Something big is happening in the copper market right now…

China just made history.

And we think it will create a ripple effect across the entire globe.

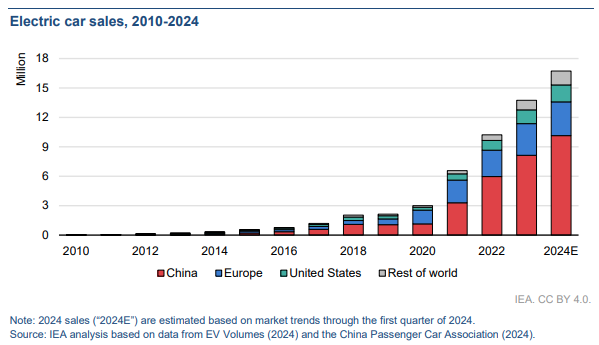

Last year, nearly 1 in 5 cars sold were electric vehicles (EVs).1

But that number could ramp up very quickly in 2024 thanks to China and India.

Chinese EV sales just leaped past 50% of new vehicle sales2 outpacing the nation’s initial goal of 40% EV adoption by 2030.3

India is also seeing a substantial surge in EV sales, marking a 40% year-over-year rise for fiscal 2024.4

This is just the beginning. EV sales are expected to exceed 30 million by 2027 and reach 73 million per year by 2040, accounting for 33% and 73% to global car sales in those years.5

We believe this news is going to ignite a flame in the copper market.

We will dive into the details momentarily, but first we want you to introduce you to this advanced mineral exploration company, Freeport Resources Inc. (TSXV:FRI) (OTCQB:FEERF).

Freeport Resources Inc. (TSXV:FRI) (OTCQB:FEERF) owns one of the largest undeveloped copper projects in Asia, perfectly positioning this company to serve key regions where EV demand is coming from…

The Oregon Group highlighted how since copper’s move above $4/lb in March 2024, the giant copper producer Freeport-McMoran’s stock jumped 20+% which was a material increase for a $60+ billion company. However, the percentage move pales in comparison with Freeport Resources Inc’s (TSX:FRI) (OTCQB: FEERF) share price increase of 200+% since early March 2024.

SUBSCRIBE FOR TRADING INSIGHTS AND ALERTS. STAY AHEAD.

Get investment opportunities before the rest of the market in real-time.

Get this company's corporate presentation now. Subscribe to download!

Over 120,000 subscribers

Copper: An Essential Ingredient in the Global EV Market

Over the last few years, world leaders have announced some particularly ambitious EV goals.

-

-

- In 2023, the European Union adopted a law requiring all new cars and vans sold in Europe to be zero-emission by 2035.6

- The Biden Administration announced a goal to make 50% of all new vehicles electric by 2030.7

- Canada just upped its EV standard to 20% of new zero-emission vehicles by 2026, 40% by 2030 and 100% by 2035.8

- China increased its target to have EVs make up 45% of new auto sales by 2027.9

-

These lofty goals are expected to have a massive impact on several industries, particularly copper.

Most people associate EVs with lithium, but they also require a ton of copper.

Goldman Sach predicted copper demand for EVs to reach 1 million metric tons in 2023 and to increase to 2.8 million by 2030.

For reference, the world’s largest copper mine Escondida produced just over 1 million tonnes in 2023.10

This could be a major development for copper exploration companies, including Freeport Resources Inc. (TSXV:FRI) (OTCQB:FEERF) and its Asia-based deposit.

