Step into the realm of Helium – the unseen powerhouse of critical industries.

Why Helium? It’s more than just a party balloon inflator. Think about the vital MRIs, the indispensable semiconductors, the essential weather forecasting tools. All powered by this elusive, rare element.

But here’s the kicker. It’s running out. The supply of this life-and-industry-altering gas dwindles with every passing moment. And this scarcity? It’s catapulting helium prices to unprecedented heights.1

Dive into the dilemma: medical facilities around the globe are grappling with potential shortages. A deficiency that threatens to disrupt critical diagnoses and treatments. The world can’t afford to overlook the helium crunch. It’s not just business; it’s a matter of global well-being.

Breaking News

Enter First Helium (TSXV:HELI) (OTCQX:FHELF) – sitting on one promising helium-rich well, primed for production, and a second ready to be tested. This isn’t merely a venture; it’s an opportunity emerging in the face of a global helium crisis.

Guided by a cohort of experts in mining, finance, and capital markets, and underpinned by a robust lineage in oil & gas exploration and operations, First Helium is strategically placed to navigate this critical juncture.

Positioned on the brink of becoming a leading helium provider in North America, First Helium (TSXV:HELI) (OTCQX:FHELF) is a pioneering force ready to make its mark on the landscape of the natural resources sector – at a time when the helium market is skyrocketing.

Get ready to acquaint yourself with the story behind the rarest natural resource in the world today and its rising star.

SUBSCRIBE FOR TRADING INSIGHTS AND ALERTS. STAY AHEAD.

Get investment opportunities before the rest of the market in real-time.

Get this company's corporate presentation now. Subscribe to download!

