The US scrap metal market is booming, fueled by the growing demand for recycled materials, disaster recovery contracts, and the transformation of the domestic steel industry. Valued at $42.3 billion in 2024,¹ this sector is critical to meeting infrastructure and sustainability goals. Companies with innovative strategies and strong financial positioning are well-placed to benefit from this expanding market.

From advanced processing capabilities to strategic market positioning, the following companies are redefining what it means to thrive in the scrap metal and recovery industries.

Let’s dive into the top five stocks to watch in 2025:

- Greenwave Technology Solutions, Inc. (NASDAQ:GWAV)

- Sims Limited (ASX:SGM) (OTC:SMSMY)

- Radius Recycling (NASDAQ:RDUS)

- Nucor Corporation (NYSE:NUE)

- Steel Dynamics (NASDAQ:STLD)

1. Greenwave Technology Solutions (NASDAQ:GWAV)

Greenwave Technology Solutions, Inc. (NASDAQ:GWAV) is emerging as a significant player in the scrap metal and disaster recovery industries, capitalizing on market trends and strategically diversifying its operations. The company’s innovative approach and recent achievements position it as a key contributor to the growing $42 billion US recycling market.

In December 2024, Greenwave secured a major subcontract valued between $15 million and $35 million as part of Hurricane Helene recovery efforts in North Carolina. This contract involves processing large amounts of debris and recovering high-value scrap metal, positioning Greenwave as a critical player in disaster recovery and recycling operations. By entering the wood recycling market during its Hurricane Helene recovery efforts, the company is also tapping into an entirely new revenue stream, demonstrating its ability to adapt and thrive in emerging sectors.

In recent months, Greenwave Technology Solutions, Inc. (NASDAQ:GWAV) has invested heavily in expanding its operational capabilities. The installation of a second automotive shredder has doubled its ferrous metal processing capacity, potentially adding $4.8 million in annual revenue.

Greenwave is also embracing digital innovation with the launch of its AI-powered Scrap App. By offering real-time pricing, simplified transactions, and logistical support, the app is designed to streamline the scrap metal trade and improve operational efficiency. This forward-thinking platform aligns with Greenwave’s mission to modernize the recycling industry.

On the financial side, Greenwave Technology Solutions, Inc. (NASDAQ:GWAV) has strengthened its balance sheet by eliminating $35.2 million in debt over the first nine months of 2024 and growing its total assets by 50%, reflecting a focus on disciplined financial management and strategic investment. Insider confidence in the company remains high, as evidenced by Danny Meeks’ recent purchase of 377,002 shares, further aligning management’s interests with those of shareholders.

In January 2025, Greenwave announced a $4 million capital raise to support its ongoing growth initiatives, including additional investments in shredding technology and the Scrap App. The company also projects fiscal year 2025 revenues between $43 million and $45 million, driven by expanded processing capacity and new contracts. Trading at approximately $0.42 per share with a market cap of $9.4 million, Greenwave provides an opportunity to enter a growing industry at an attractive valuation.

With projected fiscal year 2025 revenues of $43 million to $45 million, Greenwave Technology Solutions, Inc. (NASDAQ:GWAV) is poised for sustained growth. The company’s focus on operational efficiency, diversified revenue streams, and innovative solutions positions it as a compelling player in the evolving recycling and disaster recovery sectors.

Investors looking for opportunities in these expanding industries may find Greenwave’s strategic direction and potential worth noting.

Sponsored

Profiting from Disaster

Wildfires in California. Hurricanes flooding the South.

Billions of dollars are being poured into rebuilding America—and one company is cashing in.

With a $15-$35M deal and soaring scrap metal demand, this company poised for growth.

2. Sims Limited (OTC:SMSMY)

Sims Limited (OTC:SMSMY) is a global leader in metal recycling, known for its extensive network of facilities and advanced processing capabilities. With over 200 facilities worldwide, the company specializes in ferrous and non-ferrous metal processing, e-waste recycling, and municipal recycling services. Its commitment to sustainability and innovation has cemented its position as a dominant player in the recycling industry.

