Destruction is devastating. But it also creates opportunity.

In the last year, the US faced disasters of historic proportions.

Wildfires swept through California, reducing neighborhoods to ashes. Entire communities vanished overnight.¹

In the Southeast, hurricanes hammered the Carolinas and Florida.² Coastal towns were submerged. Highways were torn apart. Damage estimates are climbing into the billions.

For those affected, it’s heartbreaking. For others, it’s a call to action.

Rebuilding isn’t just about hammers and nails.

It’s about raw materials—steel, aluminum, and copper. These resources are critical to restoring bridges, highways, homes, and infrastructure.

And the timing couldn’t be better.

The US steel industry is undergoing a massive transformation. Nearly 79% of domestic steel production is now focused on meeting internal demand,³ driven by a surge in tariffs.

President-elect, Mr. T has already announced plans to reimpose tariffs on steel imports, including from allies like Canada, the European Union, and Japan.

These tariffs, as high as 25%⁴, are designed to protect American industries and ensure domestic companies control the market.

Tariffs make importing steel more expensive. That’s great news for US scrap metal companies. Domestic steelmakers are now laser-focused on securing reliable sources of recycled metal to fuel their operations.

But the availability of scrap is limited.

This has created fierce competition among industry giants like Nucor and Sims Metal, who are racing to secure the best materials.

The result? Scrap metal prices are climbing, and companies that can deliver a consistent supply are poised to dominate.

One company is uniquely positioned to capitalize on this perfect storm of opportunity.

Greenwave Technology Solutions, Inc. (NASDAQ:GWAV) is emerging as a leader in the scrap metal industry.

In December 2024, Greenwave secured a contract worth $15 million to $35 million as part of Hurricane Helene recovery efforts.⁵ This deal involves processing massive amounts of debris, including high-value scrap metal, in North Carolina.

But this is just the beginning.

With new tariffs on the horizon, demand for domestic scrap metal is set to increase rapidly. Greenwave’s innovative approach and strategic positioning make it a critical player in meeting this demand.

As the US steel market shifts towards self-reliance, Greenwave Technology Solutions, Inc. (NASDAQ:GWAV) is poised to deliver the resources needed to rebuild America.

And the market potential? It’s massive.

Stay with us as I break down why Greenwave is capturing the attention of both the industry and savvy investors—and how this company could be set for explosive growth in the years ahead.

8 Reasons

to Watch Greenwave Technology Solutions, Inc. (NASDAQ:GWAV)

1Secured High-Value Disaster Recovery Contracts: Greenwave Technology Solutions, Inc. (NASDAQ:GWAV) recently secured a subcontract worth between $15 million and $35 million as part of Hurricane Helene recovery efforts in North Carolina.⁶ This contract positions the company as a key player in disaster recovery and recycling operations..

2Thriving in a Tariff-Driven Market: With President-elect Trump planning to reimpose 25% tariffs on steel imports, domestic steel producers are increasingly dependent on high-quality scrap metal. Greenwave Technology Solutions, Inc. (NASDAQ:GWAV) is perfectly positioned to capitalize on this heightened demand.⁷

3Expansion of Processing Capacity: The installation of a second automotive shredder is expected to double Greenwave’s ferrous metal processing capacity, adding approximately $4.8 million in annual revenues and significantly boosting gross profit.⁸

4Eliminated Substantial Debt: Greenwave Technology Solutions, Inc. (NASDAQ:GWAV) has eliminated approximately $35.2 million in debt, including $17.2 million owed to its Chairman and CEO, strengthening its balance sheet and enabling future growth without requiring immediate additional capital.⁹

5Beneficiary of US Steel Industry Transformation: With 79% of US steel production dedicated to domestic demand,¹⁰ Greenwave’s role in providing recycled metal to steel manufacturers is critical. The company benefits directly from the rise of electric arc furnaces, which heavily rely on scrap metal.¹¹

6Significant Market Opportunity: The US scrap metal market is estimated to be worth $42.3 billion and growing.¹² As demand for recycled materials rises due to tariffs and infrastructure needs, Greenwave Technology Solutions, Inc. (NASDAQ:GWAV) is uniquely positioned to capture a significant share..

