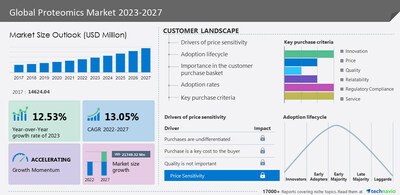

NEW YORK, Oct. 30, 2023 /PRNewswire/ — The proteomics market size is set to grow by USD 21.74 billion between 2022 and 2027 and register a CAGR of 13.05%, according to Technavio’s latest market research report estimates. The market is fragmented, and the degree of fragmentation will accelerate during the forecast period. Some of the major vendors of the proteomics market include Agilent Technologies Inc., Applied Biomics Inc., Bio Rad Laboratories Inc., Biognosys AG, Bruker Corp., CellCarta Biosciences Inc., Creative Proteomics, DiaSorin Spa, F. Hoffmann La Roche Ltd., Geno Technology Inc., HORIBA Ltd., Merck KGaA, Olink Holding AB, Perkin Elmer Inc., Promega Corp., QIAGEN NV, Thermo Fisher Scientific Inc., Waters Corp., Cell Signaling Technology Inc., and Illumina Inc. To help businesses improve their market position, Technavio’s report provides a detailed analysis of around 15+ vendors operating in the market. To leverage the current opportunities, market vendors must strengthen their foothold in the fast-growing segments, while maintaining their positions in the slow-growing segments. Backed with competitive intelligence and benchmarking, our research reports on the proteomics market are designed to provide entry support, customer profile & M&As as well as go-to-market strategy support. With a focus on identifying dominant industry influencers, Technavio’s reports present a detailed study by the way of synthesis, and summation of data from multiple sources. Technavio offers an up-to-date analysis of the current global market scenario and the overall market environment. View Sample Report

The report also covers the following areas:

Proteomics Market 2023-2027: Segmentation

- Product

- Reagents

- Instruments

- Services

- End-user

- Clinical Diagnostics

- Drug Discovery

- Others

- Geography

- North America

- Europe

- Asia

- Rest Of World (ROW)

This report offers an up-to-date analysis of the current market scenario, the latest trends and drivers, and the overall market environment. The report is segmented by Product, End-user, and Geography. The reagents segment will be significant for market growth during the forecast period. Antibodies, buffers and solutions, enzymes, kits, beads, and columns are some examples of proteomics reagents. Furthermore, these regents are used for protein purification and isolation based on specific properties, such as size, charge, or affinity. Hence, such factors drive the growth of the reagents segment of the global proteomics market.

Learn more about the factors assisting the growth of the market, download a sample report!

Proteomics Market 2023-2027: Vendor Analysis and Scope

What’s New?

- Special coverage on the Russia–Ukraine war; global inflation; recovery analysis from COVID-19; supply chain disruptions, global trade tensions; and risk of recession

- Global competitiveness and key competitor positions

- Market presence across multiple geographical footprints – Strong/Active/Niche/Trivial – Buy the report!

Vendor Offerings

- Agilent Technologies Inc. – The company offers proteomics and Peptide Quantitation through Liquid chromatography-mass spectrometry, Jet stream Peptide, and targeted proteomics.

- Bio Rad Laboratories Inc. – The company offers proteomics through two biomarker kits, namely, Comparative Proteomics Kit I Protein Profiler Module and Comparative Proteomics Kit II Western Blot Module.

- Bruker Corp. – The company offers proteomics called PASEF through 4D Proteomics approaches, shotgun proteomics analysis, Proteoforms, and Protein Quantification.

Proteomics Market 2023-2027: Market Dynamics

Key Drivers

- The emergence of precision proteomics drives the growth of the proteomics market.

- Precision proteomics employs advanced analytical tools to accurately identify and quantify proteins in complex biological samples.

- Furthermore, the increasing prevalence of chronic diseases and the demand for personalized treatments further contribute to its adoption.

- Also, since, precision medicine evolves, proteomics will continue to play a crucial role in unraveling disease biology and advancing drug development.

- Hence, such factors ensure the market’s growth in the forecast period.

Major Challenges

- Experimental challenges in protein structure determination hinder market growth.

- Generally, protein structure determination is a complex process that often requires multiple techniques and expertise.

- However, current methods, like X-ray crystallography and NMR spectroscopy, have limitations and may not always be successful.

- Detecting post-translational modifications (PTMs) and the cost and time required for protein structure determination are significant obstacles.

- Hence, such challenges impede market growth during the forecast period.

