Amid the ongoing BTC rally, most companies are playing it safe, dipping a toe into digital assets.

But one firm has set itself apart, going beyond expectations with a high-stakes strategy that’s paying off big this year.

Sure, BTC has had an impressive 64% run since January…

Source: TradingView1

…but that’s nothing next to MicroStrategy, which blasted ahead with a 260% gain so far this year, solidifying its position as the market’s boldest BTC play.

Source: Yahoo Finance2

This isn’t just a fluke.

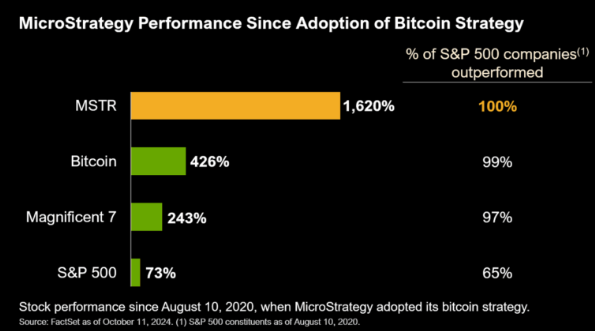

MicroStrategy’s fearless “all-in” BTC strategy has set it leagues above the S&P 500 and outpaced Wall Street’s finest, including the likes of Tesla, Apple, and Microsoft.3

Source: CNN4

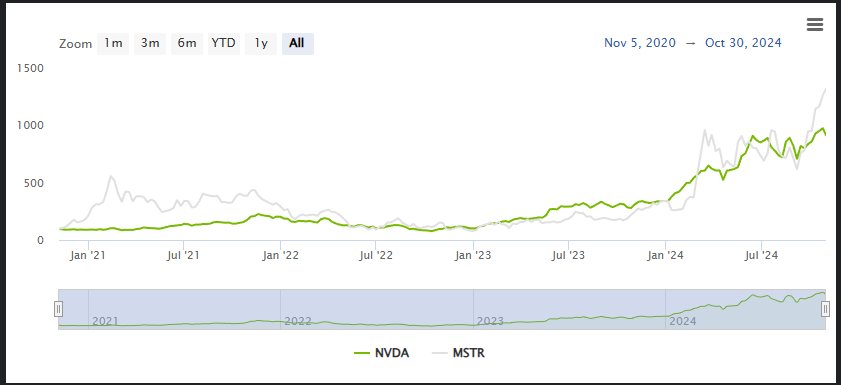

Even NVIDIA, a favorite among tech investors, couldn’t keep up.

Over the last four years, MicroStrategy delivered an astounding 1,347.5% return — dwarfing NVIDIA’s 951.7%.5

Source: StatMuse.com6 (Nov. 1, 2020 to Nov. 1, 2024)

