LONDON, ON, April 23, 2024 – Abitibi Metals Corp. (CSE:AMQ) (OTCQB:AMQFF) (FSE:FW0) (“Abitibi” or the “Company”) is pleased to announce that it has successfully completed its Phase 1 maiden drill program at the B26 Polymetallic Deposit (“B26”, the “Project” or the “Deposit”). On November 16th, 2023, the Company entered into an option agreement on the B26 Polymetallic Deposit to earn 80% over 7 years from SOQUEM Inc. (“SOQUEM”), a subsidiary of Investissement Québec (see news release dated November 16, 2023).

44 diamond drill holes were completed totalling 13,502 metres under the first phase of a fully funded 50,000‑metre, 2024-2025 drill program. To-date, assay results from the first 10 holes have been released; assay results for the remaining 34 drill holes are expected over the coming weeks and will be released once received and compiled. The Company intends to recommence drilling activities in early June once the winter break-up concludes and Phase 2 targeting is finalized.

Highlights from the Phase 1 Program include:

- B26 Main Deposit: 36 holes were completed, totalling 10,469.5 metres, to evaluate the open pit potential and potential up-dip near-surface extensions of the Main Deposit to the north and infill gaps in the model.

- Satellite West: 5 holes were completed, totalling 1,716 metres, targeting the geometric continuity of a potential satellite zone 500 metres to the west of the Main Deposit.

- Eastern Extension: 3 holes were completed, totalling 1,317 metres, targeting the expansion of the main deposit to the east where 2.45% Cu Eq over 26.7 metres, including 4.74% CuEq over 11.7 metres (1274-14-167) was intercepted in historical drilling.

- Phase 1 highlight intervals to date include:

-

- #1274-24-293: 2.6% CuEq over 37.0 metres beginning at 106 metres depth, including 6.3% CuEq over 10.6 metres

- #1274-24-294: 2.5% CuEq over 61.3 metres beginning at 128.6 metres depth, including 11.4% CuEq over 10.6 metres

- #1274-24-300: 5.35% CuEq over 8.1 metres beginning at 251.5 metres depth

- #1274-24-301: 1.47% CuEq over 97.5 metres beginning at 30.5 metres depth, including 3.9% CuEq over 21.9 metres

Jonathon Deluce, CEO of Abitibi Metals, commented, “We are thrilled with these initial results of our maiden drill program at the B26 Polymetallic Copper Deposit. We had initially planned to drill 2,750 metres but with the continued success in drilling and support from our shareholders, we expanded our maiden program to 13,500 metres, larger than our initial total program for 2024.”

Mr. Deluce continued: “The significance of this program cannot be understated. Part of our thesis when we optioned B26 was to assess the potential open-pit component that could be added to the historical underground resource. Our strategy for this maiden program was to primarily concentrate on high-priority targets within the Main Deposit to a depth of 300 metres, and the results from #293, #294, #300 and #301, which identified significant near-surface high metal factor zones, support our thesis of assessing the open-pit potential at B26 further. With the recently completed financing bringing our total treasury to approximately $19 million, we are well-positioned to build on this maiden program with a further 36,500 metres to be drilled into 2025. I look forward to sharing the remaining results in the coming weeks as we prepare for the next phase of drilling in the Spring of 2024.”

The Company’s 2024 strategy moving forward to develop B26 will be focused on five milestones:

- 16,500+ metres of drilling. With 13,500 metres completed, the Company anticipates drilling a further 16,500 metres in 2024 as part of the total 50,000 metres fully funded into 2025.

- Updated Internal Resource & 3D Model: The Company recently announced its first 3D model of the Project, integrating data from its maiden program with the 115,000+ metres drilled by SOQUEM. The new 3D geological model represents a fundamental evolution in the understanding of the geological controls of mineralization within the B26 Deposit, and is expected to inform and improve confidence in an updated internal mineral resource estimate, which is currently underway.

- Gravity Survey: The Company is planning a Gravity Survey grid to cover extensions of the VMS contact to help model the geology, primarily the mafic-felsic contacts and sulphide-rich environment, in order to target new mineralized extensions and satellites close to the surface and at a moderate depth (300 to 600 metres). This is aligned with our first-year objective of improving our understanding of the Project. Eventually, an integrated geophysics approach could deliver additional discoveries on the property.

