When most people think of helium, they think of birthday balloons.

But the fact is, helium is one of the rarest elements on earth and its role in MRI’s and other medical devices literally means the difference between life and death.

Helium is one of the most valuable resources to the security of the US and it’s depleting by the minute—sending helium prices through the roof as recently as last year.1

Imagine waking up one morning to discover your mother is showing signs of a stroke – slurred speech, numbness on the left side of her body, confusion.

But when you rush her to the Emergency Room to get diagnosed and treated, the nurse tells you the MRI machines are inoperable.

Or picture your son having an asthma attack but the pharmacies are completely out of inhalers to offer him any relief.

These terrifying scenarios could soon become a reality if the world doesn’t get more helium.

MRI machines need massive amounts of liquid helium to work efficiently. But dwindling helium production means patients may miss out on crucial diagnoses and treatments for serious diseases.

This is exactly why we can’t take the current shortage of helium lightly. Lives literally depend on it.

And it’s not just the medical field that’s being disrupted by the lack of helium supply. It’s used for predicting the weather, making semiconductors and detecting gas leaks in ships.

Fortunately, there’s one company with a large helium-rich well that’s ready for production.

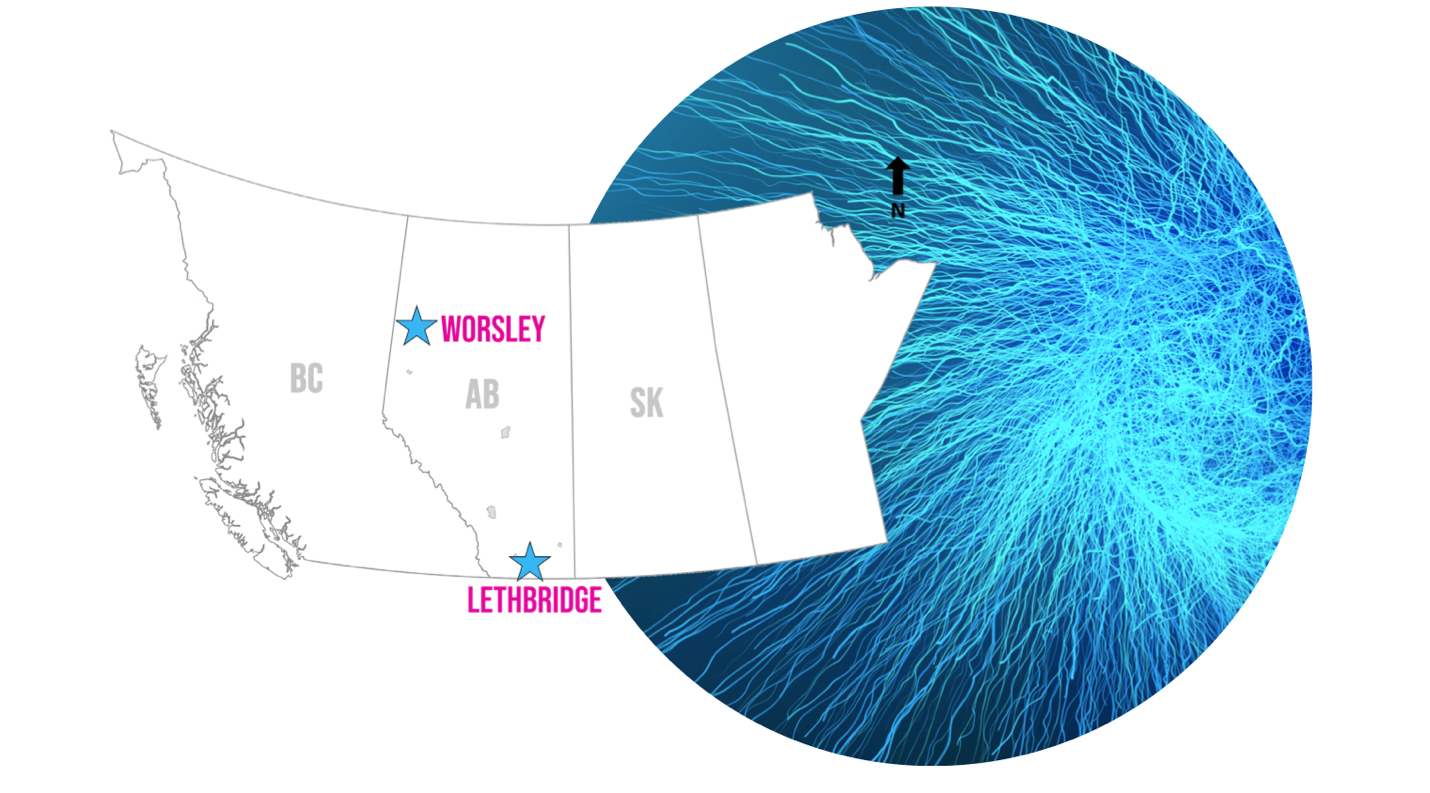

That company is First Helium (TSXV:HELI) (OTCQX:FHELF), a Canadian company exploring and developing two premium projects in prolific helium regions of Alberta, Canada.