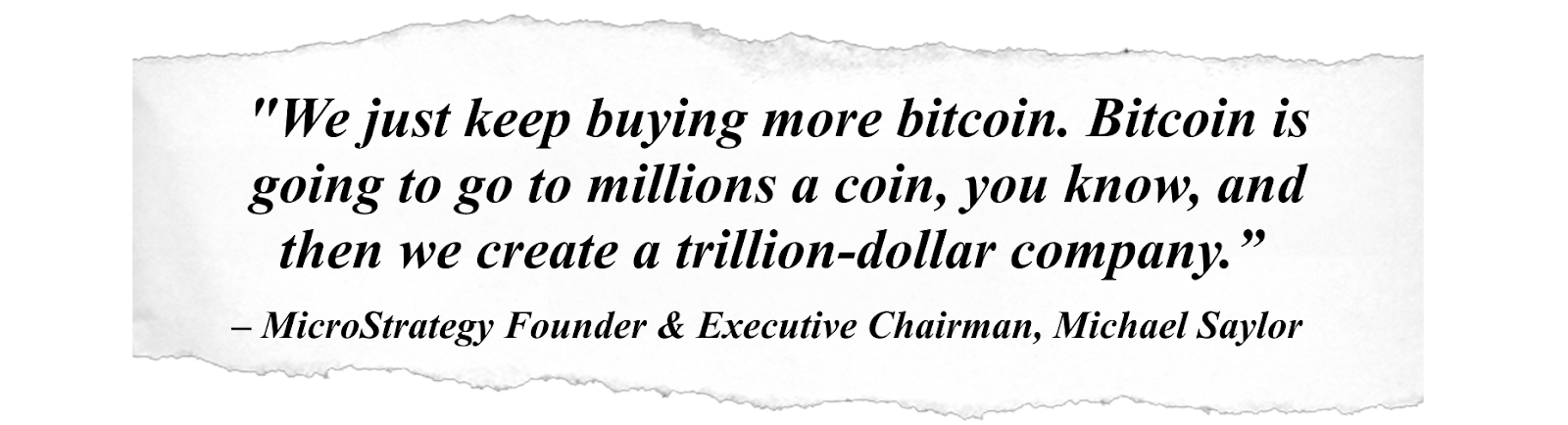

Now MicroStrategy’s Founder and Executive Chairman, Michael Saylor, says their endgame is to become a BTC investment bank…oh, and also to amass up to $150 billion of BTC .7

It’s no wonder BlackRock just boosted its stake in MicroStrategy to 5.2%, seeing exactly what lies ahead.8

This bold move aligns with predictions from industry experts like Tom Lee, who forecasted BTC reaching $100,000 within the next 12 months9.

But MicroStrategy isn’t the only company strategically buying up BTC.

Dubbed Canada’s “next MicroStrategy,” Neptune has something the others don’t: an adaptable, income-generating model that transforms digital assets into steady cash flow.

This company’s strategy is as bold as it is calculated, blending BTC mining, staking, Decentralized Finance (DeFi), and blockchain nodes into a high-powered, revenue-producing machine.

Neptune Digital Assets Corp. (TSXV:NDA) (OTCQB:NPPTF) is no newcomer either. They have one of the longest track records in their space, being among the first blockchain companies listed on the TSXV in early 2018.

And it’s paying off—Neptune has secured TSXV Top 50 status twice, a testament to its steady growth and strategic foresight.10

In a market that swings with BTC’s price, Neptune Digital Assets Corp. (TSXV:NDA) (OTCQB:NPPTF) stands out by doing what MicroStrategy doesn’t: capturing BTC’s upside while mitigating risk through diversification.

8 Reasons

to Add Neptune Digital Assets (TSXV:NDA) (OTCQB:NPPTF) to Your Watchlist

1

Surging Digital Currency Market: Strong coin prices driving stock surge, like MicroStrategy’s 260%+ since January.

2

The “Canadian MicroStrategy”: Neptune Digital Assets Corp. (TSXV:NDA) (OTCQB:NPPTF) is mirroring MicroStrategy’s focus on boldly growing their BTC treasury.

3

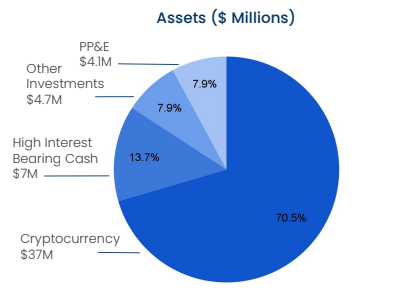

More Diversified Holdings: Exposure to BTC, but also SOL, Cosmos, ETH, real estate & SpaceX.

4

Strong Financials: No debt, 5-year runway thanks to $5M cash reserve, & impressive quarterlies that include record $24.8M comprehensive net income in the past 9 months.

5

Consistent Revenue: Self-sustaining income model from digital currency- and blockchain-related activities, including staking that generates yield from digital assets.

6

Savvy SOL Acquisition: Bought 27K SOL tokens at 67% discount in Q1 2024; up 162% today.

7

Strategic Buyback Program: Reducing outstanding shares while demonstrating management’s commitment to shareholder value & perceived growth potential.

8

Proven Leadership: Leading digital currency innovation by drawing on deep experience in blockchain, digital currency, tech & finance.

