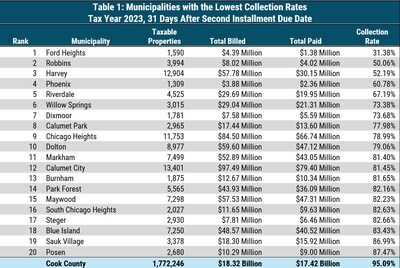

Cook suburbs with the lowest collection rates were Ford Heights (31.38%), Robbins (50.06%), Harvey (52.19%), Phoenix (60.78%), Riverdale (67.19%), Willow Springs (73.38%), Dixmoor (73.68%), Calumet Park (77.98%), Chicago Heights (78.99%) and Dolton (79.06%).

“Many south suburban residents saw their tax bills jump thousands of dollars this year,” Pappas said. “A lot of homeowners had to choose between paying their property taxes on time or buying medicine, food and gas. Now their homes may be at risk.”

Taxpayers still can avoid the Annual Tax Sale, Pappas said. The sale, which can lead to the loss of one’s property, is held about 13 months after the due date. Pappas proposed legislation signed into law last year that halved the interest rate on late tax payments to 9% annually to ease the burden on struggling homeowners.

A new property tax payment calculator on her office’s website, cookcountytreasurer.com, shows property owners how to pay in installments to avoid the sale, she added.

The number of delinquencies, or property owners who had not paid their full tax bills 31 days after they were due, increased by 22,500 to 195,845 this year, compared to 173,345 for the same period in 2023. That’s an increase of nearly 13%.

The countywide collection rate one month after bills were due stood at 95.1%, a 1.3% decrease from the same point in the previous year. In the south and southwest suburbs, collections were down by 1.5% — fueled by a 27.7% increase in the number of residential delinquencies — after reassessments in that region shifted much of the tax burden from businesses to homeowners. The shift contributed to a record 19.9% increase in that region’s median residential bill.

“In Dixmoor, where the median residential bill increased by 122%, the collection rate fell by 8.2%, to 73.7%,” according to the analysis.

Two factors — a record-short period between final tax bills in 2023 and 2024 and the dramatic shift of the tax burden in the south and southwest suburbs — likely contributed to the drop in collections. Economic factors, such as higher consumer prices, a financially struggling office and retail sector, and the lower interest rate on late bills also may have played a role.

More than one in 10 households in the south and southwest suburbs still owed taxes in 2024, a 27.4% increase from the previous year. South suburban seniors, in particular, seemed to have had a hard time paying. The number of delinquencies on properties with senior exemptions — which indicate it’s the primary residence of someone 65 or older — grew by 50.6%. But many, if not most, senior delinquencies will be reversed after assessment errors are fixed.

Visit the Pappas Portal newsletter page at cookcountytreasurer.com to read the collection rate report.

www.cookcountytreasurer.com/pappasportalnewsletter.aspx?newsletterid=2024100801

![]() View original content to download multimedia:https://www.prnewswire.com/news-releases/collections-fall-after-record-south-suburban-property-tax-increases-treasurer-pappas-reports-302270210.html

View original content to download multimedia:https://www.prnewswire.com/news-releases/collections-fall-after-record-south-suburban-property-tax-increases-treasurer-pappas-reports-302270210.html

SOURCE Cook County Treasurer Maria Pappas

Featured Image: DepositPhoto @ Andreypopov