Proteomics Market 2023-2027: Key Highlights

- CAGR of the market during the forecast period 2023-2027

- Detailed information on factors that will assist proteomics market growth during the next five years

- Estimation of the proteomics market size and its contribution to the parent market

- Predictions on upcoming trends and changes in consumer behavior

- The growth of the proteomics market

- Analysis of the market’s competitive landscape and detailed information on vendors

- Comprehensive details of factors that will challenge the growth of proteomics market vendors

Gain instant access to 17,000+ market research reports.

Technavio’s SUBSCRIPTION platform

Related Reports:

The microarray biochips market size is expected to rise to USD 14.75 billion by 2026 at a progressing CAGR of 19.95%. This microarray biochips market research report extensively covers market segmentation by application (drug discovery and development, diagnostics, and treatments, research and consumables, forensic medicines, and others) and geography (North America, Europe, Asia, and Rest of World (ROW)). The increase in market presence with a collaboration strategy is notably driving the microarray biochips market growth.

The protein microarray market size is expected to increase by USD 1.48 billion from 2021 to 2026, and the market’s growth momentum will accelerate at a CAGR of 8.92%. Furthermore, this report extensively covers protein microarray market segmentation by class type (analytical protein microarrays and functional protein microarrays) and geography (North America, Europe, Asia, and ROW). The increase in the adoption of microarrays in genomics and proteomics is notably driving the protein microarray market growth.

|

Proteomics Market Scope |

|

|

Report Coverage |

Details |

|

Base year |

2022 |

|

Historic period |

2017-2021 |

|

Forecast period |

2023-2027 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 13.05% |

|

Market growth 2023-2027 |

USD 21.74 billion |

|

Market structure |

Fragmented |

|

YoY growth 2022-2023(%) |

12.53 |

|

Regional analysis |

North America, Europe, Asia, and Rest of World (ROW) |

|

Performing market contribution |

North America at 39% |

|

Key countries |

US, UK, Germany, China, and Japan |

|

Competitive landscape |

Leading Vendors, Market Positioning of Vendors, Competitive Strategies, and Industry Risks |

|

Key companies profiled |

Agilent Technologies Inc., Applied Biomics Inc., Bio Rad Laboratories Inc., Biognosys AG, Bruker Corp., CellCarta Biosciences Inc., Creative Proteomics, DiaSorin Spa, F. Hoffmann La Roche Ltd., Geno Technology Inc., HORIBA Ltd., Merck KGaA, Olink Holding AB, Perkin Elmer Inc., Promega Corp., QIAGEN NV, Thermo Fisher Scientific Inc., Waters Corp., Cell Signaling Technology Inc., and Illumina Inc. |

|

Market dynamics |

Parent market analysis, Market growth inducers and obstacles, Fast-growing and slow-growing segment analysis, COVID-19 impact and recovery analysis and future consumer dynamics, Market condition analysis for the forecast period. |

|

Customization purview |

If our report has not included the data that you are looking for, you can reach out to our analysts and get segments customized. |

Table of Contents

1 Executive Summary

- 1.1 Market overview

- Exhibit 01: Executive Summary – Chart on Market Overview

- Exhibit 02: Executive Summary – Data Table on Market Overview

- Exhibit 03: Executive Summary – Chart on Global Market Characteristics

- Exhibit 04: Executive Summary – Chart on Market by Geography

- Exhibit 05: Executive Summary – Chart on Market Segmentation by Product

- Exhibit 06: Executive Summary – Chart on Market Segmentation by End-user

- Exhibit 07: Executive Summary – Chart on Incremental Growth

- Exhibit 08: Executive Summary – Data Table on Incremental Growth

- Exhibit 09: Executive Summary – Chart on Vendor Market Positioning

2 Market Landscape

- 2.1 Market ecosystem

- Exhibit 10: Parent market

- Exhibit 11: Market Characteristics

3 Market Sizing

- 3.1 Market definition

- Exhibit 12: Offerings of vendors included in the market definition

- 3.2 Market segment analysis

- Exhibit 13: Market segments

- 3.3 Market size 2022

- 3.4 Market outlook: Forecast for 2022-2027

- Exhibit 14: Chart on Global – Market size and forecast 2022-2027 (USD million)

- Exhibit 15: Data Table on Global – Market size and forecast 2022-2027 (USD million)

- Exhibit 16: Chart on Global Market: Year-over-year growth 2022-2027 (%)

- Exhibit 17: Data Table on Global Market: Year-over-year growth 2022-2027 (%)