Over 120,000 subscribers

Tapping into the Helium Goldmine: The First Helium Advantage

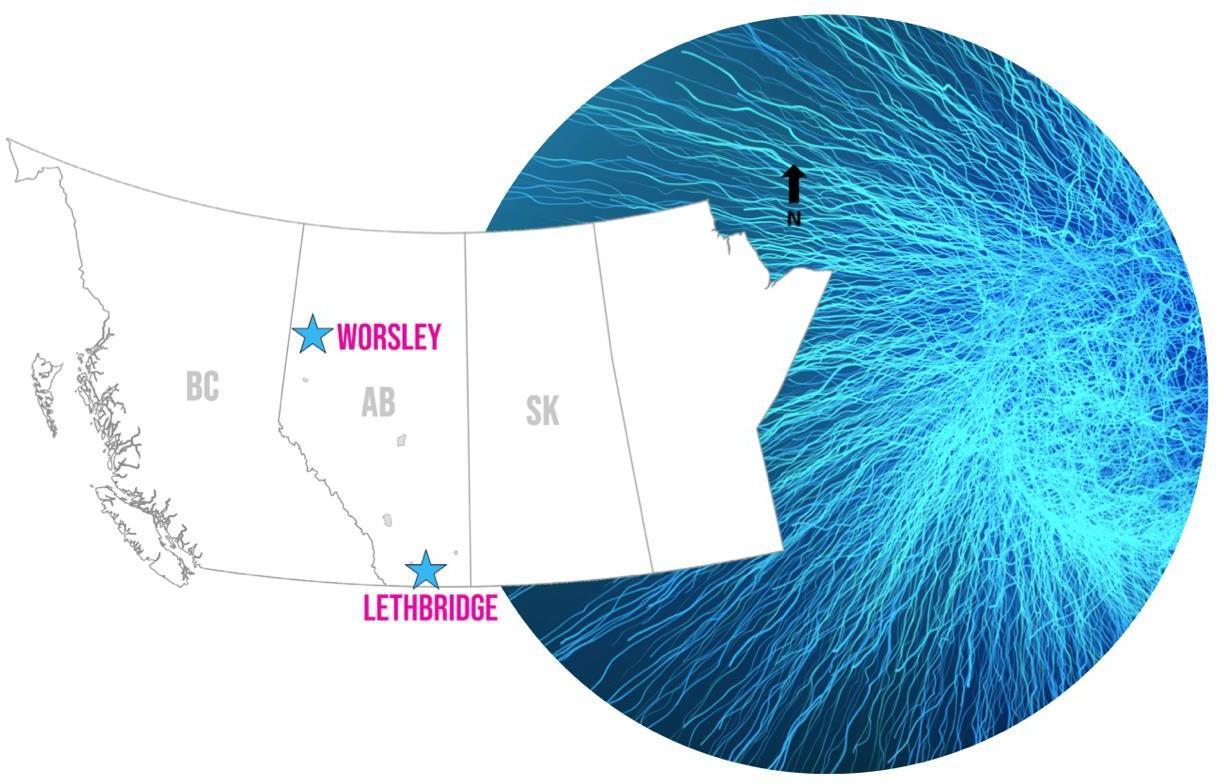

First Helium (TSXV:HELI) (OTCQX:FHELF) presents a remarkable portfolio – a combination of advanced-stage, high-value, and lower-risk project nestled in Northwestern Alberta, coupled with a high-impact exploration project situated in Southern Alberta. These are among the prime helium assets held by junior companies in North America.

This unique portfolio places First Helium on the frontline, perfectly positioned to leverage the escalating demand for helium amidst its dwindling global supply. And that’s not all.

First Helium has also seen a financial boost of $8M in operating cash flow courtesy of two oil well discoveries. This capital is has helped fuel the exploration activities at its helium projects.

Consider this scenario: a helium well boasting a robust value of $35.5M2 in the current market, yet the company housing this asset stood at a relatively modest market cap of $16.1M as of July 5, 2023.

That’s the financial canvas of First Helium – an intriguing potential for remarkable growth that keen investors constantly seek.

The story of First Helium is captivating, but it’s the company’s distinct advantages that make it an extraordinary opportunity to delve into. Here’s a snapshot of why First Helium stands in a league of its own.

5 Factors

Making First Helium (TSXV:HELI) (OTCQX:FHELF) a Compelling Watchlist Addition

1

Soaring Helium Demand – Helium is a high-value, finite resource that is vital in the tech, healthcare, aerospace, scientific research, and industrial sectors. The global helium market, which was valued at US$9.38 billion in 2021/2022, is expected to reach a value of US$21.29 billion by 2030, that’s a CAGR of over 14%.3

