- Gladiator has received assay results for additional holes drilled at the Cowley Park prospect (“Cowley Park”) comprising part of the remaining historic drill core. These results are from historical holes drilled but not previously logged or assayed and further define the continuity of the high-grade copper skarn mineralization at Cowley Park.

Results include:

- 19-CP-14: 10.3m @ 1.92% Cu and 1,459ppm Mo from 131.7m

- CP-149: 10m @ 1.07% Cu from 49m (within: 24m @ 0.63% Cu from 35m)

- CP-159: 8m @ 1.02% Cu from 105m

The interval in CP-159 represents the most south easterly intercept of copper skarn mineralization to date, with mineralization remaining open under cover.

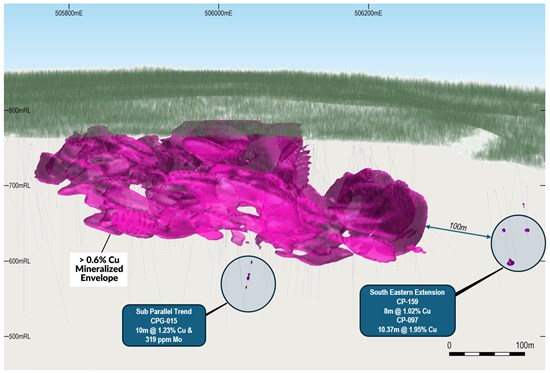

Figure 1: Isometric view of recently remodeled zone of mineralization showing position of Sub Parallel and Southeastern Extension zones of mineralization.

To view an enhanced version of this graphic, please visit:

https://images.newsfilecorp.com/files/1930/210732_3bff8c2d848a4a74_002full.jpg

- These results are from holes drilled but not previously logged or assayed by prior owners of the project, and further define the continuity of the high-grade copper skarn mineralization at Cowley Park.

- The incorporation of these results into geological modelling of the Cowley Park prospect has highlighted areas of significant exploration upside with identified targets including:

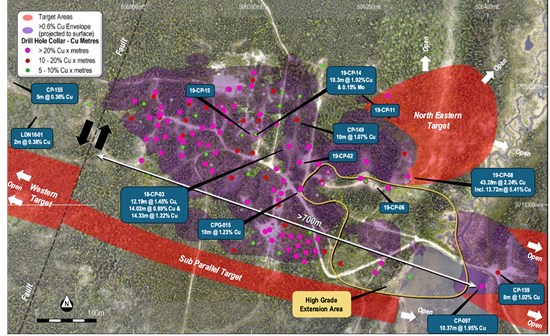

- Southeastern Extensions: The interval reported in CP-159 represents the most south easterly intercept of copper skarn mineralization reported to date, potentially extending the known mineralized system over 100m to the east, with mineralization remaining open under cover.

- Northeastern Extension: The most north easterly copper skarn intercept at Cowley Park reported to date is 43.28m @ 2.24% Cu from 93.27m with mineralization remaining open to the east under cover.

- Sub-Parallel Trends: Additional, unexplored sub-parallel trends under cover indicated by initial drilling including 10m @ 1.23% Cu from 204m in CPG-015.

- Western Extension: Recent mapping undertaken at Cowley Park has identified a significant fault that may have displaced the main mineralized body on the western side, opening up significant potential for the mineralization to extend west.

- Depth Extensions: Mineralization remains open at depth with the deepest intervals drilled to date, including 14.33m @ 1.22% Cu from 130.15m (18-CP-03) remaining open at depth

Gladiator CEO, Jason Bontempo commented:

“Results from the ongoing logging and sampling of unassayed core from exploration drilling completed in recent years has identified further, previously unreported, high-grade mineralization. The results from Gladiator’s sampling continues to define the continuity and scale of high-grade copper mineralization at Cowley Park, as well as providing further definition to the potentially significant coincident molybdenum mineralization.

These new results, combined with geological modelling of the Cowley Park prospect have highlighted multiple new areas of exploration upside under cover away from the known mineralization. These areas are key targets for summer exploration programs.

Of particular significance is the identification of the continuity of copper mineralization to the unexplored south-east of existing drill grids in CP-159.

Vancouver, British Columbia – May 28, 2024 – Gladiator Metals Corp. (TSXV:GLAD) (OTCQB:GDTRF) (FSE:ZX7) (“Gladiator” or the “Company“) is pleased to announce further results from the high-grade Cowley Park prospect at the Whitehorse Copper Project and provide an update on its exploration upside.