7Innovative Revenue Streams: Greenwave has entered the wood recycling market, leveraging its expertise in metal recycling for disaster recovery contracts.¹³ This diversification adds a new revenue stream and expands its market reach.

8Experienced Leadership with Proven Track Record: Chairman and CEO Danny Meeks has over two decades of experience in disaster recovery and recycling. His leadership was instrumental in securing a $100 million federal subcontract after Hurricane Katrina, showcasing his ability to lead large-scale operations.¹⁴

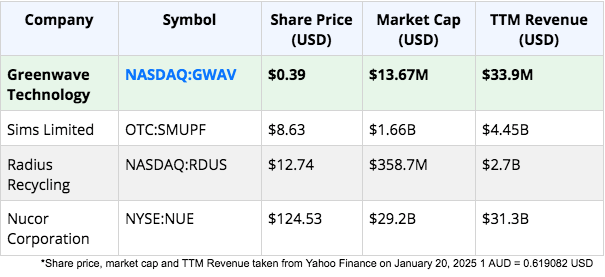

Crushing the Competition: Why Greenwave Technology Solutions (NASDAQ:GWAV) Stands Out

In the scrap metal industry, giants like Sims Limited and Radius Recycling (formerly Schnitzer Steel) dominate the headlines.

But there’s a new player rewriting the rules.

Greenwave Technology Solutions (NASDAQ:GWAV) is leveraging innovation, sustainability, and agility to carve out a unique niche in the market. And its growth trajectory is nothing short of impressive.

Here’s how Greenwave stacks up against the competition:

Greenwave Technology Solutions (NASDAQ:GWAV) is redefining the recycling industry, particularly as it undergoes significant consolidation.

Major players like Sims Limited and Radius Recycling are expanding through acquisitions to maintain their dominance in the shrinking scrap metal market.¹⁵

However, such consolidation often leads to challenges, including integrating legacy systems and managing inefficiencies, which can impact profitability.

In contrast, Greenwave‘s lean structure allows it to adapt swiftly to market demands and seize new opportunities, such as disaster recovery contracts.

A Game-Changing Move into Disaster Recovery

While companies like Sims Limited and Radius Recycling concentrate on traditional scrap collection, Greenwave is venturing into untapped markets.

A notable example is its contract valued between $15 million to $35 million for Hurricane Helene recovery services, secured through a partnership with Core Tree Care.¹⁶

This contract not only involves debris processing but also positions Greenwave as a key player in government recovery efforts, a sector with substantial annual expenditures.

Competitors like Nucor and Radius Recycling are not actively pursuing these contracts, allowing Greenwave Technology Solutions (NASDAQ:GWAV) to dominate this niche with significant growth potential.

SUBSCRIBE FOR TRADING INSIGHTS AND ALERTS. STAY AHEAD.

Get investment opportunities before the rest of the market in real-time.

Get this company's corporate presentation now. Subscribe to download!

Over 120,000 subscribers

Capitalizing on the Electric Arc Furnace Boom

The US steel industry is rapidly transitioning to electric arc furnaces (EAFs), which depend on recycled scrap metal.¹⁷

Although Sims Limited and Radius Recycling are established suppliers in this domain, Greenwave’s operational flexibility enables it to focus on providing high-quality scrap, precisely what EAFs require.

With tariffs encouraging steel manufacturers to prioritize domestic sourcing, Greenwave Technology Solutions (NASDAQ:GWAV) is strategically positioned to benefit.

While competitors manage legacy operations, Greenwave‘s streamlined approach ensures enhanced efficiency, higher profit margins, and reduced logistical complexities.

Press Releases

- Greenwave Technology Solutions, Inc.’s Scrap Metal Inventories Estimated to Surpass $6 Million as Prices Surge, Poised for Further Gains

- Greenwave’s Scrap App Adopted by a Leading U.S. Junk Car Buyer, Powering Expansion to 27 New Markets

- Greenwave’s Scrap App Adopted by a Leading U.S. Junk Car Buyer, Powering Expansion to 27 New Markets

- Greenwave Technology Solutions, Inc. Poised for Explosive Growth Amid New Steel, Aluminum, and Copper Tariffs

- Greenwave Technology Solutions, Inc. Poised for Explosive Growth Amid New Steel, Aluminum, and Copper Tariffs

A Proven Track Record in Leadership

Greenwave’s Chairman and CEO, Danny Meeks, brings over two decades of experience in disaster recovery and recycling.

