VANCOUVER, British Columbia, Sept. 19, 2024 – West Red Lake Gold Mines Ltd. (“West Red Lake Gold” or the “Company”) (TSXV:WRLG) (OTCQB:WRLGF) is pleased to report that a test mining and bulk sample program (the “Program”) is now underway at the Madsen Mine, adding a key derisking component to the efforts being made to prepare the mine for a targeted restart in 2025.

“Data and experience are invaluable in mining,” said Shane Williams, President and CEO of West Red Lake Gold. “Test mining will provide data on how best to mine at Madsen, bulk samples will allow us to compare modeled and actual mine resources, and the process will give our team another layer of operational experience. As we continue to push towards restarting the Madsen Mine in 2025, I am very excited this program is underway.”

Overall Approach

Test mining has already begun. Crews are currently developing top and bottom access (sills) ahead of long hole stoping in the Austin 1099/1100 area. The process has already been informative, and the Company expects to report on stoping progress in the next mine site update in early October.

The Program is expected to run for four months. Bulk samples will be batch stockpiled on site. The Company expects to process these bulk sample stockpiles soon after restarting the mill.

The test mining and bulk sample program is designed around three goals.

- To understand, prior to restart, the best methods to mine safely and efficiently in the various underground environments at Madsen.

- To inform mineability decisions for mineralization near old stopes. Historic stopes are currently wrapped in 2-metre, null-resource buffers that could potentially be reduced or removed if trial mining demonstrates these buffer areas are mineable. This represents potential upside to the overall mineable inventory.

- To create bulk samples that the Company can batch process on mill startup to complete reconciliation calculations between expected and actual tonnes, grade, and ounces of mined material.

The Company chose four target areas in the Madsen resource that represent the range of mining environments, average gold grades, definition drilling density, and assumed mining methods. Trial mining across these variables will inform a confident and safe plan for mining the high-grade gold resources at Madsen.

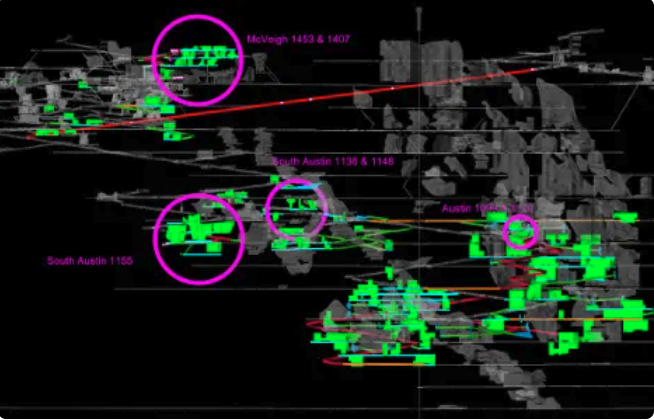

Figure 1: A section view of the Madsen project with the four target areas for the test mining and bulk sample program noted. Green shapes are planned stopes, blue lines are planned sills, red, green and orange lines are future development of varying sizes, and grey shapes are historic stopes.

The four test mining target areas collectively host 114,600 tonnes of total material with an average grade of 5.98 grams per tonne gold (g/t Au). The Company expects to bulk sample approximately 5,000 tonnes from each area in this test mining program.

Mining will be a mixture of Long Hole Stoping (LHS) and Mechanized Cut and Fill (MCF).

LHS will be used wherever resource shape and geometry allow and will ideally include 3-metre by 3-metre overcuts and undercuts (sills). Maximum level spacing will be 20 metres vertical. Production drilling will be done with Boart Stopemate drills; mucking will be completed with a 2.5-yard Scooptram.

MCF will be used in remnant mining areas. MCF stopes will have a minimum size of 3 metres by 3 metres, slashed wider in places for selective mining. MCF will be accomplished with either Long Tom drills or a single-boom Jumbo combined with a 2-yard Scooptram.

Test Mining Areas

The Company plans to mine, stockpile, and batch process approximately 5,000 tonnes from each of the four areas described below as part of the Program.

McVeigh Lenses 1453 and 1406

Lenses 1453 and 1406 are a near-surface part of the McVeigh resource block. This area has an overall expected 26,300 tonnes at 7.15 g/t gold grade and will be mined exclusively with LHS. The sill levels are 18 metres vertically spaced, which leaves 15 metres for stoping.

