Something big is happening in gold.

Gold isn’t just rising—it’s surging to record highs, with Donald Trump at the center.

This isn’t just another bull run. It’s not just central banks hoarding more reserves.

Western investors are flooding back in, flipping the gold market on its head.

For years, they sat out, offloading 30 million ounces1 while China, India, and central banks quietly stocked up.

Now, that’s changed—making Western investors question everything.

Western investors are questioning if the long ascent in the overall markets will persist while the stock market flashes warning signs:

- Trade wars, tariffs, and global tensions are creating dramatic market uncertainty.2

- Trump’s new tariffs threaten to push costs higher, squeezing businesses and consumers.

- Stock market volatility is surging—with the Dow plunging nearly 900 points in a day3 with recession fears creeping in.

- A weakening dollar and looming Fed rate cuts are driving gold’s momentum.

When markets get shaky, investors look for stability—which is why gold continues to reach new record-breaking highs.

Gold prices recently hit an all time high of over $4,300 per ounce, prompting top institutions to raise their forecasts.

JP Morgan now predicts gold will climb to $5,055 per ounce by Q4 2026,4 while Goldman Sachs is calling for $4,900 gold by the end of 2026.5

Billionaire investor John Paulson recently predicted gold could hit $4,000 to $5,000 by 2028, calling it the “ideal asset in an uncertain world”6.

And as gold climbs, smart investors aren’t just looking at bullion—they’re seeking leverage.

But here’s where it gets even more interesting:

Gold Stocks Haven’t Caught Up—Yet

Historically, gold miners outperform physical gold in bull markets.

But right now, even as gold prices surge and mining margins approach 40%7, gold stocks are still lagging behind the metal itself.

Why Are Gold Stocks Still Cheap?

The biggest gold buyers over the last two years—China, central banks, and the Middle East—don’t buy gold stocks.

That’s why, even as gold hits record highs, gold equities remain undervalued.

But record gold prices combined with stock market risks could prompt Western investors to look at gold for the first time in over a decade.

If that happens, it’s important to note that Western investors don’t just buy any gold stock—they look for leverage.

- New gold producers – Companies going from zero to production often see the biggest re-rates.

- High-cost producers – Their profit margins expand the most when gold prices surge.

- Large-cap gold miners – Big money flows into the biggest names first.

But here’s the challenge—most early-stage miners are still years from production.

Only four single-asset gold producers are set to come online in 2025, according to BMO Capital Markets.

One—Artemis’ Blackwater Mine—has already launched and the stock has re-rated. That leaves just three new producers.

And only one operates in a safe jurisdiction.

Enter West Red Lake Gold Mines Ltd. (TSXV:WRLG) (OTCQB:WRLGF)—a junior miner gearing up for production in one of the world’s most prolific gold belts.

Gold is surging. Western investors are back. New producers are scarce.

That’s why West Red Lake Gold Mines (TSXV:WRLG) (OTCQB:WRLGF) stands out as one of the most compelling gold stock setups in years.

Riding the Golden Runway Towards a Targeted Restart in Q2 2025

West Red Lake Gold Mines Ltd. (TSXV:WRLG) (OTCQB:WRLGF) is on the cusp of a major transformation, targeting a restart in Q2 2025 at its Madsen Gold Mine in Canada’s Red Lake Gold District.

That puts them on a short and desirable list—only a handful of companies are on track to enter production in 2025.

It also means West Red Lake Gold Mines – currently trading as a pre-production developer – is still significantly undervalued compared to producers it will soon join.

West Red Lake Gold Mines’ (TSXV:WRLG) (OTCQB:WRLGF) controls the 1.65-million-ounce Madsen Mine, sitting on a highly prospective 80 km² land package in one of the world’s most prolific gold belts.

It’s fully permitted.8 It’s a past-producing mine with 2.5 million ounces of historic gold production. And it contains what Mining.com has called one of the world’s highest-grade, undeveloped gold projects.9

- 1.65 Moz gold (Indicated) at 7.4 g/t Au

- 366 Koz gold (Inferred) at 6.3 g/t Au10

But the real story isn’t just about the asset itself—it’s about how close West Red Lake Gold Mines Ltd. (TSXV:WRLG) (OTCQB:WRLGF) is to production and how few investors realize it.

West Red Lake Gold Mines Just Checked Off Every Box

Most juniors are still talking about timelines and what-if scenarios.

West Red Lake Gold Mines Ltd. (TSXV:WRLG) (OTCQB:WRLGF) has already checked off most of the biggest technical and operational boxes that many developers are hoping to achieve.

First, the company released a Pre-Feasibility Study in January confirming strong economics at a conservative US$2,640/oz gold price.11 The study outlined a $496 million after-tax NPV and projected $94 million in annual free cash flow.

Then in Q1, West Red Lake Gold Mines (TSXV:WRLG) (OTCQB:WRLGF) mined and processed 15,000 tonnes from six gold zones as a bulk sample —executing the mine plan exactly as designed.

