Digital markets are entering a new era, with BTC reaching over $71,0001 and altcoins like SOL and ETH climbing sharply. This rally is fueled by a recent Fed rate cut, increasing institutional interest, and expectations around BTC ETFs. Institutional investors have acquired $13 billion in BTC ETF shares this year, accelerating mainstream adoption of digital assets and further driving up prices.

Experts see this rally as just the beginning. Predictions are bullish, with Standard Chartered suggesting a potential $125,000 valuation for BTC, while Bernstein calls a $200,000 target by 2025 “conservative.”2 Looking further ahead, Cathie Wood projects BTC could reach a stunning $1.48 million by 2030.3 Rising confidence in digital assets is fueling the broader digital currencies market, lifting valuations across the sector. Analysts expect this momentum to continue, with gains extending to a wide range of companies as demand and adoption of digital currencies technologies accelerate.

Here are five digital currencies stocks that are well-positioned to capitalize on the ongoing momentum in 2025:

-

-

- Neptune Digital Assets Corp. (TSXV:NDA) (OTCQB:NPPTF)

- MicroStrategy Incorporated (NASDAQ:MSTR)

- DeFi Technologies Inc. (CBOE:DEFI) (OTCQB:DEFTF)

- Coinbase Global Inc. (NASDAQ:COIN)

- Sol Strategies Inc. (CSE:HODL) (OTC:CYFRF)

-

1. Neptune Digital Assets Corp. (TSXV:NDA) (OTCQB:NPPTF)

Neptune Digital Assets Corp. (TSXV:NDA) (OTCQB:NPPTF) is a Canadian blockchain company making significant strides in digital asset management and staking services. As one of Canada’s first publicly traded blockchain companies, Neptune stands out for its strong focus on revenue generation across multiple areas: staking, blockchain nodes, DeFi, and a measured amount of BTC mining. This multi-pronged approach means Neptune Digital Assets is not just riding the wave of digital currencies—it’s creating stable, ongoing cash flow from its assets.

Neptune’s portfolio includes 350 BTC in cold storage, substantial holdings in SOL, ATOM, ETH, and even a US$3 million investment in SpaceX. The company also recently initiated steps to expand its digital currencies holdings further by exploring a flexible credit facility of up to US$25 million through a Swiss bank specializing in services for digital currencies-native companies. This strategic move would allow Neptune to acquire additional BTC and other digital assets without shareholder dilution, enhancing its income and balance sheet while preserving agility in a fast-evolving market.

Neptune’s financial strength is underpinned by US$4.3 million in cash reserves held with tier 1 Canadian banks, providing over two years of operational runway without needing to sell tokens or raise capital. With no debt or share purchase warrants, Neptune has the flexibility to execute strategic acquisitions, such as its investment in SpaceX and its NCIB share repurchase program,4 to drive further shareholder value.

Neptune Digital Assets was recently recognized as a top 50 company on the TSX Venture Exchange,5 reflecting both its market performance and growth potential. With digital assets gaining traction among institutional investors, Neptune’s diversified, revenue-focused model could make it a smart choice for investors looking for steady growth in the evolving blockchain sector.

Sponsored

Could This Be Canada’s Answer to MicroStrategy?

MicroStrategy’s bold BTC strategy has pushed its stock up 270%, outpacing the S&P 500.

Now, our top pick for 2025 is following a similar path.

Find out why this company could be the next big breakout in digital assets—don’t miss out!

2. MicroStrategy Incorporated (NASDAQ:MSTR)

MicroStrategy Incorporated (NASDAQ:MSTR) is renowned among blockchain investors for its significant BTC holdings. MicroStrategy has established itself as one of the biggest corporate holders of BTC, turning it into a hybrid company straddling both technology and digital currencies investment. The company’s commitment to BTC is driven by its belief in the long-term value of digital assets. As of July 31, 2024, MicroStrategy held 226,500 BTC at a total cost of $8.3 billion.6

Alongside its BTC strategy, MicroStrategy maintains a strong business in analytics software, supporting global clients with its cloud-native AI platform, MicroStrategy ONE. The latest release, developed through close customer collaboration, introduces features like “Auto for Teams” (integrating the AI bot into Microsoft Teams) and narrative data summaries, enabling streamlined insights. Enhanced accessibility, Office 365 integration, and Tableau compatibility further make data and AI-driven decisions accessible across skill levels.7

MicroStrategy’s dual focus on BTC and AI-powered analytics software creates a compelling hybrid model.

3. DeFi Technologies Inc. (CBOE:DEFI) (OTCQB:DEFTF)

DeFi Technologies Inc. (CBOE:DEFI) (OTCQB:DEFTF) is a fintech company bridging traditional capital markets and decentralized finance (DeFi) by providing investor access to innovative DeFi products. Leveraging Web3 technologies, the company offers regulated access to DeFi protocols like ETH and SOL, making decentralized finance accessible even for those less versed in blockchain.