Cowley Park – First Time Assaying of Historic Drill Core

Gladiator has been logging and assaying historical backlogged uncut core holes drilled but not previously logged or assayed by prior owners. Gladiator has received assay results for an additional three holes drilled at the Cowley Park prospect, with results including:

- 19-CP-14: 10.3m @ 1.92% Cu and 0.1459 ppm Mo from 131.7m

- CP-149: 10m @ 1.07% Cu from 49m (within: 24m @ 0.63% Cu from 35m)

- CP-159: 8m @ 1.02% Cu from 105m

The recently returned assay results (refer Table 1 & Figure 2) continue to support Gladiator’s interpretation that mineralization at Cowley Park consists of multiple bodies, dipping shallowly to the southwest.

Recent geological modelling of the Cowley Park prospect has identified multiple areas of significant exploration upside (refer to Figure 1 below) including:

- Southeastern Extension: The interval in CP-159 represents the most south-easterly intercept of copper skarn mineralization to date with mineralization remaining open under cover.

- Northeastern Extension: The most north-easterly copper-skarn intercept at Cowley Park is 43.28m @ 2.24% Cu from 93.27m, including 13.72m @ 5.41% Cu (19-CP-08) with mineralization remaining open to the east under cover.

- Sub-Parallel Trends: Additional, unexplored sub-parallel trends under cover indicated by initial drilling including 10m @ 1.23% Cu from 204m in CPG-015.

- Western Extension: Recent mapping undertaken at Cowley Park has identified a significant fault that may have displaced the main mineralized body on the western side, opening up significant potential for the mineralization to extend west.

- Depth Extensions: Mineralization remains open at depth with the deepest intervals drilled to date, including 14.33m @ 1.22% Cu from 130.15m (18-CP-03) including 5m @ 2.78% Cu, remaining open at depth.

https://images.newsfilecorp.com/files/1930/210732_3bff8c2d848a4a74_003full.jpg

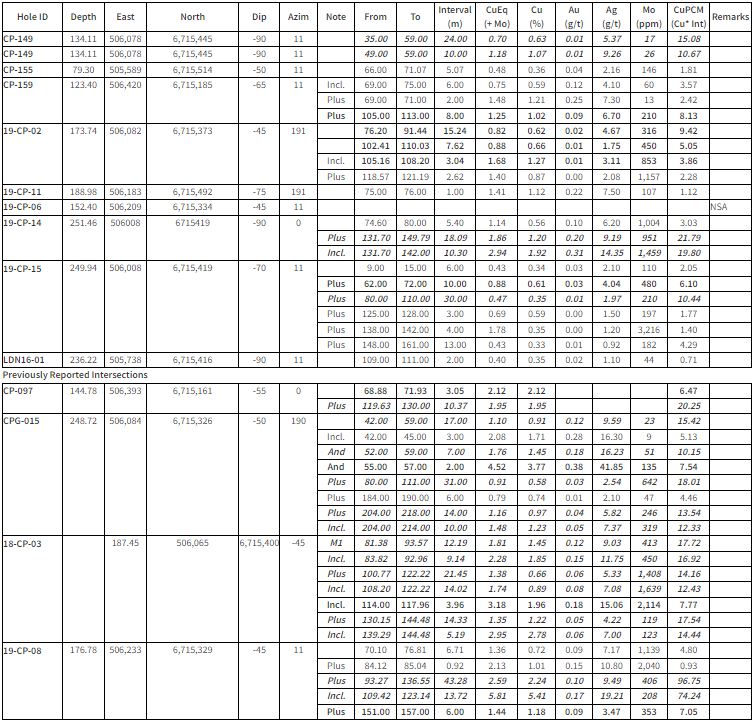

Table 1: Cowley Park Significant Intersections (Recent Logging & Sampling of Historic Holes & Intersections quoted in text and Figures in this release).

Copper Equivalent (CuEq) was based on the following assumed metal prices on the 21 April 2024 of $US 9.876 per tonne Cu, $US2,390 per Ounce Au, $US28.69 per Ounce Ag & $US43,725 per tonne Mo. Recovery is assumed to be 100% as no metallurgical test work has been completed.

