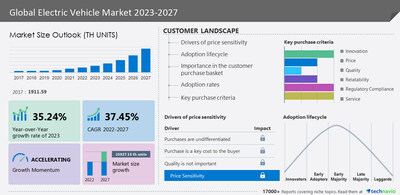

NEW YORK, June 29, 2023 /PRNewswire/ — The electric vehicle market size is estimated to grow by 25,927.15 thousand units during 2022-2027. The growth momentum will progress at a CAGR of 37.45% during the forecast period. The market is segmented by type (BEV and PHEV), charging (normal charging and supercharging), and geography (APAC, Europe, North America, South America, and Middle East and Africa). The market share growth by the BEV segment will be significant during the forecast period. A battery electric vehicle (BEV) is an EV powered by a battery and unlike the PHEV model, the only source of propulsion is the battery, which generates the power required by the vehicle. Rather than a fuel tank, a large battery is used to store the required energy to function the electric motor. As of 2019, some of the most popular models of BEV available in the market are Tesla Model 3, Nissan LEAF, and Renault ZOE. Some of the advantages of using BEVs are from the vendor point of view, due to its ease of manufacturing, BEV is one of the most manufactured vehicle types, When compared with PHEV, it requires considerably less expertise and capital; as BEV contains only one motor and a battery, there are fewer components in this model which makes the maintenance simple when compared with the counterparts; and most notably BEVs do not produce emissions, and therefore, they are called zero-emission vehicles. Such advantages are expected to drive the demand for BEVs during the forecast period. Download a Sample Report Now!

Electric Vehicle (EV) Market Insights –

- Vendors: 15+, Including Aspark Co. Ltd., BMW AG, BYD Electronic Co. Ltd., Canoo Inc., Ford Motor Co., General Motors Co, Hero Ecotech Ltd., Hyundai Motor Co., Mercedes Benz Group AG, Nissan Motor Co. Ltd., Renault SAS, Rivian Automotive Inc., Sinotruk Hong Kong Ltd., Stellantis NV, Tesla Inc., Toyota Motor Corp., Volkswagen AG, AB Volvo, Honda Motor Co. Ltd., and Mahindra and Mahindra Ltd., among others

- Coverage: Parent market analysis; key drivers, major trends, and challenges; customer and vendor landscape; vendor product insights and recent developments; key vendors; and market positioning of vendors

- Segments: Type (BEV and PHEV) and geography (APAC, Europe, North America, South America, and the Middle East and Africa)

To understand more about the Electric Vehicle (EV) Market request a sample report

Electric vehicle market – Vendor Insights

The growing competition in the market is compelling vendors to adopt various growth strategies such as promotional activities and spending on advertisements to improve the visibility of their services. Technavio report analyzes the market’s competitive landscape and offers information on several market vendors including Aspark Co. Ltd., BMW AG, BYD Electronic Co. Ltd., Canoo Inc., Ford Motor Co., General Motors Co, Hero Ecotech Ltd., Hyundai Motor Co., Mercedes Benz Group AG, Nissan Motor Co. Ltd., Renault SAS, Rivian Automotive Inc., Sinotruk Hong Kong Ltd., Stellantis NV, Tesla Inc., Toyota Motor Corp., Volkswagen AG, AB Volvo, Honda Motor Co. Ltd., and Mahindra and Mahindra Ltd.

Electric Vehicle Market – Market Dynamics

Major Trends –

Charging stations powered by renewable energy is an emerging trend shaping the electric vehicle market growth. Globally, there is a shift toward sustainable and energy-efficient modes of transport, and EVs are slowly becoming popular. The demand for electricity will significantly rise with more fleet operators opting for the electrification of vehicles and more consumers owning EVs. Thus, with the rising demand for electricity, utility companies are anticipated to shift to an alternative source of electricity. To address the growing electricity demands is to use renewable energy as an alternative and it’s a cost-efficient and practical solution. Also, the steady reduction in the cost of renewable power generation will make electricity an attractive low-cost source to drive the transport sector. The rising adoption of renewable energy will further drive the global EV market as the burden on the power grid will be lesser. Therefore, the use of renewable energy to power the EV charging stations is expected to decrease the burden of electricity generation from the power grid and make the electrification technology more environmentally friendly. Hence, such factors will drive the market growth during the forecast period.