2

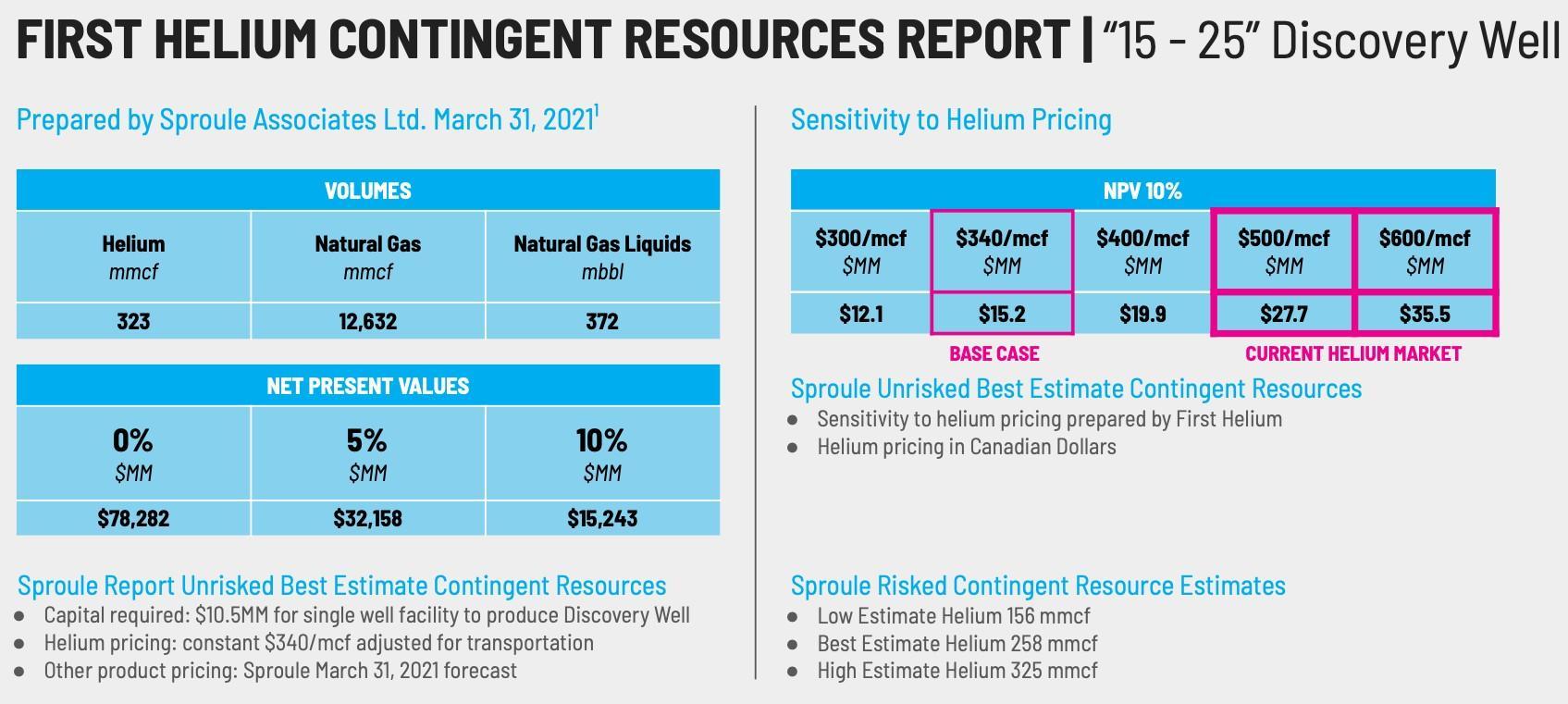

Project Nearing Production – First Helium’s (TSXV:HELI) (OTCQX:FHELF) helium-rich 15-25 discovery well is ready to be equipped and brought into production by early 2024. This mine has a conservative value of over $15M (NPV10 at $340 per mcf helium pricing, which is a lot lower than actual helium prices today).4

3

Lucrative Assets – First, the company’s helium-rich 15-25 discovery well has a forecasted long life, high netback production profile, and non-dilutive financing alternatives for facility infrastructure. Also, the company’s 1-30 and 4-29 oil discovery wells open up future potential oil exploration & development opportunities. Lastly, the Company recently purchased pipeline infrastructure to accommodate future production growth.

4

High Revenue Potential – First Helium (TSXV:HELI) (OTCQX:FHELF) has a 10-year, take-or-pay helium offtake sales agreement with a Major Global Industrial Gas Supplier. Firm pricing through the first 5 years of the agreement provides for potential revenue of up to US$100M for helium production during that time period. Production holdback of 20% allows First Helium to tap the lucrative helium “spot” market to enhance economics.