- Evaluation of Assay Preparation: In the 2018 resource estimate, SGS recommended QAQC protocols to explain the replicability for the four metals (Au-Cu-Ag-Zn). The Company has set up a series of assaying protocols with the objective to control QAQC issues from the beginning of the project. As a result, samples are crushed finer with 95% of particles passing 1.7 mm and a large split of 1 kg is pulverized down to 106 µm (150 mesh). The Company believes that these adjustments will help to better evaluate the higher-grade areas of the deposit as shown in the results of drillhole 1274-24-293 which represents the potential opportunity to increase the grade within areas of the deposit. The Company is reviewing historical intercepts to determine areas for re-assaying to be able to define more precisely higher grade lenses inside the deposit

- Additional Sampling of Historical Core: In the 2018 resource estimate, SGS identified 8,300 metres of historical unassayed core within the mineralized corridor. The Company plans to start assaying these identified areas to complete the model and help better determine the boundaries of the deposit.

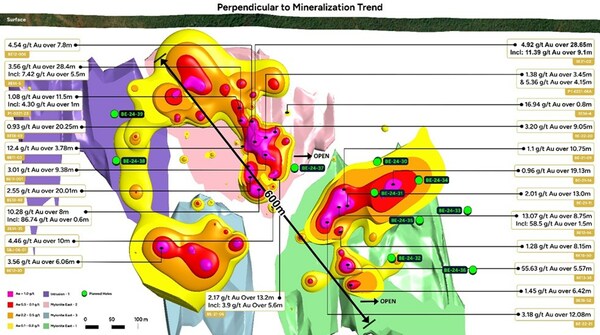

The Company is pleased to announce that drilling continues at the Beschefer Gold Project 7 km to the northeast of the B26 Deposit. To date, the Company has focused drilling on the “East Zone”, where 5 holes totalling 1,679 metres have been completed as of April 22, 2024 and is on track to complete 2,975 metres across 10 holes. The East Zone hosts some of the highest historical intercepts, including 55.63 g/t gold over 5.57 metres and 13.07 g/t gold over 8.75 metres.

Located within the prolific Abitibi Greenstone Belt, B26 comprises 66 claims covering 3,328 hectares in the Eeyou Istchee Baie-James territory and represents a substantial opportunity to develop a copper, zinc, gold, and silver Polymetallic Deposit in a region with a rich history of base and precious metal production, which includes the Detour and Casa Berardi Mines. There is year-round road access with a power line running through the Project.

Abitibi is the first public company with the option to earn into the B26 Deposit, which has a strike length of 1 km and depth extent of 0.8 km, both of which are open to expansion. Abitibi will focus on delivering shareholder value with an aggressive exploration approach, including a fully financed approximate 50,000 metres of drilling in 2024 and 2025 that will focus on advancing the historical 2018 resource1 while testing its open-pit potential.

Property Highlights Include:

- Historical 2018 resource prepared by SGS Canada Inc. for SOQUEM Inc. that includes 254 holes over 115,311 meters, advancing the asset to a significant resource that includes, across all categories, 400 million pounds of copper, 286,000 ounces of gold, and significant zinc silver exposure.

- B26 Historical Resource Summary1 (2018)

-

- Indicated: 6.97 Mt at 2.94% Cu Eq (1.32% Cu, 1.80% Zn, 0.60 g/t Au and 43 g/t Ag)

- Inferred: 4.41 Mt at 2.97% Cu Eq (2.03% Cu, 0.22% Zn, 1.07 g/t Au and 9 g/t Ag)

- Historical drilling by SOQUEM has established the continuity down to a vertical depth of 800 meters and the deposit remains open at depth and laterally with strong historical intercepts including:

-

- 2.32% Cu Eq over 89.5 metres (1274-13-117)

- 3.05% Cu Eq over 48.1 metres (1274-16-224)

- 8.95% Cu Eq over 11.5 metres (1274-14-152)

- The B26 deposit is situated within 7 km of the historical Selbaie Mine, a Polymetallic Deposit with a variety of mineralization styles and element combination, that had a historical resource of 56.9 Mt @ 0.87% Cu, 1.85% Zn, 0.55 g/t Au, 39 g/t Ag (CONSOREM 2012). Reference to this nearby property is for information only, and there are no assurances that the Company will achieve the same results at the B26 Deposit.