KEY challenges –

The high manufacturing cost of EVs is a major challenge hindering the electric vehicle market growth. The cost of manufacturing EVs is higher than gas-powered vehicles, which is considered a significant barrier to the growth of the global market and the high cost of production limits the automakers from manufacturing more units of EVs. Similarly, for many consumers, the high price of EVs makes them less affordable, particularly in countries with low economic growth. Also, the lack of awareness among consumers about different incentives provided by the government adds up to the anxiety in consumers about buying EVs. However, the cost factor remains a major concern and a significant factor for consumers while buying vehicles. Therefore, the high cost of EVs is potentially a challenge to the growth of the global market during the forecast period.

Drivers, & Challenges have an impact on market dynamics and can impact businesses. Find some insights from a sample report!

The electric vehicle market report provides critical information and factual data, with a qualitative and quantitative study of the market based on market drivers and limitations as well as future prospects.

Why Buy?

- Add credibility to strategy

- Analyzes competitor’s offerings

- Get a holistic view of the market

Grow your profit margin with Technavio- Buy the Report

What are the key data covered in this Electric Vehicle Market report?

- CAGR of the market during the forecast period

- Detailed information on factors that will drive the growth of the electric vehicle market between 2023 and 2027

- Precise estimation of the size of the electric vehicle market size and its contribution to the market in focus on the parent market

- Accurate predictions about upcoming trends and changes in consumer behaviour

- Growth of the electric vehicle market industry across APAC, Europe, North America, South America, and the Middle East and Africa

- A thorough analysis of the market’s competitive landscape and detailed information about vendors

- Comprehensive analysis of factors that will challenge the growth of electric vehicle market vendors

Gain instant access to 17,000+ market research reports.

Technavio’s SUBSCRIPTION platform

Related Reports:

The global micro electric vehicle (EV) Market is estimated to grow at a CAGR of 8.02% between 2022 and 2027. The size of the market is forecast to increase by 1,542.22 thousand units. This t report extensively covers market segmentation by type (golf and micro cars and quadricycle), application (commercial, personal, and public utilities), and geography (North America, APAC, Europe, South America, and Middle East and Africa). Technological advances in lithium-ion battery manufacturing and minimal maintenance costs leading to improved reliability are key factors driving the growth of the global micro electric vehicle (EV) market.

The military hybrid electric vehicle (HEV) and electric vehicle (EV) market is estimated to grow at a CAGR of 14.36% between 2022 and 2027 and the size of the market is forecast to increase by USD 8.48 billion. This report extensively covers market segmentation by product (manned military HEV and EV and unmanned military HEV and EV), type (AC charging and DC charging), and geography (North America, APAC, Europe, South America, and Middle East and Africa). Push toward the adoption of green (eco-friendly) vehicles is the key factor driving the growth of the global military hybrid electric vehicle (HEV) and electric vehicle (EV) market.

|

Electric Vehicle Market Scope |

|

|

Report Coverage |

Details |

|

Base year |

2022 |

|

Historic period |

2017-2021 |

|

Forecast period |

2023-2027 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 37.45% |

|

Market growth 2023-2027 |

25,927.15 thousand units |

|

Market structure |

Fragmented |

|

YoY growth 2022-2023 (%) |

35.24 |

|

Regional analysis |

APAC, Europe, North America, South America, and Middle East and Africa |

|

Performing market contribution |

APAC at 46% |

|

Key countries |

US, China, Japan, Norway, and Germany |

|

Competitive landscape |

Leading Vendors, Market Positioning of Vendors, Competitive Strategies, and Industry Risks |