By continuously compounding their earnings and reinvesting in digital currency, Neptune is building a stable, growth-focused portfolio that’s built to last.

A Bold New Player Steps into the Digital Currency Spotlight as Canada’s Microstrategy

Neptune Digital Assets Corp. (TSXV:NDA) (OTCQB:NPPTF) doesn’t just hold BTC.

They’re building a sophisticated, multi-stream digital currency business that combines the power of a diversified portfolio with the kind of revenue generation you’d expect from a digital currency ETF—and that’s where they break away from the pack.

The Neptune model is as smart as it is resilient.

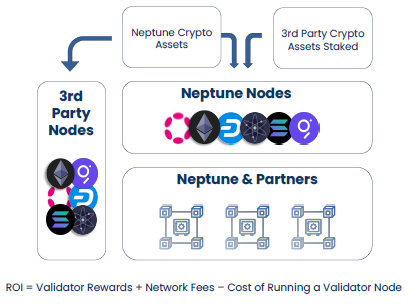

Neptune Digital Assets (TSXV:NDA) (OTCQB:NPPTF) generates consistent revenue through multiple digital currency– and blockchain-related activities: BTC mining, crypto staking, operating blockchain nodes, DeFi.

Every dollar earned from these activities doesn’t just sit; it’s reinvested into liquid digital assets yielding 4% to 19%, creating a cycle of growth that fuels further acquisitions in BTC and other digital tokens.

It’s a self-sustaining model that not only continuously grows Neptune Digital Assets’ (TSXV:NDA) (OTCQB:NPPTF) holdings, but also gives investors a simple way to gain exposure to a diversified portfolio of income-generating digital assets.

Neptune’s approach doesn’t stop at digital currency alone. While BTC remains their anchor, Neptune smartly hedges against its volatility with a diversified array of assets:

-

-

- SOL – Strategically acquired at a 67% discount, positioning Neptune for high growth potential.11

- Cosmos and ETH – Key altcoins that enhance the portfolio’s breadth and stability.12

- SpaceX – Neptune holds ~26,770 shares valued at US$3 million,13 giving investors indirect exposure to a high-demand, private aerospace leader.

-

The company also holds a healthy cash balance of $5M with tier 1 Canadian banks (that could carry them for 5 years).14

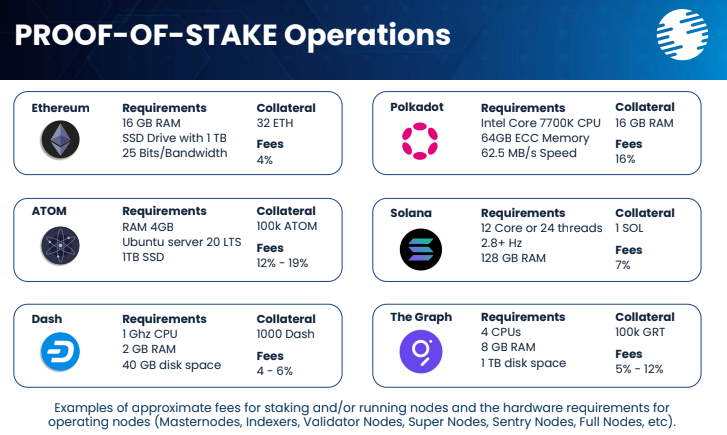

Another big differentiator for Neptune Digital Assets (TSXV:NDA) (OTCQB:NPPTF) is that they do both proof-of-work and proof-of-stake mining:

-

-

- Proof-of-work relates to BTC mining, where the first miner to solve an algorithm gets rewarded with an amount of BTC. (While Neptune does generate revenue from BTC mining, it’s actually just a tiny amount.)

- Proof-of-stake mining relates to holding digital assets and processing transactions or upholding a network in exchange for fees. (Neptune mines a number of altcoins this way. This is their true growth sector.)