For further details on quoted mineralization intersected in drilling contained in this release, plus any relevant information regarding QAQC can be found at:

- “Gladiator Discovers New Zone of Copper Mineralization at Cowley Park”

– News Release dated December 11, 2023 - “Gladiator Metals Announces Results of Maiden Drill Program at Cowley Park Copper Prospect”

– News Release dated July 24, 2023. - “Gladiator Metals Intersects Copper in Maiden Drill Campaign at Cowley Park”

– News Release dated June 5, 2023. - “Gladiator Metals Assays 32.92m @ 2.08% Copper from Historical Drill Core at Cowley Park”

– News Release dated May 15, 2023. - “Gladiator Metals Samples 12.5m @ 8.02% Copper at the Cowley Park and Commences Drilling at the Whitehorse Copper Project”

– News Release dated April 27, 2023. - “Gladiator Metal Announces Additional High-Grade Copper Drill Intercepts”

– News Release dated April 3, 2023.

QA / QC

As part of the processing and capturing of the previously unassayed drill core, Gladiator is undertaking a systematic review of the available drill core after being retrieved from storage. This includes a review of the geological logging, marking up of lineal length of the core, undertaking a comparison of the physical ticketed sampling against historic documentation where noted, remarking any notations on the core box (including hole number, box number and nominal depths) and taking core photographs.

After the systematic review, if the core is required to be sampled or resampled where it is deemed to not match the historical record of the hole, it is then marked up for sampling with a new sampling ticket that matches the submitted sample for analysis at the start of the sample interval, the drill core is then cut in half (for un-cut core) or quartered (for resampled core where required) utilizing a core saw equipped with a diamond saw blade. The core samples are then sent for analysis and the remaining half (or quarter core) retained for future reference. Certified Reference Materials (CRMs) or known blank material is placed within the sampling sequence at a nominal sampling rate of 1 in 25 samples to monitor the laboratory. Samples are submitted to the ALS Global laboratory (Canada).

Samples are then crushed to 70% passing less than 2mm before pulverizing to better than 85% passing 75 microns. Samples are then analysed by ALS method ME-ICP41 (Aqua Regia with ICP-MS finish) or ME-ICP61 (Aqua Regia with ICP-AES finish), with over limits for Cu analysed by method CU-OG46 (Aqua Regia with ICP-MS finish). Au is analysed by ALS method Au-AA25 (Ore grade Fire Assay 30g with AA finish).

As part of this process, Gladiator also captures the required sampling metadata to potentially utilize the core and analysis for any future requirements if deemed acceptable. Further drilling will need to be completed by Gladiator at some stage to confirm the reliability or usability of this data in the future including but not limited to twinning of reported mineralization. This may be required as Gladiator may not be able to confirm the accuracy of the stated drill collar location or be able to re-enter the holes to confirm depths and undertake directional surveys, or that the QA/QC might not meet the current required standards under reporting instruments, such as NI-43-101. At this point the Company is treating the data collected from this exercise as reliable for the purposes of identifying future exploration targets and may be used to inform future drilling and exploration campaigns.

In reference to historic drill results reported in this news release from the Company’s data compilation exercise, these results are historical in nature. Gladiator has not undertaken any independent investigation, nor has it independently analyzed the results of the historical exploration work in order to verify the results. The Company believes that the historical drill results currently do not conform to presently accepted industry standards. Gladiator considers these historical drill results relevant as the Company will use this data as a guide to plan future exploration and drilling programs. The Company also considers the data to be reliable for these purposes, however, the Company’s future exploration work will include verification of the data through drilling. Please refer to the Company’s previous news releases regarding Cowley Park for further details.

Where Copper Equivalents have been stated, Assumptions of the pricing are referenced in the tabulated results and recovery is assumed to be 100% as no metallurgical data is available. The following equation was used to calculate copper equivalence:

Copper Equivalent (CuEq) = ((Cu% * CuPrice 1% Per Tonne) + (Au (g/t) x (AuPrice/31.105)) + (Ag (g/t) x (AgPrice/31.105)) +(Mo% * MoPrice 1% Per Tonne)) / CuPrice 1% Per Tonne

Qualified Person

All scientific and technical information in this news release has been prepared or reviewed and approved by Kell Nielsen, a “qualified person” as defined by NI 43-101.

ON BEHALF OF THE BOARD

“Jason Bontempo“

Jason Bontempo

President and CEO

For further information contact:

Dustin Zinger, Investor Relations

+1-604-653-9464

[email protected]

Neither the TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

This news release does not constitute an offer to sell or a solicitation of an offer to sell any of the securities in the United States. The securities have not been and will not be registered under the United States Securities Act of 1933, as amended (the “U.S. Securities Act“) or any state securities laws and may not be offered or sold within the United States or to U.S. Persons unless registered under the U.S. Securities Act and applicable state securities laws or an exemption from such registration is available.