4 Historic Market Size

- 4.1 Global proteomics market 2017 – 2021

- Exhibit 18: Historic Market Size – Data Table on global proteomics market 2017 – 2021 (USD million)

- 4.2 Product Segment Analysis 2017 – 2021

- Exhibit 19: Historic Market Size – Product Segment 2017 – 2021 (USD million)

- 4.3 End-user Segment Analysis 2017 – 2021

- Exhibit 20: Historic Market Size – End-user Segment 2017 – 2021 (USD million)

- 4.4 Geography Segment Analysis 2017 – 2021

- Exhibit 21: Historic Market Size – Geography Segment 2017 – 2021 (USD million)

- 4.5 Country Segment Analysis 2017 – 2021

- Exhibit 22: Historic Market Size – Country Segment 2017 – 2021 (USD million)

5 Five Forces Analysis

- 5.1 Five forces summary

- Exhibit 23: Five forces analysis – Comparison between 2022 and 2027

- 5.2 Bargaining power of buyers

- Exhibit 24: Chart on Bargaining power of buyers – Impact of key factors 2022 and 2027

- 5.3 Bargaining power of suppliers

- Exhibit 25: Bargaining power of suppliers – Impact of key factors in 2022 and 2027

- 5.4 Threat of new entrants

- Exhibit 26: Threat of new entrants – Impact of key factors in 2022 and 2027

- 5.5 Threat of substitutes

- Exhibit 27: Threat of substitutes – Impact of key factors in 2022 and 2027

- 5.6 Threat of rivalry

- Exhibit 28: Threat of rivalry – Impact of key factors in 2022 and 2027

- 5.7 Market condition

- Exhibit 29: Chart on Market condition – Five forces 2022 and 2027

6 Market Segmentation by Product

- 6.1 Market segments

- Exhibit 30: Chart on Product – Market share 2022-2027 (%)

- Exhibit 31: Data Table on Product – Market share 2022-2027 (%)

- 6.2 Comparison by Product

- Exhibit 32: Chart on Comparison by Product

- Exhibit 33: Data Table on Comparison by Product

- 6.3 Reagents – Market size and forecast 2022-2027

- Exhibit 34: Chart on Reagents – Market size and forecast 2022-2027 (USD million)

- Exhibit 35: Data Table on Reagents – Market size and forecast 2022-2027 (USD million)

- Exhibit 36: Chart on Reagents – Year-over-year growth 2022-2027 (%)

- Exhibit 37: Data Table on Reagents – Year-over-year growth 2022-2027 (%)

- 6.4 Instruments – Market size and forecast 2022-2027

- Exhibit 38: Chart on Instruments – Market size and forecast 2022-2027 (USD million)

- Exhibit 39: Data Table on Instruments – Market size and forecast 2022-2027 (USD million)

- Exhibit 40: Chart on Instruments – Year-over-year growth 2022-2027 (%)

- Exhibit 41: Data Table on Instruments – Year-over-year growth 2022-2027 (%)

- 6.5 Services – Market size and forecast 2022-2027

- Exhibit 42: Chart on Services – Market size and forecast 2022-2027 (USD million)

- Exhibit 43: Data Table on Services – Market size and forecast 2022-2027 (USD million)

- Exhibit 44: Chart on Services – Year-over-year growth 2022-2027 (%)

- Exhibit 45: Data Table on Services – Year-over-year growth 2022-2027 (%)

- 6.6 Market opportunity by Product

- Exhibit 46: Market opportunity by Product (USD million)

- Exhibit 47: Data Table on Market opportunity by Product (USD million)

7 Market Segmentation by End-user

- 7.1 Market segments

- Exhibit 48: Chart on End-user – Market share 2022-2027 (%)

- Exhibit 49: Data Table on End-user – Market share 2022-2027 (%)

- 7.2 Comparison by End-user

- Exhibit 50: Chart on Comparison by End-user

- Exhibit 51: Data Table on Comparison by End-user

- 7.3 Clinical diagnostics – Market size and forecast 2022-2027

- Exhibit 52: Chart on Clinical diagnostics – Market size and forecast 2022-2027 (USD million)

- Exhibit 53: Data Table on Clinical diagnostics – Market size and forecast 2022-2027 (USD million)

- Exhibit 54: Chart on Clinical diagnostics – Year-over-year growth 2022-2027 (%)

- Exhibit 55: Data Table on Clinical diagnostics – Year-over-year growth 2022-2027 (%)