His leadership was instrumental in managing a $100 million federal subcontract for the cleanup of New Orleans following Hurricane Katrina, overseeing a massive logistics operation involving 1,500 trucks and 5,000 personnel over a two-year period.¹⁸

In contrast, larger competitors like Sims and Radius Recycling often rely on institutional leadership, which may be disconnected from ground-level operations.

Greenwave’s hands-on management style ensures decisions are made with agility and precision.

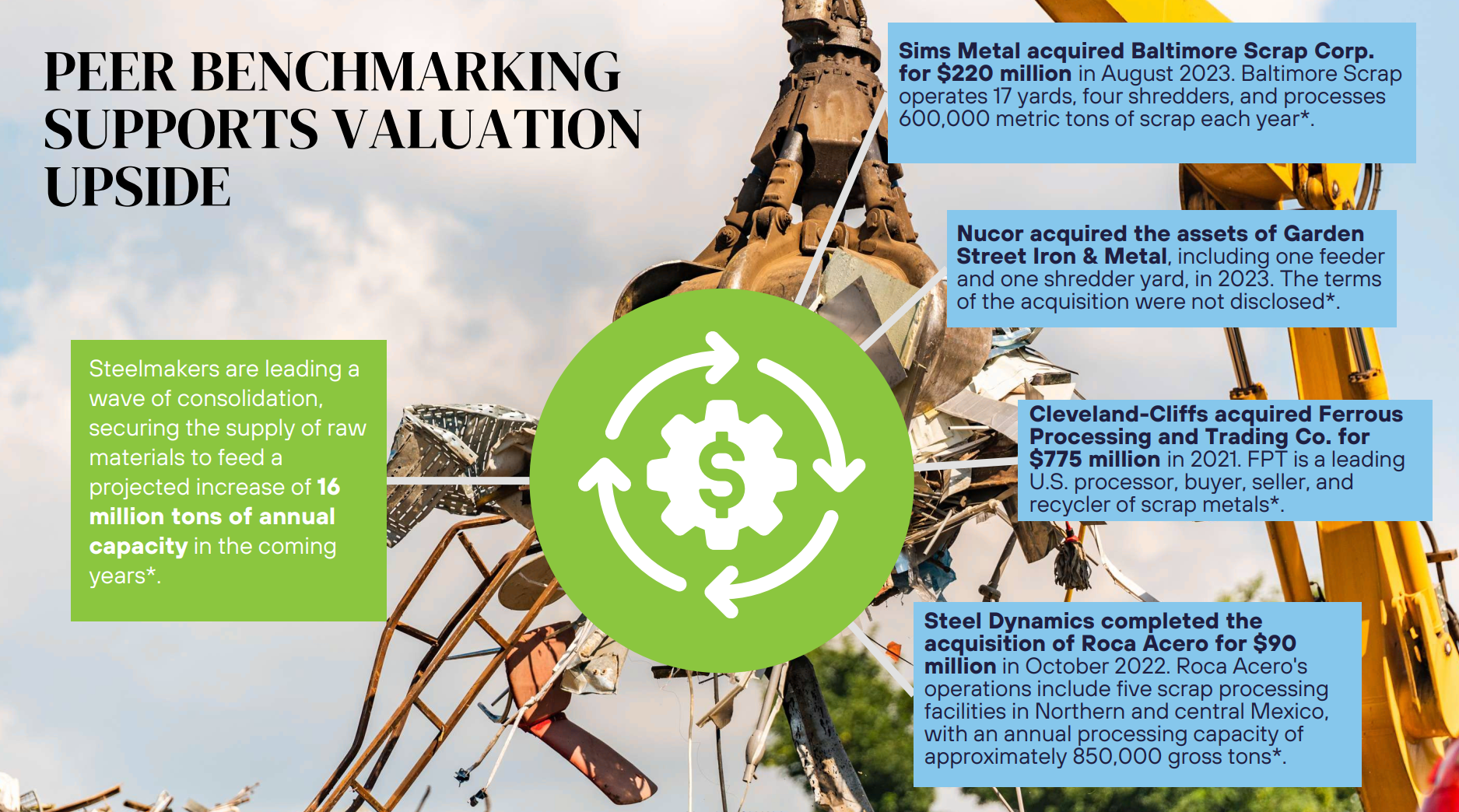

The Power of Consolidation

The scrap metal industry is experiencing rapid consolidation, with companies like Sims Limited acquiring smaller operators to secure control over supply chains.

However, Greenwave is not just a competitor; it also serves as a supplier.

By partnering with industry giants, Greenwave ensures a steady revenue stream while maintaining its independence.

This dual role as both competitor and ally makes Greenwave Technology Solutions (NASDAQ:GWAV) a unique player in the consolidation narrative.

As the industry contracts, the company’s lean model allows it to thrive where others may struggle. Unlike larger companies burdened by acquisitions, Greenwave can expand organically, avoiding the pitfalls of overextension.

How Greenwave Turns Scrap and Storms into Millions: A Revenue Model Built for Growth

Greenwave Technology Solutions, Inc. (NASDAQ:GWAV) has established a robust revenue model centered on the recycling of ferrous and non-ferrous metals, with strategic expansions into wood recycling and digital platforms.

Scrap Metal Recycling Operations

Operating 13 metal recycling facilities across Virginia, North Carolina, and Ohio, Greenwave processes a substantial volume of scrap metal.

Greenwave‘s proximity to Naval Station Norfolk—the world’s largest naval base—and the Port of Virginia enables access to a substantial supply of prime scrap metal sourced from defense contractors, shipyards, and logistics operations.¹⁹

The company sources materials from individuals, businesses, and government entities, purchasing scrap based on current market prices.

