-

-

- Copper prices just hit a 2-year high of $10,208 per ton in April.1

- Copper demand for EVs is predicted to reach 1 million metric tons in 2023 and 2.8 million by 20302

- Chinese EV sales just leaped past 50% of new vehicle sales3 fueling copper demand even further

- Asia-based producers are well-positioned to supply key markets

-

The copper market is blazing hot in 2024…

But it’s about to get even hotter.

China just made history after seeing electric vehicle (EV) sales reach 50% of new car sales.4

India isn’t far behind with a 40% surge in EV sales this year.5

North America and the EU are also gearing up to meet ambitious EV goals, creating an ever-growing need for copper, an essential ingredient not just to EVs, but the entire clean energy revolution.

These lofty goals are expected to have a massive impact on several industries, particularly copper.

Most people associate EVs with lithium, but they also require a ton of copper.

Goldman Sach sees copper demand for EVs reaching 2.8 million metric tons by 2030.

For reference, the world’s largest copper mine Escondida produced just over 1 million tonnes in 2023.6

SUBSCRIBE FOR TRADING INSIGHTS AND ALERTS. STAY AHEAD.

Get investment opportunities before the rest of the market in real-time.

Get this company's corporate presentation now. Subscribe to download!

Over 120,000 subscribers

The AI revolution intensifies copper demand

The explosion of AI technology also requires substantial energy, much of which is copper-dependent.

Data centers, crucial for AI operations, are expanding rapidly, with tech giants like Microsoft and Google investing heavily in infrastructure that relies extensively on copper.

This surge is expected to significantly increase copper use in the coming years, adding to the already high demand from the EV sector.

Soaring demand and tight supply set stage for price hikes

With demand continuing to rise and supply quickly dwindling, it’s no surprise copper prices are experiencing a sharp increase, reaching a two-year high of over $10,000 per ton.

Experts from major financial institutions predict further rises, with projections suggesting prices could reach $15,000 per ton by 2025 due to relentless demand and lagging supply.7

Despite being essential for the clean energy transition, new copper supply is hampered by long lead times for mine development and various global mining restrictions.

This supply constraint is reminiscent of recent trends in other critical minerals, such as lithium and uranium, which have also seen prices skyrocket due to similar demand pressures.