This area was selected to add information to the resource model in the McVeigh area, which has higher geologic complexity than other parts of the Madsen resource, and to bulk sample a higher-grade part of the resource.

South Austin Lens 1155

The 1155 mining area is near the midpoint of the current mine, approximately 400 metres vertical below surface. This area has an overall expected 73,300 tonnes at 5.66 g/t gold grade. This complex is a fresh mining area with no historical workings and will be mined via LHS.

This test area will confirm geological modelling practices and the reliability of the sill engineering process. Drilling is currently ongoing in this area; results are expected to refine the total targeted tonnes and grade before test mining begins.

Austin Lens 1099/1100

The Austin Lens 1099/1100 is in an area of remnant mining. It has an overall expected 6,700 tonnes at 5.39 g/t gold grade. This area will be mined with a mixture of MCF and LHS.

This area will be test-mined to establish remnant mining procedures, partly by confirming the geotechnical competence of historical backfill, and to confirm historical data.

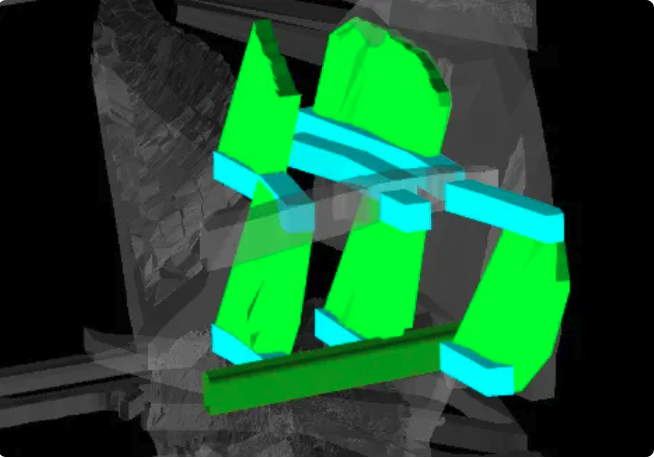

Figure 2: An orthogonal view of the Austin 1099/1100 mining area showing planned sills (blue), stopes (light green), and access (dark green).

South Austin Lenses 1136 and 1148

This test mining area has an overall expected 8,300 tonnes at 5.60 g/t gold grade.

This area is being targeted to determine the accuracy of previous resource models and drilled areas, including understanding how best to assess sills that previous operators started in this area but did not complete.

QUALIFIED PERSON

The technical information presented in this news release has been reviewed and approved by Maurice Mostert, P.Eng., Vice President of Technical Services for West Red Lake Gold and the Qualified Person for Reserves at the West Red Lake Project, as defined by National Instrument 43-101 Standards of Disclosure for Mineral Projects.

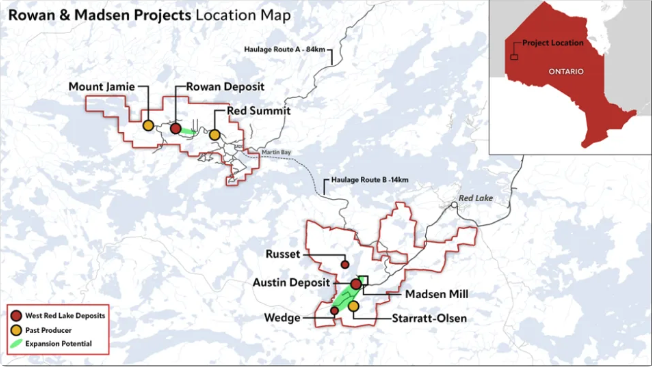

ABOUT WEST RED LAKE GOLD MINES

West Red Lake Gold Mines Ltd. is a mineral exploration company that is publicly traded and focused on advancing and developing its flagship Madsen Gold Mine and the associated 47 km2 highly prospective land package in the Red Lake district of Ontario. The highly productive Red Lake Gold District of Northwest Ontario, Canada has yielded over 30 million ounces of gold from high-grade zones and hosts some of the world’s richest gold deposits. WRLG also holds the wholly owned Rowan Property in Red Lake, with an expansive property position covering 31 km2 including three past producing gold mines – Rowan, Mount Jamie, and Red Summit.