- 7.4 Drug discovery – Market size and forecast 2022-2027

- Exhibit 56: Chart on Drug discovery – Market size and forecast 2022-2027 (USD million)

- Exhibit 57: Data Table on Drug discovery – Market size and forecast 2022-2027 (USD million)

- Exhibit 58: Chart on Drug discovery – Year-over-year growth 2022-2027 (%)

- Exhibit 59: Data Table on Drug discovery – Year-over-year growth 2022-2027 (%)

- 7.5 Others – Market size and forecast 2022-2027

- Exhibit 60: Chart on Others – Market size and forecast 2022-2027 (USD million)

- Exhibit 61: Data Table on Others – Market size and forecast 2022-2027 (USD million)

- Exhibit 62: Chart on Others – Year-over-year growth 2022-2027 (%)

- Exhibit 63: Data Table on Others – Year-over-year growth 2022-2027 (%)

- 7.6 Market opportunity by End-user

- Exhibit 64: Market opportunity by End-user (USD million)

- Exhibit 65: Data Table on Market opportunity by End-user (USD million)

8 Customer Landscape

- 8.1 Customer landscape overview

- Exhibit 66: Analysis of price sensitivity, lifecycle, customer purchase basket, adoption rates, and purchase criteria

9 Geographic Landscape

- 9.1 Geographic segmentation

- Exhibit 67: Chart on Market share by geography 2022-2027 (%)

- Exhibit 68: Data Table on Market share by geography 2022-2027 (%)

- 9.2 Geographic comparison

- Exhibit 69: Chart on Geographic comparison

- Exhibit 70: Data Table on Geographic comparison

- 9.3 North America – Market size and forecast 2022-2027

- Exhibit 71: Chart on North America – Market size and forecast 2022-2027 (USD million)

- Exhibit 72: Data Table on North America – Market size and forecast 2022-2027 (USD million)

- Exhibit 73: Chart on North America – Year-over-year growth 2022-2027 (%)

- Exhibit 74: Data Table on North America – Year-over-year growth 2022-2027 (%)

- 9.4 Europe – Market size and forecast 2022-2027

- Exhibit 75: Chart on Europe – Market size and forecast 2022-2027 (USD million)

- Exhibit 76: Data Table on Europe – Market size and forecast 2022-2027 (USD million)

- Exhibit 77: Chart on Europe – Year-over-year growth 2022-2027 (%)

- Exhibit 78: Data Table on Europe – Year-over-year growth 2022-2027 (%)

- 9.5 Asia – Market size and forecast 2022-2027

- Exhibit 79: Chart on Asia – Market size and forecast 2022-2027 (USD million)

- Exhibit 80: Data Table on Asia – Market size and forecast 2022-2027 (USD million)

- Exhibit 81: Chart on Asia – Year-over-year growth 2022-2027 (%)

- Exhibit 82: Data Table on Asia – Year-over-year growth 2022-2027 (%)

- 9.6 Rest of World (ROW) – Market size and forecast 2022-2027

- Exhibit 83: Chart on Rest of World (ROW) – Market size and forecast 2022-2027 (USD million)

- Exhibit 84: Data Table on Rest of World (ROW) – Market size and forecast 2022-2027 (USD million)

- Exhibit 85: Chart on Rest of World (ROW) – Year-over-year growth 2022-2027 (%)

- Exhibit 86: Data Table on Rest of World (ROW) – Year-over-year growth 2022-2027 (%)

- 9.7 US – Market size and forecast 2022-2027

- Exhibit 87: Chart on US – Market size and forecast 2022-2027 (USD million)

- Exhibit 88: Data Table on US – Market size and forecast 2022-2027 (USD million)

- Exhibit 89: Chart on US – Year-over-year growth 2022-2027 (%)

- Exhibit 90: Data Table on US – Year-over-year growth 2022-2027 (%)

- 9.8 UK – Market size and forecast 2022-2027

- Exhibit 91: Chart on UK – Market size and forecast 2022-2027 (USD million)

- Exhibit 92: Data Table on UK – Market size and forecast 2022-2027 (USD million)

- Exhibit 93: Chart on UK – Year-over-year growth 2022-2027 (%)

- Exhibit 94: Data Table on UK – Year-over-year growth 2022-2027 (%)

- 9.9 Germany – Market size and forecast 2022-2027

- Exhibit 95: Chart on Germany – Market size and forecast 2022-2027 (USD million)

- Exhibit 96: Data Table on Germany – Market size and forecast 2022-2027 (USD million)