Once acquired, the scrap undergoes processing—including sorting, shredding, and refining—to meet the quality standards required by end-users. Processed metals are then sold to industry giants such as Nucor Corporation, Sims Limited, Cleveland-Cliffs, Inc., and Georgia-Pacific, generating significant revenue.²⁰

A notable 20-year relationship with Sims Metal, the world’s largest publicly listed scrap metal company, has generated substantial revenue—$20.7 million in 2023 and $18.0 million in 2022—underscoring market confidence in Greenwave’s operations.²¹

Additionally, Greenwave Technology Solutions (NASDAQ:GWAV) supports Nucor Corporation, the largest steel producer in the US, by supplying its Hertford mill with recycled steel for essential applications, including national security projects like the $13 billion USS Gerald Ford aircraft carrier.²²

Additionally, Greenwave Technology Solutions (NASDAQ:GWAV) supports Nucor Corporation, the largest steel producer in the US, by supplying its Hertford mill with recycled steel for essential applications, including national security projects like the $13 billion USS Gerald Ford aircraft carrier.²²

Looking ahead, Greenwave Technology Solutions (NASDAQ:GWAV) is poised to capitalize on increased demand driven by Nucor’s upcoming steelmaking facility in Lexington, North Carolina. This state-of-the-art plant, opening in 2025, will process 430,000 tons of steel annually using nearly 100% recycled materials, reinforcing Greenwave’s strategic alignment with sustainable steel production.²³

In fiscal year 2023, Greenwave reported annual revenue of $35.67 million, reflecting a 4.97% growth from the previous year.²⁴

The company also secured an exclusive contract for the recycling of 550,000 pounds of non-ferrous metal, projected to add approximately $2 million in revenue for Q4 2024 and Q1 2025.²⁵

Looking ahead, the company has released revenue guidance of $43 to $45 million for fiscal year 2025, driven by market expansion, long-term contracts, and industry demand.²⁶

SUBSCRIBE FOR TRADING INSIGHTS AND ALERTS. STAY AHEAD.

Get investment opportunities before the rest of the market in real-time.

Get this company's corporate presentation now. Subscribe to download!

