It’s not every day we see a gold bull run quite as spectacular as this.

Everyone knows that gold shines the brightest when the world is uncertain… but this year it’s been on fire.

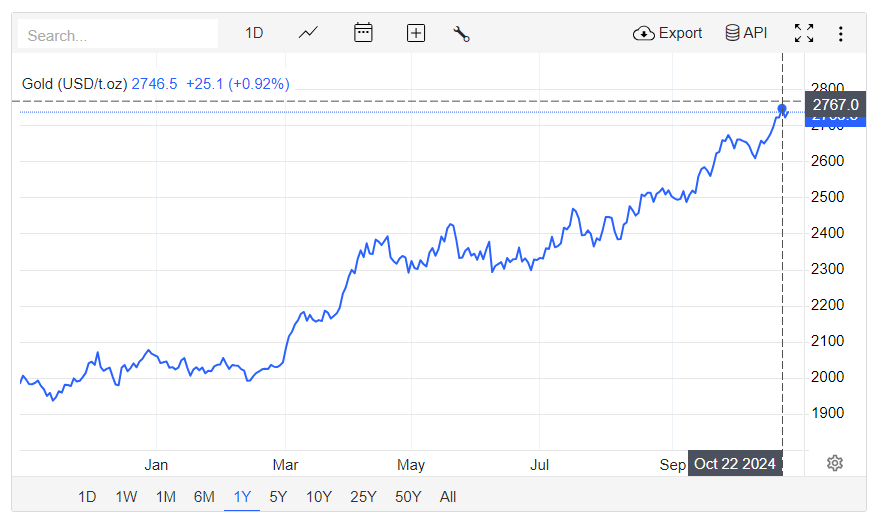

Gold Price – 10 Years

Record high of $2,767 per ounce in October 2024

Source: Trading Economics (Oct. 24, 2024)1

Source: Trading Economics (Oct. 24, 2024)1

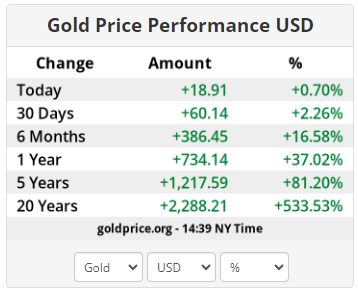

Source: Goldprice.org (Oct. 24, 2024)2

Source: Goldprice.org (Oct. 24, 2024)2

But the craziest part is, it’s just the beginning.

Citigroup, Goldman Sachs and Bank of America all see gold hitting $3,000 by mid-2025.3

All signs point to further gains for gold – the looming US election and massive spending plans creating a national debt spiral,4 a weakening US dollar,5 Fed interest rate cuts.6

Global economic uncertainties and geopolitical conflicts are only adding fuel to gold’s rise.7