First Helium’s portfolio includes an advanced-stage high-value, lower-risk project in Northwestern Alberta and a high-impact exploration project in Southern Alberta that are among the most advanced helium assets held by juniors in North America.

As an added bonus, First Helium has generated $8M in operating cash flow from two oil well discoveries to help fund exploration activities at its two helium projects.

Imagine a company with a helium well, valued at a staggering $35.5M2 in today’s market, and now compare that to its modest C$13.5M market cap as of May 18, 2023. This is where First Helium (TSXV:HELI) (OTCQX:FHELF) steps into the spotlight.

By capitalizing on the growing demand for helium and its limited global supply, First Helium has positioned itself as a leading player in the helium market. With their strategic advantage, the company is poised for exponential growth and increased market share.

Led by an extremely capable team with diverse and extensive backgrounds in oil & gas exploration and operations, mining, finance, and capital markets, First Helium (TSXV:HELI) (OTCQX:FHELF) is well-positioned to be one of the leading providers of helium in North America at a time when helium prices are at historical highs.

Here are a few reasons this company stands out among the masses:

5 Reasons

to Add to Be Gassed Up About First Helium (TSXV:HELI) (OTCQX:FHELF)

1

Rising Global Helium Demand – Helium is a high-value, finite resource, that is vital in the tech, healthcare, aerospace, scientific research and industrial sectors. The global helium market, which was valued at US$9.38 billion in 2021/2022, is expected to reach a value of US$21.29 billion by 2030, at a CAGR of over 14%.3