Information contained in this press release was reviewed and approved by Martin Demers, P.Geo., OGQ No. 770, who is a qualified person as defined under National Instrument 43-101, and responsible for the technical information provided in this news release.

Abitibi Metals Corp. is a Quebec-focused mineral acquisition and exploration company focused on the development of quality base and precious metal properties that are drill-ready with high-upside and expansion potential. Abitibi’s portfolio of strategic properties provides target-rich diversification and includes the option to earn 80% of the high-grade B26 Polymetallic Deposit, which hosts a historical resource estimate1 of 7.0MT @ 2.94% Cu Eq (Ind) & 4.4MT @ 2.97% Cu Eq (Inf), and the Beschefer Gold Project, where historical drilling has identified 4 historical intercepts with a metal factor of over 100 g/t gold highlighted by 55.63 g/t gold over 5.57 metres and 13.07 g/t gold over 8.75 metres amongst four modelled zones.

SOQUEM, a subsidiary of Investissement Québec, is dedicated to promoting the exploration, discovery and development of mining properties in Quebec. SOQUEM also contributes to maintaining strong local economies. Proud partner and ambassador for the development of Quebec’s mineral wealth, SOQUEM relies on innovation, research and strategic minerals to be well-positioned for the future.

ON BEHALF OF THE BOARD

Jonathon Deluce, Chief Executive Officer

The Company also maintains an active presence on various social media platforms to keep stakeholders and the general public informed and encourages shareholders and interested parties to follow and engage with the Company through the following channels to stay updated with the latest news, industry insights, and corporate announcements:

Twitter: https://twitter.com/AbitibiMetals

LinkedIn: https://www.linkedin.com/company/abitibi-metals-corp-amq-c/

Neither the Canadian Securities Exchange nor its Regulation Services Provider accepts responsibility for the adequacy or accuracy of this release.

Note 1: A qualified person has not done sufficient work to classify the historical estimate as current mineral resources or mineral reserves. The issuer is not treating the historical estimate as current mineral resources or mineral reserves. Source: Rapport Technique NI 43-101 Estimation des Ressources Projet B26, Québec, For SOQUEM Inc., By SGS Canada Inc., Yann Camus, ing., Olivier Vadnais-Leblanc, géo., SGS Canada – Geostat., Effective Date: April 18, 2018, Date of Report : May 11, 2018

Note 2: Copper Equivalent values were calculated using metal prices of $4.00/lb Cu, $1.50/lb Zn, $20.00/ounce Ag and $1,800/ounce Au. Metal recoveries of 100% are applied in the copper equivalent calculation. The application of a copper equivalent is a comparison measure used to level variable metal ratios. Results are not related to the recoveries and by virtue of the value of a mining production.

Note 3 – Sources:

Fayard, Q, Mercier-Langevin, P., Wodicka, N., Daigneault, R., & Perreault, S. (2020). The B26 Cu-Zn-Ag-Au Project, Brouillan Volcanic Complex, Abitibi Greenstone Belt, Part 1: Geological Setting and Geochronology.

Fayard, Q. (2020). CONTRÔLES VOLCANIQUES, HYDROTHERMAUX ET STRUCTURAUX SUR LA NATURE ET LA DISTRIBUTION DES MÉTAUX USUELS ET PRÉCIEUX DANS LES ZONES MINÉRALISÉES DU PROJET B26, COMPLEXE VOLCANIQUE DE BROUILLAN, ABITIBI, QUÉBEC.