Grades and tonnes matched expectations, with independent engineers overseeing the process from stope design to final gold pours.

This bulk sample isn’t just symbolic—it’s the operational proof investors needed to see.

Real gold. Real recovery.

The company didn’t just talk about what could work. They showed it does.

Despite this progress, West Red Lake Gold Mines (TSXV:WRLG) (OTCQB:WRLGF) is still trading like a pre-production explorer.

And yet, the mine is built. The mill is running. The underground connection drift is complete. More than 200 employees are already on site, and ore is being stockpiled in preparation for processing in the coming months.

While other juniors are years away from a restart, West Red Lake Gold Mines (TSXV:WRLG) (OTCQB:WRLGF) is lining up for gold production in H2 202512 — with the hard part already done.

The last operator at Madsen rushed to production — and missed on grade. That mistake cost them everything, and investors still remember.

West Red Lake Gold Mines Ltd. (TSXV:WRLG) (OTCQB:WRLGF) saw the potential, but took a completely different approach.

No shortcuts. No overpromises. Just a disciplined plan backed by real geology, new engineering, and methodical execution.

That difference is now showing up where it matters most:

- The grades from WRLG’s bulk sample matched expectations

- The tonnes were right on target

- The mill restart went smoothly

- And the mine plan is doing exactly what it was designed to do

In short: West Red Lake Gold Mines (TSXV:WRLG) (OTCQB:WRLGF) did what the previous operator couldn’t.

And in doing so, it’s become something rare in this market—a junior that’s actually delivering.

The Rerating Potential Is Clear

In the gold space, rerating happens when risk disappears.

When a company proves the mine works… when the grades hold up… when the infrastructure is built… when production is no longer a hope, but a process already underway—that’s when the market pays attention.

West Red Lake Gold Mines Ltd. (TSXV:WRLG) (OTCQB:WRLGF) has already delivered on all of that.

It’s rare to see a junior with a fully built mine, a restarted mill, verified bulk sample results, and production targeted within months—still trading like it’s early days.

Compare that to Pure Gold, which once hit a $1 billion market cap based on the same asset—before it ever proved it could operate.

West Red Lake Gold Mines (TSXV:WRLG) (OTCQB:WRLGF) is taking a smarter approach. It’s proving each piece step by step.

And now, with the biggest technical risks behind it, the conditions for a rerating are in place.

The market hasn’t caught up yet.

But it’s starting to notice.

With heavyweight backers like legendary industry financier Frank Giustra, who owns a 9.4% stake, and a leadership team of industry pros from billion-dollar gold producers, West Red Lake Gold Mines Ltd. (TSXV:WRLG) (OTCQB:WRLGF) is quickly transforming Madsen into a producing gold mine.

The company’s CEO, Shane Williams, was COO of Skeena Resources when it advanced the past producing Eskay Creek Gold project toward a restart. Before that Williams was VP of Operations at Eldorado Gold, where he led builds of mines in Quebec, Turkey, and Greece.

Press Releases

- West Red Lake Gold Releases Maden Mine Commercial Production Video

- West Red Lake Gold Declares Commercial Production at Madsen Gold Mine

- West Red Lake Gold Reports Mid-Q4 Madsen Mine Update

- West Red Lake Gold Confirms Additional High-Grade Gold in Lower Austin with 26.16 g/t Au over 11.2m, 37.87 g/t Au over 3.55m and 10.55 g/t Au over 8m

- West Red Lake Gold Commences 5,000 Metre Drill Program at Rowan

WRLG director Duncan Middlemiss previously served as President and CEO of Wesdome Gold Mines.

Under Middlemiss’s leadership, Wesdome achieved record annual production of 172,033 ounces in 2024, marking a 39% increase compared to the previous year14 and the company’s market cap is now sitting at a cool C$2.38 billion.15

Starting up a mine—even one with infrastructure already in place—takes serious expertise, capital, and execution.

At the Madsen Mine, that work isn’t theoretical. It’s happening:16

- Underground drilling is tightening the definition of high-grade zones ahead of production.

- A 1.4-kilometre connection drift has been completed to streamline underground operations.

- The mill has been restarted, fully ready to process ore.

- A new camp for 114 workers is built and operational.

- Over 200 employees and contractors are already on site, actively preparing for the next phase.

This isn’t early-stage exploration. It’s a near-term production story in motion.

And with each milestone achieved, West Red Lake Gold Mines Ltd. (TSXV:WRLG) (OTCQB:WRLGF) moves one step closer to its targeted restart—and one step closer to a potential market re-rating.

7 Key Traits

That Define a High-Potential Gold Stock Opportunity

Why Near-Term Producers are the Biggest Winners

In gold mining, timing is everything.

And the timing couldn’t be better for West Red Lake Gold Mines Ltd. (TSXV:WRLG) (OTCQB:WRLGF).