- Exhibit 97: Chart on Germany – Year-over-year growth 2022-2027 (%)

- Exhibit 98: Data Table on Germany – Year-over-year growth 2022-2027 (%)

- 9.10 China – Market size and forecast 2022-2027

- Exhibit 99: Chart on China – Market size and forecast 2022-2027 (USD million)

- Exhibit 100: Data Table on China – Market size and forecast 2022-2027 (USD million)

- Exhibit 101: Chart on China – Year-over-year growth 2022-2027 (%)

- Exhibit 102: Data Table on China – Year-over-year growth 2022-2027 (%)

- 9.11 Japan – Market size and forecast 2022-2027

- Exhibit 103: Chart on Japan – Market size and forecast 2022-2027 (USD million)

- Exhibit 104: Data Table on Japan – Market size and forecast 2022-2027 (USD million)

- Exhibit 105: Chart on Japan – Year-over-year growth 2022-2027 (%)

- Exhibit 106: Data Table on Japan – Year-over-year growth 2022-2027 (%)

- 9.12 Market opportunity by geography

- Exhibit 107: Market opportunity by geography (USD million)

- Exhibit 108: Data Tables on Market opportunity by geography (USD million)

10 Drivers, Challenges, and Trends

- 10.1 Market drivers

- 10.2 Market challenges

- 10.3 Impact of drivers and challenges

- Exhibit 109: Impact of drivers and challenges in 2022 and 2027

- 10.4 Market trends

11 Vendor Landscape

- 11.1 Overview

- 11.2 Vendor landscape

- Exhibit 110: Overview on Criticality of inputs and Factors of differentiation

- 11.3 Landscape disruption

- Exhibit 111: Overview on factors of disruption

- 11.4 Industry risks

- Exhibit 112: Impact of key risks on business

12 Vendor Analysis

- 12.1 Vendors covered

- Exhibit 113: Vendors covered

- 12.2 Market positioning of vendors

- Exhibit 114: Matrix on vendor position and classification

- 12.3 Agilent Technologies Inc.

- Exhibit 115: Agilent Technologies Inc. – Overview

- Exhibit 116: Agilent Technologies Inc. – Business segments

- Exhibit 117: Agilent Technologies Inc. – Key offerings

- Exhibit 118: Agilent Technologies Inc. – Segment focus

- 12.4 Bio Rad Laboratories Inc.

- Exhibit 119: Bio Rad Laboratories Inc. – Overview

- Exhibit 120: Bio Rad Laboratories Inc. – Business segments

- Exhibit 121: Bio Rad Laboratories Inc. – Key news

- Exhibit 122: Bio Rad Laboratories Inc. – Key offerings

- Exhibit 123: Bio Rad Laboratories Inc. – Segment focus

- 12.5 Bruker Corp.

- Exhibit 124: Bruker Corp. – Overview

- Exhibit 125: Bruker Corp. – Business segments

- Exhibit 126: Bruker Corp. – Key news

- Exhibit 127: Bruker Corp. – Key offerings

- Exhibit 128: Bruker Corp. – Segment focus

- 12.6 CellCarta Biosciences Inc.

- Exhibit 129: CellCarta Biosciences Inc. – Overview

- Exhibit 130: CellCarta Biosciences Inc. – Product / Service

- Exhibit 131: CellCarta Biosciences Inc. – Key offerings

- 12.7 Creative Proteomics

- Exhibit 132: Creative Proteomics – Overview

- Exhibit 133: Creative Proteomics – Product / Service

- Exhibit 134: Creative Proteomics – Key offerings

- 12.8 DiaSorin Spa

- Exhibit 135: DiaSorin Spa – Overview

- Exhibit 136: DiaSorin Spa – Business segments

- Exhibit 137: DiaSorin Spa – Key offerings

- Exhibit 138: DiaSorin Spa – Segment focus

- 12.9 F. Hoffmann La Roche Ltd.

- Exhibit 139: F. Hoffmann La Roche Ltd. – Overview

- Exhibit 140: F. Hoffmann La Roche Ltd. – Business segments

- Exhibit 141: F. Hoffmann La Roche Ltd. – Key news

- Exhibit 142: F. Hoffmann La Roche Ltd. – Key offerings

- Exhibit 143: F. Hoffmann La Roche Ltd. – Segment focus

- 12.10 HORIBA Ltd.

