Nvidia stock (NASDAQ:NVDA) reached unprecedented heights on Monday following Goldman Sachs’ upward revision of its price target for the chipmaker’s stock. The adjustment reflects anticipation of substantial earnings growth driven by the ongoing artificial intelligence (AI) boom.

The stock experienced a notable 4% surge, reaching $689.21, poised to contribute approximately $70 billion to Nvidia’s market capitalization. As of Friday’s close, the company was valued at $1.63 trillion. Nvidia has become emblematic of the AI fervor and witnessed a record-breaking monthly increase in market value during January.

Despite the impressive 39% surge in stock price so far this year, making it relatively more expensive compared to peers, Goldman Sachs analyst Toshiya Hari remains bullish. The current price-to-forward-earnings estimate ratio stands at 31.4 for Nvidia, surpassing the industry average of 22.9.

Hari emphasizes Nvidia’s status as the industry gold standard, attributing it to robust hardware and software offerings and a continuous commitment to innovation. The Goldman Sachs team raised the price target for Nvidia to $800, marking a 21% upside from current levels. This places it as the third-highest target among U.S. analysts covering the stock, based on LSEG data, up from the previous target of $625.

Goldman Sachs also adjusted its full-year 2025-2026 earnings estimates for Nvidia, increasing them by 22% on average. The rationale behind the positive outlook includes signals of strong demand for AI servers and improvements in graphics processing unit (GPU) supply.

Hari pointed to encouraging signs of AI monetization from major companies like Microsoft (NASDAQ:MSFT) and Meta Platforms (NASDAQ:META). Additionally, the positive earnings forecast from AI server manufacturer Super Micro Computer (NASDAQ:SMCI) contributes to the optimistic sentiment.

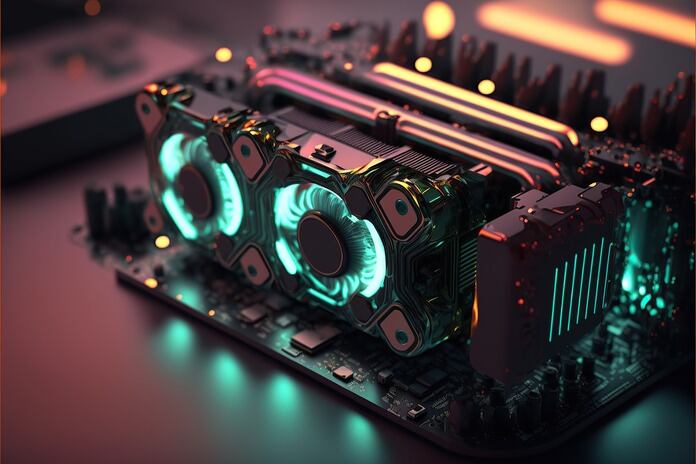

Nvidia, a key player in AI chip development, has unlocked substantial revenue streams amid the AI boom. In contrast, chipmakers less deeply involved in AI, such as Intel (NASDAQ:INTC), have seen their shares lag.

Nvidia is scheduled to report its fourth-quarter results on Feb. 21, with analysts expecting earnings per share of $4.51 and revenue of $20.19 billion, according to LSEG data. The company’s continued success in the AI sector positions it favorably, driving investor confidence and contributing to its record-breaking stock performance.

Featured Image: Freepik