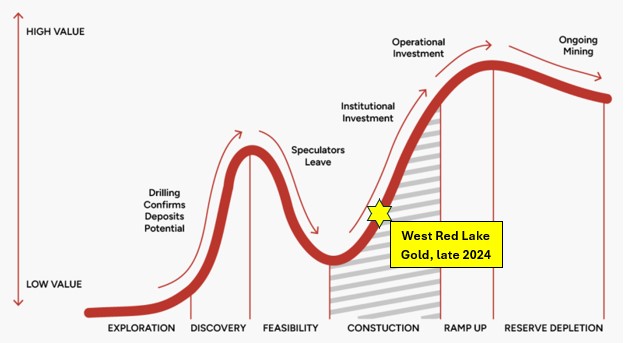

The Lassonde Curve—a roadmap for how mining projects typically grow in value—shows that the most significant opportunities arise as companies transition from development into production.

It’s during this “golden runway” phase that substantial stock price appreciation happens—sometimes by double or even triple digits—as big money flows in to capitalize on the transition from development to production.

West Red Lake Gold Mines Ltd. (TSXV:WRLG) (OTCQB:WRLGF) exemplifies this potential. Unlike many projects that spend decades navigating discovery, permitting, and financing, they’re already past those hurdles.

With West Red Lake Gold Mines (TSXV:WRLG) (OTCQB:WRLGF) targeting production at Madsen Mine targeting production in 2025, the company is rapidly moving toward becoming a fully financed gold miner.

With West Red Lake Gold Mines (TSXV:WRLG) (OTCQB:WRLGF) targeting production at Madsen Mine targeting production in 2025, the company is rapidly moving toward becoming a fully financed gold miner.

Not many investors realize just how rare this opportunity is. Less than 1 in 10,000 exploration projects ever becomes a producing mine, making near-term producers like West Red Lake Gold Mines Ltd. (TSXV:WRLG) (OTCQB:WRLGF) stand out.

Right now, the company’s share price and market cap remains lower than its peers, representing significant upside potential as milestones like mine restart create tangible reason for a higher valuation.

Just take a look at other gold miners that have seen significant appreciation as they transition into production:

-

-

- Artemis Gold: Up 225% since June 2023 as it nears production at its Blackwater Mine in British Columbia, Canada.23

- SilverCrest Metals: After putting the Las Chispas Mine in Mexico into production in Nov 2022, SILV shares skyrocketed 89%, resulting in a $1.7 billion buyout in October.24

- G Mining Ventures: Up 279% since beginning construction at the Tocantinzinho Gold Project in Brazil.25 The company poured its first gold in July 2024, further boosting investor confidence.

- Perseus Mining: Saw strong stock price appreciation leading up to its first gold pour at the Yaouré Gold Mine in Côte d’Ivoire in December 2020 and continued gains in 2021 and 2022 as it ramped up production.26

-

These examples highlight how production milestones can transform undervalued gold stocks like West Red Lake Gold Mines Ltd. (TSXV:WRLG) (OTCQB:WRLGF) into breakout success stories.

Leadership That’s Done This Before

West Red Lake Gold Mines Ltd. (TSXV:WRLG) (OTCQB:WRLGF) has the advantage of leadership that’s learned from past successes how to march the company forward to success.

7 Key Reasons

Why West Red Lake Gold Mines (TSXV: WRLG) (OTCQB:WRLGF) Should Be On Your Radar

The biggest gold bull run in decades is accelerating, and West Red Lake Gold Mines Ltd. (TSXV:WRLG) (OTCQB:WRLGF) is perfectly positioned to ride the wave as it races toward its H2 2025 restart at the Madsen Mine.

Gold is breaking records. New producers are scarce. Western investors are piling in.

And West Red Lake Gold Mines Ltd. (TSXV:WRLG) (OTCQB:WRLGF) is set to become one of the only new gold producers of 2025—right as the market is demanding fresh production.

This is exactly where smart money goes in a gold bull market. A near-term producer, high-grade gold, a fully built mine, and a leadership team that’s delivered before.

With every major milestone—bulk sample results, mine restart, and first gold pour—this stock is expected to attract serious attention.

As gold prices soar and West Red Lake Gold Mines Ltd. (TSXV:WRLG) (OTCQB:WRLGF) moves toward production, the market won’t ignore this story for long.

For market watchers looking for a high-leverage gold play with massive upside potential, West Red Lake Gold Mines (TSXV:WRLG) (OTCQB:WRLGF) is one to keep a close eye on—before the market catches up.

Shane WilliamsB. Eng. M. Sc – CEO, President & Director

Shane WilliamsB. Eng. M. Sc – CEO, President & Director  Frank GiustraAdvisor

Frank GiustraAdvisor  Anthony MakuchB.Sc, P.Eng – Director

Anthony MakuchB.Sc, P.Eng – Director  Duncan MiddlemissDirector

Duncan MiddlemissDirector  Hugh AgroB.Sc., MBA, P.Eng. (Non-Practicing) – Director

Hugh AgroB.Sc., MBA, P.Eng. (Non-Practicing) – Director