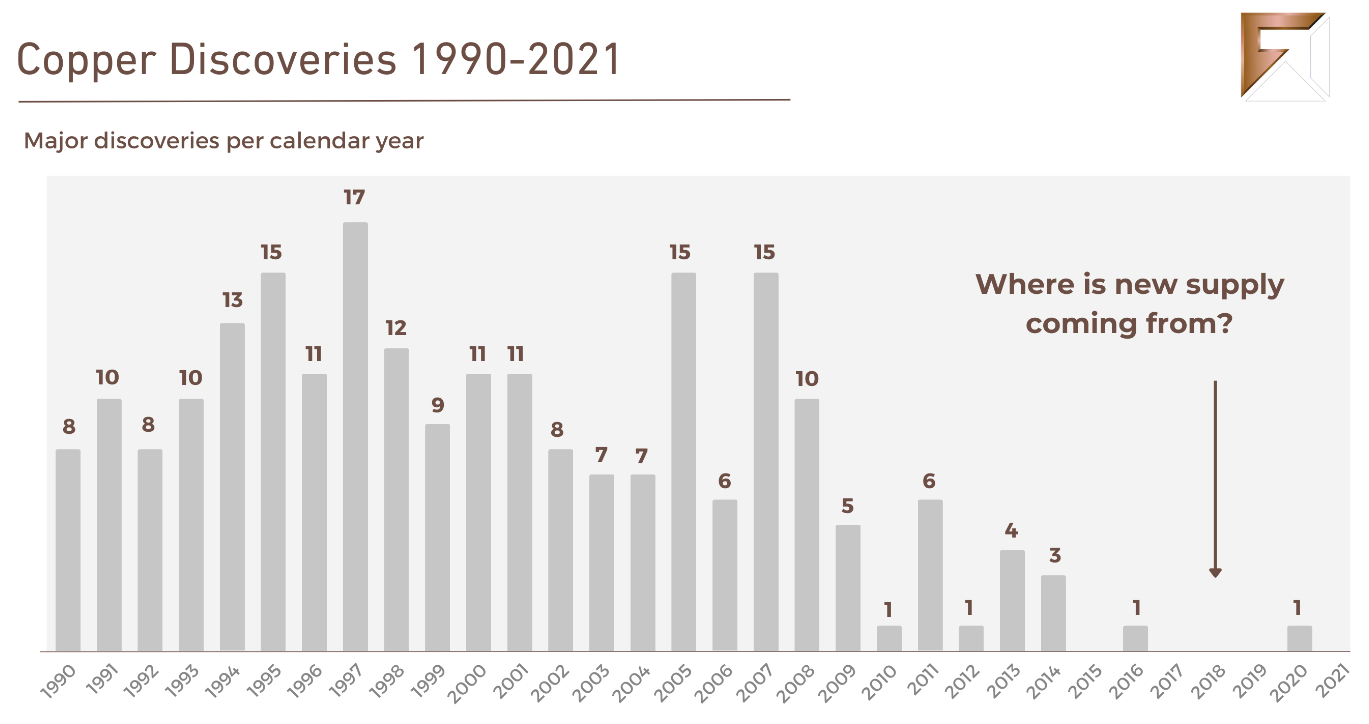

Why? Because there simply isn’t enough copper to meet this ever-growing demand and new copper discoveries are far and few between.

Source: S&P Global Market Intelligence11

Even when new deposits are discovered, it can take up to 18 years before a mine goes into production.

That’s what makes Freeport Resources Inc. (TSXV:FRI) (OTCQB:FEERF) so exciting.

This under-the-radar company scooped up its 100% owned, Pre Feasibility-stage copper project in Papua New Guinea.

But not before the previous owner invested over US$200 million in exploration and project development, ran out of cash, and had to sell for pennies on the dollar.

It isn’t a greenfield project – it’s already ranked among the largest undeveloped copper projects in the world, yet the market is just hearing about it.

That’s why we believe Freeport Resources Inc. (TSXV:FRI) (OTCQB:FEERF) is perfectly positioned for the current copper supercycle.

AI Is Increasing Copper Usage at an Unprecedented Pace

Another major driver fueling the copper boom is Artificial Intelligence (AI).

Most people don’t realize the amount of energy needed to advance future technologies like AI.Fewer realize how much copper is required to power the influx of AI data centers coming online.

Tech giants like Meta’s Mark Zuckerberg stated that energy limitations will impede the expansion of AI data centers…12

Bank of America Merrill Lynch sees the copper demand from AI data centers increasing to 500,000 tons by 2026… and that’s only taking into account the copper used in equipment.13

To help power these data centers, several tech giants are gaining a newfound interest in copper mining.

A coalition of billionaires including Bill Gates and Jeff Bezos are backing an exploration start-up with a massive copper discovery in Zambia.14

A coalition of billionaires including Bill Gates and Jeff Bezos are backing an exploration start-up with a massive copper discovery in Zambia.14

KoBold Metals, who owns the mine, is using AI to create “Google Maps” of the earth’s crust to find new deposits of copper, as well as other metals lithium, cobalt and nickel.

There’s no denying the importance of KoBold’s Mingomba copper project.

But it doesn’t compare to the monster deposit Freeport Resources Inc. (TSXV:FRI) (OTCQB:FEERF) just got its hands on.

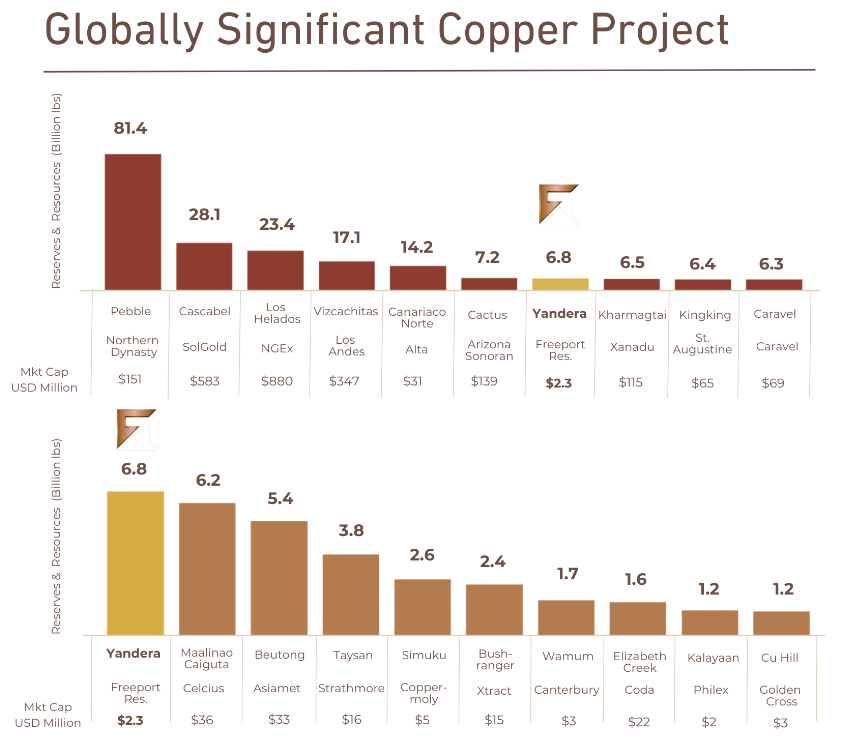

After all, Freeport Resources’ Yandera Project ranks as the 7th largest undeveloped copper deposit in the world and the largest undeveloped copper deposit in Asia.