5

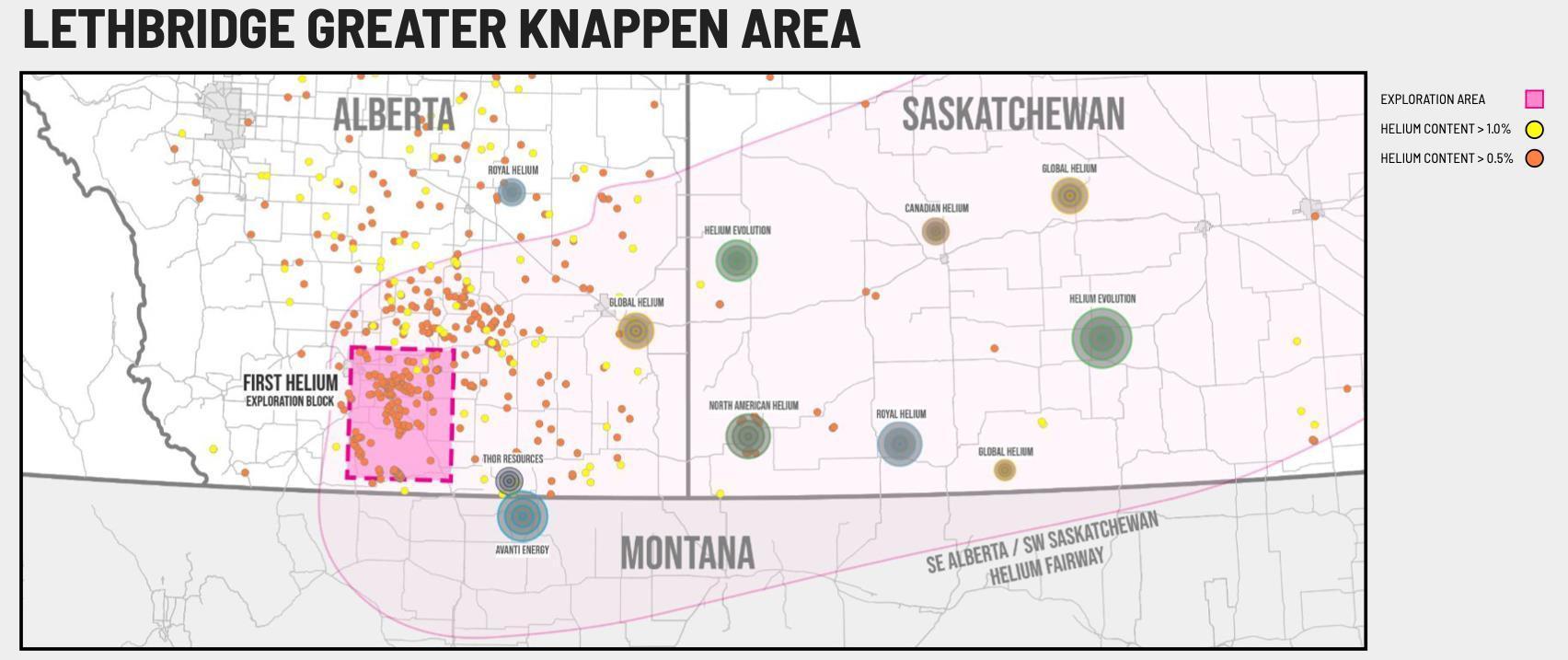

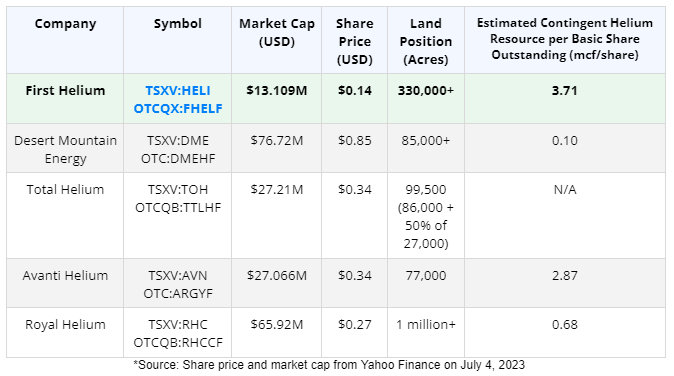

Currently Undervalued – With over 60,000 acres of 100%-owned lands, a drilled and cased potential helium target well that’s ready to be tested, numerous drilling prospects, and cash-generating oil wells, First Helium (TSXV:HELI) (OTCQX:FHELF) appears to be grossly undervalued compared to other near-production helium companies on the market, as well as their neighbors in these highly prolific helium regions.

The Escalation of Helium: Demand & Value

Helium – a powerhouse, fueling progression across a diverse range of sectors. Think medical, high-tech, industrial, science, space exploration, and manufacturing. But its influence doesn’t end there. It’s also a linchpin in the march towards cleaner energy.

As we pursue a more sustainable energy future, helium is carving out an indispensable role in the development of small modular nuclear reactors and fusion power plants.

Here’s where the crunch hits. Helium is a finite element that can’t be readily replaced. In the words of the gas industry, we’re currently in the throes of the fourth major helium shortage.

This positions emergent producers like First Helium at the heart of meeting this surging demand. What sets First Helium apart? It boasts one of the largest independent contingent resource bases in the sector.

As per the evaluation by independent firm Sproule Associates Ltd., First Helium’s Worsley discovery well carries an unrisked contingent resource estimate of a whopping 323 mmcf of helium.6

Compare this to Avanti Helium, possessing a similar published contingent resource base of 221 mmcf, but with a market cap that triples that of First Helium.

What’s more? First Helium has a strong foothold in the market with over 60,000 acres of 100%-owned lands, a potential helium target well that has been drilled and cased, and is poised for testing, along with numerous drilling prospects.

When you factor in these elements, it’s hard to dispute that First Helium appears primed for a significant breakout.