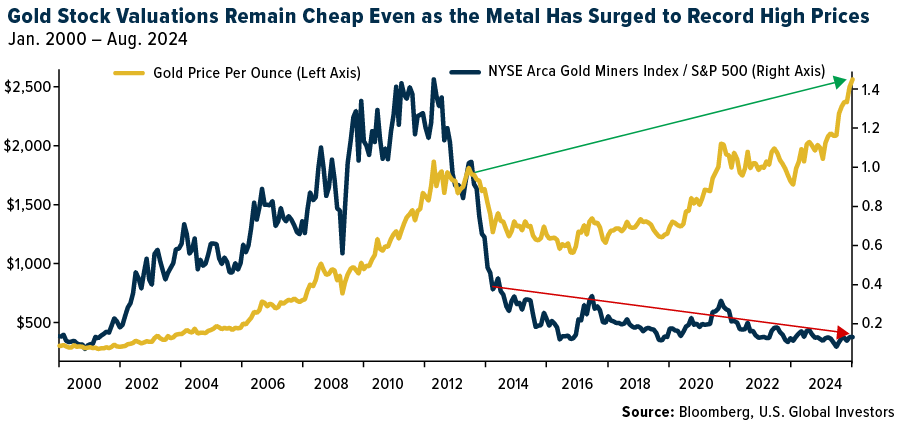

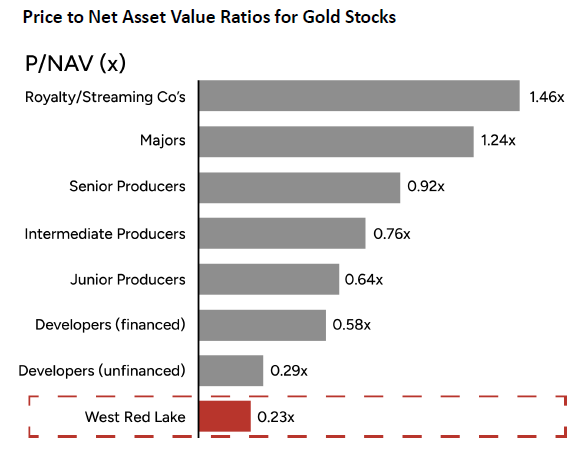

But while the metal is soaring, gold mining stocks are still significantly undervalued, offering even greater upside potential.

Chart Source: Mining.com8

Chart Source: Mining.com8

“In our opinion, the investment case for gold mining equities is clear and compelling… Gold mining stock valuations are the lowest in 25 years.”

– John Hathaway, CFA Managing Partner, Sprott Inc.9

So, why are gold stocks undervalued and what could ignite the breakout?

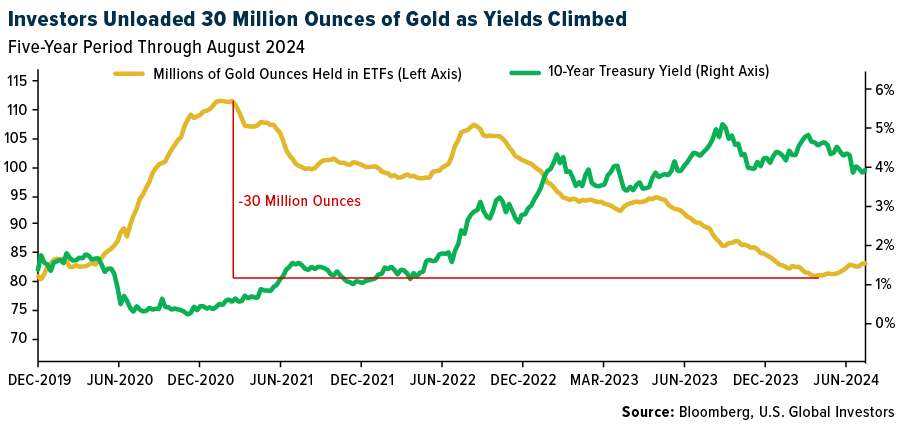

The answer starts with high interest rates, which triggered a slow gold sell-off earlier this year, leading investors to offload roughly 30 million ounces of gold.

Chart Source: Mining.com10

But as the chart above shows, the gold selloff seen in the West over the past four years is now reversing11

Here’s where the details start to really matter.

While Western investors were unloading gold, Chinese investors were buying it, rotating from underperforming assets like stocks and real estate. This pushed gold prices higher, but Chinese investors weren’t buying gold stocks, leading to their decline.

Now, the big picture is changing again – Western investors are once again paying attention to gold.

Why? Classic prompts for investors to hedge in gold – falling rates, political uncertainty, debt fears, and a disconnect between the stock market and the economy – are all now, suddenly, in play.

We can see it in the price of gold, which is on fire.

Most gold stocks, though, have yet to catch up, creating an opportunity that’s hard to ignore.

The last time gold mining stocks were this undervalued was in 2015, when profit margins were at a slim 12%.

Today, thanks to record gold prices, profit margins are nearing 40%,12 setting the stage for a massive breakout.

Once Q3 results are released and institutional investors realize the profit potential, we could see a surge in demand for gold stocks – especially since they know gold stocks have historically demonstrated greater gains than physical gold during bull markets.13

That could mean significant gains for savvy investors who get in early, especially in hotspots like Canada’s Red Lake district.

Just ask Kinross Gold, who made a billion-dollar investment in the region.14

But Kinross is huge, expensive, and doesn’t have anywhere near the upside potential of a junior miner targeting near-term gold production in the region, like West Red Lake Gold Mines Ltd. (TSXV:WRLG) (OTCQB:WRLGF).