Copper Is Potentially On The Brink of a Major Supercycle

We believe that copper is on the brink of a major bull run.

And we aren’t alone.

Copper prices just hit a 2-year high of $10,208 per ton in April.15

Copper Price

Source: BusinessInsider.com 16

Copper bulls are upping their price forecasts, including ING, BMO Capital Markets, Goldman Sachs,17 and Citibank, who expects copper to hit $15,000 a ton in 2025.18

With demand and prices up, and discoveries and supply down, the holy grail is to somehow snatch up a large world-class copper asset with the exploration risk already removed.

Which is exactly what Freeport Resources Inc. (TSXV:FRI) (OTCQB:FEERF) just pulled off.

And, according to The Oregon Group, an investment firm founded by independent capital markets professional Anthony Milewski, the best opportunities are in the small-cap copper explorers.

Click here to find out more about why The Oregon Group thinks Freeport Resources Inc. (TSXV:FRI) (OTCQB:FEERF) is being significantly undervalued by the market.

Getting in on a once-in-a-lifetime opportunity on the ground floor like this doesn’t happen everyday, which is why we’re so excited to share this story.

Advancing One of the World’s Largest Undeveloped Copper Deposits

Why does a company nobody’s heard of, and with a tiny market cap, have a huge copper project located in the same mineral belt as Freeport-McMoran’s Grasberg AKA the world’s 2nd largest copper mine, that produces about 5 million pounds of copper a day?19

In short, the previous owners invested over US$200 million in exploration and project development, ran out of cash, and had to sell for pennies on the dollar.

Even then, Freeport Resources (TSXV:FRI) (OTCQB:FEERF) waited to draw attention to this huge opportunity until announcing in late February that its project’s license was renewed.20

Now the story is out, and it’s simple: Freeport Resources’ Yandera Copper Project in Papua New Guinea is its single asset, and as far as undeveloped copper projects go, it’s Asia’s largest and the world’s 7th largest.

The $200M the previous owners invested included a Pre-Feasibility Study,* which found the project contains about 6.9 billion pounds of copper, is highly economic for mining, and has the potential to be a large-scale producer with an expected 20-year mine life.21

Now the project is in good hands. Freeport Resources’ (TSXV:FRI) (OTCQB:FEERF) management and board have significant in-country experience and a proven track record of developing and financing large-scale resource projects.

And this company is not wasting any time.

Press Releases

- Freeport Resources Appoints Key Advisors to Lead Yandera Copper Project Optimization Study

- Freeport Resources Closes $5.2 Million Over-Subscribed Private Placement

- Top 5 Stocks to Watch in 2024 as Copper Prices Surge on AI Demand

- Freeport Resources Unlocks 7th Largest Undeveloped Copper Deposit As AI Sparks Copper Supercycle

- Copper Surges Ahead as EV Sales in China and India Skyrocket

Freeport (TSXV:FRI) (OTCQB:FEERF) just raised C$4.4 million through a non-brokered private placement.22

And initiated a strategic review process to maximize the Yandera Copper Project’s value…which the company understandably believes is significantly undervalued based on soaring copper prices, the project’s investments to date, and the potential for expanding Yandera’s resources.

SUBSCRIBE FOR TRADING INSIGHTS AND ALERTS. STAY AHEAD.

Get investment opportunities before the rest of the market in real-time.

Get this company's corporate presentation now. Subscribe to download!

Over 120,000 subscribers

The company has even started discussions with several potential strategic partners with strong interest in advancing Yandera to the all-important stage of Definitive Feasibility Study.23

In other words, Freeport Resources (TSXV:FRI) (OTCQB:FEERF) scored the right asset, at the right price, in the right location, at the right time, to go for a ride on the copper bull run.

9 Reasons to Keep

Freeport Resources (TSXV:FRI) (OTCQB:FEERF) Front-and-Center on Your Watchlist

1

Long-Term Copper Market Strength: Multiple growth drivers, supply threats & ongoing projected shortfalls are driving record-high prices

2

Prolific Region: The Papua New Guinea based Yandera Copper Project shares the same mineral belt as the world’s 2nd largest copper mine, Freeport-McMoran’s Grasberg. On top of that, Yandera’s proximity to Asia, the world’s largest copper refiner and consumer, positions the project as an attractive potential long-term source of copper supply.

3

Leveraging Previous Investments: Freeport Resources (TSXV:FRI) (OTCQB:FEERF) benefits from previous owner’s US$200+ million in exploration and project development

4

Significant High-Grade Tier 1 Resource*: 6.9 billion pounds copper in 959 million tonnes (Mt) ore grading 0.37% CuEq

5

Advanced Stage Project: Pre-Feasibility Study* found the project highly economic with the potential for large-scale production & an expected 20-year mine life

6

Potential for Significant Resource Growth: The project not only has highly prospective porphyry copper targets identified for immediate exploration drilling, but is also very large at 245 km2 / 95 sq miles (about the size of Milwaukee or Sacramento)

7

Leadership That Knows How to Execute: Invaluable in-country experience & proven track record of developing and financing other large-scale resource projects means Yandera is in good hands

8

8) Strong Interest from Potential Strategic Partners: Talks already underway about advancing Yandera to Definitive Feasibility Study stage

9

9) Bigger Players on Copper M&A Hunt: Top miners are currently motivated to expand in copper.