Capitalizing on Timing and Resources

At present, the future of America’s largest helium supply hangs in the balance. The Federal Helium Reserve, a key source providing approximately 40% of the world’s helium, was slated for sale in 2021. However, there’s been no announcement of a deal so far. This uncertainty over the helium supply resonates, especially with scientists projecting only 100-200 years of helium remaining at current consumption rates.

A viable area to ramp up production? Enter Canada, which recently designated helium as a critical mineral and is home to First Helium’s assets. Despite holding the world’s 5th largest prospective helium resource,6 Canada currently contributes less than 3% to the annual global helium production.

First Helium’s assets are strategically positioned in regions where helium extraction has proven successful. For instance, Avanti Helium’s Greater Knappen Property, which lies south of First Helium’s Lethbridge property, is a case in point.

Avanti has experienced helium encounters 11,12,13 in all three wells drilled on its property since permits were issued at the end of 2021. First Helium is following suit, aiming for the same formations for its inaugural exploration well at Lethbridge.

Still, the market has yet to catch on to the growth potential of First Helium (TSXV:HELI) (OTCQX:FHELF) – making this a prime opportunity for forward-looking investors.

Right now, Royal Helium, which has more than triple the land position by acreage, but less than half of First Helium’s contingent resource base at 162 mmcf, has a market valuation of more than 6X the market cap of First Helium’s.

Among its peer group, First Helium’s land position (including its option lands at Lethbridge) is second only to Royal Helium, yet it ranks at the bottom of the group in terms of market cap. And don’t forget, First Helium (TSXV:HELI) (OTCQX:FHELF) has already generated operating cash flow of $8M from producing oil discovery wells that were deployed to exploration activities.

For the 12 months ended March 31, 2022, the company brought in over $3.6M in petroleum and natural gas sales, and for the nine months ended December 31, 2022, the company generated even higher revenues of $7.5M.1

By looking at First Helium’s peers, it certainly appears that it is being undervalued. This is a company that has a respectable land position, 103 km of 2D seismic and over 16,000 acres of 3D seismic, and a significant helium resource estimate. A very strong argument can be made that First Helium’s (TSXV:HELI) (OTCQX:FHELF) valuation should be in the upper tier of the helium space. Take a look and decide for yourself:

First Helium (TSXV:HELI) (OTCQX:FHELF) has a top-tier resource, a drilled and cased potential helium well that’s ready to be tested, and numerous drilling prospects. It’s likely only a matter of time before other investors catch on.

Remember, its Worsley discovery well alone has a minimum value of over $15 million (NPV10 at $340 per mcf helium pricing).

With the current helium market ranging between $500-600 per mcf, the well’s valuation is closer to $35.5M.14 Yet, the company is currently sitting at a market valuation of roughly $16M. That’s why it’s an ideal time for investors to do their research on this company.