|

Key companies profiled |

Aspark Co. Ltd., BMW AG, BYD Electronic Co. Ltd., Canoo Inc., Ford Motor Co., General Motors Co, Hero Ecotech Ltd., Hyundai Motor Co., Mercedes Benz Group AG, Nissan Motor Co. Ltd., Renault SAS, Rivian Automotive Inc., Sinotruk Hong Kong Ltd., Stellantis NV, Tesla Inc., Toyota Motor Corp., Volkswagen AG, AB Volvo, Honda Motor Co. Ltd., and Mahindra and Mahindra Ltd. |

|

Market dynamics |

Parent market analysis, Market growth inducers and obstacles, Fast-growing and slow-growing segment analysis, COVID-19 impact and recovery analysis and future consumer dynamics, Market condition analysis for the forecast period |

|

Customization purview |

If our report has not included the data that you are looking for, you can reach out to our analysts and get segments customized. |

Table of contents

1 Executive Summary

- 1.1 Market overview

- Exhibit 01: Executive Summary – Chart on Market Overview

- Exhibit 02: Executive Summary – Data Table on Market Overview

- Exhibit 03: Executive Summary – Chart on Global Market Characteristics

- Exhibit 04: Executive Summary – Chart on Market by Geography

- Exhibit 05: Executive Summary – Chart on Market Segmentation by Type

- Exhibit 06: Executive Summary – Chart on Market Segmentation by Charging

- Exhibit 07: Executive Summary – Chart on Incremental Growth

- Exhibit 08: Executive Summary – Data Table on Incremental Growth

- Exhibit 09: Executive Summary – Chart on Vendor Market Positioning

2 Market Landscape

- 2.1 Market ecosystem

- Exhibit 10: Parent market

- Exhibit 11: Market Characteristics

3 Market Sizing

- 3.1 Market definition

- Exhibit 12: Offerings of vendors included in the market definition

- 3.2 Market segment analysis

- Exhibit 13: Market segments

- 3.3 Market size 2022

- 3.4 Market outlook: Forecast for 2022-2027

- Exhibit 14: Chart on Global – Market size and forecast 2022-2027 (thousand units)

- Exhibit 15: Data Table on Global – Market size and forecast 2022-2027 (thousand units)

- Exhibit 16: Chart on Global Market- Year-over-year growth 2022-2027 (%)

- Exhibit 17: Data Table on Global Market- Year-over-year growth 2022-2027 (%)

4 Historic Market Size

- 4.1 Global electric vehicle market 2017 – 2021

- Exhibit 18: Historic Market Size – Data Table on Global electric vehicle market 2017 – 2021 (thousand units)

- 4.2 Type Segment Analysis 2017 – 2021

- Exhibit 19: Historic Market Size – Type Segment 2017 – 2021 (thousand units)

- 4.3 Charging Segment Analysis 2017 – 2021

- Exhibit 20: Historic Market Size – Charging Segment 2017 – 2021 (thousand units)

- 4.4 Geography Segment Analysis 2017 – 2021

- Exhibit 21: Historic Market Size – Geography Segment 2017 – 2021 (thousand units)

- 4.5 Country Segment Analysis 2017 – 2021

- Exhibit 22: Historic Market Size – Country Segment 2017 – 2021 (thousand units)

5 Five Forces Analysis

- 5.1 Five forces summary

- Exhibit 23: Five forces analysis – Comparison between 2022 and 2027

- 5.2 Bargaining power of buyers

- Exhibit 24: Chart on Bargaining power of buyers – Impact of key factors 2022 and 2027

- 5.3 Bargaining power of suppliers

- Exhibit 25: Bargaining power of suppliers – Impact of key factors in 2022 and 2027