The World-Class Copper Project You’ve Never Heard Of

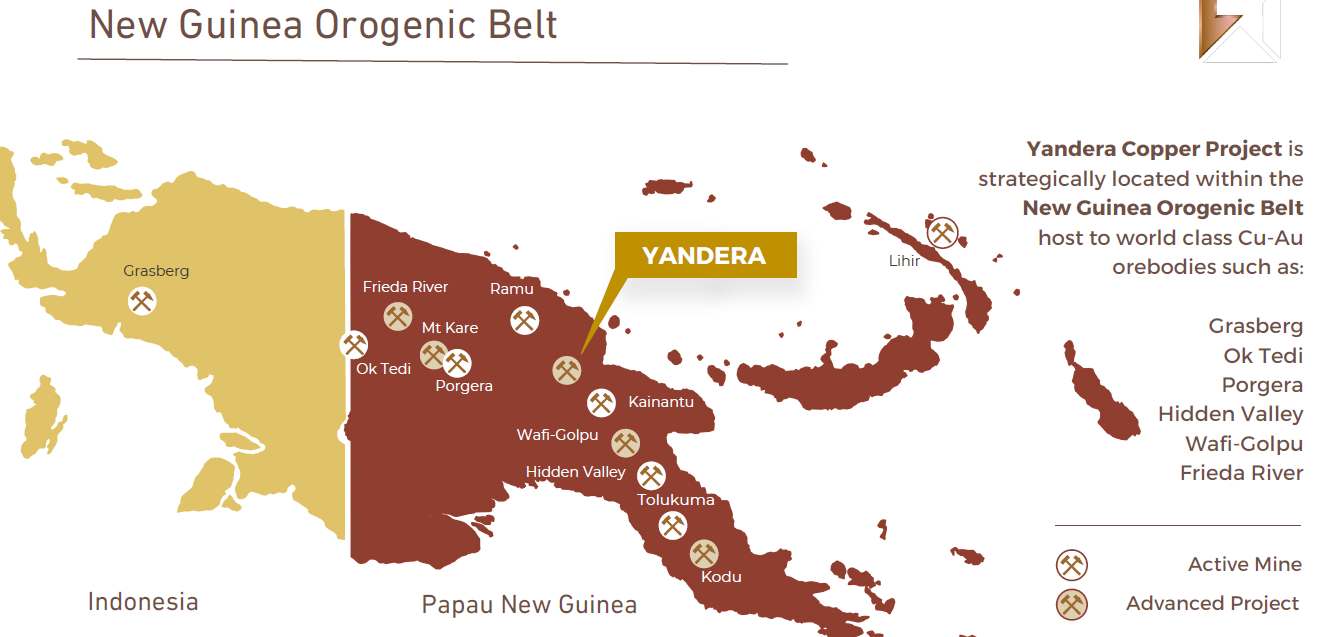

The first thing to note about Freeport Resources’ (TSXV:FRI) (OTCQB:FEERF) Yandera Copper Project is its prime location.