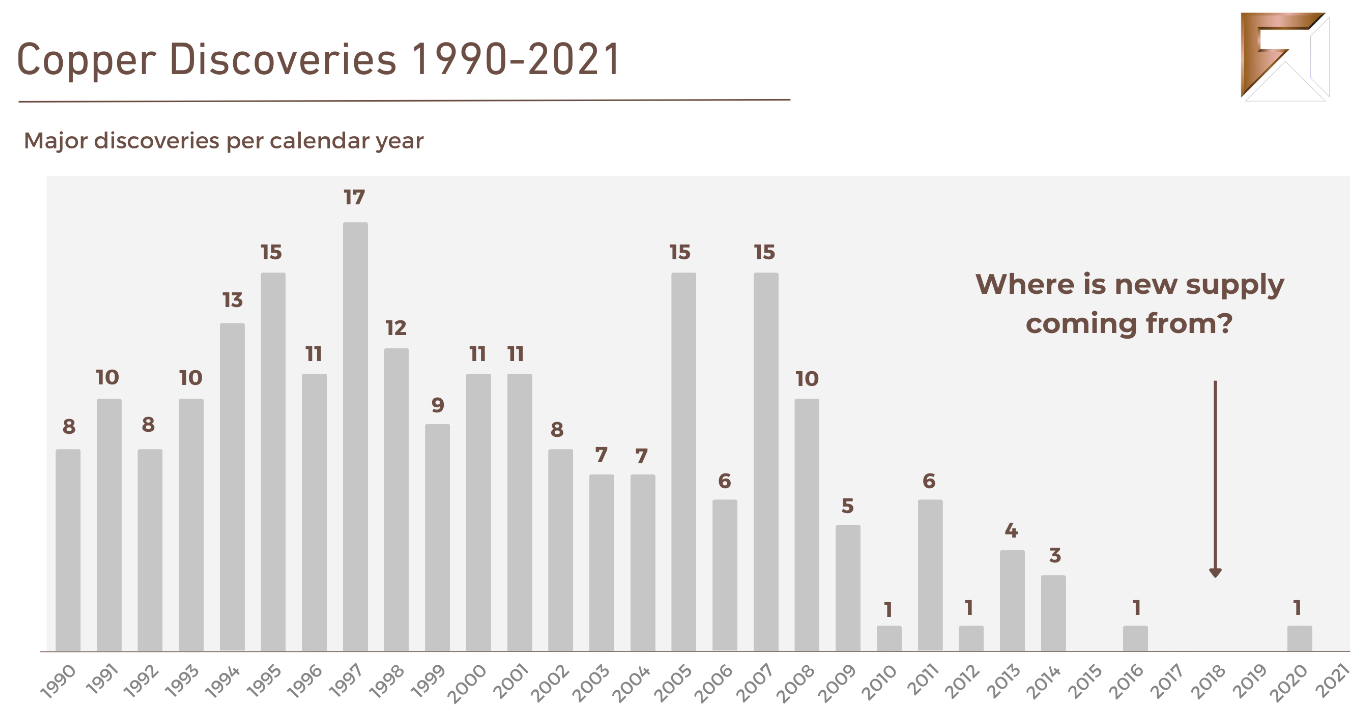

Where will the copper supply come from?

Copper is not just key for EVs; it’s vital for renewable energy too.

Thousands of kilograms of copper are needed per megawatt for wind and solar power.

The problem? A massive supply deficit looms after years of underinvestment in mining and exploration.

Simply put, there aren’t enough new copper discoveries to meet the soaring demand.

Even when new deposits are discovered, it can take up to 18 years before a mine goes into production.

Source: S&P Global Market Intelligence8

Adding to the challenge, major disruptions have hit some of the world’s largest copper producing mines.

One example is the government-ordered shutdown of Cobra Panama, one of the world’s largest copper mines with over 330,000 tons of production in 2023.9

Another was Anglo American’s announcement about reducing its copper production target by about 200,000 tons this year, essentially removing the equivalent of a large copper mine from global supply.10

Southeast Asia emerges as a key demographic for new copper production

When it comes to global copper supply, countries like Chile and Peru lead the pack for the highest production output.

However, Southeast Asia is rising fast, becoming increasingly attractive for copper supply as the appetite from EV manufacturers like China increases.

Indonesia, already in the world’s top 10 copper producers, is becoming a major player in the copper market.11