- 5.4 Threat of new entrants

- Exhibit 26: Threat of new entrants – Impact of key factors in 2022 and 2027

- 5.5 Threat of substitutes

- Exhibit 27: Threat of substitutes – Impact of key factors in 2022 and 2027

- 5.6 Threat of rivalry

- Exhibit 28: Threat of rivalry – Impact of key factors in 2022 and 2027

- 5.7 Market condition

- Exhibit 29: Chart on Market condition – Five forces 2022 and 2027

6 Market Segmentation by Type

- 6.1 Market segments

- Exhibit 30: Chart on Type – Market share 2022-2027 (%)

- Exhibit 31: Data Table on Type – Market share 2022-2027 (%)

- 6.2 Comparison by Type

- Exhibit 32: Chart on Comparison by Type

- Exhibit 33: Data Table on Comparison by Type

- 6.3 BEV – Market size and forecast 2022-2027

- Exhibit 34: Chart on BEV – Market size and forecast 2022-2027 (thousand units)

- Exhibit 35: Data Table on BEV – Market size and forecast 2022-2027 (thousand units)

- Exhibit 36: Chart on BEV – Year-over-year growth 2022-2027 (%)

- Exhibit 37: Data Table on BEV – Year-over-year growth 2022-2027 (%)

- 6.4 PHEV – Market size and forecast 2022-2027

- Exhibit 38: Chart on PHEV – Market size and forecast 2022-2027 (thousand units)

- Exhibit 39: Data Table on PHEV – Market size and forecast 2022-2027 (thousand units)

- Exhibit 40: Chart on PHEV – Year-over-year growth 2022-2027 (%)

- Exhibit 41: Data Table on PHEV – Year-over-year growth 2022-2027 (%)

- 6.5 Market opportunity by Type

- Exhibit 42: Market opportunity by Type (thousand units)

7 Market Segmentation by Charging

- 7.1 Market segments

- Exhibit 43: Chart on Charging – Market share 2022-2027 (%)

- Exhibit 44: Data Table on Charging – Market share 2022-2027 (%)

- 7.2 Comparison by Charging

- Exhibit 45: Chart on Comparison by Charging

- Exhibit 46: Data Table on Comparison by Charging

- 7.3 Normal charging – Market size and forecast 2022-2027

- Exhibit 47: Chart on Normal charging – Market size and forecast 2022-2027 (thousand units)

- Exhibit 48: Data Table on Normal charging – Market size and forecast 2022-2027 (thousand units)

- Exhibit 49: Chart on Normal charging – Year-over-year growth 2022-2027 (%)

- Exhibit 50: Data Table on Normal charging – Year-over-year growth 2022-2027 (%)

- 7.4 Super charging – Market size and forecast 2022-2027

- Exhibit 51: Chart on Super charging – Market size and forecast 2022-2027 (thousand units)

- Exhibit 52: Data Table on Super charging – Market size and forecast 2022-2027 (thousand units)

- Exhibit 53: Chart on Super charging – Year-over-year growth 2022-2027 (%)

- Exhibit 54: Data Table on Super charging – Year-over-year growth 2022-2027 (%)

- 7.5 Market opportunity by Charging

- Exhibit 55: Market opportunity by Charging (thousand units)

8 Customer Landscape

- 8.1 Customer landscape overview

- Exhibit 56: Analysis of price sensitivity, lifecycle, customer purchase basket, adoption rates, and purchase criteria

9 Geographic Landscape

- 9.1 Geographic segmentation

- Exhibit 57: Chart on Market share by geography 2022-2027 (%)

- Exhibit 58: Data Table on Market share by geography 2022-2027 (%)

- 9.2 Geographic comparison

- Exhibit 59: Chart on Geographic comparison

- Exhibit 60: Data Table on Geographic comparison

- 9.3 APAC – Market size and forecast 2022-2027

- Exhibit 61: Chart on APAC – Market size and forecast 2022-2027 (thousand units)

- Exhibit 62: Data Table on APAC – Market size and forecast 2022-2027 (thousand units)

- Exhibit 63: Chart on APAC – Year-over-year growth 2022-2027 (%)