Restarting a Proven Gold Mine in 2025

West Red Lake Gold Mines (TSXV:WRLG) (OTCQB:WRLGF) is moving toward gold production with a targeted restart in 2025 at its Madsen Gold Mine in Canada’s Red Lake Gold District.

That puts them on a short and desirable list since very few gold companies are starting an initial mine or significantly increasing their production over the next 12 months.

It also means West Red Lake Gold Mines (TSXV:WRLG) (OTCQB:WRLGF) – as a developer for now – is trading at a substantial discount to producers.

Source: West Red Lake Gold Mines15

Source: West Red Lake Gold Mines15

Their mine and 1.65-million-ounce resource sits on a nearly 80 km2 (31 sq mile) land package with highly prospective exploration targets, in a world class gold district, and contains what Mining.com has called one of the world’s highest-grade, undeveloped gold projects.16

The mine is fully permitted, has historic production of 2.5 million ounces of gold,17 and represents a significant high-grade resource of 1.65 million ounces (Moz) of gold (Au) at 7.4 g/t in 6.9 million tonnes (Indicated) and 366 Koz at 6.3 g/t Au (Inferred).18

This company has heavyweight investors backing it, including legendary industry financier Frank Giustra, who owns a 9.4% stake.19

West Red Lake Gold Mines’ (TSXV:WRLG) (OTCQB:WRLGF) leadership team is stacked with industry pros from billion-dollar gold producers, like Eldorado Gold, Coeur Mining, Detour Gold/Agnico Eagle Mines, Endeavour Mining, and Barrick Gold.

The company’s CEO, Shane Williams, was COO of Skeena Resources when it advanced the past producing Eskay Creek Gold project toward a restart. Before that Williams was VP of Operations at Eldorado Gold, where he led builds of mines in Quebec, Turkey, and Greece. One of their Directors, Anthony Makuch, was CEO of Kirkland Lake Gold when it increased annual gold production by over 340% from 315 Koz to over 1.4 Moz.20

It takes time, expertise, and cash to start up a mine, even one that has lots of infrastructure already in place. West Red Lake Gold Mines Ltd. (TSXV:WRLG) (OTCQB:WRLGF) recently tackled the funding part of that challenge through a C$68 million finance package that will fully fund Madsen into commercial production.21

This capital is a major derisking step for Madsen. The package is a US$35 million debt facility and a C$20 million financing – that attracted strong investor interest and was immediately upsized to C$25 million.

There is immense activity underway at the Madsen Mine site and West Red Lake Gold’s news flow testifies to that.

West Red Lake Gold regularly issues drill results from its ongoing definition drill program where they are actively drilling from underground to further define its gold deposit before mining begins. The company also has two rigs operating on the surface to explore potential new discoveries.

The company is also test mining to prepare for full operations, which includes blasting a 1.2-km tunnel to connect areas of the mine, restarting the mill, and building essential infrastructure like a camp and maintenance shop to ensure efficient future production.

SUBSCRIBE FOR TRADING INSIGHTS AND ALERTS. STAY AHEAD.

Get investment opportunities before the rest of the market in real-time.

Get this company's corporate presentation now. Subscribe to download!

Over 120,000 subscribers

11 Criteria

for a Standout Gold Stock Opportunity

1

Strong Market: gold prices are up 41%+ in the last year22 and forecast to hit $3000 by mid-202523

2

World-Class Location: high-grade Red Lake Gold District with 30 Moz produced to date24

3

Top-Tier Assets: fully permitted Madsen Mine with past production of 2.5 Moz gold25

4

High-Grade Resource: 1.65 million ounces of gold at 7.4 g/t in 6.9 million tonnes (Indicated)26