Source: Visual Capitalist12

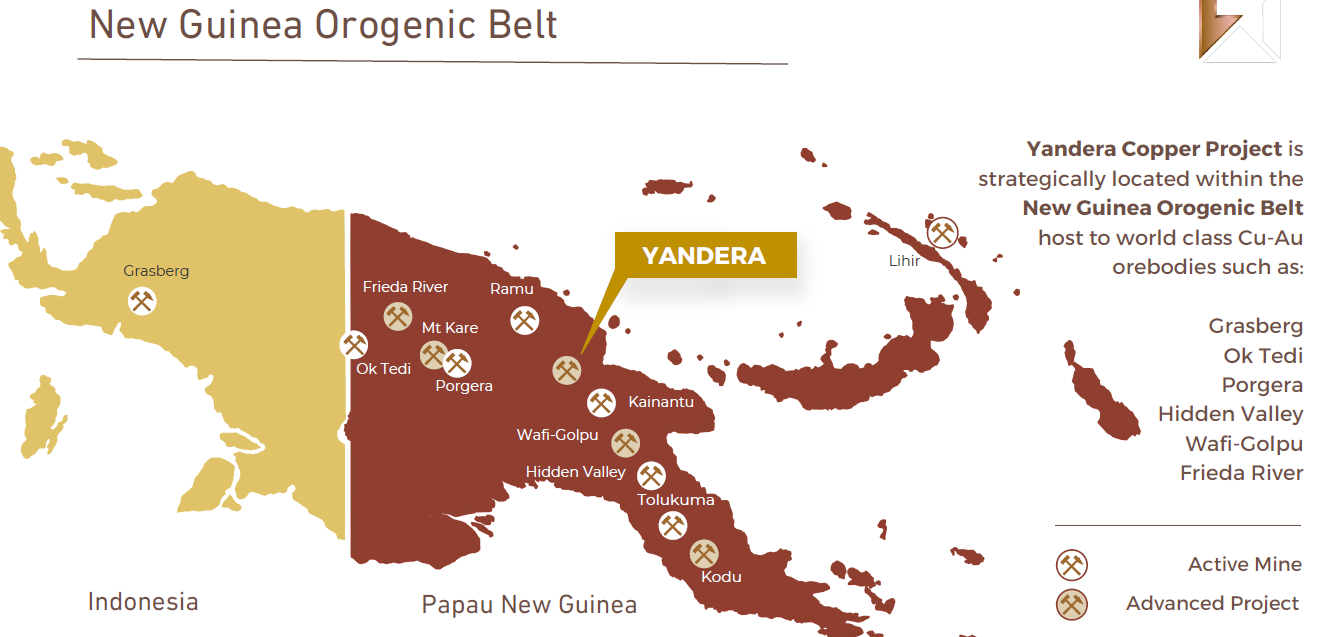

But its tiny neighbor could be the key to meeting ever-growing copper demand.

The New Guinea Orogenic Belt that hosts multiple major world-class deposits, active mines, advanced projects, and some of the world’s largest resource companies.

For over 50 years, Papua New Guinea’s economy has been dominated by the mining industry, exporting copper, gold, silver, nickel and cobalt.

Some of the exciting projects in the region include:

-

-

- Freeport-McMoran’s Grasberg Mine

- World’s second largest copper mine13 producing for over 35 years.14 Currently produces about 5 million pounds of copper a day15

- Consolidated sales as of 2023 totaled 4.2 billion pounds of copper16

- Proven & Probable Mineral Reserves of 30.8 billion pounds copper at a grade of 1.03% copper17

- Freeport-McMoran’s Grasberg Mine

-

-

-

- Ok Tedi Copper and Gold Mine (Government run)

- Produced over 5 million tonnes (Mt) of copper & 15.9 Moz of gold since 198418

- Ok Tedi Copper and Gold Mine (Government run)

-

-

-

- Barrick Gold’s Porgera Gold Mine

- 2 Moz Proven and Probable Reserves; expected to produce 50-70 Koz gold in 202419

- Barrick Gold’s Porgera Gold Mine

-

-

-

- K92 Mining’s Kainantu Gold Mine

- Large, Tier 1 asset with multiple highly prospective targets.20

- K92 Mining’s Kainantu Gold Mine

-

-

-

- Freeport Resources’ Yandera Project

- The 7th largest undeveloped copper deposit in the world and the largest undeveloped copper deposit in Asia

- According to the Pre-Feasibility Study,* Yandera contains 6.9 billion pounds of copper, is highly economic for mining, and has the potential to be a large-scale producer with an expected 20-year mine life.21

- Freeport Resources’ Yandera Project

-

Press Releases

- Freeport Resources Appoints Key Advisors to Lead Yandera Copper Project Optimization Study

- Freeport Resources Closes $5.2 Million Over-Subscribed Private Placement

- Top 5 Stocks to Watch in 2024 as Copper Prices Surge on AI Demand

- Freeport Resources Unlocks 7th Largest Undeveloped Copper Deposit As AI Sparks Copper Supercycle

- Chinese and India’s EV Demand Soars in 2024 Sending the Copper Market into a Supercycle

For those looking to invest in the copper boom, there are several avenues to consider. Investors can opt for exchange-traded funds (ETFs) or exchange-traded commodities (ETCs) that hold physical copper or futures contracts, or that track an index like the Bloomberg Industrial Metals index.