Over 120,000 subscribers

Regional Infrastructure and Municipal Projects:

Greenwave Technology Solutions (NASDAQ:GWAV) is actively involved in critical infrastructure initiatives such as the Hampton Roads Bridge Tunnel expansion and agreements with municipalities for recycling abandoned cars. These contracts diversify the company’s revenue streams and strengthen its foothold in regional markets.²⁷

Strategic Expansion into Wood Recycling

In December 2024, Greenwave Technology Solutions (NASDAQ:GWAV) announced its expansion into wood recycling, leveraging its two decades of experience in the metal recycling industry.

The company secured a subcontract with Core Tree Care, Inc., related to a prime contract with the Army Corps of Engineers, to process and remove trees near Asheville, North Carolina, as part of Hurricane Helene recovery efforts.

This contract is expected to generate between $15 million and $35 million by March 31, 2026, representing a significant new revenue stream for Greenwave.²⁸

To support this initiative, Greenwave Technology Solutions (NASDAQ:GWAV) has invested in advanced equipment, including high-value Vermeer and Morbark Wood Grinders, each valued at approximately $1.4 million.²⁹

This strategic move not only diversifies Greenwave‘s revenue streams but also capitalizes on its expertise in disaster recovery, positioning the company for continued growth and leadership in the recycling industry.

Digital Innovations: Scrap App Platform

Greenwave Technology Solutions, Inc. (NASDAQ:GWAV) is revolutionizing the scrap metal industry with its proprietary Scrap App, a state-of-the-art platform designed to simplify and enhance the buying and selling of scrap metal.

The Scrap App offers a powerful suite of tools that set it apart in the $42.3 billion³⁰ US scrap metal market:

- Real-Time Pricing: Users gain instant access to up-to-date market prices, empowering them to make informed decisions.

- AI-Powered Pricing Engine: Leveraging artificial intelligence, the app analyzes proprietary data from thousands of transactions to provide optimized quotes in real time, ensuring competitive and precise pricing for users.³¹

- Seamless Transactions: The app enables smooth, secure buying and selling processes for both individual and business users.

- Logistical Support: Integrated tools help coordinate transportation, pickups, and deliveries, improving efficiency and customer satisfaction.

Recently setting a new daily record for transactions, the Scrap App is rapidly expanding its presence in major US markets. With growing adoption, it is poised to transform the scrap metal trade by attracting a broader customer base, enhancing operational efficiencies, and driving significant revenue growth for Greenwave.

Positioning for Future Growth

Greenwave’s strategic initiatives, including the expansion into wood recycling and the development of digital platforms, are poised to significantly enhance its revenue model. By diversifying its operations and leveraging technological advancements, the company is well-positioned to capitalize on emerging opportunities in the recycling industry.

With a projected revenue of up to $45 million for fiscal year 2025, Greenwave Technology Solutions, Inc. (NASDAQ:GWAV) demonstrates a commitment to growth and innovation, making it a noteworthy player in the sustainable materials sector.³²

Insiders and Institutions Are Accumulating Greenwave Technology Solutions at $0.38

Savvy investors recognize that when insiders and institutions accumulate shares in a low-float company, it often signals significant upside potential.

Greenwave Technology Solutions, Inc. (NASDAQ:GWAV) exemplifies this scenario, presenting a compelling opportunity in the market.

Insider Accumulation: A Strong Vote of Confidence

Recent filings reveal substantial insider purchases, underscoring management’s confidence in Greenwave’s future.

- Danny Meeks, CEO, acquired 377,002 shares at an average price of $0.66 per share on December 4, 2024, totaling approximately $248,821.32.³³

- Jason T. Adelman, Director, purchased 100,000 shares at $0.66 per share on the same date, amounting to $66,000.³⁴

- Audit Committee Chair Henry Sicignano III, a former CEO of Nasdaq-listed company and double-Harvard graduate (both undergraduate and MBA), purchased 100,000 shares of common stock at $0.659/share.³⁵

These acquisitions have increased insider ownership to approximately 15.4% of the company’s outstanding shares, aligning management’s interests closely with those of shareholders.³⁶

Institutional investors hold about 8.77% of Greenwave’s shares, indicating confidence from major financial entities. Notable institutional holders include:³⁷

- Anson Funds Management LP: 558,740 shares

- UBS Group AG: 130,960 shares

- Citadel Advisors LLC: 119,210 shares

- Geode Capital Management, LLC: 75,480 shares

This institutional backing reflects a strong belief in Greenwave Technology Solutions, Inc.’s (NASDAQ:GWAV) business model and growth prospects.