Big Potential with the Worsley Helium Project: Offers Low Risk, High Reward

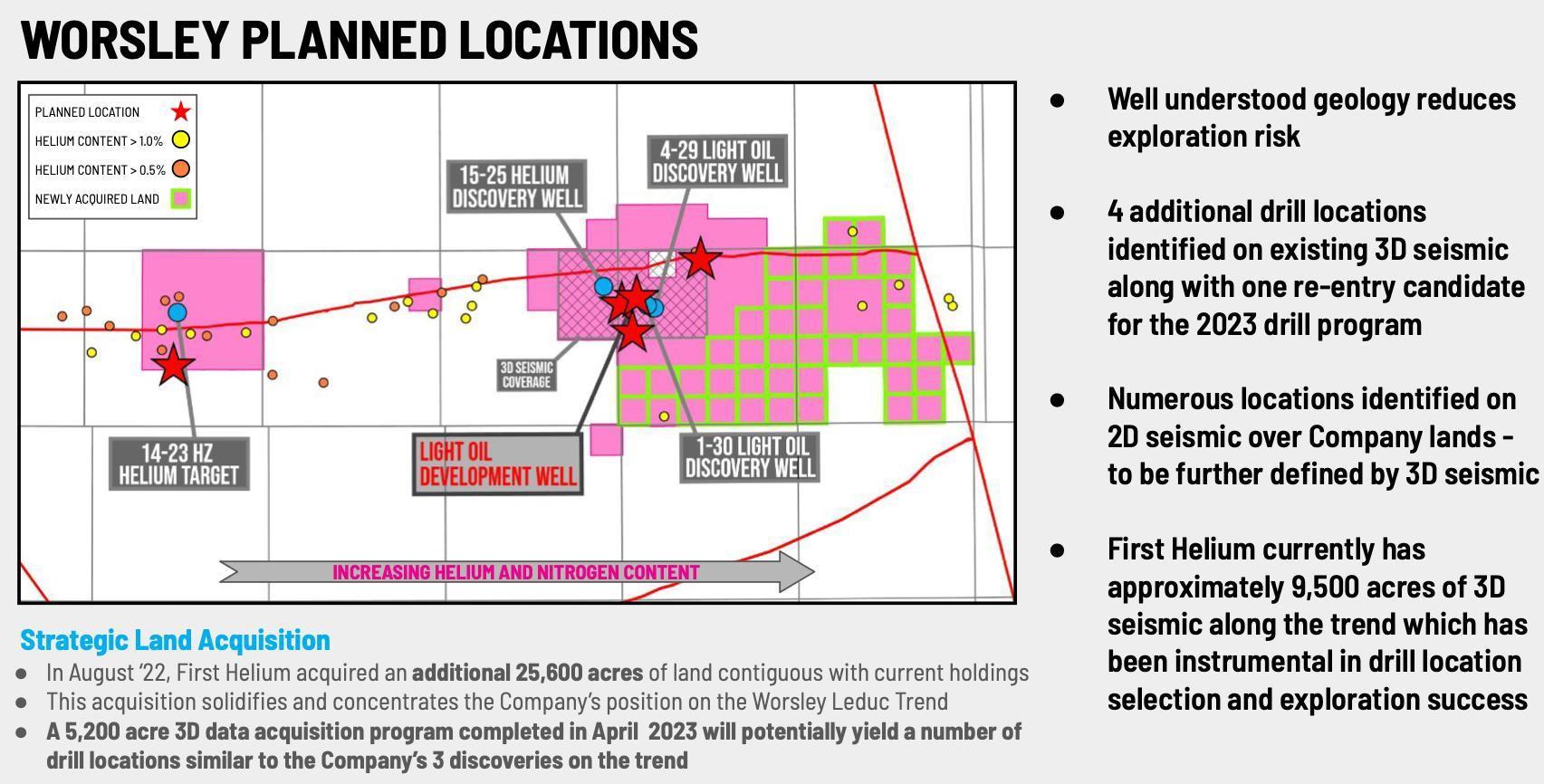

Nestled in Northwestern Alberta lies First Helium’s (TSXV:HELI) (OTCQX:FHELF) Worsley Helium Project. Spanning 60,000 contiguous acres, this project stands as a beacon of promise, underscored by their helium discovery well and two oil wells. These wells have played a key role in generating substantial cash flow, funds that have been channeled into propelling exploration activities.

The clearly defined geology of Worsley significantly mitigates exploration risks. At the heart of the project is the helium-rich 15-25 discovery well, poised for production once a modular processing facility is installed.

The project enjoys the strategic advantage of nearby existing natural gas gathering infrastructure, including 46 kms of gathering lines, which promise to expedite the project’s on-stream timing.

Press Releases

-

- First Helium Enters into Long-Term Helium Supply Agreement with Major Global Industrial Gas Company

- First Helium Exercises Option To Acquire 640 Acres Of Highly Prospective Land At East Worsley

- First Helium Commences 3D Seismic Program At Worsley

- First Helium Closes $2.4 Million Oversubscribed Private Placement

The horizontal well, 14-23, drilled as a potential helium target in the summer of 2022, is in alignment with the overarching development plan and bolsters the functionality of the helium processing facility.

As we move through 2023, First Helium (TSXV:HELI) (OTCQX:FHELF) has charted plans to extend drilling at Worsley. The preliminary engineering studies for the helium processing facility have reached completion, helium gas off-take agreements have been secured, and various financing alternatives are currently under evaluation.

First Helium’s recent acquisition of 25,000+ acres of land, contiguous with existing helium and oil discoveries, has served to further bolster its exploration land inventory and expand its footprint in the region. Together, this positions the company to achieve on-stream operations within 9-12 months from facility funding and kick-off.

SUBSCRIBE FOR TRADING INSIGHTS AND ALERTS. STAY AHEAD.

Get investment opportunities before the rest of the market in real-time.