5

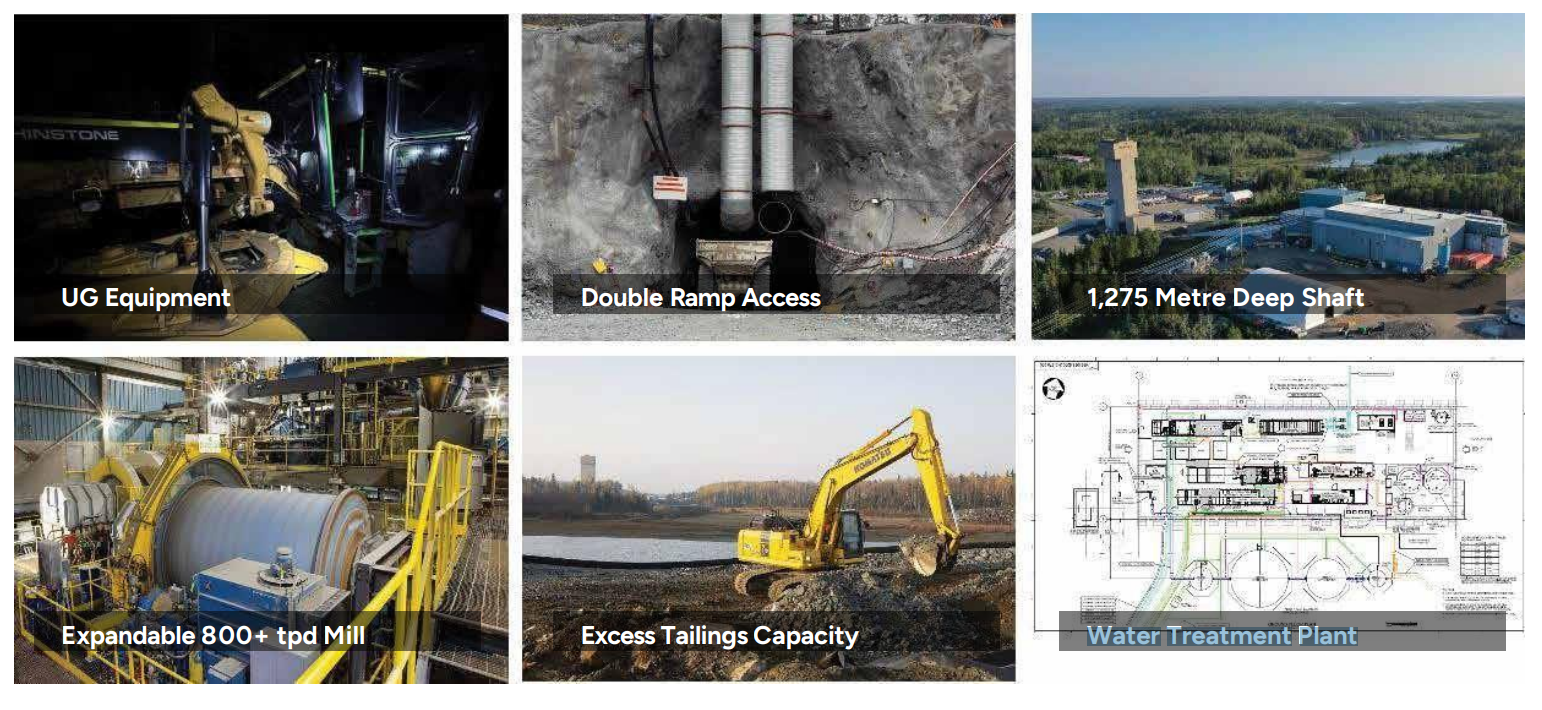

Advanced Infrastructure in Place: including a brand-new 800 tonne-per-day mill

6

Near-Term Path to Production: Madsen Mine restart targeted for 2025

7

Fully Permitted: All required permits are in place, setting up a quick return to activities

8

Upcoming Catalysts: lots of news flow throughout mine restart plan

9

Backed by Prominent Investors: including VanEck Gold Fund (4.1%), Sprott (18.6%), Frank Giustra (9.4%)

10

Robust Financial Foundation: C$68M financing package to fully fund Madsen Mine restart just announced27

11

Experienced Leadership: capital markets experts and industry pros from billion-dollar gold producers

Frank Giustra’s Success Story Includes Scoring West Red Lake Gold Mine’s Flagship Asset

Billionaire Frank Giustra’s success story is nothing short of legendary, and his latest move—securing West Red Lake Gold Mines‘ flagship asset—could be his next big win.

With a 9.4% stake in West Red Lake Gold Mines Ltd. (TSXV:WRLG) (OTCQB:WRLGF) Giustra’s involvement speaks volumes about the company’s immense potential.

Giustra’s roots in finance, particularly his leadership at Yorkton Securities, set the stage for his rise as a mining mogul.