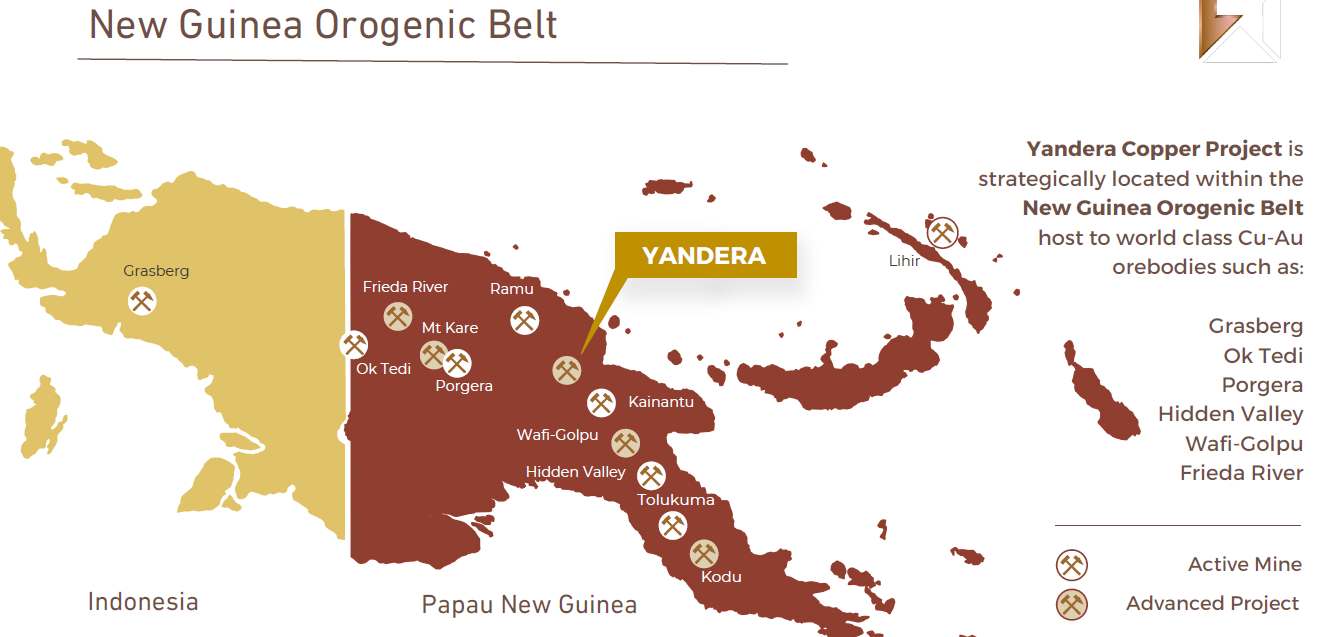

Yandera is in the heart of the New Guinea Orogenic Belt that hosts multiple major world-class deposits, active mines, advanced projects, and some of the world’s largest resource companies.

For over 50 years, Papua New Guinea’s economy has been dominated by the mining industry, exporting copper, gold, silver, nickel and cobalt.

While there are mines spread across the country, the largest surround Freeport Resources’ (TSXV:FRI) (OTCQB:FEERF) Yandera Copper Project,24 including Hidden Valley, Tolukuma, Ramu, and of special attention:

-

-

- Ok Tedi Copper and Gold Mine – government-run; produced over 5 million tonnes (Mt) of copper & 15.9 Moz of gold since 198425

- Porgera Gold Mine – Barrick Gold operated; 1.2 Moz Proved and Probable Reserves; expected to produce 50-70 Koz gold in 202426

- Lihir Gold Mine – Newmont owned; one of the world’s largest producing gold mines; first production in 1997; 670 Koz gold produced in 202327

- Kainantu Gold Mine – K92 Mining operated (more on this one in a moment)

-

Then there’s the biggest of all in the New Guinea Orogenic Belt: Freeport-McMoran’s major asset, Grasberg.

Grasberg is a monster:

-

-

- World’s 2nd largest copper mine28

- Producing for over 35 years29

- Currently produces about 5 million pounds of copper a day30

- Consolidated sales as of 2023 totaled 4.2 billion pounds of copper31

- Proven & Probable Mineral Reserves of 30.8 billion pounds copper at a grade of 1.03% copper32

-

It’s also worth noting Yandera’s proximity to Asia, the world’s largest copper refiner and consumer, which positions the project as an attractive potential long-term source of copper supply.

Just How Undervalued is Freeport Resources (TSXV:FRI) (OTCQB:FEERF)?

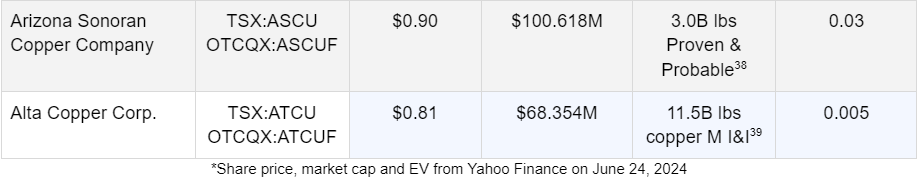

There are multiple ways to see how Freeport Resources (TSXV:FRI) (OTCQB:FEERF) is currently trading far below the value of its asset and below its peers.

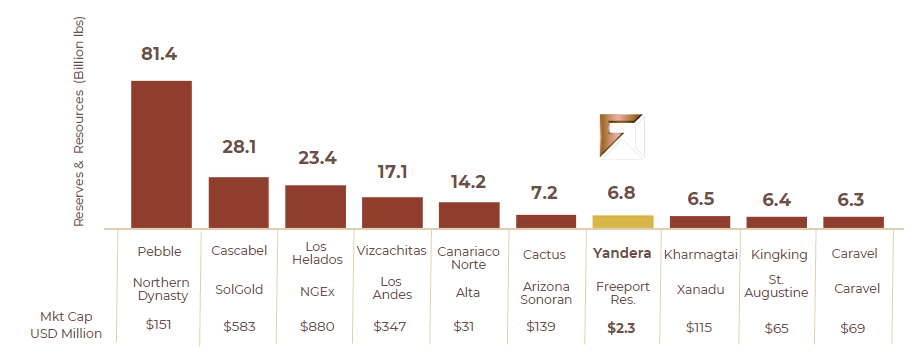

If you look at the top 10 publicly traded copper developers in the world by Reserves and Resources, Freeport Resources’ Yandera Copper Project ranks #7…yet the Company’s market cap doesn’t come close to reflecting that fact (the chart below shows a lower market cap than its current $6.6M, but they’re still undervalued at the current number).