ON BEHALF OF WEST RED LAKE GOLD MINES LTD.

“Shane Williams”

Shane Williams

President & Chief Executive Officer

FOR FURTHER INFORMATION, PLEASE CONTACT:

Investor Relations

Tel: (604) 609-6132

Email: [email protected] or visit the Company’s website at https://www.westredlakegold.com

Neither the TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

CAUTIONARY STATEMENT AND FORWARD-LOOKING INFORMATION

The decision to continue with the advancement of the Madsen Mine restart and the Company’s operations and plans with respect thereto, as described herein (the “Madsen Mine Restart”), are based on economic models prepared by the Company in conjunction with management’s knowledge of the property and the existing estimate of indicated and inferred mineral resources on the property set out in the report entitled, “Independent NI 43-101 Technical Report and Updated Mineral Resource Estimate for the PureGold Mine, Canada,” with an effective date of July 31, 2022, as amended on April 24, 2024, a copy of which is available on SEDAR+ at www.sedarplus.ca. The Madsen Mine Restart is not based on a preliminary economic assessment, a pre-feasibility study or a feasibility study of mineral reserves demonstrating economic and technical viability. Accordingly, there is increased uncertainty and economic and technical risks of failure associated with the Madsen Mine Restart, in particular: the risk that mineral grades will be lower than expected; the risk that additional ongoing mining operations are more difficult or more expensive than expected; and the risk that production and economic variables may vary considerably, due to the absence of a detailed economic and technical analysis undertaken in accordance with National Instrument 43-101 – Standards of Disclosure for Mineral Projects.

Certain statements contained in this news release may constitute “forward-looking information” within the meaning of applicable securities laws. Forward-looking information generally can be identified by words such as “anticipate”, “expect”, “estimate”, “forecast”, “planned”, and similar expressions suggesting future outcomes or events. Forward-looking information is based on current expectations of management; however, it is subject to known and unknown risks, uncertainties and other factors that may cause actual results to differ materially from the forward-looking information in this news release and include without limitation, statements relating to plans for the potential restart of mining operations at the Madsen Mine, the potential of the Madsen Mine; any untapped growth potential in the Madsen deposit or Rowan deposit; and the Company’s future objectives and plans. Readers are cautioned not to place undue reliance on forward-looking information.

Forward-looking information involve numerous risks and uncertainties and actual results might differ materially from results suggested in any forward-looking information. These risks and uncertainties include, among other things, market volatility; the state of the financial markets for the Company’s securities; fluctuations in commodity prices; timing and results of the cleanup and recovery at the Madsen Mine; and changes in the Company’s business plans. Forward-looking information is based on a number of key expectations and assumptions, including without limitation, that the Company will continue with its stated business objectives and its ability to raise additional capital to proceed. Although management of the Company has attempted to identify important factors that could cause actual results to differ materially from those contained in forward-looking information, there may be other factors that cause results not to be as anticipated, estimated or intended. There can be no assurance that such forward-looking information will prove to be accurate, as actual results and future events could differ materially from those anticipated in such forward-looking information. Accordingly, readers should not place undue reliance on forward-looking information. Readers are cautioned that reliance on such information may not be appropriate for other purposes. Additional information about risks and uncertainties is contained in the Company’s management’s discussion and analysis for the year ended November 30, 2023, and the Company’s annual information form for the year ended November 30, 2023, copies of which are available on SEDAR+ at www.sedarplus.ca.

The forward-looking information contained herein is expressly qualified in its entirety by this cautionary statement. Forward-looking information reflects management’s current beliefs and is based on information currently available to the Company. The forward-looking information is made as of the date of this news release and the Company assumes no obligation to update or revise such information to reflect new events or circumstances, except as may be required by applicable law.

For more information on the Company, investors should review the Company’s continuous disclosure filings that are available on SEDAR+ at www.sedarplus.ca.

Visit here for a free report on West Red Lake Gold Mines (TSXV:WRLG) (OTCQB:WRLGF)

SUBSCRIBE FOR TRADING INSIGHTS AND ALERTS. STAY AHEAD.

Get investment opportunities before the rest of the market in real-time.

Get this company's corporate presentation now. Subscribe to download!

Over 120,000 subscribers