- Exhibit 64: Data Table on APAC – Year-over-year growth 2022-2027 (%)

- 9.4 Europe – Market size and forecast 2022-2027

- Exhibit 65: Chart on Europe – Market size and forecast 2022-2027 (thousand units)

- Exhibit 66: Data Table on Europe – Market size and forecast 2022-2027 (thousand units)

- Exhibit 67: Chart on Europe – Year-over-year growth 2022-2027 (%)

- Exhibit 68: Data Table on Europe – Year-over-year growth 2022-2027 (%)

- 9.5 North America – Market size and forecast 2022-2027

- Exhibit 69: Chart on North America – Market size and forecast 2022-2027 (thousand units)

- Exhibit 70: Data Table on North America – Market size and forecast 2022-2027 (thousand units)

- Exhibit 71: Chart on North America – Year-over-year growth 2022-2027 (%)

- Exhibit 72: Data Table on North America – Year-over-year growth 2022-2027 (%)

- 9.6 South America – Market size and forecast 2022-2027

- Exhibit 73: Chart on South America – Market size and forecast 2022-2027 (thousand units)

- Exhibit 74: Data Table on South America – Market size and forecast 2022-2027 (thousand units)

- Exhibit 75: Chart on South America – Year-over-year growth 2022-2027 (%)

- Exhibit 76: Data Table on South America – Year-over-year growth 2022-2027 (%)

- 9.7 Middle East and Africa – Market size and forecast 2022-2027

- Exhibit 77: Chart on Middle East and Africa – Market size and forecast 2022-2027 (thousand units)

- Exhibit 78: Data Table on Middle East and Africa – Market size and forecast 2022-2027 (thousand units)

- Exhibit 79: Chart on Middle East and Africa – Year-over-year growth 2022-2027 (%)

- Exhibit 80: Data Table on Middle East and Africa – Year-over-year growth 2022-2027 (%)

- 9.8 China – Market size and forecast 2022-2027

- Exhibit 81: Chart on China – Market size and forecast 2022-2027 (thousand units)

- Exhibit 82: Data Table on China – Market size and forecast 2022-2027 (thousand units)

- Exhibit 83: Chart on China – Year-over-year growth 2022-2027 (%)

- Exhibit 84: Data Table on China – Year-over-year growth 2022-2027 (%)

- 9.9 US – Market size and forecast 2022-2027

- Exhibit 85: Chart on US – Market size and forecast 2022-2027 (thousand units)

- Exhibit 86: Data Table on US – Market size and forecast 2022-2027 (thousand units)

- Exhibit 87: Chart on US – Year-over-year growth 2022-2027 (%)

- Exhibit 88: Data Table on US – Year-over-year growth 2022-2027 (%)

- 9.10 Norway – Market size and forecast 2022-2027

- Exhibit 89: Chart on Norway – Market size and forecast 2022-2027 (thousand units)

- Exhibit 90: Data Table on Norway – Market size and forecast 2022-2027 (thousand units)

- Exhibit 91: Chart on Norway – Year-over-year growth 2022-2027 (%)

- Exhibit 92: Data Table on Norway – Year-over-year growth 2022-2027 (%)

- 9.11 Japan – Market size and forecast 2022-2027

- Exhibit 93: Chart on Japan – Market size and forecast 2022-2027 (thousand units)

- Exhibit 94: Data Table on Japan – Market size and forecast 2022-2027 (thousand units)

- Exhibit 95: Chart on Japan – Year-over-year growth 2022-2027 (%)

- Exhibit 96: Data Table on Japan – Year-over-year growth 2022-2027 (%)

- 9.12 Germany – Market size and forecast 2022-2027

- Exhibit 97: Chart on Germany – Market size and forecast 2022-2027 (thousand units)

- Exhibit 98: Data Table on Germany – Market size and forecast 2022-2027 (thousand units)

- Exhibit 99: Chart on Germany – Year-over-year growth 2022-2027 (%)