For the full year ended June 30, 2024, Sims Limited reported sales of AUD $7.2 billion (US$4.4 billion), representing a 10% increase from the previous year. This growth was achieved despite challenges such as fluctuating commodity prices and a strong Australian dollar. The company’s performance was driven by higher global scrap metal prices, operational efficiencies leading to a 14% improvement in EBITDA margins, and a 20% revenue increase in its e-waste division. The growing demand for responsible electronic recycling solutions has been a significant contributor to this success.²

Sims Limited (OTC:SMSMY) has made significant investments to expand its global presence and operational capabilities. The company allocated AUD $50 million (US$31 million) to advanced shredding and metal recovery systems, enhancing the precision and cost-effectiveness of non-ferrous metal recovery.

In August 2023, Sims Limited further expanded its presence in the Mid-Atlantic region by agreeing to acquire the assets of Baltimore Scrap Corp. (BSC) and its affiliated entities. BSC is a large metal recycler operating 17 facilities across five states—Maryland, Virginia, Pennsylvania, New York, and New Jersey—with four of those facilities housing auto shredding plants.³ BSC handles and sells approximately 600,000 metric tons of scrap each year.

The company is well-positioned to benefit from industry trends favoring electric arc furnaces, which rely heavily on high-quality recycled metals. The global e-waste management market is expected to reach $155 billion by 2030,⁴ presenting significant opportunities for Sims. Urban mining projects further demonstrate the company’s ability to meet the rising demand for recycled materials.

Recent developments indicate positive momentum. In the first quarter of fiscal year 2025, Sims Limited (OTC:SMSMY) reported an expected EBIT of approximately AUD $55 million (US$34 million), bolstered by strong performances from its North America Metal division and its share in the SA Recycling business. This improvement follows strategic portfolio adjustments, including the sale of its British metal recycling business and its remaining interest in CLP Circular Services, enhancing financial stability.⁵

Sims Limited‘s global reach, focus on innovation, and commitment to sustainability underscore its leadership in the recycling industry. As demand for recycled materials continues to rise due to decarbonization and resource scarcity, Sims is well-positioned for sustained growth in this evolving market.

3. Radius Recycling (NASDAQ:RDUS)

Radius Recycling (NASDAQ:RDUS), formerly known as Schnitzer Steel Industries, is a prominent player in North America’s scrap metal recycling industry. With over 100 facilities across the United States and Canada, the company processes ferrous and non-ferrous metals, providing essential materials for steel production and other industrial applications. Radius also exports its recycled materials to global markets, catering to growing international demand.

In fiscal year 2024, Radius Recycling reported a 12% increase in revenue, largely driven by rising demand for recycled metals and improved operational efficiencies.⁶ This growth underscores the company’s strategic alignment with industry trends, particularly the expanding use of electric arc furnaces (EAFs) in steel production. EAFs rely heavily on high-quality scrap metal, positioning Radius as a key supplier in this segment.

Radius has made significant investments in advanced shredding and sorting technology to enhance its processing capabilities. These innovations ensure the production of consistent, high-quality recycled materials, meeting the exacting standards of its customers, which include major steel producers like Nucor Corporation (NYSE:NUE).

Radius Recycling (NASDAQ:RDUS) has also expanded its presence in international markets, particularly in Europe and Asia, as these regions increase their reliance on sustainable materials. This global strategy complements the company’s strong domestic footprint, enabling Radius to scale operations and meet growing demand effectively.

By investing in technology and expanding its geographic reach, the company is poised to play a critical role in meeting these demands while supporting the broader goals of environmental responsibility. As the recycling industry evolves, Radius Recycling (NASDAQ:RDUS) remains a key player, leveraging its scale, expertise, and sustainability focus to maintain its leadership in the sector.