2

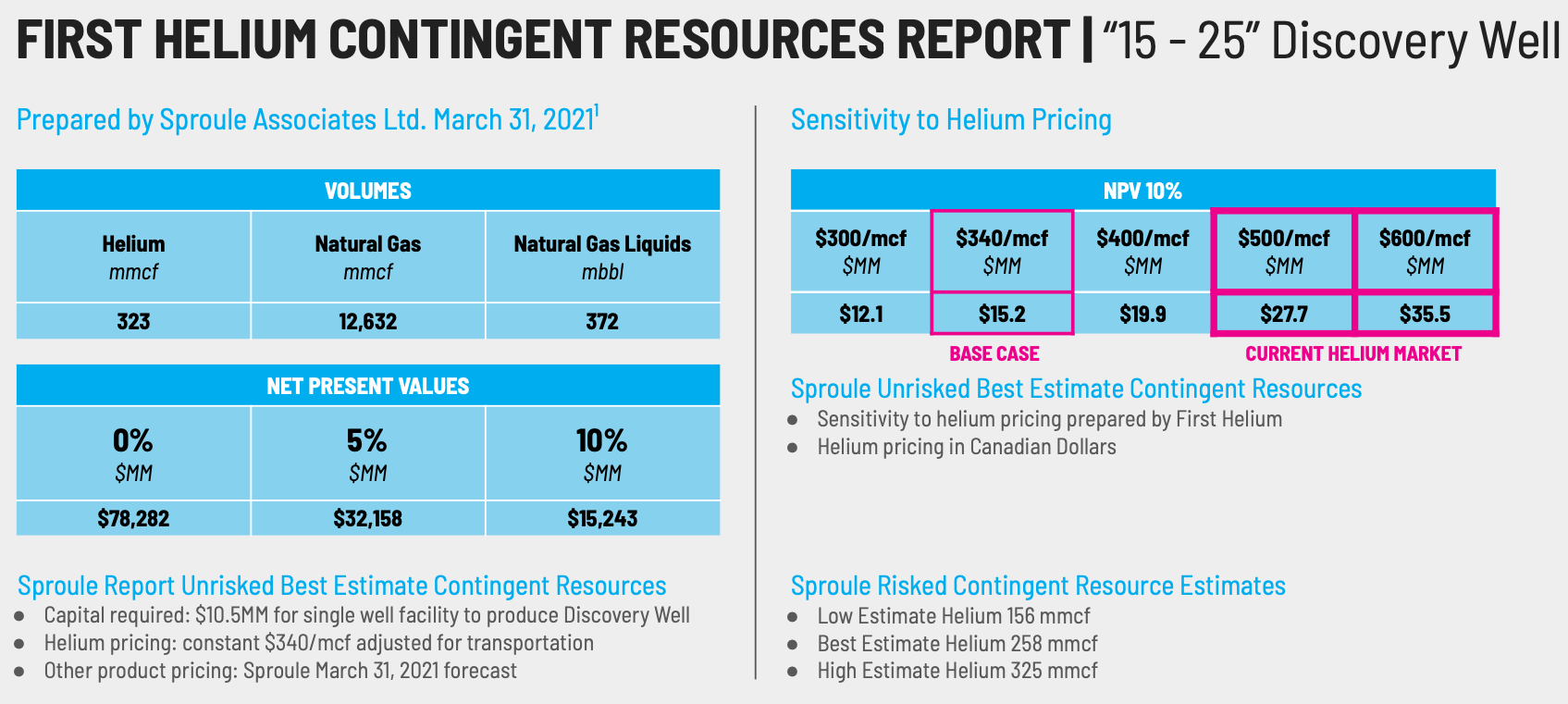

De-Risked Resource Ready for Production – First Helium’s (TSXV:HELI) (OTCQX:FHELF) helium-rich 15-25 discovery well is ready to be equipped and brought into production by early 2024 with a value of over $15M (NPV10 at $340 per mcf helium pricing),4 which is a lot lower than actual helium prices today. Plus, the company’s 1-30 and 4-29 oil discovery wells open up future potential oil exploration & development opportunities. Lastly, the Company purchased pipeline infrastructure to lay the groundwork for tying in future production growth.

3

Very Compelling Economics – Long life, high netback production profile forecast of the helium-rich 15-25 discovery well lends itself to responsible, non-dilutive financing alternatives for facility infrastructure.

4

Helium Offtake Agreement – Ten year, take-or-pay helium offtake sales agreement with Major Global Industrial Gas Supplier. Firm pricing through the first 5 years of the agreement provides for potential revenue of up to US$100M for helium production during that time period. Production holdback of 20% allows First Helium to tap the lucrative helium “spot” market to enhance economics.

5

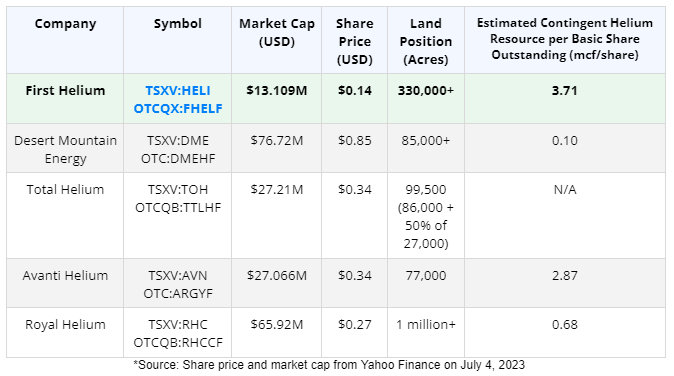

Large Undeveloped Land Base Offers Blue Sky Potential – With over 60,000 acres of 100%-owned lands, a drilled and cased potential helium target well that’s ready to be tested, numerous drilling prospects, and cash-generating oil wells, First Helium (TSXV:HELI) (OTCQX:FHELF) is undervalued compared to other near-production helium companies on the market, as well as their neighbors in these highly prolific helium regions.