- Exhibit 100: Data Table on Germany – Year-over-year growth 2022-2027 (%)

- 9.13 Market opportunity by geography

- Exhibit 101: Market opportunity by geography (thousand units)

10 Drivers, Challenges, and Trends

- 10.1 Market drivers

- 10.2 Market challenges

- 10.3 Impact of drivers and challenges

- Exhibit 102: Impact of drivers and challenges in 2022 and 2027

- 10.4 Market trends

11 Vendor Landscape

- 11.1 Overview

- 11.2 Vendor landscape

- Exhibit 103: Overview on Criticality of inputs and Factors of differentiation

- 11.3 Landscape disruption

- Exhibit 104: Overview on factors of disruption

- 11.4 Industry risks

- Exhibit 105: Impact of key risks on business

12 Vendor Analysis

- 12.1 Vendors covered

- Exhibit 106: Vendors covered

- 12.2 Market positioning of vendors

- Exhibit 107: Matrix on vendor position and classification

- 12.3 Aspark Co. Ltd.

- Exhibit 108: Aspark Co. Ltd. – Overview

- Exhibit 109: Aspark Co. Ltd. – Product / Service

- Exhibit 110: Aspark Co. Ltd. – Key offerings

- 12.4 BMW AG

- Exhibit 111: BMW AG – Overview

- Exhibit 112: BMW AG – Business segments

- Exhibit 113: BMW AG – Key offerings

- Exhibit 114: BMW AG – Segment focus

- 12.5 BYD Electronic Co. Ltd.

- Exhibit 115: BYD Electronic Co. Ltd. – Overview

- Exhibit 116: BYD Electronic Co. Ltd. – Business segments

- Exhibit 117: BYD Electronic Co. Ltd. – Key news

- Exhibit 118: BYD Electronic Co. Ltd. – Key offerings

- Exhibit 119: BYD Electronic Co. Ltd. – Segment focus

- 12.6 Canoo Inc.

- Exhibit 120: Canoo Inc. – Overview

- Exhibit 121: Canoo Inc. – Business segments

- Exhibit 122: Canoo Inc. – Key offerings

- Exhibit 123: Canoo Inc. – Segment focus

- 12.7 Ford Motor Co.

- Exhibit 124: Ford Motor Co. – Overview

- Exhibit 125: Ford Motor Co. – Business segments

- Exhibit 126: Ford Motor Co. – Key news

- Exhibit 127: Ford Motor Co. – Key offerings

- Exhibit 128: Ford Motor Co. – Segment focus

- 12.8 General Motors Co

- Exhibit 129: General Motors Co – Overview

- Exhibit 130: General Motors Co – Business segments

- Exhibit 131: General Motors Co – Key news

- Exhibit 132: General Motors Co – Key offerings

- Exhibit 133: General Motors Co – Segment focus

- 12.9 Hero Ecotech Ltd.

- Exhibit 134: Hero Ecotech Ltd. – Overview

- Exhibit 135: Hero Ecotech Ltd. – Product / Service

- Exhibit 136: Hero Ecotech Ltd. – Key offerings

- 12.10 Honda Motor Co. Ltd.

- Exhibit 137: Honda Motor Co. Ltd. – Overview

- Exhibit 138: Honda Motor Co. Ltd. – Business segments

- Exhibit 139: Honda Motor Co. Ltd. – Key news

- Exhibit 140: Honda Motor Co. Ltd. – Key offerings

- Exhibit 141: Honda Motor Co. Ltd. – Segment focus

- 12.11 Hyundai Motor Co.

- Exhibit 142: Hyundai Motor Co. – Overview

- Exhibit 143: Hyundai Motor Co. – Business segments

- Exhibit 144: Hyundai Motor Co. – Key news

- Exhibit 145: Hyundai Motor Co. – Key offerings

- Exhibit 146: Hyundai Motor Co. – Segment focus

- 12.12 Mahindra and Mahindra Ltd.