-

It all comes together to give Neptune Digital Assets (TSXV:NDA) (OTCQB:NPPTF) a very strong financial position. They have no debt15 and an impressive string of quarterly results:

-

-

- Dec. 2023: mining revenues up 56% & digital currency balances up 42% YoY16

- Jan. 2024: $6.4M Comprehensive Net Income for Q1 202417

- Apr. 2024: record $18.6M Comprehensive Net Income for 6 Months ended Feb. 202418

- Jul. 2024: record $24.8M Comprehensive Net Income for 9 Months ended May 202419

-

Performance like that enabled them to explore a credit facility of up to US$25M to quickly seize high-value opportunities in BTC and other digital currency-related assets. The good news for investors: the credit facility has extremely low capital cost and no shareholder dilution.20

Leading Neptune Digital Assets (TSXV:NDA) (OTCQB:NPPTF) is a team with deep experience in blockchain, digital currency, finance and tech, including Co-Founder Kalle Radage’s former senior roles at Oracle and Nokia.

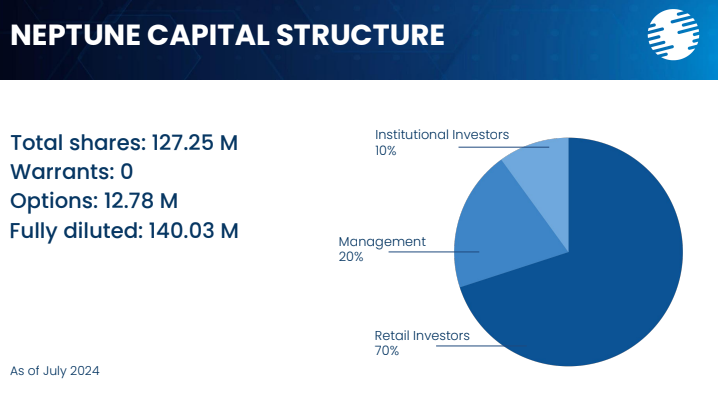

Management holds 20% ownership, and believe so much in the company’s inherent value and growth potential, that they recently initiated a share buyback program for a sizable 10% of Neptune’s public float.21

And as Neptune Digital Assets’ (TSXV:NDA) (OTCQB:NPPTF) portfolio expands, their management team can essentially stay the same size, which means profit potential only grows as they scale.

This isn’t just a BTC play — it’s a diversified, income-driven powerhouse built for the long haul.

Digital Currency Rally Sends Digital Currency Stocks Soaring

ETH is predicted to rise by 6.82% in just the next 30 days.22

SOL – the third most popular blockchain – recently soared 19% thanks to an AI memecoin frenzy23 and is expected to jump by over 13% by the end of the year.24

But BTC is the real showstopper in this rally, with staggering price predictions lighting up the market:

-

-

- Standard Chartered foresees BTC surging to $125,000 if Republicans take the Congress in the US election.25

- Bernstein Analysts label their $200,000 target by end of 2025 as “conservative” given the soaring US debt levels.26

- Ark Invest CEO, Cathie Wood, predicted BTC could reach an astounding US$1.48M by 2030.27

- MicroStrategy’s Michael Saylor, foresees BTC hitting $13M by 2045,28 going from 0.1% of global financial capital to 7%.29

-

A major driver behind the digital currency rally is the way Institutional investors in the US can’t get enough of BTC ETFs, cornering $13B in shares since the start of the year alone.30

BlackRock’s BTC ETF launch broke records, becoming the fastest-growing ETF in US history and surpassing funds that have been around for decades.31

No surprise that soaring coin prices and lofty market expectations are sending ripples across the entire digital currency sector.