But his true genius lies in spotting undervalued, overlooked mining assets and turning them into gold—literally and figuratively.

By 2016, Goldcorp had grown to the world’s fourth largest gold company,30 and was later acquired in 2019 by Newmont for ~$10 billion USD.31

Giustra went on to found Wheaton Precious Metals, now a $27.45 billion giant with interests in 18 operating mines and 26 development projects across four continents.32

Today, as President and CEO of Fiore Group, Giustra continues to wield his unmatched expertise in capital access and creative deal-making.…exactly like he’s done with West Red Lake Gold Mines Ltd. (TSXV:WRLG) (OTCQB:WRLGF).

In June 2023, Giustra and his team secured the Madsen Mine—a $1-billion asset—at a jaw-dropping bargain.

West Red Lake Gold Mines nabbed it for just C$6.5 million in cash, shares, and deferred payments.33

It’s no wonder Jay Martin is asking, “Could this be the deal of the decade?” in his recent video interview with West Red Lake Gold Mine’s CEO, Shane Williams.

Press Releases

- West Red Lake Gold Closes US$35-Million Credit Facility with Nebari and Announces Drawdown of US$15 Million

- West Red Lake Gold Intercepts 44.17 g/t Au over 1.3m and 20.63 g/t Au over 0.5m at Upper 8 Target – Madsen Property

- West Red Lake Gold Intersects 49.39 g/t Au over 4.48m and 18.46 g/t Au over 11.2m at South Austin – Madsen Mine

- West Red Lake Gold Starts Test Mining and Bulk Sample Program at Madsen Mine

- West Red Lake Gold Intersects 54.19 g/t Au over 4m and 23.73 g/t Au over 3.53m at Austin – Madsen Mine

Strong Gold Prices Boosting Gold Stocks

West Red Lake Gold Mines Ltd. (TSXV:WRLG) (OTCQB:WRLGF) and other miners with Canadian assets are riding the wave of soaring gold prices, which have jumped over 41% in the past 12 months.34

Take Equinox Gold, for instance—they’re set to produce a massive 700,000 oz of gold in 2024 from 8 operating mines, including one right in Ontario.35 Their Hasaga Property, just 1.5 miles from West Red Lake’s acreage, boasts an Indicated Mineral Resource of 408,000 oz of gold, grading an impressive 8.64 g/t gold in 1.47 million tonnes of ore.36

Evolution Mining, which holds a 1.6% stake in West Red Lake Gold Mines, has been ramping up production at their Red Lake mine in Ontario, delivering 121,000 oz of gold in FY2023 and projecting up to 135,000 oz in FY2024.37

New Gold, which has two producing assets in Canada,38 is bringing its Rainy River mine in Ontario into full production, expecting its first underground ore by the end of 2024 and reaching a rate of 5,500 tonnes per day by 2027.39

Osisko Mining, another major player, is pushing forward with their massive Windfall Project in Quebec.40 Gold Fields recently inked a $1.6B deal to take full control of Windfall, eyeing production as early as 2026.41

Probe Gold is also making strides with its Novador Project in Quebec, aiming for 255,000 oz of annual gold production over a 12.6-year mine life, according to their Preliminary Economic Assessment.

The chart below shows how each of these gold stocks has experienced major growth over the last 12 months (TTM) of strong gold prices. It also shows how West Red Lake Gold Mines’ (TSXV:WRLG) (OTCQB:WRLGF) lower share price and smaller market cap represent the most upside potential.

SUBSCRIBE FOR TRADING INSIGHTS AND ALERTS. STAY AHEAD.

Get investment opportunities before the rest of the market in real-time.

Get this company's corporate presentation now. Subscribe to download!

Over 120,000 subscribers

Managing the Risks of Mine Building

West Red Lake Gold Mines’ (TSXV:WRLG) (OTCQB:WRLGF) leadership has seen a lot of mine-building failures in the last 15 years. They’ve studied the different causes and are proactively managing those risks.