Booming Helium Market in Dire Need of New Supply

Helium is a vital resource driving advancements in medical, high-tech industrial, science, space exploration, and manufacturing.

From medical imaging through MRI machines to fiber optics and semiconductor production, helium’s unparalleled physical properties are indispensable in today’s ever-evolving high-tech landscape.

But that’s not all. As our planet strives for a cleaner energy future, helium will emerge as a pivotal component in both small modular nuclear reactors and the grand vision of fusion power plants.

The problem is, it’s a finite element that cannot be easily replenished and according to the gas industry, the world is experiencing its fourth major helium shortage, making near-term producers like First Helium (TSXV:HELI) (OTCQX:FHELF) essential to meet rising demand.

Right now, the fate of America’s largest helium supply is up in the air, as the Federal Helium Reserve (which supplies roughly 40% of the world’s helium) was supposed to be sold off in 2021, but as yet, no deal has been announced. There is concern over the certainty of supply of helium as scientists currently estimate 100-200 more years of helium supply remaining at current consumption levels.5

Canada (where First Helium’s assets are located) has the world’s 5th largest prospective helium resource6 yet produces less than 3% of the world’s annual helium production.7 In addition, Canada has recently named helium a critical mineral.8

Among its helium peers, First Helium has one of the largest independently evaluated contingent resource bases. With over 60,000 acres of 100%-owned lands, a drilled and cased potential helium target well that is ready to be tested, and numerous drilling prospects, there’s a strong case to make in stating that HELI is currently undervalued.

In addition, First Helium (TSXV:HELI) (OTCQX:FHELF) has already generated operating cash flow of $8M from producing oil discovery wells that was deployed to exploration activities.

For the 12 months ended March 31, 2022, the company brought in over $3.6M in petroleum and natural gas sales, and for the nine months ended December 31, 2022, the Company generated even higher revenues of $7.5M.9

Press Releases

HELI’s low market cap truly stands out in a few different areas; thus far, their drilling success rate is 2 for 3 after drilling, completing and testing wells. Upon ultimate completion and testing of its 14-23 horizontal well as a potential helium target, this statistic might jump to a perfect 3 for 3 on drilling.

According to independent evaluation firm Sproule Associates Ltd., First Helium’s (TSXV:HELI) (OTCQX:FHELF) Worsley discovery well has a best estimate, unrisked contingent resource estimate of 323 mmcf of helium.10

When you compare that contingent resource base to those of other near production helium companies, it’s clear that HELI’s current market valuation has room to appreciate—for example Avanti Helium, with a comparable published contingent resource base of 221 mmcf, is being accorded a market cap of more than TRIPLE that of First Helium.