This news release contains certain statements, which may constitute “forward-looking information” within the meaning of applicable securities laws. Forward-looking information involves statements that are not based on historical information but rather relate to future operations, strategies, financial results or other developments on the B26 Project or otherwise. Forward-looking information is necessarily based upon estimates and assumptions, which are inherently subject to significant business, economic and competitive uncertainties and contingencies, many of which are beyond the Company’s control and many of which, regarding future business decisions, are subject to change. These uncertainties and contingencies can affect actual results and could cause actual results to differ materially from those expressed in any forward-looking statements made by or on the Company’s behalf. Although Abitibi has attempted to identify important factors that could cause actual actions, events or results to differ materially from those described in forward-looking information, there may be other factors that cause actions, events or results to differ from those anticipated, estimated or intended. All factors should be considered carefully, and readers should not place undue reliance on Abitibi’s forward-looking information. Generally, forward-looking information can be identified by the use of forward-looking terminology such as “expects,” “estimates,” “anticipates,” or variations of such words and phrases (including negative and grammatical variations) or statements that certain actions, events or results “may,” “could,” “might” or “occur. Mineral exploration and development are highly speculative and are characterized by a number of significant inherent risks, which may result in the inability of the Company to successfully develop current or proposed projects for commercial, technical, political, regulatory or financial reasons, or if successfully developed, may not remain economically viable for their mine life owing to any of the foregoing reasons, among others. There is no assurance that the Company will be successful in achieving commercial mineral production and the likelihood of success must be considered in light of the stage of operations.

SOURCE Abitibi Metals Corp.

For further information: please call 226-271-5170, email [email protected], or visit https://www.abitibimetals.com.

Featured Image: Freepik

Disclosure:

1) The author of the Article, or members of the author’s immediate household or family, do not own any securities of the companies set forth in this Article. The author determined which companies would be included in this article based on research and understanding of the sector.

2) The Article was issued on behalf of and sponsored by, Abitibi Metals Corp. Market. Jar Media Inc. has or expects to receive from Abitibi Metals Corp.’s Digital Marketing Agency of Record (Native Ads Inc.) ninety six thousand five hundred USD for 24 days (18 business days).

3) Statements and opinions expressed are the opinions of the author and not Market Jar Media Inc., its directors or officers. The author is wholly responsible for the validity of the statements. The author was not paid by Market Jar Media Inc. for this Article. Market Jar Media Inc. was not paid by the author to publish or syndicate this Article. Market Jar has not independently verified or otherwise investigated all such information. None of Market Jar or any of their respective affiliates, guarantee the accuracy or completeness of any such information. The information provided above is for informational purposes only and is not a recommendation to buy or sell any security. Market Jar Media Inc. requires contributing authors to disclose any shareholdings in, or economic relationships with, companies that they write about. Market Jar Media Inc. relies upon the authors to accurately provide this information and Market Jar Media Inc. has no means of verifying its accuracy.

4) The Article does not constitute investment advice. All investments carry risk and each reader is encouraged to consult with his or her individual financial professional. Any action a reader takes as a result of the information presented here is his or her own responsibility. By opening this page, each reader accepts and agrees to Market Jar Media Inc.’s terms of use and full legal disclaimer as set forth here. This Article is not a solicitation for investment. Market Jar Media Inc. does not render general or specific investment advice and the information on pressreach.com should not be considered a recommendation to buy or sell any security. Market Jar Media Inc. does not endorse or recommend the business, products, services or securities of any company mentioned on pressreach.com.

5) Market Jar Media Inc. and its respective directors, officers and employees hold no shares for any company mentioned in the Article.