Through its exchange-traded products (ETPs), DeFi Technologies enables exposure to DeFi without the complexities of digital wallets. Its subsidiary, Valour, recently launched the Valour Sui (SUI) ETP on Sweden’s Spotlight Stock Market, providing exposure to the Sui blockchain’s high-speed, low-latency transactions for real-time applications like gaming and finance.8 Built with an object-centric, proof-of-stake model, Sui enables efficient, parallel transaction processing, enhancing scalability.

Valour reported C$757 million (US$561 million) in assets under management (AUM) as of September 30, 2024, marking a 49% year-to-date increase. Net inflows reached C$8.2 million in September, driven by popular products like Valour SOL SEK and ETH Zero SEK, reflecting strong investor confidence. Valour’s cash and digital assets, including BTC, ETH, ADA, and AVAX, total approximately C$40.2 million.9

Supported by a team with expertise in financial markets and digital assets, DeFi Technologies is well-positioned for growth as institutional interest in DeFi grows and regulatory clarity increases. Its strategic expansion in Europe and focus on user-friendly, secure digital asset investments highlight its role as a leader in the evolving DeFi ecosystem.

4. Coinbase Global Inc. (NASDAQ:COIN)

As the largest digital currency exchange in the US, Coinbase Global Inc. (NASDAQ:COIN) offers diverse services for retail and institutional investors, allowing users to buy, sell, and store a wide range of digital assets. The platform’s accessibility has made it a primary entry point for digital currencies investors, and since going public in 2021, Coinbase has expanded offerings with tools for active traders and custodial services for institutions, generating revenue through trading fees, staking, and subscriptions.

Coinbase’s recent launch of “Based Agent,” an AI-powered tool, enables users to set up in minutes a custom AI agent with a wallet capable of onchain transactions like trades, swaps, and staking.10 Developed in collaboration with OpenAI and Replit, this feature reflects Coinbase CEO Brian Armstrong’s support for AI-driven blockchain applications, signaling a potential shift in transaction management.

With the rise in global digital currency adoption, Coinbase’s proactive regulatory approach enhances its credibility, positioning it for continued growth. By expanding its ecosystem and introducing new technologies, Coinbase remains a key player in the evolving digital currency market.

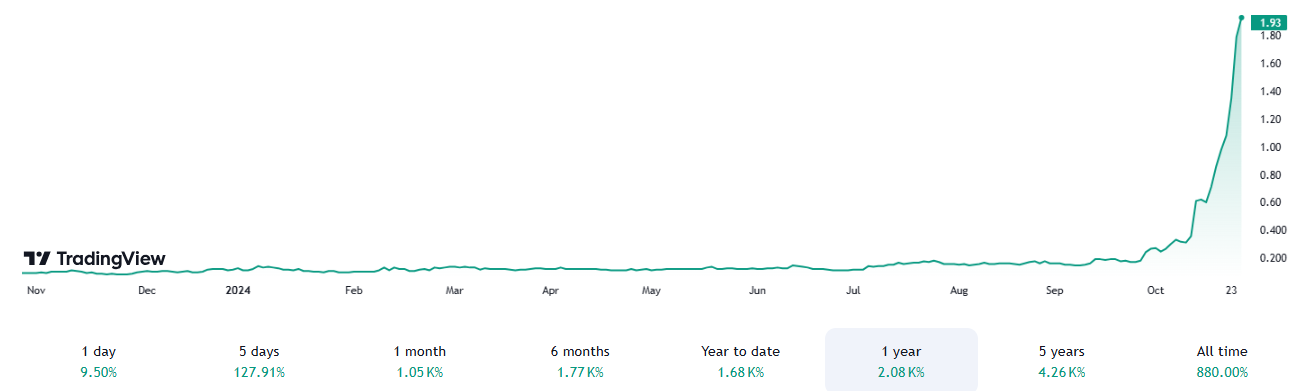

5. Sol Strategies Inc. (CSE:HODL) (OTC:CYFRF)

Based in Toronto, Sol Strategies Inc. (CSE:HODL) (OTC:CYFRF) is a publicly traded holding company focused on advancing the SOL blockchain and its ecosystem through strategic private equity and financial market investments. By targeting opportunities in staking rewards and SOL-based projects, Sol Strategies enables shareholders to indirectly engage with decentralized finance.

Sol Strategies recently announced a Letter of Intent (LOI) to acquire four blockchain validators.11 This acquisition, negotiated with an independent vendor, will involve an initial payment of C$1,384,500 in cash and C$1,384,500 in Sol Strategies shares at closing, along with an additional C$7,614,750 in shares over three years, subject to performance milestones.

In other financial activities, Sol Strategies drew down US$2 million from its C$10 million loan facility to increase its SOL holdings, bringing its total to 117,619 SOL, stored in Coinbase custody. The company has generated 1,944 SOL in staking revenue, yielding a gross profit of C$454,000 since June 2024. Additionally, Sol Strategies sold 8.57 BTC and entered a call option agreement for 8,000 SOL with a US$190 strike price.

As of the latest update, Sol Strategies holds C$2,393,700 in cash, C$442,000 in venture investments, and approximately C$80,000 in net liabilities.