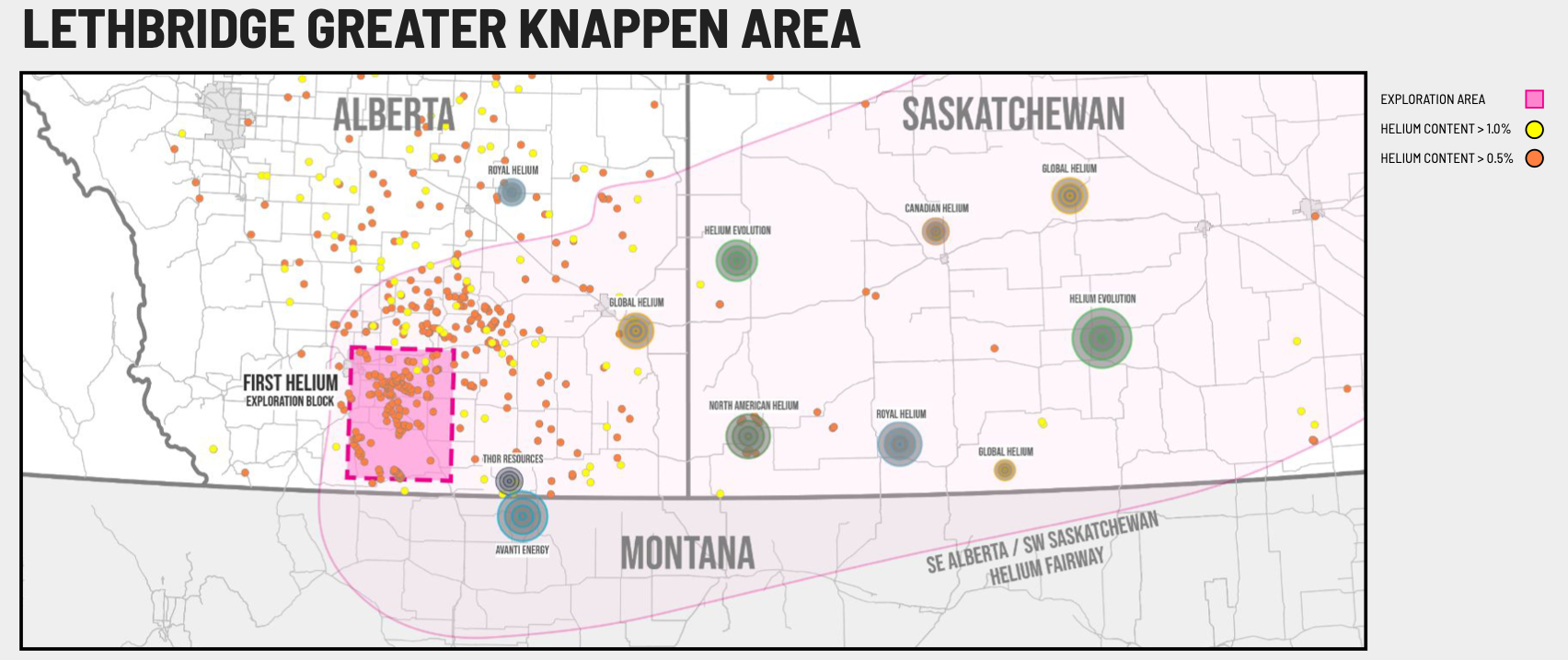

Avanti Helium’s Greater Knappen Property is located south of First Helium’s Lethbridge property. All three of Avanti’s wells drilled on its property, since permitting was granted at the end of 2021, have encountered helium.11,12,13 First Helium is targeting the same formations for its first exploration well at Lethbridge.

A second example of a near production producer is Royal Helium, which has more than triple the land position by acreage, but less than half of First Helium’s (TSXV:HELI) (OTCQX:FHELF) contingent resource base at 162 mmcf. It currently has a market valuation of more than 6X the market cap of HELI.

Among its peer group, First Helium’s land position is second only to Royal Helium, yet it ranks at the bottom of the group in terms of market cap.

So by looking at its near production peer group, it becomes a lot clearer that First Helium is being undervalued by comparison, as it has a respectable land position, 77 km of 2D seismic and over 16,000 acres of 3D seismic, and a significant helium resource estimate that should see the company’s valuation in the upper tier of the helium space… yet it’s not. There is room for price appreciation. The opportunity is now.

Let’s face it, this company has a top tier resource, a drilled and cased potential helium well that’s ready to be tested, and numerous drilling prospects. Certainly First Helium (TSXV:HELI) (OTCQX:FHELF) is worth more than the market is giving it—especially given the fact that management estimates that the Worsley discovery well alone has a minimum value of over $15 million (NPV10 at $340 per mcf helium pricing).9

With the current helium market ranging between $500-600 per mcf, the well’s valuation is closer to $35.5M.14

That’s compared to a company that’s currently sitting at a market valuation of roughly $13.5M with plenty of bluesky left to go!