Here’s how that looks for the Madsen Mine restart:

| Risk | Management Strategy/Solution |

| Under-budgeted capex creating capex blowouts | Capex requirement going forward is very slow |

| Major earthworks operations required | Not a factor: the mine is largely built |

| Plant commissioning issues | Not a factor: plant ran well a few years ago and is brand new today |

| Social and permitting issues | Not a factor: mine is completely permitted |

| Groundwater issues | Not a factor: mine has been on/off in operation for many decades so groundwater setup is understood |

| Excessive debt burden | Not a factor: no current debt except for a small gold link note; will go into operation with much smaller debt burden than almost any new mine due to massive investment made before the company acquired the mine asset |

| Geotechnical or ground condition issues | Not a factor: mine has been in operation for years; the company has been operating in the mine for a year already |

Much of the company’s reduced risk is because West Red Lake Gold Mines (TSXV:WRLG) (OTCQB:WRLGF) isn’t starting their mine project from scratch.

All of the infrastructure is already in place.

The Madsen Mine also has a brand new double ramp access underground, a 1,275-meter (4,183-foot) deep shaft, and water treatment plant.

Now, all the company has to do is complete a handful of infrastructure projects at the Madsen Mine, which are already well underway.

West Red Lake Gold Mines Ltd. (TSXV:WRLG) (OTCQB:WRLGF) expects to complete these key milestones over the next 6 to 12 months, putting the company

on an accelerated path towards its target of producing gold in 2025.

This effort will generate a lot of significant catalysts and milestones to announce to the market.

Here are just some of what the mine restart plan includes:49

-

-

- Pre Feasibility Study (PFS) by Q1 2025

- Consistent underground drilling, with 43,000 metres completed in the company’s first year at Madsen and plans to complete that much again in its second year.

- Ongoing underground development and test mining through 2024

- Targeting mine restart in H2 202550

- Optimizing the project to focus on sustainable cash flowing operation

-

That’s on top of current news like West Red Lake Gold Mines’ (TSXV:WRLG) (OTCQB:WRLGF) recently announced significant drill results at its Madsen Mine.

The company intercepted 44.17 g/t Au over 1.3m and 20.63 g/t Au over 0.5m at Upper 8 Target – Madsen Property,51 and previously 49.39 g/t Au over 4.48m and 18.46 g/t Au over 11.2m at South Austin.52

Sector M&A Increasing Dramatically

One of the biggest signs of the gold sector’s growing valuation is its surging M&A activity.

M&A last year included Pan American Silver and Agnico Eagle acquiring Yamana Gold for $4.8B, and the biggest-ever gold merger when Newmont bought Newcrest Mining for nearly $17B.

Highlights this year include Alamos Gold buying Argonaut Gold for $325M,53 Gold Fields buying Osisko Mining for $1.6B, AngloGold Ashanti buying Centamin Plc for $2.5B, and Equinox Gold refusing takeover offers since starting production at their new Greenstone Mine in Canada earlier in the year.54

That level of gold sector interest is likely to grow even further once miners’ Q3 results and big bottom-line gains start getting announced soon.

That kind of market interest can have an outsized effect on the valuation of a smaller company like West Red Lake Gold Mines (TSXV:WRLG) (OTCQB:WRLGF).

