The Semiconductor Industry Association (SIA) reports a noteworthy upturn in global chip sales, marking the first increase in 15 months and signaling a rebound in demand. November witnessed worldwide semiconductor revenue reaching $48 billion, reflecting a 2.9% rise from October and a substantial 5.3% year-over-year growth. Taiwan Semiconductor Manufacturing Co (NYSE:TSM), a pivotal supplier to industry giants Apple (NASDAQ:AAPL) and Nvidia (NASDAQ:NVDA), shares positive sentiment, anticipating a return to robust growth in the current quarter.

China emerged as a driving force behind the surge in global chip sales in November, recording a substantial 7.6% year-over-year increase in chip purchases. Europe and the Americas also contributed to the recovery, with chip sales rising by 5.6% and 3.5% year-over-year, respectively. However, Japan experienced a decline of 2.8% in chip sales during the same period. Encouraged by the upswing in chip sales, TSMC now projects a minimum of 20% revenue growth for the year, allocating a budget of $28 billion to $32 billion for capital expenditures in 2024, compared to approximately $30 billion in 2023.

The semiconductor industry faced challenges over the past year, grappling with weak demand in key markets such as smartphones and the impact of higher global interest rates on economic growth and trade, leading to increased chip inventories. Samsung Electronics, the world’s largest memory chipmaker, reported its sixth consecutive quarter of declining operating profit last week, underscoring the uneven nature of the return to chip demand growth among manufacturers.

TSMC’s CEO, Wei, expressed confidence in the industry’s rebound, stating, “Our business has bottomed out on a year-over-year basis, and we expect 2024 to be a healthy growth year.” He pointed to the surge in artificial intelligence (AI) development worldwide as a potential catalyst, driving demand for powerful chips produced by TSMC. The company is set to expand its global presence, proceeding with plans for chipmaking facilities in Japan, Germany, and the U.S., underscoring its positive outlook for the future of chip demand.

Despite the optimism, uncertainties persist. TSMC had moderated its capital expenditure plans in 2023 amid high chip inventories in the global consumer electronics industry. Questions also loom over chip demand in China, the world’s largest market for computing, smartphones, internet, and chips. Additionally, concerns have been raised about Apple’s latest iPhones, with reports suggesting a potential sales slump in China. Nonetheless, CEO Wei remains optimistic, stating, “We expect 2024 to be a healthy growth year and are well-positioned to capture a major portion of the market in terms of semiconductor components in AI.”

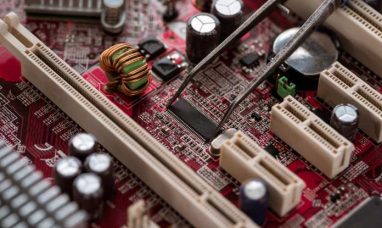

Featured Image: Unsplash