Another strategic approach is investing in shares of companies that mine, refine, and trade copper. The performance of these companies’ stocks is often closely linked to copper prices.

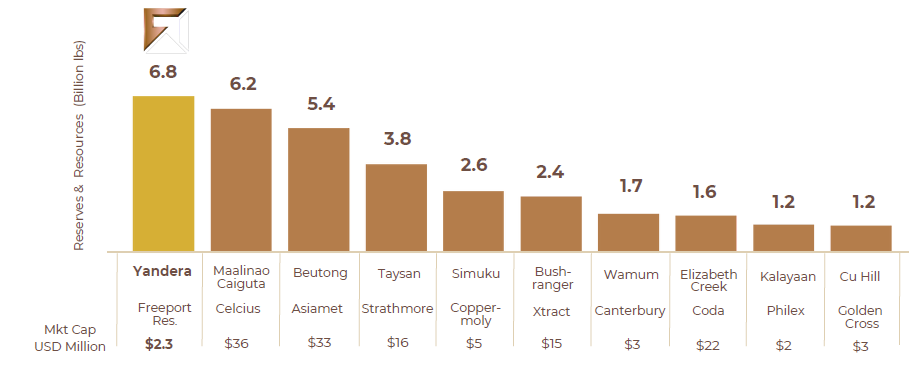

Out of the vast sea of copper exploration companies listed on the stock exchange, one stands out as extremely appealing: Freeport Resources (TSXV:FRI) (OTCQB:FEERF) (FSE:4XH).

SUBSCRIBE FOR TRADING INSIGHTS AND ALERTS. STAY AHEAD.

Get investment opportunities before the rest of the market in real-time.

Get this company's corporate presentation now. Subscribe to download!

Over 120,000 subscribers

Advancing one of the world’s largest undeveloped copper deposits

Freeport Resources’ (TSXV:FRI) (OTCQB:FEERF) (FSE:4XH) huge copper project is located in the same mineral belt as Freeport-McMoran’s Grasberg, the world’s second largest copper mine, that produces about 5 million pounds of copper a day.22