Get this company's corporate presentation now. Subscribe to download!

Over 120,000 subscribers

Based on existing 2D and 3D seismic data, First Helium (TSXV:HELI) (OTCQX:FHELF) has identified at least four additional drill locations. New seismic data, shot in early 2023, is expected to yield additional high-quality drilling prospects. On top of that, the company possesses approximately 16,000 acres of 3D seismic data along the trend, playing a crucial role in selecting drill locations and driving exploration success.

Worsley’s de-risked resource, and ready-for-production status, coupled with the strategic land acquisitions and existing infrastructure, positions HELI very well in the helium industry for the near future and into the long term.

Remarkable Upside Potential Found at The Lethbridge Project

While the Worsley Project remains more advanced, First Helium’s (TSXV:HELI) (OTCQX:FHELF) Lethbridge Project lies within the prolific SE Alberta/SW Saskatchewan Helium Fairway, an area with a rich history of helium exploration dating back to the 1960s, and offers substantial for high-impact exploration and development.

With concentrations reaching up to 1.5% in the region’s wells, there’s significant helium potential. Similar helium-rich features have been identified at nearby Cypress Hills and Battle Creek in southwestern Saskatchewan.

Approximately 40 km to the east in close proximity to the Lethbridge Project, there’s already helium being produced at the Knappen Dome. This advantageous positioning and utilization of advanced seismic technology allows First Helium to identify and secure the most promising areas for exploration and development.

Through a strategic and meticulous approach, HELI acquired option rights to over 880,000 acres of land within the region and high-graded a select 276,000 acres for further evaluation. Leveraging the invaluable 3D seismic data that covered more than 60% of the selected 276,000 acres, the company has gained a significant exploration head start at an accelerated pace and cost-efficient basis.

The company has already identified multiple target traps within this proven productive region, balancing identifiable exploration risk with remarkable upside potential. One drill-ready location is ready for drilling later in 2023.

First Helium is Guided by a Highly Knowledgeable Leadership Team

First Helium (TSXV:HELI) (OTCQX:FHELF) boasts seasoned management who have successful track records in oil and gas exploration and production, capital markets and finance, helium project development, construction and project management, and mining exploration and development.

RECAP: 5 Reasons

to Inhale the Potential of First Helium (TSXV:HELI) (OTCQX:FHELF) Today

1

Rising Helium Demand: Helium is an invaluable resource with high value in high-profit sectors like tech, healthcare, aerospace, and industry.

2

Production Ready: First Helium (TSXV:HELI) (OTCQX:FHELF) has a helium-rich 15-25 discovery well that is fully prepared for production, pending installation of a processing facility, by early 2024. The conservative estimated value of this well exceeds $15M (NPV10 at $340 per mcf helium pricing).

3

Strong Financials: The helium-rich 15-25 discovery well offers a forecasted production profile with long life and high netback. Company’s cash-generating 1-30 and 4-29 oil discovery wells open up future exploration & development opportunities.

4

Massive Potential – The company’s 10-year, take-or-pay helium offtake sales agreement provides for potential revenue of up to US$100M.

5

Blue Sky Potential: First Helium (TSXV:HELI) (OTCQX:FHELF) possesses over 60,000 acres of fully owned lands in Northern Alberta, including a drilled and cased potential helium target well ready for testing. With numerous drilling prospects, the company appears undervalued compared to other near-production helium companies in the market.

In an era where the helium shortage and its associated risks are increasingly coming to the forefront, First Helium (TSXV:HELI) (OTCQX:FHELF) has strategically secured significant helium assets within Canada. With an extensive line-up of potential future drilling sites, this company unveils a compelling proposition of low risk with high potential.

However, the recognition of First Helium’s intrinsic value is bound to widen over time. Thus, now is an opportune moment to delve into a deeper understanding of this company. To gain comprehensive insights into First Helium (TSXV:HELI) (OTCQX:FHELF) and its forward-looking plans, feel free to subscribe below. Stay updated with their latest news and secure your personal copy of their Investor Presentation.

*All figures in CAD unless otherwise stated

SUBSCRIBE FOR TRADING INSIGHTS AND ALERTS. STAY AHEAD.

Get investment opportunities before the rest of the market in real-time.

Get this company's corporate presentation now. Subscribe to download!

Over 120,000 subscribers