Certain of the statements and information in this news release constitute “forward-looking statements” or “forward-looking information”. Any statements or information that express or involve discussions with respect to predictions, expectations, beliefs, plans, projections, objectives, assumptions or future events or performance (often, but not always, using words or phrases such as “expects”, “anticipates”, “believes”, “plans”, “estimates”, “intends”, “targets”, “goals”, “forecasts”, “objectives”, “potential” or variations thereof or stating that certain actions, events or results “may”, “could”, “would”, “might” or “will” be taken, occur or be achieved, or the negative of any of these terms and similar expressions) that are not statements of historical fact may be forward-looking statements or information.

Forward-looking statements or information are subject to a variety of known and unknown risks, uncertainties and other factors that could cause actual events or results to differ from those reflected in the forward-looking statements or information, including, without limitation, the need for additional capital by the Company through financings, and the risk that such funds may not be raised; the speculative nature of exploration and the stages of the Company’s properties; the effect of changes in commodity prices; regulatory risks that development of the Company’s material properties will not be acceptable for social, environmental or other reasons; availability of equipment (including drills) and personnel to carry out work programs; and that each stage of work will be completed within expected time frames. This list is not exhaustive of the factors that may affect any of the Company’s forward-looking statements or information. Although the Company has attempted to identify important factors that could cause actual results to differ materially, there may be other factors that cause results not to be as anticipated, estimated, described or intended. Accordingly, readers should not place undue reliance on forward-looking statements or information.

The Company’s forward-looking statements and information are based on the assumptions, beliefs, expectations and opinions of management as of the date of this news release, and other than as required by applicable securities laws, the Company does not assume any obligation to update forward-looking statements and information if circumstances or management’s assumptions, beliefs, expectations or opinions should change, or changes in any other events affecting such statements or information.

Featured Image: Freepik

Disclosure:

1) The author of the Article, or members of the author’s immediate household or family, do not own any securities of the companies set forth in this Article. The author determined which companies would be included in this article based on research and understanding of the sector.

2) The Article was issued on behalf of and sponsored by, Gladiator Metals Corp. Market Jar Media Inc. has or expects to receive from Gladiator Metals Corp.’s Digital Marketing Agency of Record (Native Ads Inc.) one hundred twenty one thousand and five hundred ninety American dollars for 23 days (33 business days).

3) Statements and opinions expressed are the opinions of the author and not Market Jar Media Inc., its directors or officers. The author is wholly responsible for the validity of the statements. The author was not paid by Market Jar Media Inc. for this Article. Market Jar Media Inc. was not paid by the author to publish or syndicate this Article. Market Jar has not independently verified or otherwise investigated all such information. None of Market Jar or any of their respective affiliates, guarantee the accuracy or completeness of any such information. The information provided above is for informational purposes only and is not a recommendation to buy or sell any security. Market Jar Media Inc. requires contributing authors to disclose any shareholdings in, or economic relationships with, companies that they write about. Market Jar Media Inc. relies upon the authors to accurately provide this information and Market Jar Media Inc. has no means of verifying its accuracy.

4) The Article does not constitute investment advice. All investments carry risk and each reader is encouraged to consult with his or her individual financial professional. Any action a reader takes as a result of the information presented here is his or her own responsibility. By opening this page, each reader accepts and agrees to Market Jar Media Inc.’s terms of use and full legal disclaimer as set forth here. This Article is not a solicitation for investment. Market Jar Media Inc. does not render general or specific investment advice and the information on PressReach.com should not be considered a recommendation to buy or sell any security. Market Jar Media Inc. does not endorse or recommend the business, products, services or securities of any company mentioned on PressReach.com.

5) Market Jar Media Inc. and its respective directors, officers and employees hold no shares for any company mentioned in the Article.