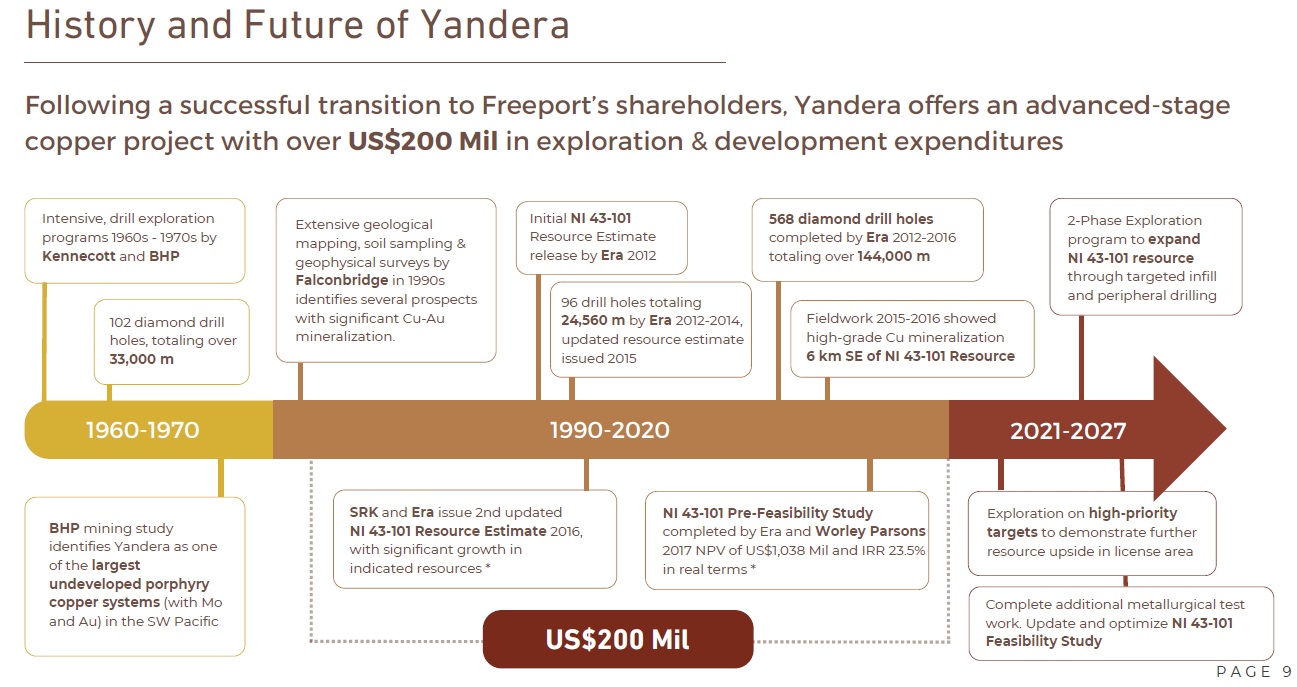

On top of that, the Yandera Project, which is currently the largest undeveloped in Asia, has $200 million of work completed by the previous owners.

This includes a Pre-Feasibility Study,* which found the project contains about 6.9 billion pounds of copper, is highly economic for mining, and has the potential to be a large-scale producer with an expected 20-year mine life.23

It’s not just the size of Freeport Resources’ (TSXV:FRI) (OTCQB:FEERF) (FSE:4XH) Yandera Project that makes it noteworthy. Its proximity to Asia, the world’s largest copper refiner and consumer, positions the project as an attractive potential long-term source of copper supply.

Why the Yandera Copper Project is a Monster of Its Own

Freeport Resources’ (TSXV:FRI) (OTCQB:FEERF) stands out as a premier asset in the copper mining sector, largely due to more than $200 million invested by its previous owners.

This funding fueled extensive exploration, including 102 diamond drill holes spanning over 33,000 meters, revealing one of the world’s largest undeveloped porphyry copper systems, enriched with additional molybdenum and gold deposits.

Further investments totaling an additional $100 million for 471 drill holes over 144,000 meters solidified its status.

A significant Pre-Feasibility Study (PFS) in 2017 by the esteemed Worley Parsons24 highlighted its economic viability, showcasing the potential for substantial production and a valuation exceeding a billion dollars:

-

-

- Resource Estimates: Approximately 959 million tonnes with a copper grade of 0.37%.25

- Contained Copper: Estimated at 6.9 billion pounds.

- Annual Production Potential: Projected at 100,000 tonnes.

- Operational Lifespan: Expected to be 20 years.

- Operating Costs: Estimated at $1.95 per pound of copper, significantly below the current market price of approximately $4.40 per pound.

- Economic Valuation: Post-tax Net Present Value (NPV) at 10% stands at $1.04 billion, with a Post-Financing Internal Rate of Return (IRR) of 23.5%.

-

Now under the full ownership of Freeport Resources, the Yandera project spans an expansive 245 square kilometers, roughly the size of Milwaukee or Sacramento. Its potential for further resource expansion is immense, given the groundwork laid by its rich exploration history.

With copper demand and prices on the rise, and new discoveries dwindling, Freeport Resources Inc. (TSXV:FRI) (OTCQB:FEERF) (FSE:4XH) is poised to capture significant market and M&A interest.

Want even more reasons to dig deeper into Freeport Resources? Click here for a full detailed report on Freeport Resources (TSXV:FRI) (OTCQB:FEERF) (FSE:4XH)

SUBSCRIBE FOR TRADING INSIGHTS AND ALERTS. STAY AHEAD.

Get investment opportunities before the rest of the market in real-time.

Get this company's corporate presentation now. Subscribe to download!

Over 120,000 subscribers