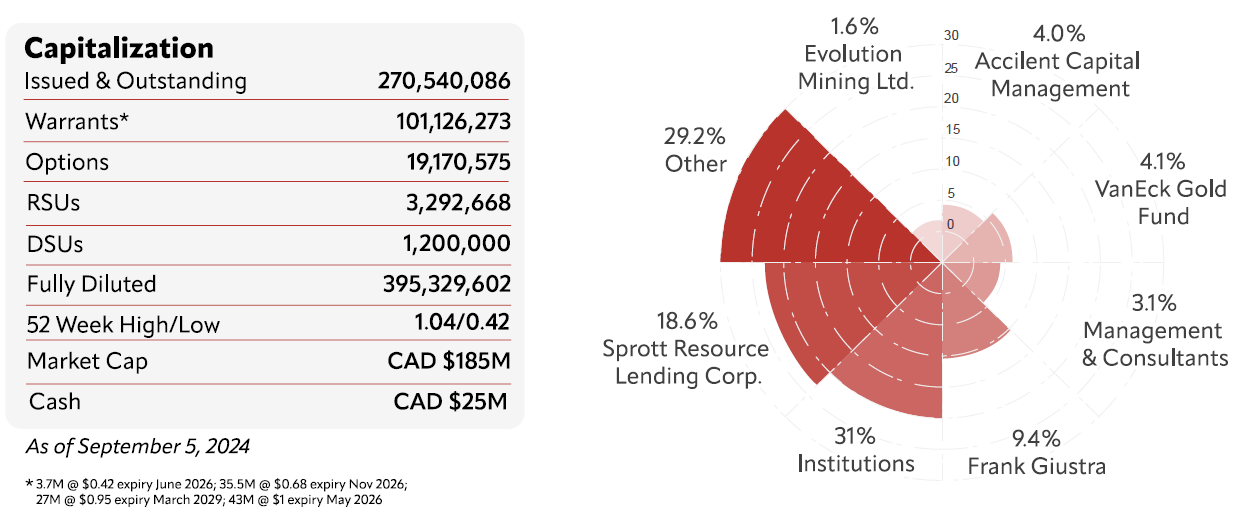

Money in the Bank & Skin in the Game

West Red Lake Gold Mines Ltd. (TSXV:WRLG) (OTCQB:WRLGF) is backed by heavyweight investors that ensure the company’s financial stability and growth potential:

-

-

- Evolution Mining Ltd. Market Cap: $6.25B (1.6%)

- Accilent Capital Management (4.0%)

- VanEck Gold Fund (4.1%)

- Sprott Resource Lending Corp. (18.6%)

- Legendary industry financier Frank Giustra (9.4%)

- Other institutional investors (31%)

-

Their management and consultants have 3.1% ownership, which shows they’re also convinced West Red Lake Gold Mines (TSXV:WRLG) (OTCQB:WRLGF) is a smart investment.

Leadership That’s Done This Before

West Red Lake Gold Mines Ltd. (TSXV:WRLG) (OTCQB:WRLGF) has the advantage of leadership that’s learned from past successes how to march the company forward to success.

11 Reasons

Why West Red Lake Gold Mines (TSXV: WRLG) (OTCQB:WRLGF) Should Be On Your Radar

1

Strong Market: gold prices are up 41%+ in the last year and forecast to hit $3000 by mid-202556

2

World-Class Location: high-grade Red Lake Gold District with 30 Moz produced to date57

3

Top-Tier Assets: fully permitted Madsen Mine with past production of 2.5 Moz gold58

4

High-Grade Resource: 1.65 million ounces of gold at 7.4 g/t in 6.9 million tonnes (Indicated)59

5

Advanced Infrastructure in Place: including a brand-new 800 tonne-per-day (tpd) mill

6

Near-Term Path to Production: Madsen Mine restart targeted for 2025

7

Fully Permitted: All required permits are in place, setting up a quick return to activities

8

Upcoming Catalysts: lots of news flow throughout mine restart plan

9

Backed by Prominent Investors: including VanEck Gold Fund (4.1%), Sprott (18.6%), Frank Giustra (9.4%)

10

Robust Financial Foundation: C$68M mine restart financing package secured60

11

Experienced Leadership: capital markets experts and industry pros from billion-dollar gold producers

The ultimate gold bull run is expected to hit even more highs. That’s a major wind at the back of West Red Lake Gold Mines Ltd. (TSXV:WRLG) (OTCQB:WRLGF) as they move their Madsen Mine toward its 2025 restart. The headlines from new gold price records and the company’s milestones should attract a lot of market attention.

If you’re interested in outstanding gold mining opportunities, keep a close eye on West Red Lake Gold Mines Ltd. (TSXV:WRLG) (OTCQB:WRLGF). This could be a deal that is worth pursuing.

SUBSCRIBE FOR TRADING INSIGHTS AND ALERTS. STAY AHEAD.

Get investment opportunities before the rest of the market in real-time.

Get this company's corporate presentation now. Subscribe to download!

Over 120,000 subscribers

Shane WilliamsB. Eng. M. Sc – CEO, President & Director

Shane WilliamsB. Eng. M. Sc – CEO, President & Director Frank GiustraAdvisor

Frank GiustraAdvisor Anthony MakuchB.Sc, P.Eng – Director

Anthony MakuchB.Sc, P.Eng – Director Duncan MiddlemissDirector

Duncan MiddlemissDirector Hugh AgroB.Sc., MBA, P.Eng. (Non-Practicing) – Director

Hugh AgroB.Sc., MBA, P.Eng. (Non-Practicing) – Director