6) This document contains forward-looking information and forward-looking statements, within the meaning of applicable Canadian securities legislation, (collectively, “forward-looking statements”), which reflect management’s expectations regarding Gladiator Metals Corp.’s future growth, future business plans and opportunities, expected activities, and other statements about future events, results or performance. Wherever possible, words such as “predicts”, “projects”, “targets”, “plans”, “expects”, “does not expect”, “budget”, “scheduled”, “estimates”, “forecasts”, “anticipate” or “does not anticipate”, “believe”, “intend” and similar expressions or statements that certain actions, events or results “may”, “could”, “would”, “might” or “will” be taken, occur or be achieved, or the negative or grammatical variation thereof or other variations thereof, or comparable terminology have been used to identify forward-looking statements. These forward-looking statements include, among other things, statements relating to: (a) revenue generating potential with respect to Gladiator Metals Corp.’s industry; (b) market opportunity; (c) Gladiator Metals Corp.’s business plans and strategies; (d) services that Gladiator Metals Corp. intends to offer; (e) Gladiator Metals Corp.’s milestone projections and targets; (f) Gladiator Metals Corp.’s expectations regarding receipt of approval for regulatory applications; (g) Gladiator Metals Corp.’s intentions to expand into other jurisdictions including the timeline expectations relating to those expansion plans; and (h) Gladiator Metals Corp.’s expectations with regarding its ability to deliver shareholder value. Forward-looking statements are not a guarantee of future performance and are based upon a number of estimates and assumptions of management in light of management’s experience and perception of trends, current conditions and expected developments, as well as other factors that management believes to be relevant and reasonable in the circumstances, as of the date of this document including, without limitation, assumptions about: (a) the ability to raise any necessary additional capital on reasonable terms to execute Gladiator Metals Corp.’s business plan; (b) that general business and economic conditions will not change in a material adverse manner; (c) Gladiator Metals Corp.’s ability to procure equipment and operating supplies in sufficient quantities and on a timely basis; (d) the accuracy of budgeted costs and expenditures; (e) Gladiator Metals Corp.’s ability to attract and retain skilled personnel; (f) political and regulatory stability; (g) the receipt of governmental, regulatory and third-party approvals, licenses and permits on favorable terms; (h) changes in applicable legislation; (i) stability in financial and capital markets; and (j) expectations regarding the level of disruption to as a result of CV-19. Such forward-looking information involves a variety of known and unknown risks, uncertainties and other factors which may cause the actual plans, intentions, activities, results, performance or achievements of Gladiator Metals Corp. to be materially different from any future plans, intentions, activities, results, performance or achievements expressed or implied by such forward-looking statements. Such risks include, without limitation: (a) Gladiator Metals Corp.’s operations could be adversely affected by possible future government legislation, policies and controls or by changes in applicable laws and regulations; (b) public health crises such as CV-19 may adversely impact Gladiator Metals Corp.’s business; (c) the volatility of global capital markets; (d) political instability and changes to the regulations governing Gladiator Metals Corp.’s business operations (e) Gladiator Metals Corp. may be unable to implement its growth strategy; and (f) increased competition.

Except as required by law, Gladiator Metals Corp. undertakes no obligation to update or revise any forward-looking statements, whether as a result of new information, future event or otherwise, after the date on which the statements are made or to reflect the occurrence of unanticipated events. Neither does Gladiator Metals Corp. nor any of its representatives make any representation or warranty, express or implied, as to the accuracy, sufficiency or completeness of the information in this document. Neither Gladiator Metals Corp. nor any of its representatives shall have any liability whatsoever, under contract, tort, trust or otherwise, to you or any person resulting from the use of the information in this document by you or any of your representatives or for omissions from the information in this document.

7) Any graphs, tables or other information demonstrating the historical performance or current or historical attributes of Gladiator Metals Corp. or any other entity contained in this document are intended only to illustrate historical performance or current or historical attributes of Gladiator Metals Corp. or such entities and are not necessarily indicative of future performance of Gladiator Metals Corp. or such entities.

8) Investing is risky. The information provided in this article should not be considered as a substitute for professional financial consultation. Users should be aware that investing in any form carries inherent risks, and as such, there is a possibility of losing some or all of their investment. The value of investments can fluctuate significantly within a short period, and investors must understand that past performance is not indicative of future results. Additionally, users should exercise caution as transactions involving investments may be irreversible, even in cases of fraud or accidental actions. It is crucial to acknowledge that rapidly evolving laws and technical issues can have adverse effects on the usability, transferability, exchangeability, and value of investments. Furthermore, users must be cognizant of potential security risks associated with their investment activities. Individuals are strongly encouraged to conduct thorough research, seek professional advice, and carefully evaluate their risk tolerance before engaging in any investment endeavors. Market Jar Media Inc. is neither an investment adviser nor a broker-dealer. The information presented on the website is provided for informative purposes only and is not to be treated as a recommendation to make any specific investment. No such information on PressReach.com constitutes advice or a recommendation.