With approximately 22 million shares outstanding and a significant portion held by insiders and institutions, Greenwave’s public float is limited.

This low float can lead to increased volatility and the potential for rapid price appreciation, especially when positive news or increased demand arises.

Current Valuation: An Potentially Attractive Entry Point

As of January 13, 2025, Greenwave Technology Solutions, Inc.’s (NASDAQ:GWAV) stock is trading at approximately $0.3773 per share, resulting in a market capitalization around $8.4 million.

Considering the company’s revenue guidance of $43 to $45 million for fiscal year 2025, the stock is trading at a remarkably low multiple of its projected revenues, suggesting a potential undervaluation relative to its industry peers.

Greenwave’s expansion into wood recycling and its strong presence in the scrap metal industry position the company for significant growth. The recent insider and institutional investments further reinforce the company’s strategic direction and potential for value creation.

The combination of substantial insider buying, institutional ownership, a low public float, and a favorable valuation presents a compelling scenario for investors. Greenwave Technology Solutions, Inc. (NASDAQ:GWAV) stands out as a company with aligned leadership, strategic growth initiatives, and the potential for significant market appreciation.

The Visionaries Steering Greenwave Technology Solutions

Greenwave Technology Solutions, Inc. (NASDAQ:GWAV) is guided by a team of seasoned professionals whose expertise and strategic vision are propelling the company to new heights in the recycling industry.

8 Reasons

to Keep Greenwave Technology Solutions (NASDAQ:GWAV) on Your Radar

1

Key Player in Disaster Recovery: Greenwave Technology Solutions, Inc. (NASDAQ:GWAV) secured a $15-$35 million contract for Hurricane Helene recovery, positioning the company as a leader in disaster recovery services.⁴⁰

2

New Revenue Stream: Entered the wood recycling market, diversifying its business and expanding market opportunities.⁷

3

Stronger Financials: Eliminated $35.2 million in debt, including $17.2 million owed to its CEO, improving the balance sheet and enabling future growth.

4

Leadership with Proven Track Record: CEO Danny Meeks has over 20 years of experience, including managing a $100 million Hurricane Katrina subcontract.

5

Industry Growth Potential: Positioned to capitalize on the $42.3 billion US scrap metal market as demand for recycled materials rises.¹¹

6

Increased Processing Capacity: A second automotive shredder is expected to double ferrous metal processing and add $4.8 million in annual revenue.

7

Insider and Institutional Confidence: Significant insider share purchases and institutional holdings highlight strong belief in the company’s future.⁴¹

8

Undervalued Opportunity: With a market cap of $8.4 million and shares at ~$0.38, GWAV offers growth potential, with projected FY 2025 revenues of $43-$45 million.⁴²

Why It’s Time to Watch Greenwave

Greenwave Technology Solutions (NASDAQ:GWAV) operates at the crossroads of innovation, sustainability, and market opportunity.

By capitalizing on disaster recovery contracts, the growing demand for high-quality scrap metal, and strategic expansions like wood recycling, Greenwave is carving a niche in an industry ripe for transformation.

With a market cap of just $8.4 million and shares trading at $0.37, Greenwave offers a rare opportunity to engage with a company poised for significant growth.

In a market dominated by legacy players, Greenwave stands out for its agility, vision, and ability to execute.

Investors should take note—this company is on the rise.

Subscribe to our newsletter to get more information on Greenwave Technology Solutions (NASDAQ:GWAV) here.

SUBSCRIBE FOR TRADING INSIGHTS AND ALERTS. STAY AHEAD.

Get investment opportunities before the rest of the market in real-time.

Get this company's corporate presentation now. Subscribe to download!

Over 120,000 subscribers