De-Risked Resource Ready for Production: Worsley Helium Project

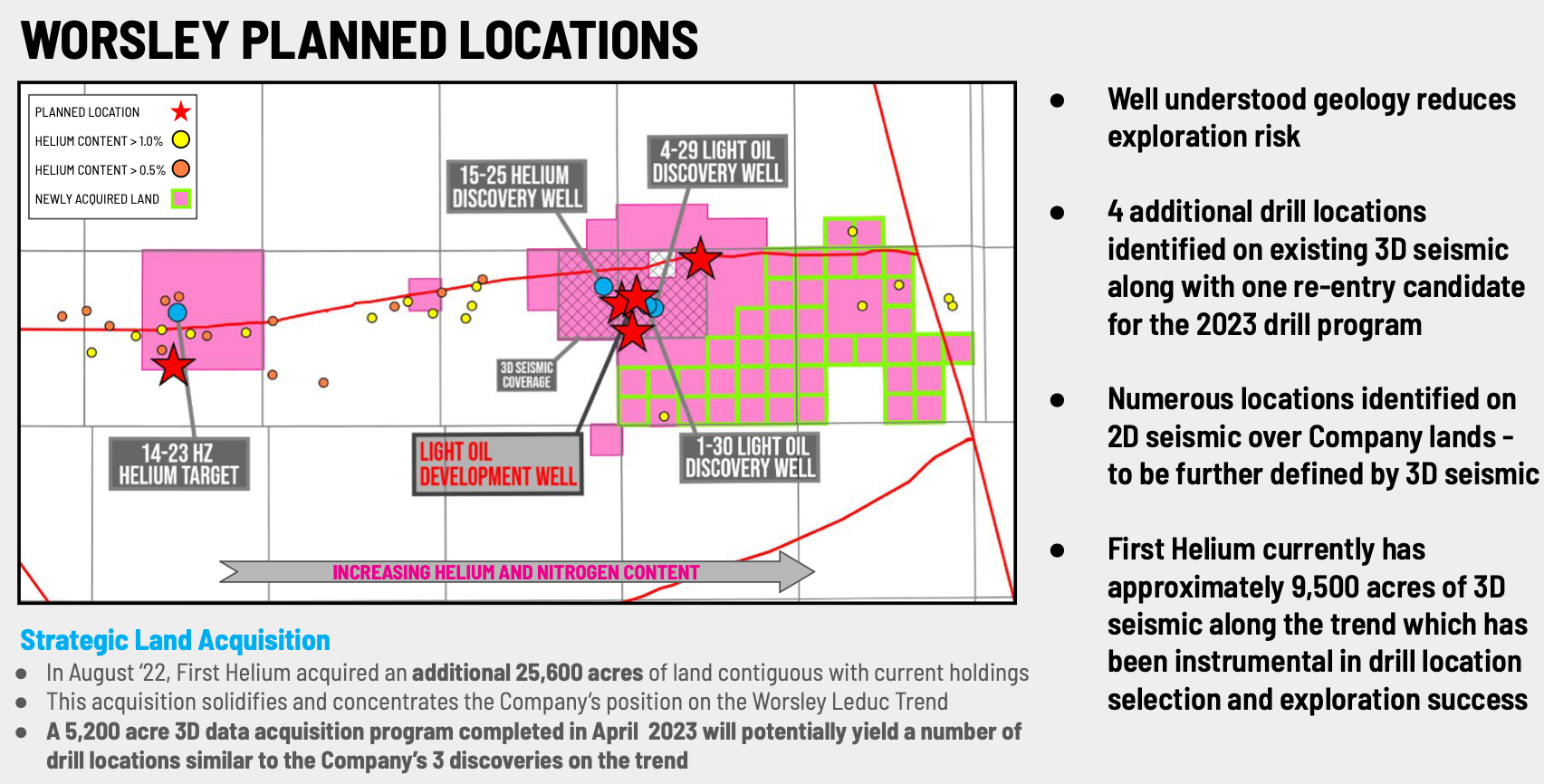

Located in Northwestern Alberta, First Helium‘s (TSXV:HELI) (OTCQX:FHELF) Worsley Helium Project, spans 60,000 contiguous acres. The project’s promise is amplified by their helium discovery well and two oil wells, which have generated significant cash flow to help fund exploration activities.

Worsley’s well-understood geology significantly reduces exploration risk. Central to the project is the helium-rich 15-25 discovery well, set for production upon the installation of a modular processing facility.

There’s existing natural gas gathering infrastructure nearby, comprising 46 kms of gathering lines to help expedite the on-stream timing of the project. As well, the horizontal well, 14-23, drilled as a potential helium target in summer of 2022, further aligns with the overall development plan and complements the helium processing facility.

In 2023, HELI plans to continue drilling at Worsley. Preliminary engineering studies on the helium processing facility have been completed, helium gas off-take agreements secured, and financing alternatives are being evaluated.