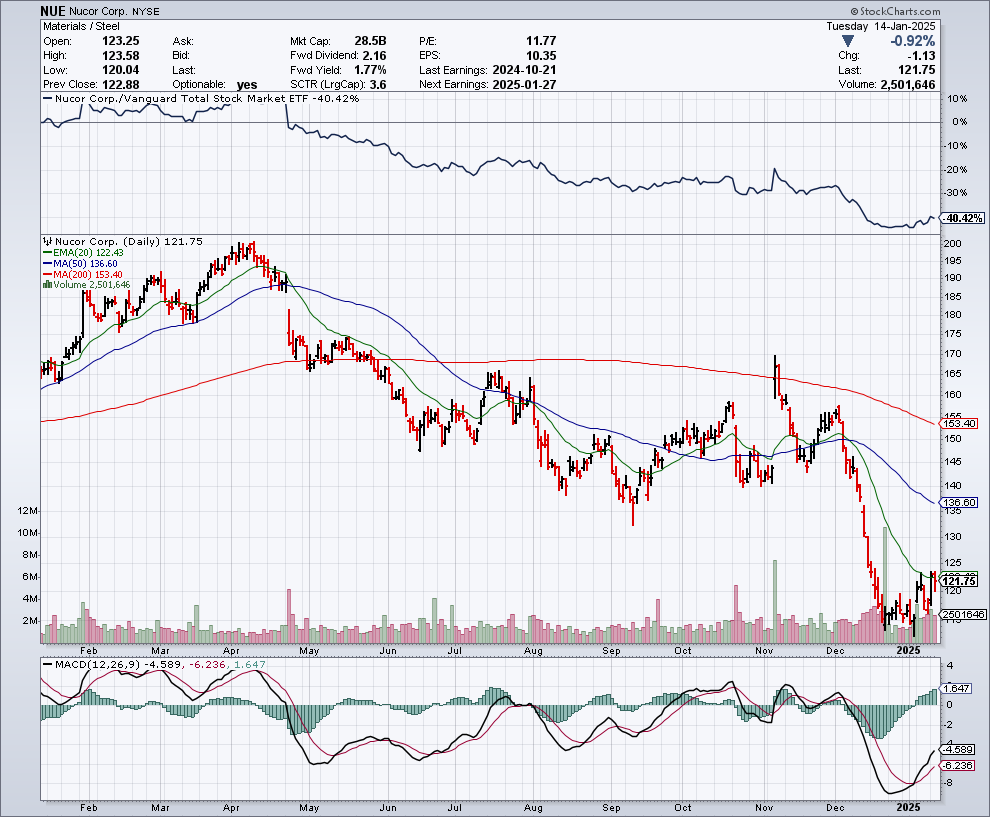

4. Nucor Corporation (NYSE:NUE)

Nucor Corporation (NYSE:NUE), the largest steel producer in the US, plays a pivotal role in the scrap metal ecosystem. With a strong emphasis on sustainability and innovation, Nucor has positioned itself at the forefront of the industry by employing electric arc furnaces (EAFs) to produce steel using nearly 100% recycled materials.

In a significant expansion move, Nucor recently launched operations at its new state-of-the-art rebar micro mill in Lexington, North Carolina. This $350 million facility, which began production in early 2025, boasts an annual capacity of 430,000 tons and employs about 200 full-time workers with an average annual compensation of nearly $100,000.⁷

The Lexington mill produces rebar with nearly 100% recycled content, aligning with Nucor’s commitment to sustainability. Additionally, Nucor invested $20 million in an adjacent rebar fabrication facility, creating 25 new jobs and further strengthening its presence in the region.⁸

In Q3 2024, the company reported its third-quarter 2024 results, which reflected the challenging market conditions in the steel industry. Nucor‘s consolidated net earnings attributable to stockholders were $249.9 million, or $1.05 per diluted share, a significant decrease from $1.14 billion, or $4.57 per diluted share, in the third quarter of 2023.⁹ Net sales for the quarter decreased by 15% year-over-year to $7.44 billion, with the average sales price per ton declining by 15% compared to the same period in 2023.

Nucor also recently announced guidance for its fourth quarter of 2024, projecting earnings between $0.55 to $0.65 per diluted share, a significant decrease from $3.16 per diluted share in the fourth quarter of 2023. This decline is primarily attributed to decreased earnings in the steel mills segment due to lower volumes and average selling prices.¹⁰

Nucor’s success is closely tied to its strong relationships with scrap metal suppliers, including partnerships with companies like Sims Limited and Greenwave Technology Solutions, Inc. (NASDAQ:GWAV). These partnerships provide Nucor with a steady and reliable flow of high-quality scrap metal, ensuring the consistency and cost-effectiveness of its operations.