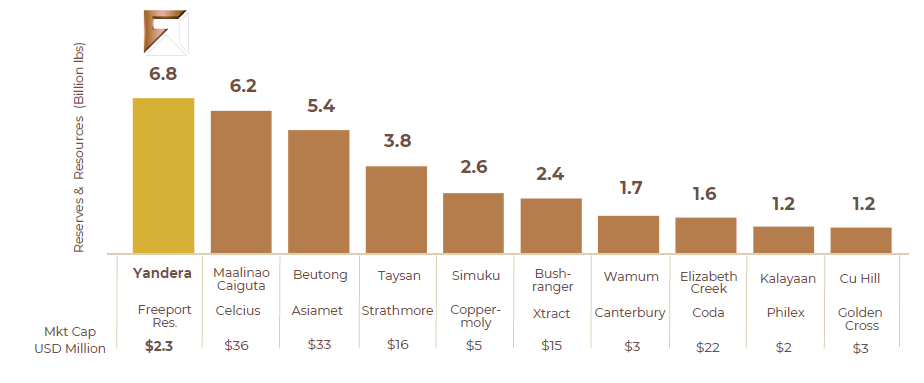

Then if you look at the top 10 copper projects of publicly traded companies in South Asia-Australia by Reserves and Resources, Freeport Resources’ (TSXV:FRI) (OTCQB:FEERF) Yandera is #1…yet its market cap doesn’t reflect the value of that asset.

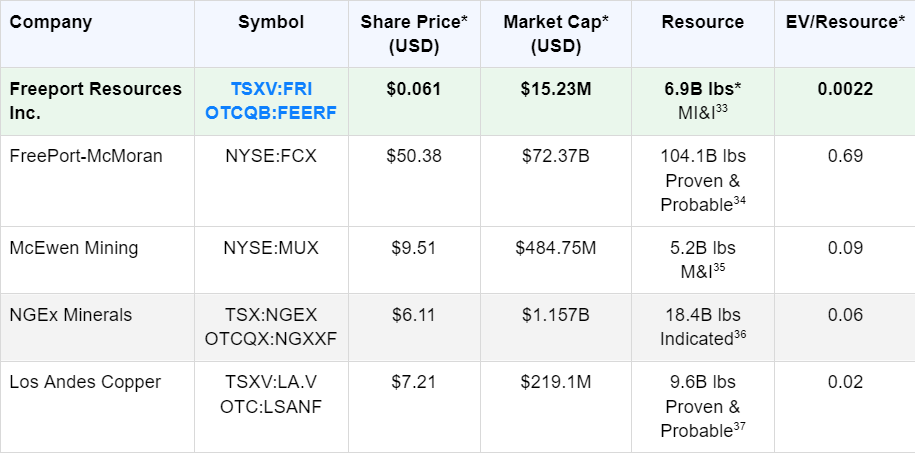

The table below is another way to look at it. By comparing Enterprise Value (EV) to Resource, Freeport Resources (TSXV:FRI) (OTCQB:FEERF) is clearly valued far below these select peers.

Why the Yandera Copper Project is a Monster of Its Own

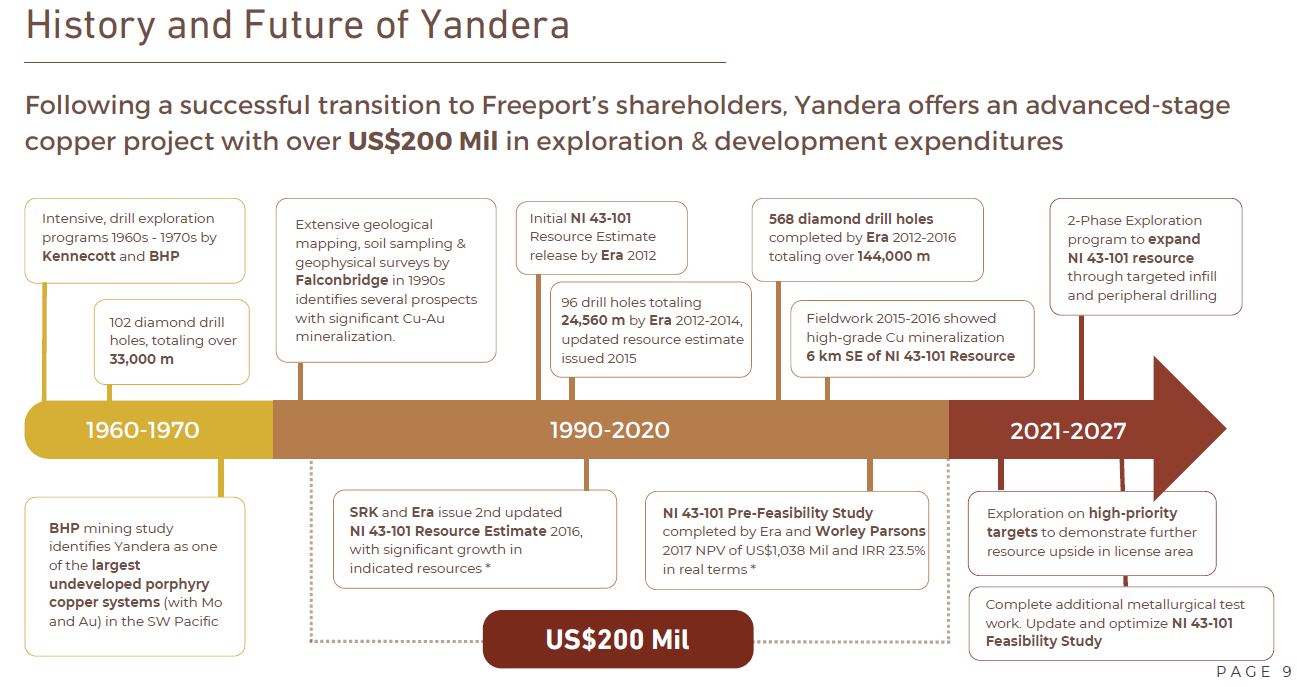

Freeport Resources’ (TSXV:FRI) (OTCQB:FEERF) Yandera owes its advanced stage and world-class copper project status to over US$200 million invested by prior owners.