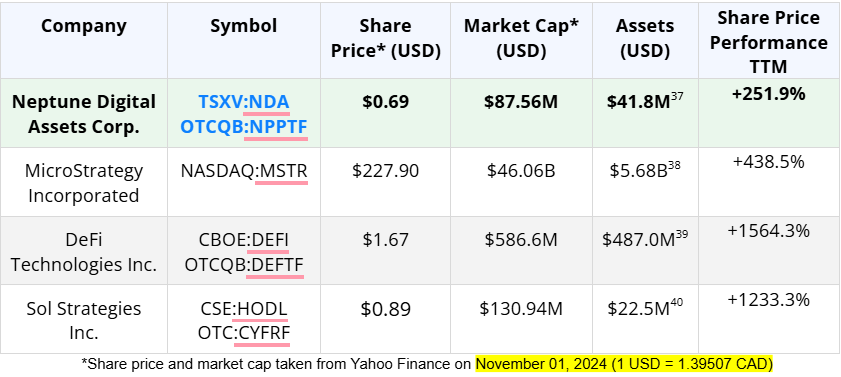

While MicroStrategy (up 6.6% when BTC recently hit a 3-month high32) and Neptune Digital Assets Corp. (TSXV:NDA) (OTCQB:NPPTF) are riding high on the wave; they’re far from the only contenders in this space.

Let’s see how Neptune measures up to some of the other high-performing digital currency stocks.

How Neptune Digital Stacks Up Against Top Performers

To get a better understanding of how the digital currency rally is boosting stocks in the digital currency space, let’s look at how Neptune Digital Assets Corp. (TSXV:NDA) (OTCQB:NPPTF) stacks up against other contenders like SOL Strategies and DEFI Technologies.

Each has carved out its own place in the market, but Neptune’s diversified, high-potential approach sets it apart.

We’ve already talked a lot about MicroStrategy’s model and performance.

SOL Strategies, the primary investor behind SOL’s blockchain platform, is riding high on the latest trend—a niche that fuses AI with meme-inspired digital currency.33 Built on proof-of-stake, SOL offers the speed and cost-efficiency ETH can’t match, enabling it to dominate in areas like Decentralized Finance (DeFi) and non-fungible tokens (NFTs).34

DEFI Technologies takes a broad approach, giving investors exposure to digital assets through ETPs (Exchange Traded Products) and targeted Web3 infrastructure investments. They’re well-positioned to capture the growth of assets like BTC, ETH, and SOL, providing diversified digital asset exposure with minimal direct ownership risk.35

Neptune Digital Assets Corp. (TSXV:NDA) (OTCQB:NPPTF) distinguishes itself with a diversified portfolio and strategic investments. Notably, Neptune has amassed 31,715 SOL tokens, all staked and earning rewards, underscoring their commitment to high-potential digital assets.36

While all four companies have seen impressive share price appreciation over the past year, Neptune’s diversified portfolio, stable revenue model, and strategic reinvestment into high-yield digital assets position it to capitalize on market opportunities.

As the table below shows Neptune’s stock still has significant room to grow compared to its peers, offering one of the strongest upside potentials in the space.

Diversified Digital Currency Staking: Neptune’s Reliable Engine for BTC Growth

For Neptune Digital Assets Corp. (TSXV:NDA) (OTCQB:NPPTF), digital currency staking isn’t just a side gig — it’s a cornerstone strategy that sustainably fuels high yields while validating blockchain transactions.

If you’re not deep into blockchain, the technical details of staking might sound complex. But here’s the takeaway:

-

-

- Staking involves running software nodes or validators where Neptune is responsible for storing data, processing transactions, and adding new blocks to the blockchain.

- Unlike proof-of-work BTC mining, staking doesn’t involve running specialized hardware to validate transactions.

- Staking also requires a lot less energy than BTC mining.

-

Neptune Digital Assets Corp. (TSXV:NDA) (OTCQB:NPPTF) has been in the staking business since launching its first DASH node in 2017.

Today, Neptune runs validators on some of the most promising proof-of-stake networks, including Cosmos (ATOM), Fantom (FTM), Polkadot (DOT), and ETH, generating steady returns with minimal operational costs.

This model predictably delivers Neptune Digital Assets Corp. (TSXV:NDA) (OTCQB:NPPTF) a steady 4-19% yield without all the risks of traditional BTC mining, where competition and costs are high, and revenue predictability is low.

The company then reinvests their reliable income from staking back into BTC to further boost their core treasury and strengthen their financial position.