Nucor Corporation (NYSE:NUE) has invested heavily in its recycling operations to secure critical raw materials, aligning with the increasing demand for sustainable steel production. By capitalizing on the growing reliance on EAFs and the surge in demand for recycled materials, Nucor has solidified its position as a key contributor to the circular economy.

Sponsored

Turning Chaos into Cash

Wildfires and hurricanes ravaged the US this year, leaving billions in damages.

But one company is turning disaster into opportunity.

From contracts valued at over $15 million to booming scrap demand, this company is dominating a $42B market.

5. Steel Dynamics (NASDAQ:STLD)

Steel Dynamics (NASDAQ:STLD) is one of the largest domestic steel producers and metals recyclers in North America, renowned for its vertically integrated model that combines steel production with raw material procurement. The company’s scrap metal division, OmniSource, plays a critical role in supplying its EAF operations.

The company recently reported its third quarter 2024 financial results, showing both strengths and areas of pressure in its operations. For Q3 2024, Steel Dynamics reported net income of $318 million, or $2.05 per diluted share, surpassing analysts’ expectations of $1.98 per share. Net sales for the quarter were $4.34 billion, down 5.4% year-over-year but still exceeding the consensus estimate of $4.18 billion. Despite the decline, these results demonstrate the company’s ability to outperform market expectations in a challenging environment.¹¹

For Q4 2024, Steel Dynamics (NASDAQ:STLD) has provided earnings guidance in the range of $1.26 to $1.30 per diluted share.¹²

Steel Dynamics continues to prioritize sustainability in its operations. The company announced certified, science-based greenhouse gas emissions intensity targets for its steel operations, covering Scope 1, Scope 2, and upstream Scope 3 emissions categories. In recognition of its efforts, Steel Dynamics was honored with a 2024 Sustainability Partner Award from Union Pacific, acknowledging its leadership and progress in achieving sustainability goals.¹³

The company is also making significant strides in expanding its operations. Steel Dynamics is investing $2.5 billion in a new aluminum flat rolled facility and biocarbon plant at the Infinity Megasite in Columbus, Mississippi.¹⁴ The planned aluminum flat rolled mill is designed to have an annual production capacity of 650,000 metric tons of finished products, serving the sustainable beverage packaging, automotive, and common alloy industrial sectors. Construction on the rolling mill is expected to begin in 2023 with completion slated for mid-2025.¹⁵

As Steel Dynamics prepares to release its Q4 and full-year 2024 results on January 22, 2025, investors and industry observers will be closely watching for insights into the company’s performance and future outlook. With its diversified product portfolio, commitment to innovation, and strategic investments, Steel Dynamics continues to position itself as a leader in the North American steel industry, adapting to market challenges while pursuing long-term growth and sustainability goals.¹⁶

Recycling Industry Outlook: Positioned for Growth

The scrap metal and disaster recovery industries are at an inflection point, driven by:

- Regulatory Changes: Tariffs on imported steel and incentives for domestic production are boosting demand for high-quality scrap metal.

- Technological Advancements: Innovations in processing and recycling technologies are enhancing operational efficiencies.

- Sustainability Goals: Increasing emphasis on environmental responsibility is driving the adoption of recycled materials in infrastructure projects.

With its strategic positioning, innovative approach, and strong financial foundation, Greenwave Technology Solutions (NASDAQ:GWAV) leads the pack, while Sims, Raduis, Nucor, and Steel Dynamics bring unique strengths to this dynamic market.

As the recycling industry continues to grow, these companies represent compelling opportunities for investors seeking exposure to this critical sector.

SUBSCRIBE FOR TRADING INSIGHTS AND ALERTS. STAY AHEAD.

Get investment opportunities before the rest of the market in real-time.

Get this company's corporate presentation now. Subscribe to download!

Over 120,000 subscribers