- Exhibit 147: Mahindra and Mahindra Ltd. – Overview

- Exhibit 148: Mahindra and Mahindra Ltd. – Business segments

- Exhibit 149: Mahindra and Mahindra Ltd. – Key news

- Exhibit 150: Mahindra and Mahindra Ltd. – Key offerings

- Exhibit 151: Mahindra and Mahindra Ltd. – Segment focus

- 12.13 Mercedes Benz Group AG

- Exhibit 152: Mercedes Benz Group AG – Overview

- Exhibit 153: Mercedes Benz Group AG – Business segments

- Exhibit 154: Mercedes Benz Group AG – Key offerings

- Exhibit 155: Mercedes Benz Group AG – Segment focus

- 12.14 Nissan Motor Co. Ltd.

- Exhibit 156: Nissan Motor Co. Ltd. – Overview

- Exhibit 157: Nissan Motor Co. Ltd. – Business segments

- Exhibit 158: Nissan Motor Co. Ltd. – Key news

- Exhibit 159: Nissan Motor Co. Ltd. – Key offerings

- Exhibit 160: Nissan Motor Co. Ltd. – Segment focus

- 12.15 Renault SAS

- Exhibit 161: Renault SAS – Overview

- Exhibit 162: Renault SAS – Product / Service

- Exhibit 163: Renault SAS – Key news

- Exhibit 164: Renault SAS – Key offerings

- 12.16 Stellantis NV

- Exhibit 165: Stellantis NV – Overview

- Exhibit 166: Stellantis NV – Business segments

- Exhibit 167: Stellantis NV – Key news

- Exhibit 168: Stellantis NV – Key offerings

- Exhibit 169: Stellantis NV – Segment focus

- 12.17 Tesla Inc.

- Exhibit 170: Tesla Inc. – Overview

- Exhibit 171: Tesla Inc. – Business segments

- Exhibit 172: Tesla Inc. – Key news

- Exhibit 173: Tesla Inc. – Key offerings

- Exhibit 174: Tesla Inc. – Segment focus

13 Appendix

- 13.1 Scope of the report

- 13.2 Inclusions and exclusions checklist

- Exhibit 175: Inclusions checklist

- Exhibit 176: Exclusions checklist

- 13.3 Currency conversion rates for US$

- Exhibit 177: Currency conversion rates for US$

- 13.4 Research methodology

- Exhibit 178: Research methodology

- Exhibit 179: Validation techniques employed for market sizing

- Exhibit 180: Information sources

- 13.5 List of abbreviations

- Exhibit 181: List of abbreviations

About Us

Technavio is a leading global technology research and advisory company. Their research and analysis focuses on emerging market trends and provide actionable insights to help businesses identify market opportunities and develop effective strategies to optimize their market positions. With over 500 specialized analysts, Technavio’s report library consists of more than 17,000 reports and counting, covering 800 technologies, spanning 50 countries. Their client base consists of enterprises of all sizes, including more than 100 Fortune 500 companies. This growing client base relies on Technavio’s comprehensive coverage, extensive research, and actionable market insights to identify opportunities in existing and potential markets and assess their competitive positions within changing market scenarios.

Contact

Technavio Research

Jesse Maida

Media & Marketing Executive

US: +1 844 364 1100

UK: +44 203 893 3200

Email: [email protected]

Website: www.technavio.com

![]() View original content to download multimedia:https://www.prnewswire.com/news-releases/electric-vehicle-market-to-grow-at-a-cagr-of-37-45-from-2022-to-2027-charging-stations-powered-by-renewable-energy-is-the-primary-trend-shaping-the-market-report-technavio-301866517.html

View original content to download multimedia:https://www.prnewswire.com/news-releases/electric-vehicle-market-to-grow-at-a-cagr-of-37-45-from-2022-to-2027-charging-stations-powered-by-renewable-energy-is-the-primary-trend-shaping-the-market-report-technavio-301866517.html

SOURCE Technavio

Featured image: I Stock © oonal