- Exhibit 144: HORIBA Ltd. – Overview

- Exhibit 145: HORIBA Ltd. – Business segments

- Exhibit 146: HORIBA Ltd. – Key news

- Exhibit 147: HORIBA Ltd. – Key offerings

- Exhibit 148: HORIBA Ltd. – Segment focus

- 12.11 Illumina Inc.

- Exhibit 149: Illumina Inc. – Overview

- Exhibit 150: Illumina Inc. – Business segments

- Exhibit 151: Illumina Inc. – Key news

- Exhibit 152: Illumina Inc. – Key offerings

- Exhibit 153: Illumina Inc. – Segment focus

- 12.12 Merck KGaA

- Exhibit 154: Merck KGaA – Overview

- Exhibit 155: Merck KGaA – Business segments

- Exhibit 156: Merck KGaA – Key news

- Exhibit 157: Merck KGaA – Key offerings

- Exhibit 158: Merck KGaA – Segment focus

- 12.13 Perkin Elmer Inc.

- Exhibit 159: Perkin Elmer Inc. – Overview

- Exhibit 160: Perkin Elmer Inc. – Business segments

- Exhibit 161: Perkin Elmer Inc. – Key news

- Exhibit 162: Perkin Elmer Inc. – Key offerings

- Exhibit 163: Perkin Elmer Inc. – Segment focus

- 12.14 Promega Corp.

- Exhibit 164: Promega Corp. – Overview

- Exhibit 165: Promega Corp. – Product / Service

- Exhibit 166: Promega Corp. – Key offerings

- 12.15 QIAGEN NV

- Exhibit 167: QIAGEN NV – Overview

- Exhibit 168: QIAGEN NV – Product / Service

- Exhibit 169: QIAGEN NV – Key news

- Exhibit 170: QIAGEN NV – Key offerings

- 12.16 Thermo Fisher Scientific Inc.

- Exhibit 171: Thermo Fisher Scientific Inc. – Overview

- Exhibit 172: Thermo Fisher Scientific Inc. – Business segments

- Exhibit 173: Thermo Fisher Scientific Inc. – Key news

- Exhibit 174: Thermo Fisher Scientific Inc. – Key offerings

- Exhibit 175: Thermo Fisher Scientific Inc. – Segment focus

- 12.17 Waters Corp.

- Exhibit 176: Waters Corp. – Overview

- Exhibit 177: Waters Corp. – Business segments

- Exhibit 178: Waters Corp. – Key news

- Exhibit 179: Waters Corp. – Key offerings

- Exhibit 180: Waters Corp. – Segment focus

13 Appendix

- 13.1 Scope of the report

- 13.2 Inclusions and exclusions checklist

- Exhibit 181: Inclusions checklist

- Exhibit 182: Exclusions checklist

- 13.3 Currency conversion rates for USUSD

- Exhibit 183: Currency conversion rates for USUSD

- 13.4 Research methodology

- Exhibit 184: Research methodology

- Exhibit 185: Validation techniques employed for market sizing

- Exhibit 186: Information sources

- 13.5 List of abbreviations

- Exhibit 187: List of abbreviations

About US

Technavio is a leading global technology research and advisory company. Their research and analysis focus on emerging market trends and provide actionable insights to help businesses identify market opportunities and develop effective strategies to optimize their market positions. With over 500 specialized analysts, Technavio’s report library consists of more than 17,000 reports and counting, covering 800 technologies, spanning 50 countries. Their client base consists of enterprises of all sizes, including more than 100 Fortune 500 companies. This growing client base relies on Technavio’s comprehensive coverage, extensive research, and actionable market insights to identify opportunities in existing and potential markets and assess their competitive positions within changing market scenarios.

Contact

Technavio Research

Jesse Maida

Media & Marketing Executive

US: +1 844 364 1100

UK: +44 203 893 3200

Email: [email protected]

Website: www.technavio.com

![]() View original content to download multimedia:https://www.prnewswire.com/news-releases/proteomics-market-to-grow-by-usd-21-74-billion-from-2022-to-2027agilent-technologies-inc-applied-biomics-inc-bio-rad-laboratories-inc-biognosys-ag-and-more-among-the-key-companies-in-the-market—technavio-301970472.html

View original content to download multimedia:https://www.prnewswire.com/news-releases/proteomics-market-to-grow-by-usd-21-74-billion-from-2022-to-2027agilent-technologies-inc-applied-biomics-inc-bio-rad-laboratories-inc-biognosys-ag-and-more-among-the-key-companies-in-the-market—technavio-301970472.html

SOURCE Technavio

Featured image: Megapixl © Og-vision