First Helium’s recent acquisition of 25,000+ acres of land, contiguous with existing helium and oil discoveries, has served to further bolster their exploration land inventory and expand their footprint in the region. Together, this positions the company to achieve on-stream operations within 9-12 months from facility funding and kick-off.

Based on existing 2D and 3D seismic data, First Helium (TSXV:HELI) (OTCQX:FHELF) has identified at least four additional drill locations. New seismic data, shot in early 2023, is expected to yield additional high quality drilling prospects. On top of that, the company possesses approximately 16,000 acres of 3D seismic data along the trend, playing a crucial role in selecting drill locations and driving exploration success.

Worsley’s de-risked resource, and ready-for-production status, coupled with the strategic land acquisitions and existing infrastructure, positions HELI very well in the helium industry for the near-future and into the long term.

Large Undeveloped Land Base Offers Blue Sky Potential: The Lethbridge Project

While the Worsley Project remains more advanced, First Helium’s (TSXV:HELI) (OTCQX:FHELF) Lethbridge Project lies within the prolific SE Alberta/SW Saskatchewan Helium Fairway, an area with a rich history of helium exploration dating back to the 1960s, and offers substantial for high-impact exploration and development.

With concentrations reaching up to 1.5% in the region’s wells, there’s significant helium potential. Similar helium-rich features have been identified at nearby Cypress Hills and Battle Creek in southwestern Saskatchewan.

Approximately 40 km to the east in close proximity to the Lethbridge Project, there’s already helium being produced at the Knappen Dome. This advantageous positioning and utilization of advanced seismic technology allows First Helium to identify and secure the most promising areas for exploration and development.

Through a strategic and meticulous approach, HELI acquired option rights to over 880,000 acres of land within the region and high-graded a select 276,000 acres for further evaluation. Leveraging the invaluable 3D seismic data that covered more than 60% of the selected 276,000 acres, the company has gained a significant exploration head start at an accelerated pace and cost-efficient basis.

The company has already identified multiple target traps within this proven productive region, balancing identifiable exploration risk with remarkable upside potential. One drill-ready location is ready for drilling later in 2023.

Highly Equipped Leadership Team

First Helium (TSXV:HELI) (OTCQX:FHELF) boasts a seasoned leadership team with successful track records in oil and gas exploration and production, capital markets and finance, helium project development, construction and project management, and mining exploration and development.

RECAP: 5 Reasons

to Inhale the Potential of First Helium (TSXV:HELI) (OTCQX:FHELF) Today

1

Rising Global Helium Demand: Helium is an invaluable resource with high value in sectors such as tech, healthcare, aerospace, and industry.

2

De-Risked Resource Ready for Production: First Helium (TSXV:HELI) (OTCQX:FHELF) has a helium-rich 15-25 discovery well that is fully prepared for production by early 2024 with an estimated value of the well exceeds $15M (NPV10 at $340 per mcf helium pricing).

3

Very Compelling Economics: The helium-rich 15-25 discovery well offers a production profile with long life and high netback, making it an attractive prospect for responsible, non-dilutive financing alternatives for facility infrastructure.

4

Helium Offtake Agreement – Ten year, take-or-pay helium offtake sales agreement with Major Global Industrial Gas Supplier. Firm pricing through the first 5 years of the agreement provides for potential revenue of up to US$100M for helium production during that time period. Production holdback of 20% allows First Helium to tap the lucrative helium “spot” market to enhance economics.

5

Large Undeveloped Land Base Offers Blue Sky Potential: First Helium (TSXV:HELI) (OTCQX:FHELF) possesses over 60,000 acres of fully owned lands, including a drilled and cased potential helium target well ready for testing. With numerous drilling prospects, the company appears undervalued compared to other near-production helium companies in the market.

We’re witnessing a critical point in the landscape of the global helium supply, with a shift in demand and North American governments expressing the importance of domestic helium suppliy, First Helium (TSXV:HELI) (OTCQX:FHELF) has strategically amassed valuable helium assets in Canada.

With a large inventory of future drilling targets, First Helium presents investors with a low-risk opportunity to invest in a pre-production helium producer.

With any early-mover situation, there’s no better time to begin your due diligence, so click here to monitor First Helium’s (TSXV:HELI) (OTCQX:FHELF) news and milestones.