Intensive, drill-based exploration programs. 102 diamond drill holes totaling over 33,000 meters. A mining study by BHP identified one of the largest undeveloped porphyry copper systems in the world (not to mention ancillary molybdenum and gold).

Another US$100 million was spent and 471 holes totaling over 144,000 meters. Then the previous owner’s US$200 million in exploration and development investments.

That included the 2017 Pre-Feasibility Study* (PFS) by Worley Parsons,40 one of the world’s leading engineering companies.

Despite the PFS* only focusing on one of the Yandera Copper Project’s deposits, it found the project to be highly economic, with the potential for large-scale production, and a billion-dollar-plus valuation:

-

-

- Resource (at 0.15% copper cut-off): 959 million tonnes grading 0.37% copper

- Contained Copper: 6.9 billion pounds

- Forecasted Annual Copper Production: 100,000 tonnes

- Expected Mine Life: 20 years

- Forecasted Average Operating Cost: US$1.95/pound copper (in other words, operating costs 2.25x lower than the current copper price of around US$4.40/pound)

- Project Post-Tax NPV (Net Present Value) at 10%: US$1.04 billion

- Project Post-Financing IRR: 23.5%

-

Now Freeport Resources (TSXV:FRI) (OTCQB:FEERF) has 100% ownership of this very large project (245 km2 / 95 sq miles, about the size of Milwaukee or Sacramento) with potential for significant resource growth from a number of other deposits on the property.

The value of the Yandera asset alone is likely to draw a lot of market attention. Then add in rising copper prices, and Freeport Resources’ (TSXV:FRI) (OTCQB:FEERF) stock has the potential for some serious near-term gains.

Potential Upside from Acquiring a World-Class Asset at a Steep Discount

Like Freeport Resources’ (TSXV:FRI) (OTCQB:FEERF) Yandera, K92’s Kainantu is a large, Tier 1 asset with significant growth potential thanks to multiple highly prospective targets.41

Even more similar is how K92 Mining acquired Kainantu.

In 2015, the world’s top gold miner, Barrick Gold, was cutting costs and selling non-core assets. K2 snatched up Kainantu for an initial US$2 million. That’s a fraction of Barrick’s prior US$280 million investment in the project.42

On the strength of that single asset, K92 Mining has since realized a 13x gain between March 2015 to May 2024.

That’s the kind of significant upside potential a vastly undervalued mining asset can deliver.

Big Players are on the M&A Hunt to Add to Their Copper Resources

If there’s one group that’s on the watch for opportunities like Freeport Resources (TSXV:FRI) (OTCQB:FEERF) and its Yandera Copper Project, it’s big resource companies.

When it comes to growing their copper resources and holding onto their stake in the market, it’s faster, easier and far less costly for these mining titans to acquire a known resource than to explore for one.

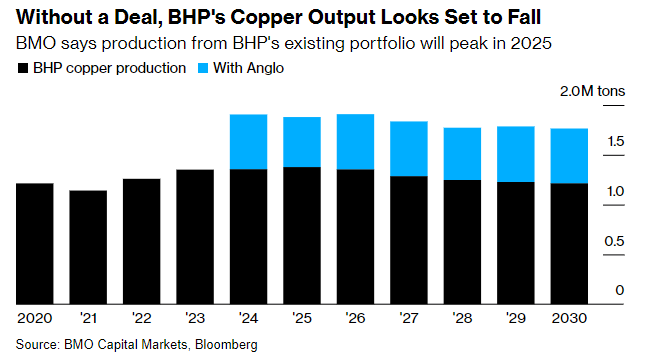

And with operating copper mines nearing their peak due to ore grades dropping and reserves being exhausted,43 all the big miners are currently motivated to expand in copper.44

The perfect example is BHP’s recent $39-billion M&A bid for Anglo American.

Without the deal, BHP’s copper output looks set to fall…

…but with the deal, BHP would have about 10% of global copper mine output plus control of some of the best and biggest copper mines right when the world is barreling toward a copper supply shortage.

Yes, Anglo American rejected the initial proposal, but BHP is considering an improved offer, and all this action has led to predictions for a wider wave of mining M&A, with many of BHP and Anglo’s rivals on the hunt for their own copper deals.45