6) This document contains forward-looking information and forward-looking statements, within the meaning of applicable Canadian securities legislation, (collectively, “forward-looking statements”), which reflect management’s expectations regarding Abitibi Metals Corp.’s future growth, future business plans and opportunities, expected activities, and other statements about future events, results or performance. Wherever possible, words such as “predicts”, “projects”, “targets”, “plans”, “expects”, “does not expect”, “budget”, “scheduled”, “estimates”, “forecasts”, “anticipate” or “does not anticipate”, “believe”, “intend” and similar expressions or statements that certain actions, events or results “may”, “could”, “would”, “might” or “will” be taken, occur or be achieved, or the negative or grammatical variation thereof or other variations thereof, or comparable terminology have been used to identify forward-looking statements. These forward-looking statements include, among other things, statements relating to: (a) revenue generating potential with respect to Abitibi Metals Corp.’s industry; (b) market opportunity; (c) Abitibi Metals Corp.’s business plans and strategies; (d) services that Abitibi Metals Corp. intends to offer; (e) Abitibi Metals Corp.’s milestone projections and targets; (f) Abitibi Metals Corp.’s expectations regarding receipt of approval for regulatory applications; (g) Abitibi Metals Corp.’s intentions to expand into other jurisdictions including the timeline expectations relating to those expansion plans; and (h) Abitibi Metals Corp.’s expectations with regarding its ability to deliver shareholder value. Forward-looking statements are not a guarantee of future performance and are based upon a number of estimates and assumptions of management in light of management’s experience and perception of trends, current conditions and expected developments, as well as other factors that management believes to be relevant and reasonable in the circumstances, as of the date of this document including, without limitation, assumptions about: (a) the ability to raise any necessary additional capital on reasonable terms to execute Abitibi Metals Corp.’s business plan; (b) that general business and economic conditions will not change in a material adverse manner; (c) Abitibi Metals Corp.’s ability to procure equipment and operating supplies in sufficient quantities and on a timely basis; (d) Abitibi Metals Corp.’s ability to enter into contractual arrangements with additional parties; (e) the accuracy of budgeted costs and expenditures; (f) Abitibi Metals Corp.’s ability to attract and retain skilled personnel; (g) political and regulatory stability; (h) the receipt of governmental, regulatory and third-party approvals, licenses and permits on favorable terms; (i) changes in applicable legislation; (j) stability in financial and capital markets; and (k) expectations regarding the level of disruption to as a result of CV-19. Such forward-looking information involves a variety of known and unknown risks, uncertainties and other factors which may cause the actual plans, intentions, activities, results, performance or achievements of Abitibi Metals Corp. to be materially different from any future plans, intentions, activities, results, performance or achievements expressed or implied by such forward-looking statements. Such risks include, without limitation: (a) Abitibi Metals Corp.’s operations could be adversely affected by possible future government legislation, policies and controls or by changes in applicable laws and regulations; (b) public health crises such as CV-19 may adversely impact Abitibi Metals Corp.’s business; (c) the volatility of global capital markets; (d) political instability and changes to the regulations governing Abitibi Metals Corp.’s business operations (e) Abitibi Metals Corp. may be unable to implement its growth strategy; and (f) increased competition.

Except as required by law, Abitibi Metals Corp. undertakes no obligation to update or revise any forward-looking statements, whether as a result of new information, future event or otherwise, after the date on which the statements are made or to reflect the occurrence of unanticipated events. Neither does Abitibi Metals Corp. nor any of its representatives make any representation or warranty, express or implied, as to the accuracy, sufficiency or completeness of the information in this document. Neither Abitibi Metals Corp. nor any of its representatives shall have any liability whatsoever, under contract, tort, trust or otherwise, to you or any person resulting from the use of the information in this document by you or any of your representatives or for omissions from the information in this document.

7) Any graphs, tables or other information demonstrating the historical performance or current or historical attributes of Abitibi Metals Corp. or any other entity contained in this document are intended only to illustrate historical performance or current or historical attributes of Abitibi Metals Corp. or such entities and are not necessarily indicative of future performance of Abitibi Metals Corp. or such entities.

8) Investing is risky. The information provided in this article should not be considered as a substitute for professional financial consultation. Users should be aware that investing in any form carries inherent risks, and as such, there is a possibility of losing some or all of their investment. The value of investments can fluctuate significantly within a short period, and investors must understand that past performance is not indicative of future results. Additionally, users should exercise caution as transactions involving investments may be irreversible, even in cases of fraud or accidental actions. It is crucial to acknowledge that rapidly evolving laws and technical issues can have adverse effects on the usability, transferability, exchangeability, and value of investments. Furthermore, users must be cognizant of potential security risks associated with their investment activities. Individuals are strongly encouraged to conduct thorough research, seek professional advice, and carefully evaluate their risk tolerance before engaging in any investment endeavors. Market Jar Media Inc. is neither an investment adviser nor a broker-dealer. The information presented on the website is provided for informative purposes only and is not to be treated as a recommendation to make any specific investment. No such information on PressReach.com constitutes advice or a recommendation.