Here’s a closer look at Neptune’s impressive portfolio of high-impact digital assets:

-

-

- 350 BTC in cold storage (no active selling or trading)

- 32,000 SOL (27K of which was acquired at 67% discount)

- 200,000 ATOM

- Positions in ETH, DOT, FTM, DASH, Graph (GRT), OCEAN, and a number of other tokens41

-

Graph (GRT) and OCEAN are linked to AI, offering Neptune Digital Assets Corp. (TSXV:NDA) (OTCQB:NPPTF), valuable exposure to the fast-growing AI market.42

The company’s diversification also includes select real estate assets and a ~US$3 million stake in SpaceX,43 giving them a position in one of the world’s most valuable startups with a recent valuation of $210 billion.44

And since Neptune Digital Assets Corp. (TSXV:NDA) (OTCQB:NPPTF), exploring a credit facility of up to US$25 million, they’re positioned to quickly load up their already impressive portfolio with even more BTC and other digital currency assets without any shareholder dilution.45

As the digital currency rally continues gaining steam, expect the value of Neptune Digital Assets’ (TSXV:NDA) (OTCQB:NPPTF) asset base to just keep climbing higher.

Strong Balance Sheet & Shareholder Alignment

It’s rare to find a rapidly growing company with such financial strength and shareholder-friendly structure.

Neptune Digital Assets (TSXV:NDA) (OTCQB:NPPTF) stands out with zero debt, a robust $5 million cash balance (enough to support a 5-year runway),46 and 20% insider ownership ensuring strong alignment between management and investors.

The last time Neptune had to raise money was over three-and-a-half years ago (April 2021)47, so all the warrants from that have fallen off.

Then there’s Neptune’s recently initiated share buyback program for 10% of the company’s public float.48

Buybacks are one of the most reliable indications that a management team is stoked about their company’s near-term growth potential.

Put it all together and Neptune Digital Assets Corp. (TSXV:NDA) (OTCQB:NPPTF) is a well-capitalized company with an attractive cap structure that’s positioned for continued growth as the digital currency rally rolls on.

Leadership with Deep Experience in Blockchain, Digital Currency & Finance

Neptune Digital Assets (TSXV:NDA) (OTCQB:NPPTF) is led by a team of experts in business building, capital markets, and tech, including long-time relationships in the blockchain and digital currency space that have given them priority access to digital assets.

8 Reasons

Neptune Digital Assets (TSXV:NDA) (OTCQB:NPPTF) Could Be the Next Breakout Digital Currency Stock

1

Digital Currency Market Momentum: With the BTC rally in full swing, Neptune is positioned to see gains similar to MicroStrategy’s 260%+ rise since January.

2

The “Canadian MicroStrategy”: Neptune is taking a page from MicroStrategy’s playbook with a bold strategy to grow its BTC holdings.

3

Diversified Portfolio: Exposure to top-tier assets like BTC, SOL, ETH, and even a stake in SpaceX, setting Neptune apart from BTC-only plays.

4

Financial Strength: Debt-free, with $5M in cash and record net income of $24.8M in the past nine months.

5

Consistent Revenue: Self-sustaining income model from digital currency- and blockchain activities

6

Smart SOL Acquisition: Acquired at a 67% discount in early 2024, SOL’s value is now up 162%

7

Strategic Buyback Program: Demonstrating commitment to shareholder value by reducing outstanding shares and signaling growth confidence.

As digital currency prices climb, Neptune Digital Assets’ (TSXV:NDA) (OTCQB:NPPTF) revenues and asset base are set to grow rapidly, driven by strategic investments in BTC, diversified digital assets, and innovative holdings like SpaceX.

With an impressive track record of recent quarterly results, market participants will be watching closely as Q4 results approach year-end.

For exposure to a diversified, income-generating digital currency stock, keep an eye on Neptune Digital Assets Corp. (TSXV:NDA) (OTCQB:NPPTF) and consider adding the ticker to your watchlist.

Cale MoodieBSF, CPA, CA – Co-Founder, CEO and Director

Cale MoodieBSF, CPA, CA – Co-Founder, CEO and Director Kalle RadageCo-Founder, COO and Director

Kalle RadageCo-Founder, COO and Director Dustin ZingerVP Investor Relations

Dustin ZingerVP Investor Relations