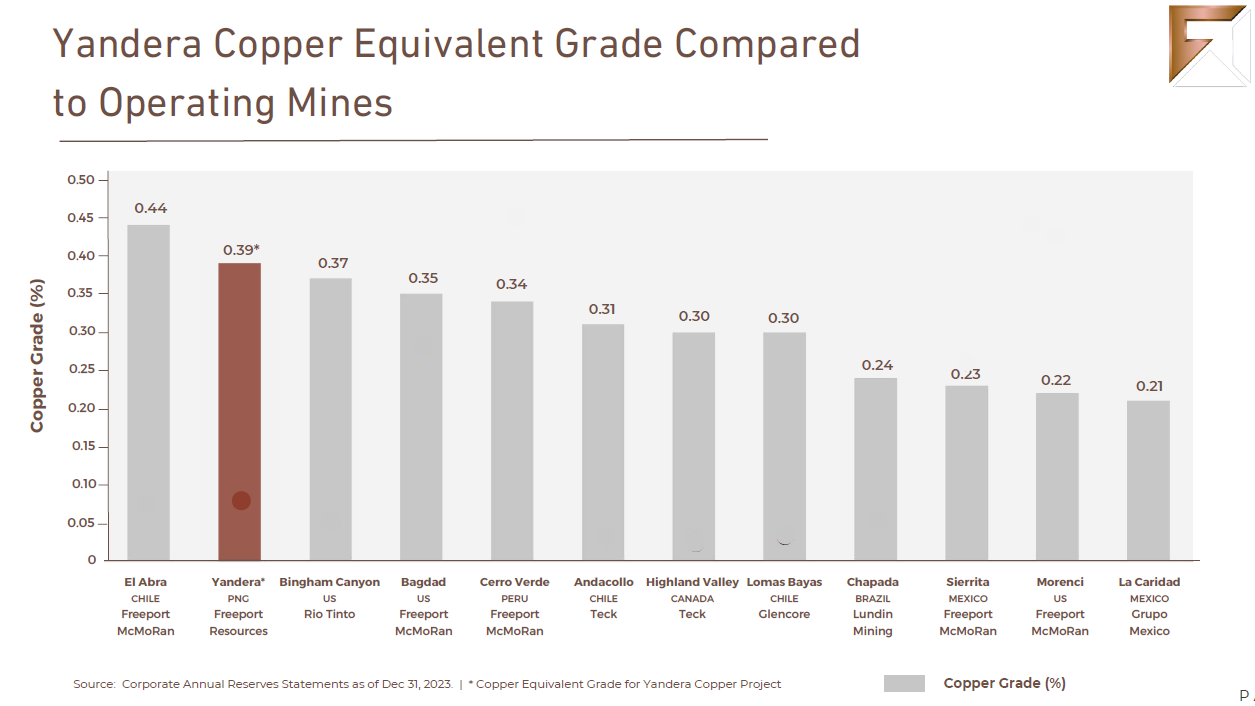

What’s one of the first things they’re likely to notice, apart from its size, when they check out Freeport Resources (TSXV:FRI) (OTCQB:FEERF)?

The Yandera Project also contains copper grades* that stack up to existing mines currently operated by top producers.

It’s another sign of just how valuable (yet undervalued) Freeport Resources (TSXV:FRI) (OTCQB:FEERF) is, which makes it seem like just a question of time before a big player comes looking to buy them out.

Leadership that Knows How to Develop & Finance Large Resource Projects

It’s one thing to scoop up the right asset, at the right price, in the right location, at the right time; it’s another to realize that asset’s full potential to maximize shareholder value.

Fortunately for Freeport Resources (TSXV:FRI) (OTCQB:FEERF), they have multiple key leaders that have successfully been around that block before. Here are just a few of them.

9 Reasons to Keep

Freeport Resources (TSXV:FRI) (OTCQB:FEERF) Front-and-Center on Your Watchlist

1

Long-Term Copper Market Strength: Multiple growth drivers, supply threats & ongoing projected shortfalls are driving record-high prices

2

Prolific Region: Yandera Copper Project shares the same mineral belt as the world’s 2nd largest copper mine, Freeport-McMoran’s Grasberg

3

Leveraging Previous Investments: Freeport Resources (TSXV:FRI) (OTCQB:FEERF) benefits from previous owner’s US$200+ million in exploration and project development

4

Significant High-Grade Tier 1 Resource: 6.9 billion pounds copper in 959 Mt ore grading 0.37% CuEq

5

Advanced Stage Project: Pre-Feasibility Study* found the project highly economic with the potential for large-scale production & an expected 20-year mine life

6

Potential for Significant Resource Growth: Very large project (about the size of Milwaukee or Sacramento) with highly prospective porphyry copper targets identified for immediate exploration drilling

7

Leadership That Knows How to Execute: In-country experience & track record of developing and financing other large-scale resource projects

8

Strong Interest from Potential Strategic Partners: Talks already underway about advancing Yandera to Definitive Feasibility Study stage

9

Big Players on Copper M&A Hunt: : Top miners are currently motivated to expand in copper, including BHP’s $39-billion bid for Anglo American46

With copper demand and prices on the rise, and new discoveries dwindling, Freeport Resources Inc. (TSXV:FRI) (OTCQB:FEERF) and its advanced stage Yandera Copper Project are poised to capture significant market and M&A interest.

For those tracking undervalued copper mining opportunities, it’s worth keeping a close eye on the developments and forthcoming announcements from Freeport Resources (TSXV:FRI) (OTCQB:FEERF).

SUBSCRIBE FOR TRADING INSIGHTS AND ALERTS. STAY AHEAD.

Get investment opportunities before the rest of the market in real-time.

Get this company's corporate presentation now. Subscribe to download!

Over 120,000 subscribers

Nathan Chutas

Nathan Chutas  Tobias Kulang Thomas CPA

Tobias Kulang Thomas CPA Scott Davis CFO and Director

Scott Davis CFO and Director